Is there such a thing as a “perfect” investment opportunity? Many investors would answer that question with an automatic “no”. However, those readers have probably not been introduced to

Diamcor Mining Inc. (

TSX: V.DMI,

OTCQB: DMIFF,

Forum).

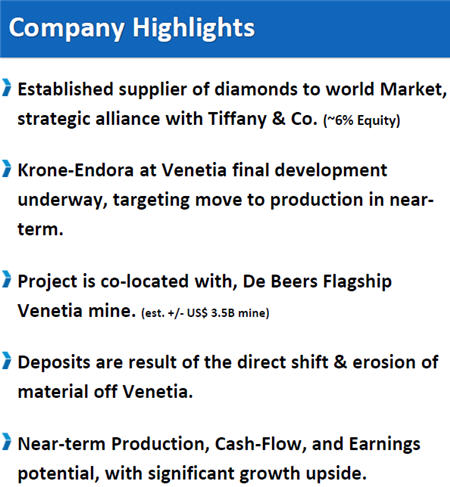

What separates this Company from other mining/resource opportunities? Perfect synchronicity. DMI is moving a (now rare)

gemstone-quality diamond mining operation toward commercial production at precisely the same time that fundamentals in the diamond mining industry could not be more supportive for such high-quality diamond mining.

Understanding the opportunity here starts with looking at the Big Picture for diamond mining.

Diamonds are forever. Yes, but the supply of diamonds is finite. In particular, the supply of high-end gem and near-gem diamonds is especially limited. This separates diamond mining from virtually any other niche of mining.

A huge, 91.72 carat rough diamond from Krone-Endora

A huge, 91.72 carat rough diamond from Krone-Endora

He who has the Rough [diamonds] makes the Rules.

- CEO Dean Taylor, Diamcor Mining

Finite diamond supply

With many metals, it’s also becoming increasingly difficult to find deposits with high grades of ore. However, metal is metal. At a high enough price, lower grade ore can still be mined and smelted/refined into pure metals for industrial or investment use.

Not diamonds. Every diamond is essentially unique – in terms of size and quality. In addition to size and shape, diamonds also vary according to colour, clarity, and weight. With industrial diamonds, these qualitative issues are of much less significance and the supply of industrial diamonds remains robust.

Conversely, the high end (and generally larger) diamonds that are sought after by the jewelry industry are becoming increasingly scarce. As far back

as 2010, De Beers, the world’s largest diamond producer, began warning about the supply of gemstone diamonds being exhausted.

Prospectors are being forced to search increasingly remote corners of the Earth for high quality diamond pipes, kimberlite volcanic rock in which the rough stones are embedded. The last important discovery was the Diavik mines, 300 kilometres north of Yellowknife, in the Northwest Territories of Canada, in the late 1990s. But Diavik is drying up after years of open-pit excavations.

This makes it difficult to obtain exposure to the high end of the diamond industry. Skepticism exists with respect to De Beers’ claim, given the highly secretive nature of the diamond industry. However, the reality is that diamond mines in South Africa, Botswana and Namibia (the world’s nexus for diamond mining) are

“showing signs of depletion”.

De Beers’ annual production is slowing. And that company recently announced a $2.1 billion underground expansion for its flagship Venetia Diamond Mine in South Africa, just to produce an additional 3 million carats and extend mine life. To put this into context, De Beers is producing an estimated 34.6 million carats of diamonds in 2018, so this $2.1 billion investment would supply less than 1/10

th of one year’s annual production.

What about synthetic diamonds? Diamonds can now be

grown in a laboratory. In a conference call with Stockhouse Editorial, Diamcor’s Chairman and CEO, Dean Taylor had an instant retort when asked about synthetic diamonds.

When you’re about to propose marriage to your sweetheart, do you want to risk the response to that question on an artificial diamond? When ladies show off their engagement rings to friends/family, do they want to add the caveat that the stone(s) is “not a natural diamond”?

More seriously, Taylor pointed to the economics of synthetic diamonds. The cost to grow larger diamonds ratchets higher at such a rate that synthesizing high-end diamonds for the jewelry industry is not economical enough to compensate (most buyers) for the lack of prestige of an artificial stone.

This leads right back to Diamcor Mining. DMI’s flagship project is located directly adjacent to the Venetia Mine.

Location, location, location. In the world of mining, a well-known cliché is that the best place to explore for a prospective new mineral/metal deposit is right next to the best existing deposits. Being located adjacent to Venetia is as good as it gets for a junior diamond mining company.

What makes Venetia the “flagship project” for De Beers is more than just the scale of production (peaking at 9 million carats per year). The Venetia Mine is known to yield a very high percentage of gem or near-gem quality diamonds from its annual production, estimated to be well over 50%, one of the highest ratios in the world.

The Krone-Endora Project

Diamcor’s operational focus is the Krone-Endora Project, representing the two parcels of land comprised by this land package. The Project is 5,888 hectares in total,

100%-owned, with no other royalty interests. The initial area of development is roughly 307 hectares, and the Company has already obtained a 30-year mining license for an area of 657 hectares.

.jpg?width=450&height=403) (click to enlarge)

(click to enlarge)

However, while Krone-Endora is directly adjacent to De Beers’ Venetia Mine, it is an entirely different type of mineralization deposit. This is an “eluvial” deposit, a term that will be unfamiliar to even many experienced mining investors.

Investors are much more familiar with “alluvial” formations, mineralization that has formed through washing soil/rock from higher elevations, with the mineralization collecting in sedimentary deposits. In contrast, an eluvial deposit is created through

“weathering or weathering plus gravitational movement”.

The Krone-Endora deposit is an eluvial formation, created (millions of years ago) when a chunk of diamond-rich glacier, roughly 1,000 meters in depth, sheared off of the higher elevation of the Venetia property, and deposited that material, including the same diamonds onto the lower surrounding areas in the direction of the Krone-Endora property. This means that mining this deposit requires nothing more than low-cost strip mining.

Acquiring this Project was fortuitous and is a reflection of Diamcor’s experience in the diamond mining industry. Back in 2008, De Beers was engaging in a “strategic review”, with the goal of monetizing non-core assets.

At the time, this eluvial formation that straddles Krone and Endora was undeveloped and regarded as a non-core asset. The management team of Diamcor became aware of the sale of this property through its existing diamond mining operations in South Africa. The Company executed a definitive agreement with De Beers in December 2008, closing on this acquisition in February 2011.

As part of the acquisition process, a NI 43-101 technical report was produced for Krone-Endora, released in July 2009. The report calculated an Inferred resource of 54,258,600 tonnes of diamond-bearing gravel, hosting an estimated 1,314,000 carats of diamonds – with (as previously noted) a very high percentage of high-end gem/near-gem diamonds. Given the eluvial formation and near-surface diamonds, management is targeting all in extraction costs of only roughly $5 per tonne.

Historically, diamonds from the Venetia Mine have yielded an average selling price of USD$200 per carat. This compares to the industry average of approximately USD$90 per carat and is yet another indication of the superior quality of these diamonds.

As a back-of-the-envelope calculation, the current resource works out to

a potential economic value of more than USD$250 million. Not bad for a Company with a current market cap of

less than CAD$20 million. Perhaps even more noteworthy,

the NI 43-101 is derived from only a 5% portion of this land package. This means that the long-term economic potential for this Project could be vastly greater.

For DMI’s long-term investors, the frustration to date has been delays on permitting and related issues. And this Company is still a secret to the mining industry. The top-10 shareholders combined hold roughly 80% of the outstanding shares. For new investors, however, the time is ripe.

Abundant infrastructure is already in place [see Appendix below]. DMI has extracted over 110,000 carats from Krone-Endora in the form of previous bulk sampling. The Company’s latest sale was announced on

September 12, 2018: USD$726,588 in proceeds from the sale of 2,606.50 carats – a sale price that averaged more than USD$250 carat and yielded three gem-quality diamonds in the “special” category.

(click to enlarge)

(click to enlarge)

Now Diamcor plans to ramp up production at Krone-Endora to full, commercial strip mining of this lucrative deposit. DMI’s shareholders are not the only spectators who are eagerly awaiting development of this Project. Waiting in the wings is the Company’s strategic partner – Tiffany & Co. Canada, subsidiary of world famous, New York-based Tiffany & Co.

Tiffany has invested USD$10 million into Krone Endora and has a strategic alliance with Diamcor. In return for this commitment, Tiffany holds first right of refusal to buy all diamonds produced from this Project at prevailing market prices. The exception to this is that Diamcor reserves the right to exclude diamonds in the “special” category, which is 10.8 carats or larger.

This will immediately strike experienced mining investors as a pretty sweet deal. Ten million dollars for first right of refusal, but DMI retains the right to market the largest highest value stones. This reflects an axiom unique to the diamond mining industry.

Many investors have heard of “the Golden Rule”:

He who has the Gold makes the Rules.

In the world of diamond mining, this expression has been modified. CEO Taylor recited the diamond mining version of this “rule”.

He who has the Rough [diamonds]

makes the Rules.

When it comes to gem and near-gem diamonds, there has never been so little “rough” accessible for the diamond mining industry. Naturally, this scarcity of supply implies steadily rising prices for gem quality diamonds. This means that companies like Diamcor have never been in a better position to commercialize a high-end diamond deposit like Krone-Endora.

For many mining investors, being able to get into an advanced low-cost/high-end diamond mining project like Krone-Endora – at essentially a ground-floor price – will look like the

perfect mining opportunity.

Appendix: existing infrastructure at Krone-Endora

.jpg?width=100&height=58)

(click to enlarge images above)

www.diamcormining.com

FULL DISCLOSURE: Diamcor Mining Inc. is a paid client of Stockhouse Publishing.

(click to enlarge images above)

www.diamcormining.com

FULL DISCLOSURE: Diamcor Mining Inc. is a paid client of Stockhouse Publishing.