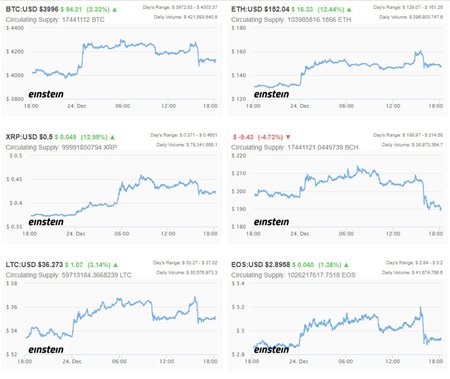

What a difference a week makes. Seven days ago things didn’t look as though they could really get much worse for cryptocurrency markets, as investors crawled towards the end of 2018 looking forward to putting it behind them. Traditional markets dictate that a 20% drop in price would constitute a bear market and so given 80-plus percentage drops in Bitcoin (BTC) and Ethereum (ETH), it was hard to imagine things getting any more bearish.

However, it appears that the so-called “Santa Rally” is on, jingling its digital coins all the way to a 22% and 71% increase in price for BTC and ETH respectively in the last week. And this occurred while Santa clearly stayed away from US equities markets, as the Dow suffered its worst week in more than a decade.

BTC has rallied by more than US$1,100 from its December low, but its share of the overall cryptocurrency market has fallen to roughly half. If history is any indication, this is a potentially bullish sign for digital assets.

Cryptocurrencies as a whole have added about US$47 billion back in value over the past nine days, sending a strong signal that the market has set a firm price bottom. The combined market cap of all assets reached a low near US$100 billion on December 15th. It has since recovered to US$147.1 billion.

CLICK BELOW FOR LIVE CRYPTOCURRENCY PRICE INDEXES:

The highs seen today were accompanied by a sharp acceleration in trading volume, contrasting sharply with traditional financial markets, which tend to exhibit reduced activity during the holidays. Exchange-based volumes reached $24.5 billion in the last 24 hours, according to latest available data.

Bitcoin kickstarted the recovery on December 17th, the one-year anniversary of its record run, opening the door to a much wider corrective rally.

It’ll be interesting to see now how the remainder of the year plays out. In traditional asset classes liquidity inclines to thin out at year’s end, particularly as these markets tend to have the largest percentage of daily volumes flowing through them in the Western economies. However, with crypto, the inverse tends to be true with the Eastern economies dictating the majority of flow, so liquidity may well remain more constant while we enjoy a festive break over in the West.