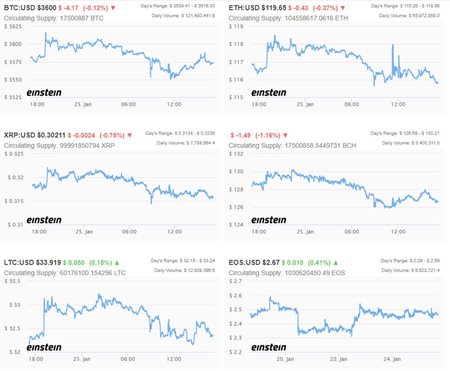

The week is ending on a flat note with very little movement amongst the major cryptocurrencies as Bitcoin approaches its longest bear market in history. At press time, markets have plateaued to around the US$120 billion cap level and have been unable to make any significant gains above that.

Bitcoin (BTC) has again tested resistance at US$3,600 a couple of times over the past 24 hours. A minor daily loss of a fraction of a percent has kept it trading here at the time of writing. In the past week, BTC has done very little but is generally down over the course of the week and

short term predictions for the coming weeks look grim.

Ethereum (ETH) has also slumbered with just minor movements since yesterday. ETH is still lulling around US$119, with little apparent momentum as we approach the weekend.

XRP (the native currency of the Ripple Network) is down .75% on the day while increasing its valuation lead over ETH to US$800 million.

CLICK BELOW FOR LIVE CRYPTOCURRENCY PRICE INDEXES:

Financial analysts from one of the leading investment banks in the US, are reported to have predicted that Bitcoin is likely to plunge to lows below US$1,260 if the current bear market continues. In a report from

Bloomberg, JP Morgan analysts say that the value of digital assets is yet to be proven and that current the make logic only in a hypothetical “dystopian” event. Importantly, investors have lost confidence in other traditional assets, for example, gold and the U.S. dollar.

According to John Normand, head of cross-asset strategy with JPMorgan, “Even in extreme scenarios such as a recession or financial crises, there are more liquid and less-complicated instruments for transacting, investing and hedging [than cryptocurrencies].”

The analyst reckoned that institutional clients’ involvement in the crypto market has greatly thinned in the last six months. The market is dominated by individual traders. Moreover, crypto as a payment method will continue to face challenges owing to the fact that the bank was unable to find banks that take cryptos for payment in 2018.

The analysts at JP Morgan said that Bitcoin is likely to slide to US$2,400 while a drop below US$1,260 is a possibility especially if the ongoing bear trend in the market fails to reverse.