There is a Renaissance in nuclear power. Less than a decade after the Fukushima nuclear disaster, this is a reality that few people saw coming. Powering this reversal are changing attitudes. After decades of political intransigence (from a few, key players), a global consensus has finally emerged with respect to the imminent perils of climate change.

Because of the delays in this consensus, this has only increased the sense of urgency now that the political will exists to implement changes. Climate-related catastrophic events (often defined as a one-in-100-years-event) are already increasing exponentially. Projections for more extreme and

permanent consequences from rising sea levels and warmer ocean temperatures – in both human and economic terms -- have been significantly advanced.

Within this consensus, everyone agrees that the shift from fossil fuel-powered vehicles to electric vehicles is essential. Everyone agrees that increasing our use/reliance on clean, renewable power sources like wind and solar is essential. And, increasingly, there is agreement that these changes (alone)

won’t be enough.

Under even the most optimistic projections for adopting these emerging green technologies, few nations on the planet will be able to achieve their own self-declared goals for CO

2 emissions reduction from these means alone. How can humanity accelerate a significant reduction in our collective carbon footprint?

Nuclear power.

“Nuclear power plants will need a further 200M lbs of uranium each year, ie another Cigar lake or Patterson discovery each year.”

- Peter Dasler, President and CEO, CanAlaska Uranium Ltd

“Nuclear” is the answer

Nuclear power offers one enormous advantage versus any other existing power-generation option for reducing our carbon footprint: scale. Each new nuclear power reactor brought into production adds enormous incremental power generation.

The obvious examples here are France and Sweden. Both of these nations made a strong commitment (decades earlier) to “go nuclear” and today they are considered two of the West’s “greenest” nations in terms of achieving CO

2 reduction targets. That’s an individual look at how nuclear power represents an efficient/economical means for dramatically reducing reliance on fossil fuel power.

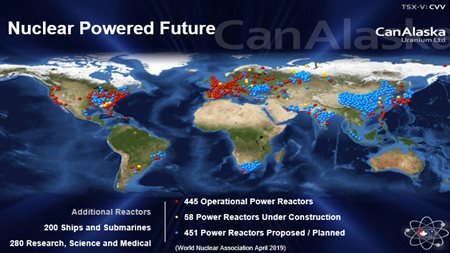

Collectively, this is how the Big Picture looks with respect to the nuclear power industry. There are currently 445 nuclear reactors in operation globally (outside of smaller, non-commercial reactors). But the real story here is the future growth that is already in the pipeline.

- 58 power reactors under construction

- 451 ordered/proposed/planned

(click to enlarge)

(click to enlarge)

With 58 reactors under construction and ~500 on the drawing board, this represents a potential doubling of the global nuclear industry. This won’t happen overnight, but once a firm commitment to nuclear power is made, the nuclear power industry is capable of ramping up construction dramatically.

In the 1980’s, the previous zenith in nuclear power growth, 218 new power reactors were commissioned. This translates to an average of

one new reactor every 17 days [source:

World Nuclear Association]. Of the reactors currently under construction, 26 are due to come online in either 2019 or 2020. The Renaissance has begun.

Investors wanting to capitalize on the resurgence of the nuclear power industry will want the answer to a basic question. What does this growth in nuclear power equate to in terms of demand for uranium, the fuel which powers these reactors?

Peter Dasler, the President and CEO of

CanAlaska Uranium Ltd. (

TSX: V.CVV,

OTCQB: CVVUF,

Forum) framed this news for mining investors. CanAlaska is a prospect generator with a strong focus on uranium project development in the world-famous Athabasca Basin, home of the planet’s largest deposits of high-grade uranium.

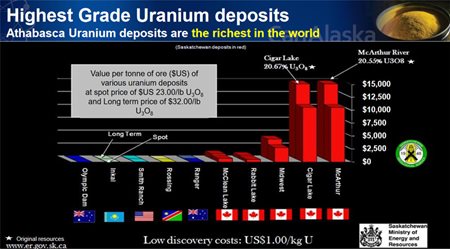

“Nuclear power plants will need a further 200M lbs of uranium each year, ie another Cigar lake or Patterson discovery each year.”

(click to enlarge)

(click to enlarge)

For investors new to the uranium mining industry, Cigar Lake is the second flagship mine for Cameco Corporation (TSX: CCO), the Canadian giant in uranium production. Cigar Lake presently produces roughly 12 million pounds of U

3O

8 per year from its extremely high-grade (>14% U

3O

8) uranium deposit. Cameco’s operations are also centered in the Athabasca Basin.

Cameco’s original flagship mine is its high-grade McArthur River Mine. McArthur River is a larger operation than Cigar Lake in terms of both production (~18 million pounds per year U

3O

8) and mineral reserves, and also boasts very high grades of uranium with its proven and probable reserves averaging 6.91% U

3O

8.

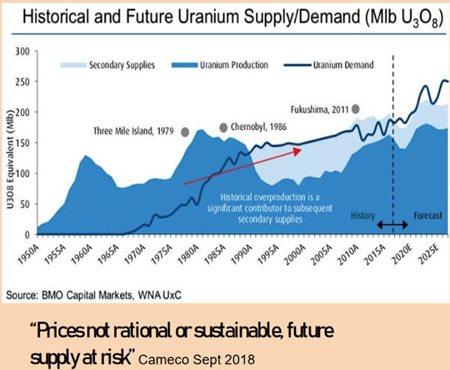

McArthur River is currently closed. Why? Excessively low prices for uranium. Cameco made the difficult decision to put McArthur River into care and maintenance in November 2017, along with its Key Lake Uranium Mill. This came with the spot price of yellowcake at approximately US$20 per pound and not far above its absolute bottom of ~US$18 per pound. That took those 18 million pounds per year of supply off of the market.

Since that time, the spot price has risen to as high as nearly US$30 per pound (currently >US$25 per pound). But Cameco has shown no inclination to restart production at McArthur River.

(click to enlarge)

(click to enlarge)

Uranium demand is now increasingly rapidly. Supply has actually been shrinking rather than rising. The price of uranium hit an all-time high of US$136 per pound in 2007. For the decade following that peak, long-term contract prices averaged above US$50 per pound. Why have mining investors not already seen uranium prices moving more quickly toward those previous levels?

Long-term supply contracts are a significant part of the answer here. Utility companies operating these power plants require secured supplies of yellowcake for their reactors and typically enter into multi-year supply contracts. Notably, these long-term contract prices have remained well above the spot price. Even now, with a spot price of US$25.75 per pound, the long-term contract price remains 20% higher, holding at US$32 per pound.

A Forbes article from

February 28, 2019 places this subject into context for investors.

Another factor contributing to its price discovery will be the expiration of long-term uranium procurement contracts. Many utility companies around the world tend to hedge their uranium needs years in advance in order to guarantee future prices and ensure a steady supply from reliable producers. In 2020-21, many of these supply contracts are expected to expire and hence might lead to a larger supply deficit.

The massive long-term growth in large-scale nuclear power is ultimately the biggest driver for this sector. Supply cut-backs and the expiry of long-term supply contracts are near-term catalysts that should lead to a significantly higher repricing of U

3O

8. An additional driver for nuclear power and uranium demand is a function of emerging nuclear technology – and economics.

Small Modular Reactors

As noted, nuclear power is increasingly seen as the most efficient means for achieving emissions reduction goals because of the enormous scale of such power generation. Ironically, what could be about to revolutionize the use of nuclear power going forward is the reduction of this scale:

making nuclear power a potentially economically viable option for smaller communities.

CanAlaska Uranium’s CEO has been closely following the development of “small modular reactors” (SMR’s). Peter Dasler outlined the implications here for Stockhouse Editorial.

“Off-grid communities can now look to small modular reactors for clean year- round power, rather than the high cost to transport and burn diesel fuel.”

These SMR’s pack the same, enormous power “punch” as a conventional reactor (in proportionate terms), but at a dramatically reduced size and with commensurate reductions in capital costs. Revolutionary. By itself, SMR’s could have been the impetus for a nuclear power Renaissance. Climate change dynamics will increase the adoption of this technology.

Even without the emergence of SMR’s a Renaissance for nuclear power is already underway. As noted by Peter Dasler, fueling the growth of large-scale nuclear power alone will require “a new Cigar Lake” every year.

With the emergence of this small-scale nuclear technology, this adds a new and potentially dramatic wildcard to global uranium demand.

One of the companies perfectly poised to capitalize on this nuclear Renaissance is CanAlaska Uranium. The Company holds two, large prospective Athabasca Basin land packages. In an upcoming Stockhouse feature article on CanAlaska, investors will learn why management is especially enthused about its

West McArthur Uranium Project, including

its proximity to Cameco’s McArthur River Mine (and Key Lake Mill), as well as

an exciting uranium discovery on this property.

www.canalaska.com

FULL DISCLOSURE: This is a paid article of Stockhouse Publishing.