Savvy retail and institutional investors in the mining exploration industry know there are certain absolutes when it comes to discovering value and opportunity in the sector –

- Rediscovering mineral wealth in areas with historic mining success.

- 43-101 compliant resource. Large exploration land package with abundant upside for new discoveries.

- Low operational costs – initial, current and long-term.

- All mining permits in place.

- A highly developed and advanced project in an area with significant historic mining success.

- A proven, experienced management and operations team.

- And, Location! Location! Location!

Scorpio Gold Corp. (

V.SGN,

Forum) meets or exceeds all of the above conditions for a successful mining operation, and at what appears to be a very attractive, undervalued share price.

The Company is a Canadian junior-stage exploration and mine development company engaged in the evaluation and development of two historical producing gold properties in the politically-safe and pro-mining state of Nevada. These properties are located in the mountainous area of south-central Nevada, and, in many ways, echo the long and storied history of the region.

Scorpio Gold Corporation recently re-acquired a 100% interest in the Mineral Ridge gold mine in Esmeralda County, Nevada. And the results of this mining operation speak for itself – since achieving commercial production status in January 2012, the Company has produced over 216,000 ounces of gold at Mineral Ridge alone.

Mineral Ridge is a conventional

open pit heap leaching operation. Gold and silver bearing solution from the leach pad is collected in the pregnant pond and processed through the vertical carbon column in the Absorption, Desorption and Refining (ADR) plant for recovery of the gold and silver metals from leachate on carbon. Loaded carbon is shipped to Metals Research in Kimberley, Idaho for stripping and processing into doré. The

doré bars are then delivered to the Royal Canadian Mint's refinery in Ottawa for further refining of the precious metals.

As noted in the November 2017 43-101 compliant reserve totals in the chart below, Mineral Ridge has defined several mineable resources very near to existing infrastructure:

Mineral Ridge Mine Reserve Estimate

(Click image to enlarge)

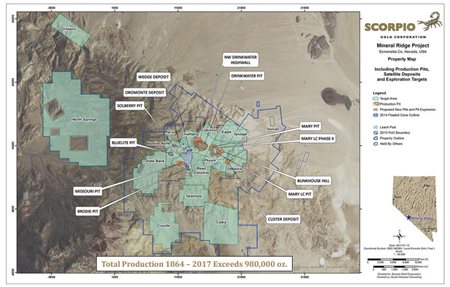

Mineral Ridge Property – 13,879 Acres

(Click image to enlarge)

Mineral Ridge Property – 13,879 Acres

(Click image to enlarge)

(Click image to enlarge)

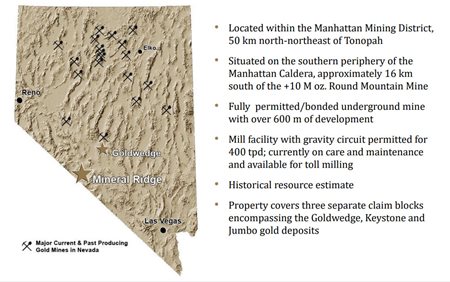

The Company believes it’s also found a hidden gem at its Goldwedge property. Scorpio Gold commenced rehabilitation of the mill facility and surrounding infrastructure in early 2013. Surface site work included the removal of sludge in the settling pond left over from previous operations, and repair and relining of the settling pond liner. Improvements to the 400 ton per day mill facility included installation of a pair of cyclones to ensure proper grinding control, installation of a second plate and frame press to minimize tailings bottle necks, inspection and repair of circuit pumps, and the repair of the properties TSF (Tails Storage Facility) liner. and review of the process equipment to improve circuit efficiencies.

Also 100 percent owned by Scorpio, the Goldwedge property is located 54 kilometers north-northeast of the town of Tonopah within the Manhattan Mining District of south-central Nevada. The Goldwedge project includes a fully-permitted underground mine with over 600 meters of underground development and a milling facility with a gravity recovery circuit.

The 726 hectare (1,795 acre) property lies a mere 16 kilometres south of Round Mountain and covers three separate claim blocks that encompass the Goldwedge, Keystone, and Jumbo gold deposits.

(Click image to enlarge)

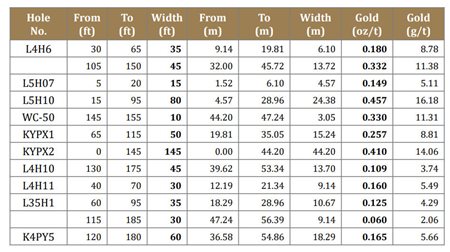

The Keystone Deposit at Goldwedge Property – Historic High-Grade Drill Results

(Click image to enlarge)

The Keystone Deposit at Goldwedge Property – Historic High-Grade Drill Results

(Click image to enlarge)

(Click image to enlarge)

In conversation with Stockhouse Editorial, soon to be Company director and court appointed Custodian of Gryphon Gold Corp, Murray Bockhold talked about the historical significance of Scorpio’s two brownfield properties – Mineral Ridge in Esmeralda County and Goldwedge in the Manhattan District:

“The thing about the Mineral Ridge project that makes it attractive is that it’s a restart. There’s no metallurgy or reserve risk so there’s really not a lot of risk in the project beyond securing the capital for the new processing plant. We’re a brownfield operation on a site that has greenfield exploration potential. Once we are back in production projected cashflow is expected to be north of US$15 million per year.”

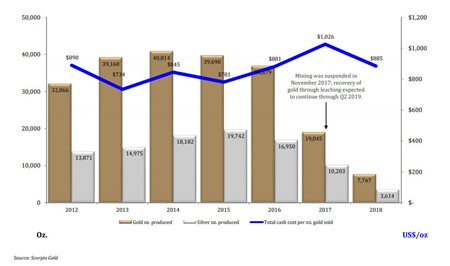

And as the chart below indicates, historical cost of production at Mineral Ridge in relation to total cash cost per ounce of gold sold is very attractive.

Production by Metal & Cost

(Click image to enlarge)

(Click image to enlarge)

(Click image to enlarge)

Mr. Bockhold went on to say this about Scorpio’s other project at Goldwedge:

“With Waterton out of the way we have hit the restart button in every sense of the word. This week we begin drilling at our Keystone Jumbo Exploration Project at Goldwedge. Scorpio received U. S. Forest Service approval earlier this year to drill up to 29 holes on the property. With our re-capitalized balance sheet we can pursue all avenues to enhance shareholder value after a 2 year hiatus.”

In the News

On

June 24, 2019, Scorpio Gold made a major announcement in regards to the approval of its Water Pollution Control Permit (WPCP) which will allow the Company to “advance its mining, processing, and exploration activities at its Mineral Ridge project located in Esmerelda County, Nevada.” The announcement also included the:

- addition of 1,500 acres to the existing project boundary for exploration purposes

- expansion of the existing open pits (Mary, Last Chance, Drinkwater and Brodie)

- development of four new pits (Custer, Custer South, Oromonte 1 and Oromonte 2)

- development and advancement of underground mining below existing and new pits

- construction of a 4,500 tons per day (TPD) processing facility with CIL recovery and tailings filtration circuits

- and, expansion of the existing heap leach pad to accommodate for the conversion of the facility to a dry stack tailings facility.

On

March 6, 2019, Scorpio Gold announced the completion of a US$3 million buyout of Waterton Global Resources Managements existing US6 million senior secured debt and re-acquire a 100% interest in the Mineral Ridge property.

Interim CEO and Company director Brian Lock commented:

"This is a great day for Scorpio Gold, having eliminated its US$6-million senior secured debt with Waterton in exchange for an upfront payment of US$3-million in cash, and increasing its ownership of the Mineral Ridge Gold Mine to 100%. Scorpio Gold is finalizing the previously-announced US$6-million convertible debenture financing. We can now focus our efforts on re-engaging with lenders who had previously expressed interest in funding our new processing facility at the Mineral Ridge project. This will allow us to capture the value in the gold reserves contained in the heap leach pad and unmined portions of the mine. We see potential to increase those resources by further exploration within and outside our area of operations. Our operating team at Mineral Ridge has proved its excellence over the past eight years and once financed, will build and operate the new process facility with an expected mine life of at least seven years.”

On April 15, 2019, the Company completed a 2-for-1 consolidation of its outstanding common shares. All share and per share amounts are shown on a post-consolidated basis retroactively throughout a Company

news release.

On April 29, 2019, the Company closed an over-subscribed US$7 million convertible debenture offering.

A Strong, Experienced Management Team in Place

(Click image to enlarge)

In Closing

(Click image to enlarge)

In Closing

Proposed developments for the Mineral Ridge and Goldwedge mines could add years to the mine life and increase opportunities to extract additional gold and other metals.

The company extended the area’s history of intermittent mining, which began around 1865, when it started at the site in 2011 and commercial production commenced in January 2012.

Historically, the mine produced 575,000 ounces of gold from open pit and underground operations. Total production in 2017 totaled 19,045 ounces of gold and 10,203 ounces of silver, according to the 2017 year-end report from Scorpio Gold.

While many junior mining companies have struggled in recent years to ignite investor enthusiasm, Scorpio Gold Corp. is a bonafide blue-sky property while positioning itself as an established gold mining powerhouse with a well-defined strategy that’s receiving renewed support from the market. Investors viewing how far this Company has come already need to focus on one fact – Scorpio Gold Corp is just beginning to fire on all cylinders.

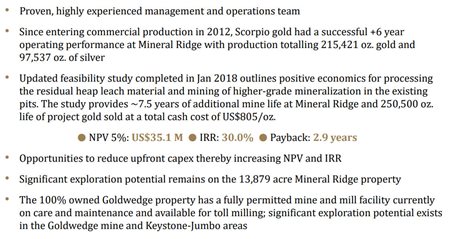

Summary Highlights

(Click image to enlarge)

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.

(Click image to enlarge)

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.