(Image via Berkwood Resources. Click image to enlarge)

Just over a year ago, Thomas Yingling was presented with some of the most promising resource estimates he’d ever seen.

A research firm had just assessed the flagship project of his graphite exploration company

Berkwood Resources Ltd. (

TSX-V:BKR,

OTC:CZSVF,

Forum) and come up with an unofficial resource calculation: 503,000 tonnes Cg (Carbon as graphite).

At the time,

Stockhouse highlighted what that potential meant. Using comparable numbers and an average selling price of US $1,465/t, it would translate to

potential revenue of US $400 million.

The Berkwood team got to work on making those estimates a reality. 27 diamond drill holes at the flagship Lac Gueret South Project (“Zone 1”) in Quebec became 45 holes totalling 6,091 metres by the end of 2018, hitting significant graphite in

all but one.

(Image via Berkwood Resources. Click image to enlarge)

There’s no better feeling in the mining industry than meeting your targets, and finally in August, Berkwood filed a

43-101 Mineral Resource Estimate that was right on the money: 1,755,300 tonnes of indicated resources at 17.00 % Cg and 1,526,400 tonnes in inferred resources at 16.39 % Cg, resulting in 549,400 tonnes Cg. At an average price of US $1,500 per tonne and a conservative 30% profit margin, Berkwood would be looking at

potential revenue of more than $247 million.

How did the Company manage to score such an impressive discovery? It helps to be located right beside an already successful project. Next door to Berkwood’s holdings in the Côte-Nord region of northeastern Quebec is

Mason GraphiteInc. (

TSX-V:LLG), which has its own Lac Gueret project ~4.7 million tonnes of ore over the project life at a grade of 27.8% Cg.

Yingling, the CEO and President of Berkwood Resources, recently sat down with Stockhouse Editorial to talk about the Company’s strategy. In the interview, he pointed out that looking where Mason had already found success is a tried-and-true practice for a reason.

“The best place to find a new mine is in the shadow of head frames. That line has been used in the mining industry for years because it works. The whole premise was doing exactly what Mason did, and we are. Everyone knows we're in good country and with amazing metallurgy. The big question was do we have enough of it, and the 43-101 was very robust.”

Waiting on estimate results can be excruciating, but once you get them, the action can begin in earnest. In addition to confirming earlier estimates, the results have allowed Berkwood to iron out an operational strategy that takes the Company’s other holdings into account.

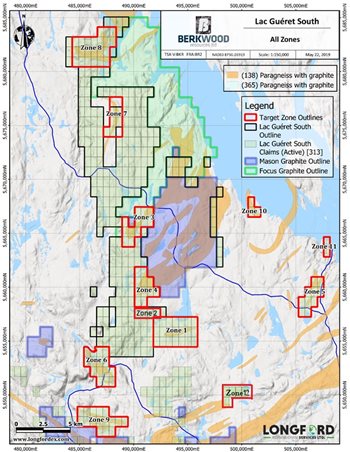

This is where Yingling and his team are most excited, and with good reason. The 43-101 estimate was fantastic, but Berkwood has so far only explored around 20% of Zone 1. In addition, the Company has other zones of graphite outcrops in the area.

On Aug. 7, it announced that it had acquired six new blocks of claims with previously confirmed graphite outcrops which had been sampled, bringing Berkwood’s total number of graphite outcrops to 12. Putting the earlier estimate in perspective, the Company has barely scratched the surface by exploring one out of 12 outcrops.

(Image via Berkwood Resources. Click image to enlarge)

(Image via Berkwood Resources. Click image to enlarge)

When Berkwood first made the Lac Guéret discovery in 2017, the Company needed to see just how strong it was. Now, with an NI 43-101 compliant resource estimate and additional graphite properties in close proximity, that plan has shifted to building a centrally located processing facility fed from the multiple outcropping pods of mineralization within a 10 km radius.

That’s only possible because the outcrops don’t need extensive drilling to reach resource. The current concern in the graphite market is one of oversupply, and in his interview with Stockhouse Editorial, Yingling explained that the surrounding outcropping pods of graphite are viable because they are extremely economical.

“We've realized that the most robust economics are to hit graphite not just close to the surface but actually outcropping. The benefit of that is, the first shovel into the graphite body you're actually selling, you're actually into your payzone. You're not having to dig down a hundred meters or dig a shaft or a huge massive open pit, so the economics of it are stunning, and the environmental impact on the planet is very small. In a green metal, which is what we are, we're wanting to minimize our environmental impact and maximize the economics.”

Yingling refers to the new strategy as a simple hub and spoke situation. Berkwood’s outcrops will be mined and the graphite trucked centrally, and it so happens that all the outcrops are already road accessible. If they do it right, the haul of numerous small deposits in one area would be no different than having one large deposit.

But for that comparison to hold, Berkwood knows that the graphite needs to be extremely economical. The recent 43-101 had a conservative cut-off grade of 6.81% Cg, and only shallow drilling was pursued. Still, previous metallurgical testing yielded 97.8% graphite in concentrate grade. As well, the Company’s surveyed graphite is primarily jumbo flake and large flake, the highest purity and most profitable flake sizes.

Recently, the Company had its Zone 1 graphite concentrates assessed, and the findings were stellar. Aside from confirming an above-average coarse flake size and the high graphite carbon grade,

the graphite was purifiable to 99.95% and suitable for expandable graphite production.

(Image via Berkwood Resources. Click image to enlarge)

Expandable graphite is one of the fastest growing market segments in the industry. By adding small molecules between carbon layers in high-grade graphite and applying heat, the graphite flakes expand and are then pressed into sheets. This process lowers the bulk density of the graphite, increases the surface area roughly ten-fold, and increases the volume of the graphite by up to 300 times.

By having graphite that is both battery-grade and expandable, Berkwood’s resource can be sold into a wide range of applications (and buyers). And it bears repeating that the current numbers are only from Zone 1 and don’t account for the additional promise from the outcrops. One of the high priority outcrops, Zone 6, had reported surface samples of up to 41.1% Cg.

After the Company received the initial mineral resource estimate for Zone 1, it

mobilized field crews to its outcrops for assessment and surface sampling. Once it solidifies its highest priority targets, the next steps will be to clear dirt at those outcrops and commence shallow drilling, which was recommended as the most economical.

(Image via Berkwood Resources. Click image to enlarge)

(Image via Berkwood Resources. Click image to enlarge)

Even though Berkwood’s additional outcrop claims might seem fortuitous to some, behind-the-scenes, it wasn’t leaving much up to chance. All the claims had either been already sampled or graphite bearing formations were surveyed. Most of the previous work was done under a joint venture of

Quinto Technology Inc. and

SOQUEM Inc., with the former becoming a part of

Cleveland-Cliffs Inc. (

NYSE:CLF).

Here, the Company has an ace up its sleeve: Quinto’s former VP Michel Robert, who was responsible for managing the Lac Gueret project that eventually became Mason Graphite’s Lac Gueret property, and is now serving as an advisor at Berkwood on the very same properties.

The reason for Berkwood’s profitable graphite outcrops, according to Robert, is an especially wide region of similar geology. In an interview with Stockhouse Editorial, he compared the findings to nearby properties and gave Berkwood the edge.

“What you’re looking at [in this area] is an ancient sea bottom that has been metamorphosed, folder, displaced by faults and finally eroded. Essentially, you're looking at a zone that is about 50km wide by 200km long, and the geology at point A is similar to the geology 50 km away at point B. At one end there's Mason and ourselves, at the other end is Focus nearly 200 km away with the same geology.

In the days of Quinto, we had identified dozens of graphite bearing outcrops in the area now covered by Berkwood’s claims. We’ve drilled one and are already close to half of the useful graphite that Mason and Focus each have in the ground. Now we are moving to the other outcropping pods, rather than drilling deeper at the first one, since that would be more expensive and have more effect on the environment.

Mason and Focus did their exploration work mostly on the first deposit they encountered. As it stands right now, we spent a lot less than Mason and Focus per tonne of graphite identified. To get where we are, Berkwood drilled 6,000 m; Mason drilled 40,000 m and Focus drilled 23,000 m.”

Taking everything into consideration, it’s easy to see why the Berkwood team is excited about the future. They have a resource on good host rock with high grade graphite at the surface. The projects are in an accessible area of Quebec with roads already going nearby all of the outcrops, and that’s before the government’s

$400 million commitment to upgrading nearby Highway 389.

And most importantly for shareholders, the Berkwood team is composed of experienced miners responsible for many successes in the mining industry. Far from being an exploration pump-up play, the Company’s resource estimates give it legs to stand on for a long-term project. As new products that use graphite continue to be developed, Berkwood’s holdings and strategy put it squarely on multiple paths to success.

(Video courtesy of Proactive Investors. Click image to play video)

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.