(Image via Blue Star Gold)

There’s gold in the North, and we’re starting to see just how much.

When you combine a positive trend for gold projects with a Canadian market hungry for new prospects, you’re going to see exploration programs around the country. Increasingly,

those opportunities are coming from Northern Canada.

The territories are relatively untapped compared to deposits closer to the border, but the local majors have been ramping up their operations. Alongside them, we have gold exploration companies like

Blue Star Gold Corp. (TSX-V:BAU, Forum) also making significant inroads.

Stockhouse readers will be familiar with Blue Star from

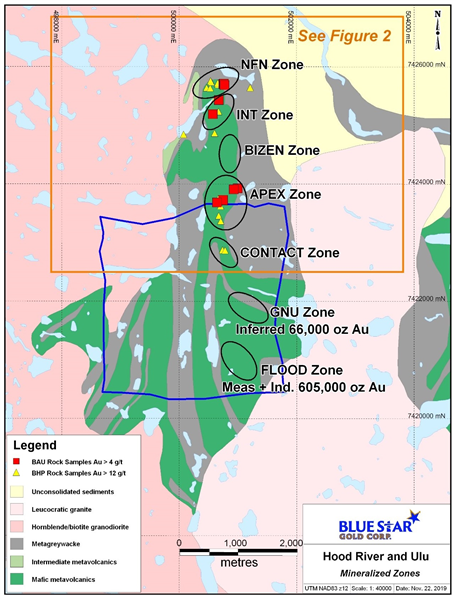

previous coverage in September highlighting the Company’s significant fall exploration plans in Nunavut. Operating in an area approximately 530km north of Yellowknife, the Company (which also

trades as 5WP on the Frankfurt Stock Exchange) owns the prospective Hood River Property and is currently in the process of acquiring the adjacent high-grade Ulu Gold Project. Both projects sit on mafic volcanic and sedimentary rocks, and both have historical gold findings.

Over the course of the fall exploration program, Blue Star planned to focus on the North Fold Nose (NFN) zone of the Hood River Project. The zone was the location where, a few decades earlier,

BHP Group Limited (

NYSE:BHP) had previously intersected 25.5 g/t Au over 1.54m.

A few months later, we can see that the zones have some serious gold and silver. On Nov. 25, Blue Star announced

the complete results from its exploration program, consisting of eleven completed holes for approximately 1,540m of core. The many highlights include six-metre intercepts of 12.92 g/t Au and 5.89 g/t Au, as well as one-metre drill intercepts of

48.7 g/t Au, 31.1 g/t Au, and 32.5 g/t Au.

(Image via Blue Star Gold)

(Image via Blue Star Gold)

The successful drilling program was just one part of the exploration plan. Running in parallel was a prospecting and sampling program that explored gold mineralized zones south from NFN and towards the Ulu property, all making up the confirmed 5km Robb Trend of mineralized zones.

As with the drilling results, the sampling and prospecting program confirmed that Blue Star was looking in the right place for gold. In addition to confirming previously seen gold values at two zones and adding to the potential of NFN, surface sampling discovered a new zone of prospective mineralization 350m south of NFN with multiple samples greater than 3.9 g/t Au,

including a one-metre intercept of 25.2 g/t Au at the new zone.

What has become clear to Blue Star’s management with each batch of results from the exploration program is that the Hood River and Ulu Projects are increasingly looking like bargains. On Oct. 09, the Company released

the first of its core sampling results from the program, confirming high-grade surface samples with intersections of 15.37 g/t Au over 5.0m and 6.92 g/t Au over 3.0m. On Oct. 28, the

next round of results were equally prosperous, and across the board the program intersected target mineralization in all holes.

Commenting on the entire scope of the completed exploration program, the CEO and President of Blue Star Stephen Wilkinson had nothing but high praise and bolstered hopes moving forward:

"Our 2019 exploration program focused on the gold zones of the north-western part of our Hood River concessions has far exceeded our best expectations. The diamond drilling confirmed a new gold zone at the NFN which could potentially develop into another substantial gold and silver resource. In addition the gold resources of the Flood and Gnu zones in the Ulu mining lease anchor the newly-recognized 5 km long Robb trend in the south. In addition, the prospecting discovered a new zone, that we call the INT gold zone, about 350 m south of the NFN zone and also confirmed and increased previously seen gold values at the Apex and Bizen Zones.”

Beyond exceeding expectations, the results of the program are allowing Blue Star to tackle 2020 with substantially greater understanding of the mineralization they’re sitting on. As part of the most recent release, the Company detailed that the new mineralized zone INT extends for more than 50m along strike with average thickness of 4m, and it remains open along strike and to depth.

(Image via Blue Star Gold)

(Image via Blue Star Gold)

But that’s just the tip of Blue Star’s iceberg. In his comments, CEO Wilkinson also pointed out that the team has seen very similar geological formations to their existing zones on the eastern half of the Hood River property, and the completion of the Ulu acquisition will open up an entire new area for confirming mineralization along the Robb Trend and beyond.

Right now, Blue Star is positioned at a rare and valuable point in time for a junior exploration company. The Company has a growing gold resource with numerous new targets for both step-out and infill drilling, it is working on an acquisition that will significantly bolster its position, and the region it is operating in is continuing to get attention and support for future mining projects.

A development in any of the fields will add a lot of strength to Blue Star’s value. With 2020 around the corner and experts expecting

gold prices to rise higher, the prospects for the Company look just as positive in the short term as they do in the long.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.