The need for affordable, secure, and well-maintained housing is an existential problem throughout BC’s Lower Mainland. And now, more than ever, that need has never been more apparent given the challenges of the COVID-19 pandemic…especially for students…both domestic and international. But one company is meeting those needs with a creative, aggressive and timely business model that both retail and institutional are taking note of.

And while many businesses have struggled during the pandemic, there have been some that have prospered, and even increased their business. Vancouver-based,

CIBT Education Group Inc. (MBA) (

TSX.MBA,

OTCQX: MBAIF,

Forum) is one of those companies. Founded in 1994 and is one of the largest education and student housing investment companies in Canada.

And the company is on track to accelerate revenue growth in an underserved and undervalued market. Here’s how.

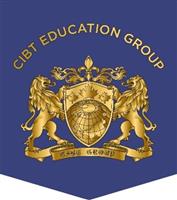

Traditionally, education, housing development, and financial investment have yielded a profitable and productive capital alliance. Now they make up the CIBT Education Group. Formerly Capital Alliance Group, CIBT Education renamed itself after its CIBT School of Business & Technology subsidiary in late 2007. CIBT also owns Sprott-Shaw College, with the schools offering career-oriented business, healthcare & technology programs as well as executive and language training programs in Canada and abroad. Some 10,000 students are enrolled in the group's campuses in 2020, which number about 29 locations world-wide. CIBT targets recent high school and college graduates with a particular niche in health-care-related programs such as Licensed Practical Nurse and Healthcare Assistant programs.

CIBT also owns

Global Education City Holdings (GEC), which is focused on education-related real estate which includes intelligent-designed, student-centric housing. GEC provides accommodation services to 72 schools in Metro Vancouver. Today, the total portfolio and development budget under the GEC brand exceeds CDN$1.5 billion dollars.

GEC is the largest student housing provider in Western Canada offering students clean, safe, and convenient rental apartments.

Investors take note – GEC plans to separately list onto a North American stock market with a possible dual-listing in Canada and the U.S.

Investment Corner

Investment Corner

According to the company, the reasons for the dual listing plan are as follows:

- CIBT’s prospective Canadian listing platform is designed to accommodate domestic institutional investors because its real-estate portfolio is rapidly growing in Canada.

- The company’s intended U.S listing platform is adaptable to investors from Asia (i.e. Hong Kong, Taiwan, and Singapore). Investors from these countries generally prefer U.S listings and CIBT is currently experiencing a large volume of investments flowing out from these countries, particularly Hong Kong.

- Asian investors have traditionally understood shareholder value in real estate and educational businesses. The company’s academic-asset business model ties education with student-centric rental apartments and Education Super Centers with substantial size and scale.

- Asian investors investing in future GEC stocks are not subject to the Foreigner Tax levied against property investments in Canada

- Asia based investors can freely trade U.S stocks from their home market without capital-gain tax in Hong Kong.

“We are delighted to have received another $7 million of investment commitments. As well as our subsidiary limited partnerships completing private placements totaling $18.33 million within the last 90 days, we have also completed the GEC Marine Gateway acquisition in October at a discounted price of $48.5 million. This latest round of investment into the GEC® Oakridge project represents further support of our business model by the investment community.”

Toby Chu, Chairman, President and Chief Executive Officer

In the News

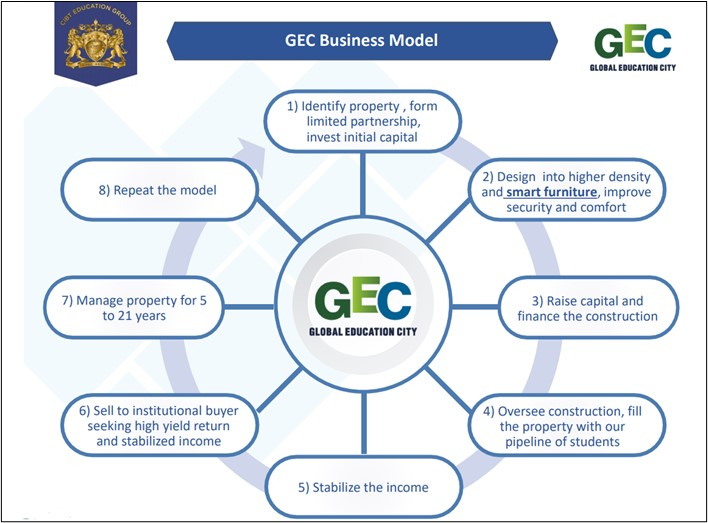

Recently, on February 10th, CIBT reported a major announcement that its flagship project – GEC Education Mega Center – had received approval from Surrey City Council at the first and second Public Hearings held on February 8, 2021. The Company will start the Development Permit application process after the Enactment of Bylaw, followed by the Building Permit application. Construction of the project may begin upon receipt of the Building Permit – management expects construction to commence after the summer of 2021.

The sizeable project will be a 49-storey concrete mixed-used commercial and residential building with 41 residential floors, 6 commercial and retail floors, 2 amenity floors, and 7 underground parking levels. The building design stands 542 feet tall, making it the fourth tallest building in Metro Vancouver. The Project is expected to be completed by 2024. The size and scale of GEC’s rapidly growing academic assets are becoming attractive to institutional investors from Canada, U.S. and abroad.

From the CEO

From the CEO

Toby Chu is the founder, President and Chief Executive Officer and Chairman of CIBT Education Group Inc., headquartered in Vancouver BC, Canada. Mr. Chu founded CIBT in 1994 and has since developed the Company into an international corporation with 45 business locations in Canada and abroad.

To realize his vision of global education, Mr. Chu acquired Sprott Shaw College in 2007 – one of the largest private career colleges in Canada established in 1903. Today, Sprott Shaw operates 16 campuses in BC alone. Sprott Shaw became the core infrastructure, academic resource, and content provider for CIBT Group's future expansions. By 2020, Sprott Shaw College transformed from a predominantly domestic college into a diversified student-mix.

In 2014, Mr. Chu initiated the student-housing division of the Company called Global Education City ("GEC") by acquiring a hotel, several serviced apartments and development properties to construct North America's first Education Super Center and Education Mega Center. Utilizing the pipeline of domestic and international students owned by CIBT's education platform and a network of seventy-two school partners in Metro Vancouver, GEC's student housing business grew exponentially in a few short years. Total real estate portfolio, including development budget, grew to $1.5 billion with 11 projects, 16 properties in Metro Vancouver. In 2021, GEC expanded to corporate-housing catering to corporate clients from the technology and health-care sectors.

Mr. Chu is the recipient of numerous prestigious awards. In 1993, Mr. Chu was named the "Top 40 Businesspeople under the Age of 40." In 1994, Mr. Chu became the top 30 finalists among 300 nominees across Canada for the Entrepreneur of the Year Award. In 2015, Mr. Chu earned the Entrepreneur of the Year Award by the Association of Chinese Canadian Entrepreneurs. Under Mr. Chu's management, CIBT earned the following recognition during the past twenty-seven years:

- Top 400 Fastest-Growing Companies in Canada in 2020, by Globe and Mail's Report on Business Magazine

- Top 500 America's Fastest-Growing Companies 2020, ranked by the Financial Times, London

- Top 100 Fastest-Growing Companies in Canada in 1993, 2003, 2009, 2010, 2011, 2012, 2013, ranked by the Profit Magazine

- Top 100 Fastest-Growing Companies in BC from 2015 to 2020, by Business in Vancouver newspaper

- Top 100 Public Companies in British Columbia from 2008 to 2020, by Business in Vancouver newspaper

- Succeeding Profiles of Chinese Canadian Entrepreneurs by the Asia-Pacific Foundation

- Top 2 Best International Prep College in China by sohu.com in 2009

- Top 5 Sino-Foreign Colleges in China by edu.qq.com in 2009

- Top 10 Most Influential Sino-Foreign MBA Programs in China by China's Executive Weekly Magazine in 2004 and 2007

- Top 5 TSX-Venture Listed Companies by the TSX-Venture Exchange in 2008

- Top 500 Largest Publicly Traded Companies across Canada by Report on Business magazine

- Ranked in 8th position on the OCTQX 2018 Best 50 Top Performing companies

(CEO Toby Chu. Photo courtesy CIBT Education Group Inc.)

In conversation with Stockhouse Editorial, Mr. Chu detailed how the company’s dual listing strategy opens up opportunities to the entire global investment community along with CIBT’s unique education / academic real estate business model.

SH: CIBT's Oakridge Project recently received Vancouver city council public hearing approval. Can you tell us some of the details of this deal and what it means for shareholders and would-be investors?

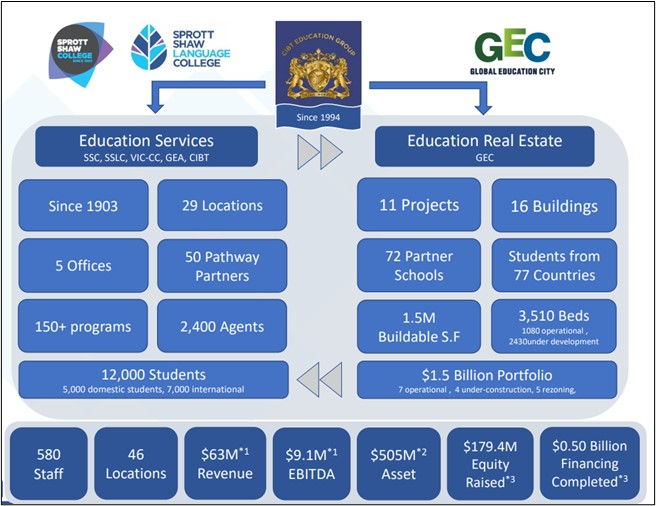

TC: Value Proposition 1. After a development project received rezoning approval would translate to significant valuation gain for the underlying properties. As an example, the estimated land value after rezoning approval is over $50 million. Our purchase price of the three houses combined was $30.3 million.

Value Proposition 2. We will commence construction in a few months. After the construction is complete, the new building has an estimated cost of $110 million.

Value Proposition 3. We will rent the rental units out to over 475 occupants, which will generate over $7.5 million rental income annually.

Value Proposition 4. After stabilization, typically six to twelve months after possession, we will exit to institutional buyers such as REITs, LifeCo, Real-estate funds and reap high-yields for our investors. Our projected exit value for GEC Oakridge in 2024 is $167 million, based on five years of growth trend, market condition, cap-rate and projected net income. The value proposition is obvious. Currently, three families are living on the three properties. Post-construction, over 475 occupants will be living on the same three parcels of land but in 18 storey concrete apartments. The value proposition transforms into substantial profit to our investors.

If the market is bad, we are a happy rent-collector of $7.5 million per year and willing to wait-out the market condition.

Value Proposition 5. We will stay behind as property managers for five to ten years for the new owner at a fixed annual lease rate. Most REITs do not like management chores and are happy to own the property and assign GEC to operate and manage it via a Head-Lease arrangement guaranteeing them an annual fixed return. GEC will continue to earn the annual rental revenue of $7.5 million, earn a margin between Head-Lease and Retail Rate renting to GEC clients.

And, Value Proposition 6. This management arrangement allows the Buyer to feel comfortable buying the GEC asset because we will be there five years after the sale, instead of disappearing after the sale. GEC LP investors also feel better that GEC is standing behind the exit strategy giving them liquidity upon-exit.

We repeat the same business model for all other projects. We believe by adding value to every step of our business model creates substantial value to our investors.

SH: What are some of the current projects you're working on?

TC: Our properties are under four categories:

- Rezoning Phase – revenue-producing in 48 - 60 months

- Permit Ready (rezoning approved, construction imminent) – revenue-producing within 36 – 42 months

- Under-construction – revenue-producing within 24 – 30 months

- Operational – revenue-producing now.

We will continue to balance our portfolio by acquiring income-producing properties to generate immediate cash-flow returns to our investors.

We will oversee those under-construction projects to make sure that the design and construction conform to GEC standards.

We will exercise value-engineering measures to obtain Rezoning, Development and Building Permits for category 2 projects.

Finally, we will continue to acquire lands and use our experience to add value and transform the property into an income-producing building.

Categories 1, 2 and 3 give us the lowest cost and highest return on investment, but time-consuming with construction and opportunity risks.

Category 4 gives us cash-flow return immediately but at a higher cost of purchase and, therefore, lower investment return.

SH: It's a roller coaster ride in stocks over the past 12 months. Can you tell our investor audience what you think 2021 looks like on the road to profitability?

TC: GEC has been profitable for the past four years. F2020 reported a loss of $4.75M. However, completely non-cash related. The loss was contributed to valuation write-down amid the peak of COVID-19, with our year ended on Aug 31, 2020. From September 2020 to January 2021, Vancouver's real estate market has set new record highs month-after-month. We have reasons to believe our valuation write-down in F2020 was conservative and appropriate. We may see a recovery of the written down value in F2021 and forward, if not an even higher value if the current real estate market trend continues.

SH: Your operations include education, media communications, revenue-producing properties, and real estate development. That's quite the portfolio!

TC: Education feeds clients to our student-centric rental apartments. Vertical integration chains like PepsiCo owns KFC, Pizza Hut and Taco Bell. Disney, the media and movie company, expanded to bricks-and-mortar like Disney Land and Disney World, vertical integration and generated significant cash-flow. Airlines expanded their passenger business to cargo business, where they earned their profit from the cargo business while losing money from the passenger business.

We believe vertical integration can reduce cost, add synergies, and enhance our business model.

SH: What sets the Company apart from other student housing investment companies in this space, and what makes your business model attractive to investors?

TC: In Western Canada, we saw little or no "organized" competitions other than home-stay families and private property owners renting their property to students. Our niches are:

- Over 29 brick-and-mortar schools and recruitment offices; 20 are operating in BC

- Educated over 12,000 students in Y2019, and 11,000 students in Y2020

- A network of 72 partner-schools working with us in the lower mainland. They provide the education to the students. We provide accommodation to their students

- 27 years of DNA in the education sector, as compared to most other student-housing operators from around the world came from the real estate or finance background. We owned the education platform and a vast network of education partners feeding students (tenants) to our properties.

- Our Education Super Centre and Education Mega Centre will change the student-housing landscape. Our super centres integrate five to twelve schools of various disciplines, attached to it thousands of student-centric rental apartments within the same complex located next to the SkyTrain station. Supported by shared amenities such as a shared cafeteria, shared computer labs, shared student lounges, wellness centres, video-conferencing rooms will reduce the operating costs for all the schools located at the super centres. Such facilities become a clean, safe and convenient learning and living environment for the students.

- The scale will completely differentiate GEC from any student-housing providers worldwide. Student-housing business is residential only. Education Super Centre is much more than a rental apartment, but an integrated hub for education and affordable living.

SH: And finally, Toby, from the investor's perspective, can you tell us about the managerial and operational set-up of the Company and how will CIBT / GEC position itself as an industry leader?

TC: We have been in operations for 27 years. Our management team is dedicated and long-term executives at the corporate and operations levels. Some of our executive team members have been working for the Company for as long as 27 years. At least twenty of our senior executives have been working with the Company for 10 - 25 years.

We have succession plans in place, three presidents responsible for their divisions according to their interest, skillset and experience. We have the President of Education Services, President of Real Estate Services, and the President and CEO responsible for the corporate affairs. Each president specializes in their field of expertise. We are consistent, stable, and progressive.

In Conclusion

As a high value investment proposition, CIBT has a multitude of positive financial metrics going for it:

- brick and mortar properties

- one of Canada’s largest, most established private educational network of colleges

- a large inventory of in-demand student-centric housing

- a strong cash position

- a total portfolio and development budget under the GEC brand reaches CDN$1.5 billion

- and experienced, forward-thinking leadership and management.

The CIBT / GEC business model ticks practically all of the boxes that savvy investors are looking for in a blue chip educational / real estate investment opportunity.

Click image to watch GEC’s Student Housing story: https://vimeo.com/432572070

For more information, visit cibt.net

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.