When we first introduced our Stockhouse investor audience to

Vox Royalty Corp. (VOX) (

TSX-V.VOX,

OTCQX: VOXCF,

Forum) back in

March, viewers got a peek into a very unique precious metals royalty company. Investors often look to the royalty business model as a perfect hedge exposed to commodity upside without the inflationary cost pressures.

At present, Vox Royalty holds a portfolio of over 50 royalties and streams across the globe, strongly weighted on precious metals royalties. Vox also boasts the world’s largest proprietary royalty database of 8,000-plus royalties and has the second largest mining royalty portfolio in Australia behind giant Franco-Nevada Corp. (

TSX.FNV).

The company seeks out the very best royalties over development-stage and producing assets with low geopolitical risk (approximately 80% of its assets are located in Australia, Canada, and the U.S.). In less than three years, Vox has completed over 20 separate transactions acquiring over 45 royalties – leading the industry in growth. The acquisitions have been primarily focussed on near term producing assets with an organic pipeline of several long-life, economically robust development-stage assets.

What Exactly is a Mining Royalty Company and How Does it Work?

Simply put, a mining royalty company operates as an aggregator of current and future revenue streams from mining operations.

Royalty deals are based on overall project revenues. The revenues are calculated as the royalty percentage multiplied by the product of the production of the metal and the price of the commodity. The benefit of this unique asset is that the royalty holder gets exposure to all the upside potential with limited exposure to the risks and specifically no exposure to the rising costs of mining the metal. Making it the perfect inflationary exposure for investors.

(Click image to enlarge)

Targeting the Highest Returns on Invested Capital in the Royalty Industry

(Click image to enlarge)

Targeting the Highest Returns on Invested Capital in the Royalty Industry

Companies like Vox Royalty offer potential investors the ‘pick of the crop’ when it comes to top performing metals & mining plays, while mitigating some of the risk associated with junior exploration companies. Vox posses a few very distinct and desirable ROI advantages over other royalty companies. Vox’s intellectual property advantage provides company shareholders and investors with a systematic & structural advantage in generating exponential returns in the mining industry. The proof is in the pudding – Vox has generated exponential revenue growth of over 350% quarter-over-quarter over five quarters (avg. Q3-2020 to Q3-2021) with producing assets expected to grow from five to over ten by late 2023. According to the company, it will be announcing “numerous growth catalysts expected in coming quarters.” Stay tuned to Stockhouse and

Vox Royalty Corp. for all of the latest news and company details.

In the News

On

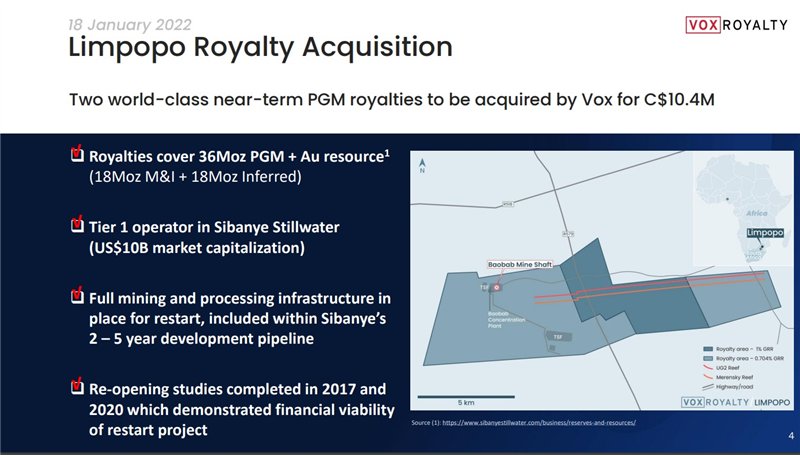

January 18th, Vox Royalty announced the acquisition of the Limpopo PGM project located on the northern section of the eastern limb of the Bushveld Complex in South Africa and operated by Sibanye Stillwater Ltd. (

OTC US: SBYSF) – one the company’s portfolio crown jewels. According to Riaan Esterhuizen, Executive Vice President of Vox Royalty Australia, the $10 million-plus purchase will provide investors, “exposure to a fully constructed world-class 18-million-ounce Platinum Group Metals (PGM) resource with near-term restart potential from a US$10 billion operator…with mine infrastructure already in place, feasibility studies underway and a financially strong operating partner in Sibanye-Stillwater.”

Transaction Highlights:

(Click image to enlarge)

(Click image to enlarge)

Kyle Floyd, Chief Executive Office of Vox, also commented on the Limpopo acquisition:

"Vox continues to successfully execute its strategy of finding world-class royalties on de-risked operations with meaningful near-term catalysts. This is an extraordinary acquisition that we expect will provide significant value to Vox shareholders for decades to come."

Most recently,

on April 5th, Vox Royalty provided detailed updates on recent developments and exploration from a quintet of its royalty operating partners: ValOre Metals Corp. (

TSX-V.VO), Genesis Minerals Ltd. (

OTC US: GSISF), Norwest Minerals Ltd., Zijin Mining Group Co. Ltd. (

OTCPK: ZIJMF), and Kalamazoo Resources Ltd. (

OTCPK: KAMRF).

Key Development Updates:

Investors Corner: The High-Growth Royalty Co. Focused on Sector-Leading Returns

As the stock chart below clearly indicates, VOX has continued to gain momentum and traction with retail and institutional investors over the past year –

demonstrating a 40%-plus increase in shareholder value since April 2021.

(12 month TSX-V.VOX stock chart Apr 2021 – Apr 2022. Click image to link to chart)

(12 month TSX-V.VOX stock chart Apr 2021 – Apr 2022. Click image to link to chart)

In a recent Stockhouse Editorial interview (see below), CEO Kyle Floyd summarized the value and opportunity offered by VOX:

“We have what I believe is an industry leading business model in many respects. Focused on what separates us from the competition - finding better value in volume for our investors. Doing that on a continued basis, systematically ahead of everybody else in the sector, we're going to continue that focus and that discipline. I believe in the last year we added more NAV (net asset value) per share than any other royalty company in the space. We've been able to do that because we continue to find very interesting opportunities at very good value for our shareholders.”

Meet the Team

“We have what I believe is an industry leading business model in many respects. Focused on what separates us from the competition - finding better value in volume for our investors. Doing that on a continued basis, systematically ahead of everybody else in the sector, we're going to continue that focus and that discipline. I believe in the last year we added more NAV (net asset value) per share than any other royalty company in the space. We've been able to do that because we continue to find very interesting opportunities at very good value for our shareholders.”

Meet the Team

Technical management, mining engineers, and geologists who own approximately 15% of Vox shares.

(Click image to enlarge)

Vox Royalty Corp. - Video Q&A Interview with CEO Kyle Floyd - Mar 15, 2022

(Click image to enlarge)

Vox Royalty Corp. - Video Q&A Interview with CEO Kyle Floyd - Mar 15, 2022

(Click image to play video)

(Click image to play video)

In the 2nd part of our 3 part series, we’ll take a deeper dive into Vox Royalty’s project portfolio, its business model, and what separates the company from the competition.

For regular updates, visit www.voxroyalty.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.