-

Affluent Canadian and American investors optimistic about the future

-

Seventy per cent of affluent North American investors on track to meet

financial goals

-

US investor sentiment holds steady while Canadian sentiment rises

-

Canadians and Americans aligned in financial New Year's resolutions and

priorities

TSX/NYSE/PSE: MFC

SEHK:945

TORONTO, Jan. 21, 2013 /CNW/ - Affluent North American investors are

feeling very optimistic about their personal finances heading into

2013. Seventy per cent of affluent investors in both Canada and the

United States agree that they are either ahead of plan, or on track, to

meet their personal financial goals and about 50 per cent anticipate

that their financial position will improve over the next two years.

Six out of ten affluent Canadian and American investors say that they

are on track to meet their current financial goals while roughly 10 per

cent say that they are ahead of plan on their goals. Just one in five

investors surveyed in both countries indicate that they are behind on

their financial goals but they are likely to catch up.

"It's positive to see that, despite ongoing news about the fiscal cliff,

global debt and U.S. debt ceiling, economic uncertainty and other

challenges, our surveys indicate that affluent North American investors

are feeling very confident about their financial future," said Paul

Lorentz, Executive Vice-President, Investment and Insurance Solutions

for Manulife Financial.

The findings are derived from a comparison of the results of the latest

Manulife Financial and John Hancock Investor Sentiment Index surveys.

The surveys - conducted in Canada and the U.S in December 2012 -

measure affluent investors' feelings about whether or not this is a

good time to invest in a variety of savings and investment vehicles and

the likelihood of purchasing specific financial products and services.

Investor sentiment differs in North America

In Canada, overall affluent investor sentiment index strengthened in the

second half of the year, rising to +31, from +26 in January 2012. In

the U.S.,investors' confidence held steady in the fourth quarter of

2012, with the John Hancock Investor Sentiment Index® ticking upward

slightly to +18 from a score of +17 in the third quarter of last year.

New Year's resolutions, financial priorities aligned

Other findings from the surveys show that Canadians and Americans are

aligned in their financial New Year's resolutions and how they plan to

achieve their top financial goals.

-

In Canada (31 per cent) and the United States (29 per cent), the top

financial-planning related New Year's Resolution is to trim household

budgets.

-

Rebalancing portfolios is the second top resolution for 19 per cent of

Canadians and also for 19 per cent of Americans.

Top financial priorities for 2013 among affluent Canadians and Americans

differ slightly.

-

Canadians' top three priorities are to manage/maintain current lifestyle

(32 per cent), pay down debt (18 per cent) and save for retirement (15

per cent).

-

American respondents say their top financial priorities are the same:

however, they differ in order with maintain/manage their current

lifestyle (35 per cent) topping the list followed by, saving for

retirement (29 per cent) and paying down debt (11 per cent).

Similar steps to achieving financial goals

When asked what steps, if any, affluent investors are taking to achieve

their financial goals, Canadians and Americans identified the same top

four steps. However, these steps varied in terms of priority.

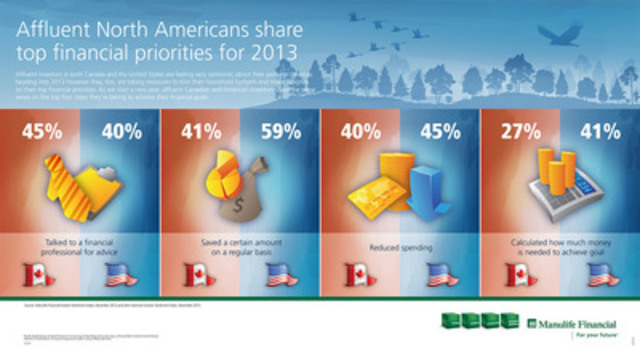

Percentage of Affluent investors that indicated what steps they have

taken to achieve their financial goals:

|

Step taken

|

Affluent Canadians

|

Affluent Americans

|

Talked to a financial

professional for advice

|

45%

|

40%

|

Saved a certain amount on

a regular basis

|

41%

|

59%

|

|

Reduced spending

|

40%

|

45%

|

Calculated how much

money needed to achieve

goal

|

27%

|

41%

|

Seven in ten affluent Canadians work with a financial advisor to achieve

their financial goals while in the U.S., five in ten affluent investors

choose to seek professional financial advice. However, affluent

investors in both countries indicated that they work with advisors for

a similar reason. Seeking advice on how to get better returns is the

main reason for Canadians (24 per cent) and Americans (56 per cent) to

work with a professional financial advisor.

"We encourage people to work closely with an advisor and stick to a

financial plan," Mr. Lorentz added. "People with integrated financial

plans, working with strong, reliable and trustworthy companies,

generally feel better prepared for the future, are more confident about

reaching their goals and are better equipped deal with the ups and

downs in the economy."

In both countries, those who do not work with a financial advisor say it

is because they feel knowledgeable enough to manage their investments

on their own (Canada, 26 per cent, U.S., 43 per cent).

About the Investor Sentiment Index Surveys

Both Investor Sentiment Index surveys are conducted in a similar

fashion. The survey measures affluent investors' feelings about the

current economic climate and their evaluations of what represents a

good or bad investment given the current environment. The poll also

asks consumers about their confidence in reaching key financial goals

and the likelihood of purchasing financial products and services.

An online survey of 1,127 investors was conducted in the U.S. between

November 26th to December 7th. In Canada, a sample of 1,003 investors were surveyed between November

30th to December 8th. Both surveys included household decision-makers at least 25 years of

age, with a household income of $75,000 or greater and investable

assets of $100,000 or more.

The Canadian research was conducted by Research House, an Environics

Company. The U.S. survey was conducted by independent research firm

Mathew Greenwald & Associates.

In a similarly-sized random sample survey, the margin of error would be

plus or minus +/- 3.10 percentage points at the 95% confidence level.

About Manulife Financial

Manulife Financial is a leading Canada-based financial services group

with principal operations in Asia, Canada and the United States.

Clients look to Manulife for strong, reliable, trustworthy and

forward-thinking solutions for their most significant financial

decisions.

Our international network of employees, agents and distribution partners

offers financial protection and wealth management products and services

to millions of clients. We also provide asset management services to

institutional customers. Funds under management by Manulife Financial

and its subsidiaries were C$515 billion (US$523 billion) as at

September 30, 2012. The Company operates as Manulife Financial in

Canada and Asia and primarily as John Hancock in the United States.

Manulife Financial Corporation trades as 'MFC' on the TSX, NYSE and PSE,

and under '945' on the SEHK. Manulife Financial can be found on the

Internet at manulife.com.

About John Hancock

John Hancock Financial is a division of Manulife Financial, a leading

Canada-based financial services group with principal operations in

Asia, Canada and the United States. Operating as Manulife Financial in

Canada and Asia, and primarily as John Hancock in the United States,

the Company offers clients a diverse range of financial protection

products and wealth management services through its extensive network

of employees, agents and distribution partners.

The John Hancock unit, through its insurance companies, comprises one of

the largest life insurers in the United States. John Hancock offers a

broad range of financial products and services, including life insurance, annuities, fixed products, mutual funds, 401(k) plans, long-term care insurance, college savings, and other forms of business insurance. Additional information about

John Hancock may be found at johnhancock.com.

Image with caption: "Affluent North American Investors Believe They Are Financially On Track(CNW Group/Manulife Financial Corporation)". Image available at: http://photos.newswire.ca/images/download/20130121_C7380_PHOTO_EN_22757.jpg

SOURCE: Manulife Financial Corporation