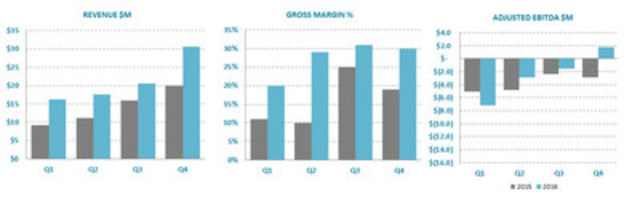

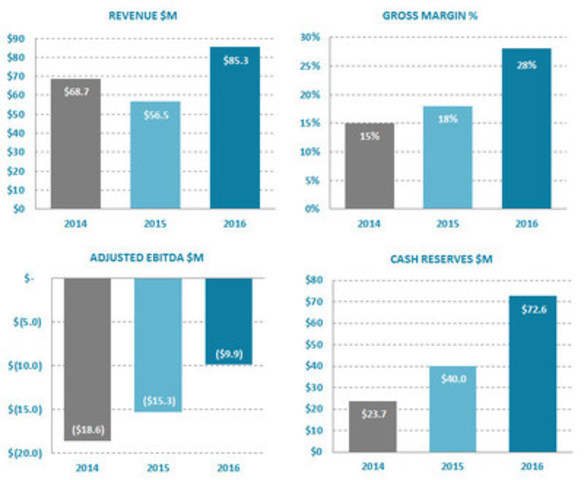

- Q4 results complete a strong 2016, including 51% revenue growth and 28% gross margin for the full year

- Positive $1.8M Adjusted EBITDA in Q4

- $87M in orders for 2017 delivery sets up continued growth

VANCOUVER, March 1, 2017 /PRNewswire/ - Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced

consolidated financial results for the fourth quarter and full year ended December 31, 2016. All

amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting

Standards (IFRS).

Randy MacEwen, President and CEO said, "We are pleased to report strong Q4 and full year 2016

financial results. Ballard generated revenue of $30.7 million in the final quarter of the year,

contributing to $85.3 million in full year 2016 revenue, up 51%. We also delivered an 11-point

improvement in gross margin for the quarter to 30%, and a 10-point improvement for the full year to 28%. The Company delivered a

strong quarter in Q4 with Adjusted EBITDA of positive $1.8 million, and full year improvement of

35% to negative $9.9 million."

Mr. MacEwen continued, "These results reflect significant progress on the strategic front during 2016. We secured transactions

in China laying the foundation for the local manufacture and sale of fuel cell engines and

stacks into China's large mass transportation sector. We enabled a reduction in annualized

operating expense of more than $6 million through a repositioning of our exposure to the backup

power market and a rationalization of the executive team. Ballard continued to expand our Technology Solutions business,

underpinned by solid progress under the long-term contract with Volkswagen Group. We also further strengthened the balance sheet,

reinforcing our strategic positioning."

Mr. MacEwen added, "In 2017, we expect continued strong growth in revenue and further expansion in gross margin. This is

supported by $87 million in committed orders expected for delivery this year – already exceeding

2016 revenue. We expect 2017 growth to be led by the Heavy Duty Motive market and our Technology Solutions business, along with

the Portable Power market."

Tony Guglielmin, Ballard's CFO noted, "The balance sheet was further fortified during the year

and we ended 2016 with cash reserves of $72.6 million, up 81% from the end of 2015. Our strategic

initiatives over the last year, combined with a positive growth trajectory and strong balance sheet, position Ballard to progress

toward our profitability objectives."

Q4 2016 Financial Highlights

(all comparisons are to Q4 2015 unless otherwise noted)

- Total revenue was $30.7 million, a 54% improvement –

- Power Products revenue was $19.0 million, up 45% and reflecting strong growth in Heavy

Duty Motive, and

- Technology Solutions revenue was $11.7 million, up 71%.

- Gross margin was 30%, up 11-points to $9.3 million, due to the increased proportion of

revenue from high-margin Heavy Duty Motive and Portable Power.

- Cash operating costs2 were $8.1 million, a 5% increase due partially to higher

technology and product development activities.

- Adjusted EBITDA2 improved 160% to $1.8 million, due to the increase in revenue and

gross margin.

- Net income (loss)3 was ($1.1) million or ($0.01) per

share, improvements of 17% and 27%, respectively, noting that Q4 2015 reflected a gain of $5.4

million on the sale of intellectual property to Volkswagen Group.

- Adjusted net income (loss)2 was ($1.0) million or ($0.01) per share, improvements of 83% and 85%, respectively.

- Cash provided by operating activities was $8.0 million, a 176% increase reflecting cash

operating income of $1.1 million, combined with net working capital inflows of $6.9 million.

Full Year 2016 Financial Highlights

(all comparisons are to full year 2015 unless otherwise noted)

- Total revenue was $85.3 million, a 51% improvement –

- Power Products revenue was $55.7 million, up 65% reflecting strong growth in Heavy Duty

Motive and a full year of Portable Power revenue; and

- Technology Solutions revenue was $29.6 million, up 31%.

- Gross margin was 28%, up 10-points to $24.2 million primarily due to a shift in product mix

toward higher margin Portable Power, Heavy Duty Motive and Technology Solutions.

- Cash operating costs2 were $34.3 million, an increase of 18% and driven primarily

by a full year of Protonex operating costs.

- Adjusted EBITDA2 improved 35% to ($9.9) million, due to higher revenue and gross

margin, partially offset by restructuring expenses of $2.3 million.

- Net income (loss)3 was ($21.1) million or ($0.13)

per share, declines of 263% and 212%, respectively, noting that 2015 reflected a gain of $19.6

million on the sale of intellectual property to Volkswagen Group.

- Adjusted net income (loss)2 was ($19.3) million or ($0.12) per share, improvements of 22% and 33%, respectively.

- Cash used by operating activities was ($3.9) million, an improvement of 85% reflecting cash

operating loss of ($12.4) million and net working capital inflows of $8.5

million.

- Cash reserves were $72.6 million at December 31, representing

an increase of 81% from the end of 2015.

2017 Outlook

Ballard has committed orders of $87 million expected for delivery in 2017, along with a

significant pipeline of qualified commercial sales opportunities. The Company believes that these orders and the sales pipeline,

along with current market conditions and its strategic, competitive and balance sheet positioning, support continued revenue

growth, gross margin expansion and improved financial performance in 2017. China is expected to

account for an increased proportion of total revenue in 2017.

Ballard anticipates growth in Power Products in 2017, supported by increased activity in Heavy Duty Motive and growth in

Portable Power.

The Company expects Technology Solutions to account for a larger proportion of total revenue in 2017, supported by work

related to contracts in China as well as engineering services work with automotive partners. In

addition, Technology Solutions work is expected with customers in the rail, military and unmanned aerial vehicle sectors.

Q4 & Full Year 2016 Financial Summary

|

|

|

|

(Millions of U.S. dollars)

|

Three months ended December 31,

|

Twelve months ended December 31,

|

|

2016

|

2015

|

% Change

|

2016

|

2015

|

% Change

|

|

REVENUE

|

|

|

|

|

|

|

|

Fuel Cell Products & Services:1

|

|

|

|

|

|

|

|

Heavy Duty Motive

|

$11.0

|

$4.1

|

170%

|

$26.5

|

$12.0

|

122%

|

|

Portable Power

|

$2.9

|

$3.4

|

-15%

|

$11.4

|

$3.4

|

236%

|

|

Material Handling

|

$3.0

|

$4.1

|

-26%

|

$12.9

|

$12.7

|

2%

|

|

Backup Power

|

$2.1

|

$1.6

|

31%

|

$4.9

|

$5.7

|

-15%

|

|

Sub-Total

|

$19.0

|

$13.1

|

45%

|

$55.7

|

$33.8

|

65%

|

|

Technology Solutions

|

$11.7

|

$6.8

|

71%

|

$29.6

|

$22.7

|

31%

|

|

Total Fuel Cell Products & Services Revenue

|

$30.7

|

$20.0

|

54%

|

$85.3

|

$56.5

|

51%

|

|

PROFITABILITY

|

|

|

|

|

|

|

|

Gross Margin $

|

$9.3

|

$3.8

|

145%

|

$24.2

|

$10.0

|

142%

|

|

Gross Margin %

|

30%

|

19%

|

11-points

|

28%

|

18%

|

10-points

|

|

Operating Expenses

|

$9.0

|

$9.3

|

-4%

|

$42.3

|

$34.9

|

21%

|

|

Cash Operating Costs2

|

$8.1

|

$7.7

|

5%

|

$34.3

|

$29.1

|

18%

|

|

Adjusted EBITDA2

|

$1.8

|

($2.9)

|

160%

|

($9.9)

|

($15.3)

|

35%

|

|

Net Income (Loss)

|

($1.1)

|

($1.4)

|

17%

|

($21.1)

|

($5.8)

|

-263%

|

|

Earnings Per Share

|

($0.01)

|

($0.01)

|

-27%

|

($0.13)

|

($0.04)

|

-212%

|

|

Adjusted Net Loss2

|

($1.0)

|

($5.9)

|

83%

|

($19.3)

|

($24.8)

|

22%

|

|

Adjusted Net Loss Per Share2

|

($0.01)

|

($0.04)

|

85%

|

($0.12)

|

($0.18)

|

33%

|

|

CASH

|

|

|

|

|

|

|

|

Cash Used by Operating Activities:

|

|

|

|

|

|

|

|

Cash Operating Income (Loss)

|

$1.1

|

($4.6)

|

124%

|

($12.4)

|

($19.3)

|

36%

|

|

Working Capital Changes

|

$6.9

|

($5.9)

|

215%

|

$8.5

|

($6.1)

|

241%

|

|

Cash Used By Operating Activities

|

$8.0

|

($10.6)

|

176%

|

($3.9)

|

($25.4)

|

85%

|

|

Cash Reserves

|

$72.6

|

$40.0

|

81%

|

|

|

|

For a more detailed discussion of Ballard Power Systems Q4 and full year 2016 results, please see the Company's financial

statements and management's discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, March 2, 2017 at 8:00 a.m. PDT (11:00 a.m. EDT) to review its Q4 and full year 2016 operating

results and Outlook for 2017. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and

PowerPoint slide webcast can be accessed through a link on Ballard's homepage (www.ballard.com). Following the call, the audio webcast will be archived in the 'Quarterly Earnings' area of

the 'Investors' section of the Company's website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) provides clean energy products that reduce customer costs and risks,

and helps customers solve difficult technical and business challenges in their fuel cell programs. To learn more about Ballard,

please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning projected revenue growth, product shipments, gross margin,

Adjusted EBITDA, cash operating expenses and product sales. These forward-looking statements reflect Ballard's current

expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Any such statements are based on Ballard's assumptions relating to its financial forecasts and

expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of

the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to

differ materially, please refer to Ballard's most recent management discussion & analysis. Other risks and uncertainties that

may cause Ballard's actual results to be materially different include general economic and regulatory changes, detrimental

reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed

discussion of these and other risk factors that could affect Ballard's future performance, please refer to Ballard's most recent

Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard's

expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue

reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required

under applicable legislation.

Further Information

Guy McAree +1.604.412.7919, investors@ballard.com or media@ballard.com

Endnotes :

|

1

|

We report our results in the single operating segment of Fuel Cell Products

and Services. Our Fuel Cell Products and Services segment consists of the sale and service of fuel cell products for our

power product markets of Heavy Duty Motive (consisting of bus and tram applications), Portable Power, Material Handling

and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer

and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel

cell applications.

|

|

|

|

2

|

Note that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net

Income (Loss), are non GAAP measures. Non GAAP measures do not have any standardized meaning prescribed by GAAP and

therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash

Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) assist investors in assessing Ballard's operating

performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and

other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash

Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) to the Consolidated Financial Statements, please

refer to Ballard's Management's Discussion & Analysis.

|

|

|

|

Cash Operating Costs measures operating expenses excluding stock based

compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring

charges, acquisition costs and financing charges. EBITDA measures net loss attributable to Ballard Power Systems Inc.

excluding finance expense, income taxes, depreciation of property, plant and equipment, amortization of intangible

assets, and goodwill impairment charges. Adjusted EBITDA adjusts EBITDA for stock based compensation expense,

transactional gains and losses, asset impairment charges, finance and other income, and acquisition costs. Adjusted Net

Income (Loss) measures net income (loss) attributable to Ballard from continuing operations, excluding impairment losses

or recoveries on trade receivables, transactional gains and losses, asset impairment charges, and acquisition

costs.

|

|

|

|

3

|

Net Income (loss) includes gains of $19.6 million in 2015 (including $5.4

million in the fourth quarter of 2015) on sale of intellectual property to Volkswagen Group.

|

SOURCE Ballard Power Systems Inc.