Financial stocks surged following last year’s elections, but many of the bank stocks retreated slightly after hitting highs in

early March. That retreat lined up with the failure of House Republicans’ efforts to repeal and replace the Affordable Care Act.

It’s hard to say what policies will get passed through Congress and when, but banks and financial companies seem to have also

benefited from the ongoing economic recovery and rising interest rates.

While there’s been a lot of talk about the future of interest rates, only a few analysts are talking about consumer expectations

regarding interest rates and how that could potentially impact lenders. With interest rates not that far from historic lows, there

is an expectation they will rise at some point in the future—by how much or when is the big unknown. Some might think that if

consumers are worried interest rates are going to rise quickly, they could decide to make larger purchases sooner to lock in

current interest rates. A recent Consumer Reports

article suggested “if you’re thinking of taking out a new fixed-rate mortgage, consider doing it sooner rather than later, when

rates may be even higher.” Consumer expectations regarding future interest rates could explain why mortgage applications and new

home sales continue to rise, even as interest rates creep up.

Increased loan growth combined with potentially higher interest rates is generally a positive environment for banks because it

can help boost net interest margins—the difference between the interest banks and financial institutions earn on loans and what

they pay out to depositors. In recent months, several major banks raised their earnings guidance citing anticipated improvements in

net interest margins.

Citigroup Earnings

A greater portion of Citigroup Inc (NYSE: C)

earnings are generated overseas compared to some of its peers, and some analysts think the company could be negatively impacted as

a result—particularly by a growing call for protectionist policies in some countries where it operates. While some analysts are

concerned about C’s international exposure, others seem to think this could be a positive for the company if global growth starts

to accelerate.

C is expected to report $1.24 earnings-per-share, or EPS, on revenue of $17.81 billion, according to consensus third-party

analysts. Revenue is expected to increase 1% and EPS is expected to increase 12%, as the company has focused on cutting costs. Last

quarter, C’s operating expenses decreased 9% to $10.1 billion.

Short-term options traders have priced in a potential 2.14% share price move in either direction around the earnings release,

according to the Market Maker Move™ indicator on the thinkorswim® platform. Calls have been active at the April 13

weekly 60 strike price while puts have seen activity at the April 13 weekly 56.5 and 57.5 strikes. The implied volatility sits at

the 26th percentile.

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over

a set period of time. Put options represent the right, but not the obligation, to sell the underlying security at a predetermined

price over a set period of time.

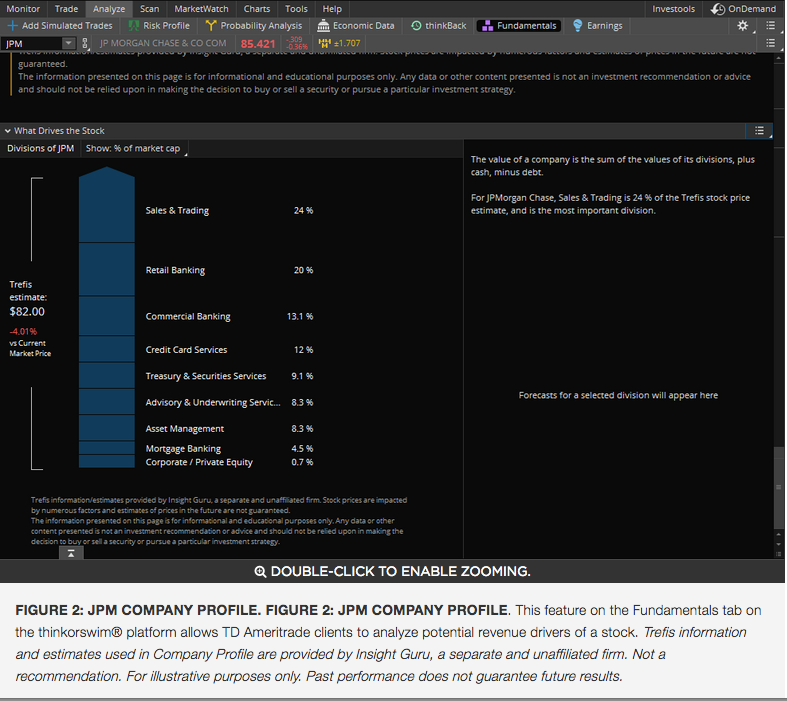

JPMorgan Chase Earnings

Dow component JPMorgan Chase & Co. (NYSE: JPM) is expected to report a 14% increase in EPS to $1.51 on revenue of $24.57

billion, according to consensus third-party analysts. Coming in a little higher than analyst estimates, data from Estimize* points

to JPM reporting $1.56 EPS. Last quarter, the company reported a 24% increase in profit as its trading units benefited from heavy

activity following the U.S. elections. In addition to its trading business, JPM cited growth in deposits and loans, and higher

credit card sales as contributors to its strong earnings.

JPM CEO Jamie Dimon is widely respected in the industry and his insights in shareholder letters and on conference calls are

widely followed for potential insights into the global economic and political climate. In the past, Dimon has warned of potential

negative impacts of Brexit and growing sentiment against globalism.

Heading into earnings, short-term options traders have priced in a potential 1.9% share price move in either direction around

the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform. Calls have been active at the

April 13 weekly 90 and 91 strikes while puts have been active at the April 13 weekly 80.5 and 85 strikes. The implied volatility

sits at the 38th percentile.

Wells Fargo Earnings

Wells Fargo & Co (NYSE: WFC) remains in the

news as the company continues dealing with its sales scandal that resulted from unauthorized accounts being opened in consumers’

names without their knowledge. The bank recently announced it would claw back $75 million in compensation from top executives. The

bank saw a 43% decline in consumer checking account openings in February, possibly a sign that consumers have been slow to regain

trust.In Q1 2017, WFC is expected to report $0.97 EPS on revenue of $22.13 billion, according to consensus third-party

analysts.

Short-term options traders have priced in a potential 1.77% share price move in either direction around the earnings release,

according to the Market Maker Move indicator™ on the thinkorswim® platform. Calls have been active at the April 13 weekly 54 and 56

strikes while puts have been active at the April 13 weekly 52.5 strike. The implied volatility sits at the 38th percentile.

The next round of financial sector earnings is a week away with Bank of America (BAC) and Goldman Sachs (GS) reporting on April

18, and Morgan Stanley (MS) is expected to report on April 19.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.