TSX Symbol: WJX

TORONTO, May 2, 2017 /CNW/ - Wajax Corporation

("Wajax" or the "Corporation") today announced improved 2017 first quarter results compared to the previous year.

|

|

|

(Dollars in millions, except per share data)

|

Three Months Ended March 31

|

|

2017

|

2016

|

|

CONSOLIDATED RESULTS

|

|

|

|

Revenue

|

$318.4

|

$285.0

|

|

Equipment sales

|

$93.3

|

$79.0

|

|

Equipment rental

|

$12.5

|

$12.4

|

|

Industrial parts

|

$89.6

|

$80.6

|

|

Product support

|

$110.3

|

$99.0

|

|

Other

|

$12.7

|

$14.0

|

|

|

|

|

Net earnings (loss)

|

$6.2

|

$(9.7)

|

|

Basic earnings (loss) per share

|

$0.31

|

$(0.49)

|

|

|

|

|

Adjusted net earnings (loss)(1)(2)

|

$6.2

|

$(0.6)

|

|

Adjusted basic earnings (loss) per share(1)(2)(3)

|

$0.31

|

$(0.03)

|

First Quarter Highlights

- The Corporation generated revenue of $318.4 million, an increase of 11.7% compared to the

prior year, due to higher revenue in western Canada relating to improved volumes in

construction, mining and forestry. Regionally, revenue increased 25.4% in western Canada, 4.5%

in central Canada and 1.0% in eastern Canada.

- The Corporation generated net earnings of $6.2 million or $0.31

per share, due to increased revenue and decreased selling and administrative expenses. The result compares to a prior year

adjusted net loss of $0.6 million or $0.03 per share.

- Compared to the fourth quarter of 2016, consolidated backlog increased $34.2 million, or 27%

due primarily to higher equipment orders.(1)(4) Compared to the first quarter of 2016, consolidated backlog

decreased $45.8 million, or 22%, due primarily to lower mining equipment orders.(1)(4)

- The Corporation's leverage ratio decreased to 1.94 times primarily as a result of a higher trailing 12-month Adjusted

EBITDA.(1)

- Wajax declared a second quarter 2017 dividend of $0.25 per share payable on July 5, 2017 to shareholders of record on June 15, 2017.

"We are satisfied with the improvement in our first quarter results which benefited from improved volumes in western

Canada. In addition, the broad improvement in equipment sales, industrial parts, product support and lower selling and

administrative expenses demonstrates the effectiveness of our reorganization. We express our thanks to the entire Wajax team who

worked very hard to deliver our first quarter results and continued to improve our safety record." said Mark Foote, President and Chief Executive Officer.

"With the completion of the reorganization, Wajax is now reporting as a single segment in this quarter versus the three

segments reported in the fourth quarter of 2016. The single segment reporting more accurately reflects the way in which the

company is organized and the manner in which we assess performance and allocate resources."

Mr. Foote continued, "Although the first quarter results are positive, we continue to expect that most major resource and

industrial markets will remain under continued spending constraints and margin pressures for the remainder of 2017. We will

remain focused on generating revenue sufficient to offset the four large mining shovel deliveries made in 2016, which are not

expected to be repeated in 2017, managing our margins effectively and ensuring we deliver the annualized savings expected from

our reorganization. Assuming the achievement of these objectives, management anticipates adjusted net earnings in 2017 will

increase compared to 2016 adjusted net earnings".

Wajax Corporation

Founded in 1858, Wajax (TSX: WJX) is one of Canada's longest-standing and most diverse

industrial products and services providers. The Corporation operates an integrated distribution system providing sales, parts and

services to a broad range of customers in diversified sectors of the Canadian economy, including: transportation, forestry,

industrial and commercial, construction, oil sands, mining, metal processing, government and utilities and oil and gas.

The Corporation's goal is to be Canada's leading industrial products and services provider,

distinguished through its three core capabilities: sales force excellence, the breadth and efficiency of repair and maintenance

operations, and the ability to work closely with existing and new vendor partners to constantly expand its product offering to

customers. The Corporation believes that achieving excellence in these three areas will position it to create value for its

customers, employees, vendors and shareholders.

Wajax will Webcast its First Quarter Financial Results Conference Call. You are invited to listen to the live Webcast on

Tuesday, May 2, 2017 at 1:00 p.m. ET. To access the Webcast,

enter www.wajax.com and click on the link for the Webcast on

the Investor Relations page.

Notes

|

(1)

|

"Adjusted net earnings (loss)", "Adjusted basic earnings (loss) per share",

"Consolidated backlog", "leverage ratio" and "Adjusted EBITDA" are financial measures which do not have standardized

meanings prescribed under generally accepted accounting principles ("GAAP"), and may not be comparable to similar

measures presented by other issuers. The Corporation's Management's Discussion and Analysis ("MD&A") includes

additional information regarding these financial measures, including definitions and reconciliations to the most

comparable GAAP measures, under the heading "Non-GAAP and Additional GAAP Measures".

|

|

(2)

|

Adjusted net loss for the three months ended March 31, 2016: net loss

excluding after-tax restructuring costs of $9.1 million, or $0.46 per share basic.

|

|

(3)

|

For the three months ended March 31, 2017, the weighted average shares

outstanding for calculation of basic earnings (loss) per share were 19,818,629 (2016 – 19,990,764).

|

|

(4)

|

The Corporation has made a correction to the backlog figure as at December

31, 2016 reported in its 2016 annual MD&A. Corrected backlog was $125.8 million compared to reported backlog of

$116.7 million, an increase of $9.1 million.

|

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking statements and forward-looking information, as defined in applicable

securities laws (collectively, "forward-looking statements"). These forward-looking statements relate to future events or

the Corporation's future performance. All statements other than statements of historical fact are forward-looking

statements. Often, but not always, forward looking statements can be identified by the use of words such as "plans",

"anticipates", "intends", "predicts", "expects", "is expected", "scheduled", "believes", "estimates", "projects" or "forecasts",

or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could",

"would", "should", "might" or "will" be taken, occur or be achieved. Forward looking statements involve known and unknown

risks, uncertainties and other factors beyond the Corporation's ability to predict or control which may cause actual results,

performance and achievements to differ materially from those anticipated or implied in such forward looking statements.

There can be no assurance that any forward looking statement will materialize. Accordingly, readers should not place undue

reliance on forward looking statements. The forward looking statements in this news release are made as of the date of this

news release, reflect management's current beliefs and are based on information currently available to management. Although

management believes that the expectations represented in such forward-looking statements are reasonable, there is no assurance

that such expectations will prove to be correct. Specifically, this news release includes forward looking statements

regarding, among other things, our outlook for major resource and industrial markets for the remainder of 2017; our areas of

focus for the remainder of 2017, including generating revenue sufficient to offset the four large mining shovel deliveries made

in 2016 which are not expected to repeat, effectively managing our margins and delivering the operational improvements and full

annualized savings expected from our 2016 strategic reorganization; our outlook for 2017 adjusted net earnings should we be

successful in achieving the forgoing objectives; our 4 Points of Growth Strategy and the goals for such strategy, including our

goal of becoming Canada's leading industrial products and services provider; and our belief that

achieving excellence in our areas of core capability will position Wajax to create value for its customers, employees, vendors

and shareholders. These statements are based on a number of assumptions which may prove to be incorrect, including, but not

limited to, assumptions regarding general business and economic conditions; the supply and demand for, and the level and

volatility of prices for, oil and other commodities; financial market conditions, including interest rates; our ability to

execute our 4 Points of Growth strategy, including our ability to develop our core capabilities, execute on our organic growth

priorities, complete and effectively integrate acquisitions and to successfully implement new information technology platforms,

systems and software; our ability to execute our strategic reorganization and realize the benefits therefrom, including cost

savings and productivity gains; the future financial performance of the Corporation; our costs; market competition; our ability

to attract and retain skilled staff; our ability to procure quality products and inventory; and our ongoing relations with

suppliers, employees and customers. The foregoing list of assumptions is not exhaustive. Factors that may cause

actual results to vary materially include, but are not limited to, a deterioration in general business and economic conditions;

volatility in the supply and demand for, and the level of prices for, oil and other commodities; a continued or prolonged

decrease in the price of oil; fluctuations in financial market conditions, including interest rates; the level of demand for, and

prices of, the products and services we offer; levels of customer confidence and spending; market acceptance of the products we

offer; termination of distribution or original equipment manufacturer agreements; unanticipated operational difficulties

(including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost

escalation, our inability to reduce costs in response to slow-downs in market activity, unavailability of quality products or

inventory, supply disruptions, job action and unanticipated events related to health, safety and environmental matters); our

ability to attract and retain skilled staff and our ability to maintain our relationships with suppliers, employees and

customers. The foregoing list of factors is not exhaustive. Further information concerning the risks and

uncertainties associated with these forward looking statements and the Corporation's business may be found in this news release

under the heading "Risk Management and Uncertainties" and in our Annual Information Form for the year ended December 31, 2016, filed on SEDAR. The forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary statement. The Corporation does not undertake any obligation to

publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless so required by

applicable securities laws. Readers are further cautioned that the preparation of financial statements in accordance with

IFRS requires management to make certain judgements and estimates that affect the reported amounts of assets, liabilities,

revenues and expenses. These estimates may change, having either a negative or positive effect on net earnings as further

information becomes available, and as the economic environment changes.

Additional information, including Wajax's Annual Report and Annual Information Form, are available on SEDAR at www.sedar.com.

Wajax Corporation

Management's Discussion and Analysis – Q1 2017

The following management's discussion and analysis ("MD&A") discusses the consolidated financial condition and results of

operations of Wajax Corporation ("Wajax" or the "Corporation") for the three months ended March 31,

2017. This MD&A should be read in conjunction with the information contained in the unaudited condensed consolidated

financial statements and accompanying notes for the quarter ended March 31, 2017, the annual

audited consolidated financial statements and accompanying notes for the year ended December 31,

2016 and the associated MD&A. Information contained in this MD&A is based on information available to

management as of May 2, 2017.

Management is responsible for the information disclosed in this MD&A and the unaudited condensed consolidated financial

statements and accompanying notes, and has in place appropriate information systems, procedures and controls to ensure that

information used internally by management and disclosed externally is materially complete and reliable. Wajax's Board of

Directors has approved this MD&A and the unaudited condensed consolidated financial statements and accompanying notes.

In addition, Wajax's Audit Committee, on behalf of the Board of Directors, provides an oversight role with respect to all public

financial disclosures made by Wajax and has reviewed this MD&A and the unaudited condensed consolidated financial statements

and accompanying notes.

Unless otherwise indicated, all financial information within this MD&A is in millions of Canadian dollars, except ratio

calculations, share, share rights and per share data. Additional information, including Wajax's Annual Report and Annual

Information Form, are available on SEDAR at www.sedar.com.

Wajax Corporation Overview

Founded in 1858, Wajax (TSX: WJX) is one of Canada's longest-standing and most diverse

industrial products and services providers. The Corporation operates an integrated distribution system providing sales, parts and

services to a broad range of customers in diversified sectors of the Canadian economy, including: transportation, forestry,

industrial and commercial, construction, oil sands, mining, metal processing, government and utilities and oil and gas.

The Corporation's goal is to be Canada's leading industrial products and services provider,

distinguished through its three core capabilities: sales force excellence, the breadth and efficiency of repair and maintenance

operations and the ability to work closely with existing and new vendor partners to constantly expand its product offering to

customers. The Corporation believes that achieving excellence in these three areas will position it to create value for its

customers, employees, vendors and shareholders.

Strategic Direction and Outlook

The strategic reorganization announced in March 2016 has been completed and, as a result, the

Corporation continues to estimate annualized cost savings of approximately $17 million starting in

2017. $8.6 million in cost savings was recognized in 2016 as a result of the reorganization.

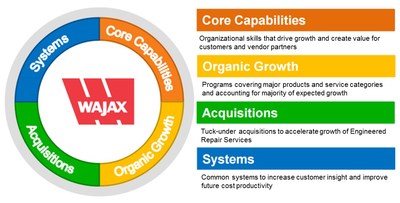

Management remains committed to and confident in the execution of our 4 Points of Growth Strategy to create value for

customers, vendors and shareholders.

Looking forward to the remainder of 2017, although there have been some announced increases in planned investments by Canadian

oil and gas companies, management expects that most major resources and industrial markets will remain under continuing spending

and resultant competitive pressure. The focus for the remainder of 2017 will continue to be on: (1) generating revenue

sufficient to offset the four large shovel deliveries made in 2016 (which are not expected to be repeated), (2) effectively

managing margins and (3) ensuring the Corporation delivers the operational improvements and full annualized savings expected from

the reorganization. Assuming the achievement of these objectives, management anticipates adjusted net earnings in 2017 will

increase compared to 2016 adjusted net earnings. See the Non-GAAP and Additional GAAP Measures section.

Highlights for the Quarter

- The Corporation generated revenue of $318.4 million, an increase of 11.7% compared to the

prior year due to higher revenue in western Canada relating to improved volumes in

construction, mining and forestry. Regionally, revenue increased 25.4% in western Canada, 4.5%

in central Canada and 1.0% in eastern Canada.

- The Corporation generated net earnings of $6.2 million or $0.31

per share, due to increased revenue and decreased selling and administrative expenses. The result compares to a prior

year adjusted net loss of $0.6 million or $0.03 per share.(1)

- Compared to December 31, 2016, backlog increased $34.2 million,

or 27%, due primarily to higher equipment orders.(1)(2) Compared to the first quarter of 2016, backlog

decreased $45.8 million, or 22%, due primarily to lower mining equipment orders.(1)

- The Corporation's leverage ratio decreased to 1.94 times primarily as a result of a higher trailing 12-month adjusted

EBITDA.(1)

|

(1)

|

"Backlog", "Leverage Ratio", "Adjusted Net Loss and "Adjusted EBITDA" do

not have standardized meanings prescribed by generally accepted accounting principles ("GAAP"). See the Non-GAAP

and Additional GAAP Measures section.

|

|

(2)

|

The Corporation has made a correction to the backlog figure as at December

31, 2016 reported in its 2016 annual MD&A. Corrected backlog was $125.8 million compared to reported backlog of

$116.7 million, an increase of $9.1 million.

|

Summary of Operating Results

|

Statement of earnings highlights

For the three months ended March 31

|

2017

|

|

2016

|

% change

|

|

Revenue

|

$

|

318.4

|

$

|

285.0

|

11.7%

|

|

Gross profit

|

$

|

60.8

|

$

|

54.7

|

11.0%

|

|

Selling and administrative expenses

|

$

|

49.5

|

$

|

52.7

|

(5.9)%

|

|

Restructuring costs

|

$

|

-

|

$

|

12.5

|

(100.0)%

|

|

Earnings (loss) before finance costs and income

taxes(1)

|

$

|

11.2

|

$

|

(10.5)

|

207.3%

|

|

Finance costs

|

$

|

2.5

|

$

|

2.7

|

(5.9)%

|

|

Earnings (loss) before income taxes(1)

|

$

|

8.7

|

$

|

(13.2)

|

166.0%

|

|

Income tax expense (recovery)

|

$

|

2.4

|

$

|

(3.4)

|

171.7%

|

|

Net earnings (loss)

|

$

|

6.2

|

$

|

(9.7)

|

164.0%

|

|

-

|

Basic earnings (loss) per share(2)

|

$

|

0.31

|

$

|

(0.49)

|

163.3%

|

|

-

|

Diluted earnings (loss) per share(3)

|

$

|

0.31

|

$

|

(0.49)

|

163.3%

|

|

Adjusted net earnings (loss)(1)(4)

|

$

|

6.2

|

$

|

(0.6)

|

1,133.3%

|

|

-

|

Adjusted basic earnings (loss) per share(1)(2)(4)

|

$

|

0.31

|

$

|

(0.03)

|

1,133.3%

|

|

-

|

Adjusted diluted earnings (loss) per share(1)(3)(4)

|

$

|

0.31

|

$

|

(0.03)

|

1,133.3%

|

|

Key ratios:

|

|

|

|

|

|

Gross profit margin

|

19.1%

|

19.2%

|

|

|

Selling and administrative expense as a percentage of revenue

|

15.6%

|

18.5%

|

|

|

EBIT margin(1)

|

3.5%

|

(3.7)%

|

|

|

Effective income tax rate

|

28.1%

|

25.9%

|

|

|

Statement of financial position highlights

As at

|

|

March 31

2017

|

|

December 31

2016

|

%

change

|

|

Trade and other receivables

|

$

|

194.1

|

$

|

194.6

|

(0.3)%

|

|

Inventories

|

$

|

290.6

|

$

|

283.4

|

2.5%

|

|

Accounts payable and accrued liabilities

|

$

|

(221.0)

|

$

|

(232.7)

|

(5.0)%

|

|

Other working capital amounts(1)

|

$

|

4.1

|

$

|

20.6

|

(80.0)%

|

|

Working capital(1)

|

$

|

267.8

|

$

|

265.9

|

0.7%

|

|

Rental equipment

|

$

|

57.6

|

$

|

58.1

|

(1.0)%

|

|

Property, plant and equipment

|

$

|

44.4

|

$

|

45.7

|

(2.7)%

|

|

Funded net debt(1)

|

$

|

134.0

|

$

|

126.0

|

6.4%

|

|

Key ratios:

Leverage ratio(1)

|

1.94 times

|

|

2.07 times

|

|

|

|

|

(1)

|

These measures do not have a standardized meaning prescribed by

("GAAP"). See the Non-GAAP and Additional GAAP Measures section.

|

|

(2)

|

Weighted average shares outstanding for calculation of basic Earnings

(loss) per share were 19,818,629 (2016 – 19,990,764).

|

|

(3)

|

Weighted average shares outstanding for calculation of diluted earnings

(loss) per share were 20,188,117 (2016 – 19,990,764).

|

|

(4)

|

Net loss excluding after-tax restructuring costs of $9.1 million or $0.46

per share in 2016.

|

Operating Segments

With the completion of the reorganization announced in 2016, the Corporation's Chief Executive Officer, who is also the Chief

Operating Decision Maker, regularly assesses the performance of, and makes resource allocation decisions based on, the

Corporation as a whole. As a result, the Corporation has determined that it comprises a single operating segment and

therefore a single reportable segment, which differs from the three reportable segments which existed prior to the

reorganization.

Results of Operations

Revenue

|

For the three months ended March 31

|

|

2017

|

|

2016

|

|

Equipment sales

|

$

|

93.3

|

$

|

79.0

|

|

Equipment rental

|

|

12.5

|

|

12.4

|

|

Industrial parts

|

|

89.6

|

|

80.6

|

|

Product support

|

|

110.3

|

|

99.0

|

|

Other

|

|

12.7

|

|

14.0

|

|

Total revenue

|

$

|

318.4

|

$

|

285.0

|

Revenue in the first quarter of 2017 increased 11.7%, or $33.4 million, to $318.4 million, from $285.0 million in the first quarter of 2016. The following

factors contributed to the increase in revenue:

- Equipment sales have increased due to higher construction, forestry and mining sales in western Canada, partly offset by reductions in material handling equipment in western and eastern Canada.

- Revenue from industrial parts has increased due primarily to increased bearings and power transmission sales in eastern

Canada and increased fluid power and process equipment sales in central and eastern

Canada.

- Product support revenue has increased $11.3 million to $110.3

million on strength in construction parts sales in all regions and mining parts and service sales in western

Canada.

Backlog of $160.0 million at March 31, 2017 increased $34.2 million compared to December 31, 2016 due mainly to orders for equipment

and industrial parts in all regions.(1) Backlog decreased $45.8 million

compared to March 31, 2016 due primarily to decreases in mining equipment orders.

|

(1)

|

The Corporation has made a correction to the backlog figure as at December

31, 2016 reported in its 2016 annual MD&A. Corrected backlog was $125.8 million compared to reported backlog of

$116.7 million, an increase of $9.1 million.

|

Gross Profit

Gross profit margin of 19.1% is comparable to the prior period margin of 19.2%. Margin pressure resulting from a higher mix of

equipment sales and a competitive new equipment pricing environment was largely offset by more stable parts margins and improved

service margins. Given a generally consistent gross profit margin on a quarter-over-quarter basis, volume increases resulted in a

$6.1 million or 11% increase in gross profit to $60.8 million from

$54.7 million in the first quarter of 2016.

Selling and administrative expenses

Selling and administrative expenses decreased $3.2 million in the first quarter of 2017,

compared to the same quarter last year, due mainly to $3.0 million of savings related to the

restructuring completed in 2016. Selling and administrative expenses as a percentage of revenue decreased to 15.6% in the first

quarter of 2017 from 18.5% in the first quarter of 2016.

In addition to the $3.0 million of selling and administrative savings, the Corporation realized

an additional $1.1 million of cost of sales savings related to the restructuring completed in 2016.

The Corporation continues to expect that the full annualized cost savings related to the restructuring completed in 2016 will be

approximately $17.0 million starting in 2017.

Finance costs

Quarterly finance costs of $2.5 million decreased $0.2

million compared to 2016 due to lower funded net debt levels. See the Liquidity and Capital Resources section.

Income tax expense (recovery)

The Corporation's effective income tax rate of 28.1% for the first quarter of 2017 was higher compared to the

statutory rate of 26.9% due to the impact of expenses not deductible for tax purposes. The Corporation's effective income

tax recovery rate of 25.9% for the first quarter of 2016 was lower compared to the statutory rate of 26.9% due to the impact of

expenses not deductible for tax purposes. The statutory income tax rate of 26.9% is unchanged compared to 2016.

Net earnings (loss)

In the first quarter of 2017, the Corporation had net earnings of $6.2 million, or

$0.31 per share, compared to a net loss of $9.7 million, or

$0.49 per share, in the first quarter of 2016. The $15.9

million increase in net earnings resulted primarily from restructuring costs of $9.1 million

after-tax, or $0.46 per share, incurred in the prior quarter and increased revenues and lower

selling and administrative expenses compared to the prior quarter.

Adjusted net earnings (loss) (See the Non-GAAP and Additional GAAP Measures section)

Adjusted net earnings in the first quarter of 2017 are equal to net earnings. Adjusted net loss in the first

quarter of 2016 excludes the restructuring provision of $9.1 million after-tax, or $0.46 per share. As such, adjusted net loss was $0.6 million, or $0.03 per share, in 2016.

Comprehensive income

Total comprehensive income of $6.2 million in the first quarter of 2017 included net

earnings of $6.2 million offset partially by an other comprehensive loss of $0.1 million. In the first quarter of 2016, total comprehensive loss included a net loss of $9.7 million and an other comprehensive loss of $1.6 million.

Board Chair

On March 7, 2017, the Corporation announced that Paul Gagné, a director since 1996 and

Chairman of the Board since 2006, will retire from the Board of Directors at the close of the Corporation's 2017 annual meeting

of shareholders. Rob Dexter has been nominated by his fellow directors to assume the duties of

Chairman following the 2017 annual meeting. Rob has been a director since 1988 and has most recently served as Chair of the Human

Resources and Compensation Committee of the board.

Senior Vice President, Finance and Chief Financial Officer

Effective March 8, 2017, Darren Yaworsky assumed the role

of Senior Vice President, Finance and Chief Financial Officer. Mr. Yaworsky is an experienced finance executive with an extensive

background in corporate finance, treasury and risk management. Most recently, he served as Vice President, Finance and Treasurer

at Canadian Pacific Railway and, prior to that, held several senior financial executive roles within the Enbridge Group of

Companies, including Treasurer of Enbridge Energy Partners LP and Treasurer of Enbridge Income Fund.

Mr. Yaworsky succeeded John Hamilton, who joined Wajax as Senior Vice President, Finance and

Chief Financial Officer in 1999. Mr. Hamilton's planned retirement from Wajax in March 2017 was

announced in August 2016.

Senior Vice President, Human Resources / Information Systems

In January 2017, the role of Stuart Auld, Senior Vice

President, Information Systems was expanded to include leading the Corporation's Human Resources team upon the departure of

Kathleen Hassay, Senior Vice President, Human Resources, who left the organization in early

2017. Mr. Auld joined Wajax in 2014 and since that time has been instrumental in coordinating a number of change activities

at Wajax.

Selected Quarterly Information

The following table summarizes unaudited quarterly consolidated financial data for the eight most recently completed

quarters. This quarterly information is unaudited but has been prepared on the same basis as the 2016 annual audited

consolidated financial statements.

|

|

2017

|

2016

|

2015

|

|

|

Q1

|

|

Q4

|

|

Q3

|

|

Q2

|

|

Q1

|

|

Q4

|

|

Q3

|

|

Q2

|

|

Revenue

|

$

|

318.4

|

$

|

313.7

|

$

|

286.6

|

$

|

336.6

|

$

|

285.0

|

$

|

324.4

|

$

|

290.9

|

$

|

340.7

|

|

Net earnings (loss)

|

$

|

6.2

|

$

|

8.9

|

$

|

7.6

|

$

|

4.3

|

$

|

(9.7)

|

$

|

(33.3)

|

$

|

7.5

|

$

|

9.0

|

|

Net earnings (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic

|

$

|

0.31

|

$

|

0.45

|

$

|

0.38

|

$

|

0.22

|

$

|

(0.49)

|

$

|

(1.66)

|

$

|

0.38

|

$

|

0.52

|

|

-

Diluted

|

$

|

0.31

|

$

|

0.44

|

$

|

0.37

|

$

|

0.21

|

$

|

(0.49)

|

$

|

(1.66)

|

$

|

0.37

|

$

|

0.51

|

Although quarterly fluctuations in revenue and net earnings are difficult to predict, during times of weak energy sector

activity, the first quarter will tend to have seasonally lower results. As well, large deliveries of mining trucks and

shovels and power generation packages can shift the revenue and net earnings throughout the year.

The first quarter 2016 net loss of $9.7 million included after-tax restructuring costs of

$9.1 million. Excluding the restructuring costs, first quarter 2016 adjusted net loss was

$0.6 million. The fourth quarter 2015 net loss of $33.3 million

included after-tax impairment of goodwill and intangible assets of $37.3 million. Excluding the

impairment of goodwill and intangible assets, fourth quarter 2015 adjusted net earnings was $4.0

million. See the Non-GAAP and Additional GAAP Measures section.

A discussion of Wajax's previous quarterly results can be found in Wajax's quarterly MD&A available on SEDAR at www.sedar.com.

Consolidated Financial Condition

Capital Structure and Key Financial Condition Measures

|

March 31

2017

|

December 31

2016

|

|

Shareholders' equity

|

$

|

276.6

|

$

|

276.8

|

|

Funded net debt(1)

|

134.0

|

126.0

|

|

Total capital

|

$

|

410.6

|

$

|

402.8

|

|

Funded net debt to total capital(1)

|

32.6%

|

31.3%

|

|

Leverage ratio(1)

|

1.94

|

2.07

|

|

(1) See the Non-GAAP and Additional GAAP

Measures section.

|

The Corporation's objective is to maintain a leverage ratio between 1.5 times and 2.0 times. However, there may be

instances where the Corporation is willing to maintain a leverage ratio outside this range to either support key growth

initiatives or fluctuations in working capital levels during changes in economic cycles. See the Funded Net Debt section

below.

Shareholders' Equity

The Corporation's shareholders' equity at March 31, 2017 of $276.6

million decreased $0.2 million from December 31, 2016.

The Corporation's share capital, included in shareholders' equity on the balance sheet, consists of:

|

Number of

Common Shares

|

Amount

|

|

Issued and outstanding, December 31, 2016 and March 31, 2017

|

20,026,819

|

$

|

180.6

|

|

Shares held in trust, December 31, 2016

|

(200,968)

|

$

|

(1.8)

|

|

Purchased for future settlement of certain share-based compensation

plans

|

(100,000)

|

|

(0.9)

|

|

Shares held in trust, March 31, 2017

|

(300,968)

|

|

(2.7)

|

|

Issued and outstanding, net of shares held in trust, March 31,

2017

|

19,725,851

|

$

|

177.9

|

At the date of this MD&A, the Corporation had 19,725,851 common shares issued and outstanding, net of shares held in

trust.

At March 31, 2017, Wajax had four share-based compensation plans; the Wajax Share Ownership Plan

("SOP"), the Directors' Deferred Share Unit Plan ("DDSUP"), the Mid-Term Incentive Plan for Senior Executives ("MTIP") and the

Deferred Share Unit Plan ("DSUP").

As of March 31, 2017, there were 356,522 (2016 – 334,131) SOP and DDSUP (treasury share settled)

rights outstanding and 519,464 (2016 – 316,296) MTIP and DSUP (market purchased share settled) rights outstanding. 70,385

SOP rights and 280,119 DDSUP rights were vested.

Wajax recorded compensation expense of $0.9 million for the quarter (2016 – $0.3 million) in respect of these plans.

Funded Net Debt (See the Non-GAAP and Additional GAAP Measures section)

|

March 31

2017

|

December 31

2016

|

|

Bank indebtedness (cash)

|

$

|

3.7

|

$

|

(4.9)

|

|

Obligations under finance lease

|

|

8.2

|

|

8.9

|

|

Long-term debt

|

|

122.1

|

|

122.0

|

|

Funded net debt(1)

|

$

|

134.0

|

$

|

126.0

|

|

(1) See the Non-GAAP and Additional GAAP Measures section.

|

Funded net debt of $134.0 million at March 31, 2017 increased

$8.0 million compared to December 31, 2016. The increase during

the quarter was due primarily to dividends paid of $5.0 million and common shares purchased and

held in trust for future settlement of awards made under certain share-based compensation plans of $2.2

million.

The Corporation's ratio of funded net debt to total capital increased to 32.6% at March 31, 2017

from 31.3% at December 31, 2016, primarily due to the higher funded net debt in the current

period.

The Corporation's leverage ratio of 1.94 times at March 31, 2017 decreased from the December 31, 2016 ratio of 2.07 times due to the higher trailing 12-month adjusted EBITDA offset partially by

the higher debt level. See the Non-GAAP and Additional GAAP Measures section.

See the Liquidity and Capital Resources section.

Financial Instruments

Wajax uses derivative financial instruments in the management of its foreign currency and interest rate exposures.

Wajax's policy restricts the use of derivative financial instruments for trading or speculative purposes.

Wajax enters into short-term currency forward contracts to hedge the exchange risk associated with the cost of certain inbound

inventory and foreign currency-denominated sales to customers along with the associated receivables as part of its normal course

of business. As at March 31, 2017, Wajax had the following contracts outstanding:

- to buy U.S. $41.2 million (December 31, 2016 – to buy U.S.

$55.1 million), and

- to sell U.S. $12.8 million (December 31, 2016 – to sell U.S.

$10.8 million).

The U.S. dollar contracts expire between April 2017 and May 2018,

with a weighted average U.S./Canadian dollar rate of 1.3269.

Contractual Obligations

There have been no material changes to the Corporation's contractual obligations since December 31,

2016. See the Liquidity and Capital Resources section.

Off Balance Sheet Financing

Off balance sheet financing arrangements include operating lease contracts for facilities with various landlords, a portion of

the long-term lift truck rental fleet and other equipment related mainly to office equipment. There have been no material

changes to the Corporation's total obligations for all operating leases since December 31,

2016. See the Contractual Obligations section above.

Although Wajax's consolidated contractual annual lease commitments decline year-by-year, it is anticipated that existing

leases will either be renewed or replaced, resulting in lease commitments being sustained at current levels. In the

alternative, Wajax may incur capital expenditures to acquire equivalent capacity.

The Corporation had $46.2 million (December 31, 2016 –

$44.0 million) of consigned inventory on-hand from a major manufacturer at March 31, 2017, net of deposits of $12.8 million (December

31, 2016 – $19.1 million). In the normal course of business, Wajax receives inventory

on consignment from this manufacturer which is generally rented or sold to customers or purchased by Wajax. Under the terms

of the consignment program, Wajax is required to make periodic deposits to the manufacturer on the consigned inventory that is

rented to Wajax customers or on-hand for greater than nine months. This consigned inventory is not included in Wajax's

inventory as the manufacturer retains title to the goods. In the event the inventory consignment program was terminated,

Wajax would utilize interest free financing, if any, made available by the manufacturer and/or utilize capacity under its credit

facilities.

Although management currently believes Wajax has adequate debt capacity, Wajax would have to access the equity or debt

markets, or reduce dividends to accommodate any shortfalls in Wajax's credit facilities. See the Liquidity and Capital

Resources section.

Liquidity and Capital Resources

The Corporation's liquidity is maintained through various sources, including bank and non-bank credit facilities, senior notes

and cash generated from operations.

Bank and Non-bank Credit Facilities and Senior Notes

At March 31, 2017, Wajax had issued $7.0 million of letters of

credit for a total utilization of $7.0 million of its $250 million

bank credit facility. In addition, Wajax had $125 million in senior notes outstanding bearing

an interest rate of 6.125% per annum, payable semi-annually, maturing on October 23, 2020.

Borrowing capacity under the bank credit facility is dependent on the level of inventories on-hand and outstanding trade accounts

receivables. At March 31, 2017, borrowing capacity under the bank credit facility was equal

to $250 million.

The bank credit facility contains customary restrictive covenants, including limitations on the payment of cash dividends and

an interest coverage maintenance ratio, all of which were met as at March 31, 2017. In particular,

the Corporation is restricted from declaring dividends in the event the Corporation's leverage ratio, as defined in the bank

credit facility agreement, exceeds 3.25 times. The senior notes are unsecured and contain customary incurrence based

covenants that, although different from those under the bank credit facility described above, are not expected to be any more

restrictive than under the bank credit facility. All covenants were met as at March 31,

2017.

Under the terms of the bank credit facility, Wajax is permitted to have additional interest bearing debt of $15 million. As such, Wajax has up to $15 million of demand inventory

equipment financing capacity with two non-bank lenders. At March 31, 2017, Wajax had no

utilization of the interest bearing equipment financing facilities.

As of May 2, 2017, Wajax's $250 million bank credit facility, of

which $243.0 million was unutilized at March 31, 2017, along with the

additional $15 million of capacity permitted under the bank credit facility, should be sufficient

to meet Wajax's short-term normal course working capital and maintenance capital requirements and certain strategic investments.

However, Wajax may be required to access the equity or debt markets to fund significant acquisitions.

In addition, the Corporation's tolerance to interest rate risk decreases/increases as the Corporation's leverage ratio

increases/decreases. At March 31, 2017, $125 million of the

Corporation's funded net debt, or 93%, was at a fixed interest rate which is within the Corporation's interest rate risk

policy.

Cash Flow

The following table highlights the major components of cash flow as reflected in the Consolidated Statements of Cash Flows for

the three months ended March 31, 2017 and March 31, 2016.

|

March 31

2017

|

March 31

2016

|

Change

|

|

Net earnings (loss)

|

$

|

6.2

|

$

|

(9.7)

|

$

|

15.9

|

|

Items not affecting cash flow

|

|

11.5

|

|

5.9

|

|

5.6

|

|

Net change in non-cash operating working capital

|

|

(10.0)

|

|

6.2

|

|

(16.2)

|

|

Finance costs paid

|

|

(0.5)

|

|

(0.5)

|

|

-

|

|

Income taxes paid

|

|

(3.2)

|

|

(1.6)

|

|

(1.6)

|

|

Rental equipment additions

|

|

(3.4)

|

|

(1.9)

|

|

(1.5)

|

|

Other non-current liabilities

|

|

(0.6)

|

|

(0.7)

|

|

0.1

|

|

Cash generated from (used in) operating activities

|

$

|

0.1

|

$

|

(2.3)

|

$

|

2.4

|

|

Cash used in investing activities

|

$

|

(0.4)

|

$

|

(0.9)

|

$

|

0.5

|

|

Cash used in financing activities

|

$

|

(8.1)

|

$

|

(5.9)

|

$

|

(2.2)

|

Cash Generated From (Used In) Operating Activities

Cash flows generated from operating activities amounted to $0.1 million in the first

quarter of 2017, compared to cash flows used in operating activities of $2.3 million in the same

quarter of the previous year. The increase of $2.4 million was mainly attributable to an

increase in net earnings of $15.9 million and items not affecting cash flow of $5.6 million. These increases were offset partially by cash used in changes in non-cash operating working

capital of $16.2 million, higher income taxes paid of $1.6 million

and higher rental equipment additions of $1.5 million.

Rental equipment additions in the three months ended March 31, 2017 of $3.4 million (2016 – $1.9 million) related primarily to lift trucks.

Significant components of non-cash operating working capital, along with changes for the three months ended March 31, 2017 and March 31, 2016 include the following:

|

Changes in Non-cash Operating Working Capital(1)

|

March 31

2017

|

March 31

2016

|

|

Trade and other receivables

|

$

|

0.4

|

$

|

5.0

|

|

Contracts in progress

|

|

4.1

|

|

3.3

|

|

Inventories

|

|

(6.5)

|

|

(6.2)

|

|

Deposits on inventory

|

6.3

|

|

(0.2)

|

|

Prepaid expenses

|

(0.8)

|

|

1.3

|

|

Accounts payable and accrued liabilities

|

(13.3)

|

|

3.8

|

|

Provisions

|

(0.4)

|

|

(0.7)

|

|

Total Changes in Non-cash Operating Working Capital

|

$

|

(10.0)

|

$

|

6.2

|

|

(1) Increase (decrease) in cash flow

|

|

|

|

Significant components of the changes in non-cash operating working capital for the quarter ended March

31, 2017 compared to the quarter ended March 31, 2016 are as follows:

- Trade and other receivables decreased $0.4 million in 2017 compared to a decrease of

$5.0 million in 2016. The decrease in 2016 resulted primarily from lower sales activity in the

first quarter compared to the last quarter of 2015.

- Contracts in progress decreased $4.1 million in 2017 compared to a decrease of $3.3 million in 2016. The decreases in both years were due to a reduction in contract revenue recognized in

advance of billings related to power generation projects.

- Inventories increased $6.5 million in 2017 compared to an increase of $6.2 million in 2016. The increase in 2017 was due to higher equipment and work in process inventory

partially offset by lower parts inventory as a result of inventory reduction measures. The increase in 2016 was due mainly to

higher seasonal inventory levels, primarily forestry equipment, offset partially by lower parts inventory.

- Accounts payable and accrued liabilities decreased $13.3 million in 2017 compared to an

increase of $3.8 million in 2016. The decrease in 2017 resulted primarily from lower trade

payables due in part to the payment of equipment inventory. The increase in 2016 resulted from the restructuring cost provision

recorded in the first quarter offset partially by lower trade payables.

Investing Activities

During the first quarter of 2017, Wajax invested $0.4 million in property, plant and

equipment additions, net of disposals, compared to $0.9 million in the first quarter of 2016.

Financing Activities

The Corporation used $8.1 million of cash from financing activities in the three months

ended March 31, 2017 compared to $5.9 million in the three months

ended March 31, 2016. Financing activities in the three months ended March

31, 2017 included dividends paid to shareholders totaling $5.0 million, common shares

purchased and held in trust for future settlement of awards made under certain share-based compensation plans of $2.2 million and finance lease payments of $1.0 million. Financing activities in

the three months ended March 31, 2016 included dividends paid to shareholders totaling $5.0 million and finance lease payments of $1.1 million.

Dividends

Dividends to shareholders were declared as follows:

|

Record Date

|

Payment Date

|

|

Per Share

|

|

Amount

|

|

March 15, 2017

|

April 4, 2017

|

|

$

|

0.25

|

|

$

|

5.0

|

|

Three months ended March 31, 2017

|

|

|

$

|

0.25

|

|

$

|

5.0

|

|

|

|

|

|

|

|

|

On May 2, 2017, Wajax announced a second quarter dividend of $0.25

per share ($1.00 per share annualized) payable on July 5, 2017 to

shareholders of record on June 15, 2017.

Critical Accounting Estimates

The preparation of the consolidated financial statements in conformity with IFRS requires management to make judgements,

estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities,

revenue and expenses. Actual results could differ from those judgements, estimates and assumptions. The Corporation

bases its estimates on historical experience and various other assumptions that are believed to be reasonable in the

circumstances.

The areas where significant judgements and assumptions are used to determine the amounts recognized in the financial

statements include the allowance for doubtful accounts, inventory obsolescence and goodwill and intangible assets.

The key assumptions concerning the future and other key sources of estimation uncertainty that have a significant risk of

resulting in a material adjustment to the carrying amount of assets and liabilities within the next fiscal year are as

follows:

Allowance for doubtful accounts

The Corporation is exposed to credit risk with respect to its trade and other receivables. However, this is somewhat

minimized by the Corporation's diversified customer base, of over 30,000 customers with no one customer accounting for more than

10% of the Corporation's annual consolidated sales, which covers most business sectors across Canada. In addition, the Corporation's customer base spans large public companies, small independent

contractors, OEM's and various levels of government. The Corporation follows a program of credit evaluations of customers

and limits the amount of credit extended when deemed necessary. The Corporation maintains provisions for possible credit losses,

and any such losses to date have been within management's expectations. The provision for doubtful accounts is determined

on an account-by-account basis. The $0.8 million provision for doubtful accounts at

March 31, 2017 decreased $0.3 million from December 31, 2016. As economic conditions change, there is risk that the Corporation could experience a

greater number of defaults compared to 2016 which would result in an increased charge to earnings.

Inventory obsolescence

The value of the Corporation's new and used equipment is evaluated by management throughout the year, on a

unit-by-unit basis. When required, provisions are recorded to ensure that the book value of equipment is valued at the

lower of cost or estimated net realizable value. The Corporation performs an aging analysis to identify slow moving or

obsolete parts inventories and estimates appropriate obsolescence provisions related thereto. The Corporation takes

advantage of supplier programs that allow for the return of eligible parts for credit within specified time periods. The

inventory obsolescence charged to earnings for the three months ended March 31, 2017 was

$1.7 million compared to $2.7 million in the three months ended

March 31, 2016. As economic conditions change, there is risk that the Corporation could have an

increase in inventory obsolescence compared to prior periods which would result in an increased charge to earnings.

Goodwill and intangible assets

The Corporation performs annual impairment tests of its goodwill and intangible assets unless there is an early

indication that the assets may be impaired in which case the impairment tests would occur earlier. There was no early

indication of impairment in the quarter ending March 31, 2017.

Determination of the Corporation's operating segments requires significant judgement. Operating segments have changed

since December 31, 2016 as follows:

Operating segments

Subsequent to the reorganization announced in 2016, the Corporation's Chief Executive Officer, who is also the Chief

Operating Decision Maker, regularly reviews the operating results of the Corporation as a whole to make resource allocation

decisions. Given the level at which results are reviewed, the Corporation has determined that it comprises a single

operating segment and therefore a single reportable segment, which differs from the three reportable segments which existed prior

to the reorganization.

Changes in Accounting Policies

New standards and interpretations adopted in the current period

Effective January 1, 2017, the Corporation adopted the amendments to IAS 7 Statement of Cash

Flows, which requires disclosures that enable users of financial statements to evaluate changes in liabilities arising from

financing activities, including both changes arising from cash flow and non-cash changes.

New standards and interpretations not yet adopted

The new standards or amendments to existing standards that may be significant to the Corporation set out below are not yet

effective for the year ended December 31, 2017 and have not been applied in preparing these

consolidated financial statements.

On January 1, 2018, the Corporation will be required to adopt IFRS 15 Revenue from Contracts

with Customers. The standard contains a single model that applies to contracts with customers and two approaches to recognizing

revenue: at a point in time or over time. The model features a contract-based five-step analysis of transactions to determine

whether, how much and when revenue is recognized. New estimates and judgemental thresholds have been introduced, which may affect

the amount and/or timing of revenue recognized. The Corporation has established a project team to study the impact of the new

standard and to manage its adoption. The team has documented the Corporation's revenue streams, has engaged the assistance

of an expert and has started to analyze the impact of the standard on its revenue recognition practices.

On January 1, 2018, the Corporation will be required to adopt IFRS 9 Financial Instruments,

which will replace IAS 39 Financial Instruments: Recognition and Measurement. The new standard replaces the current multiple

classification and measurement models for financial assets and liabilities with a single model that has only two classification

categories: amortized cost and fair value. Additional changes to the new standard will align hedge accounting more closely with

risk management. The Corporation is currently assessing the impact of this standard on its consolidated financial statements.

On January 1, 2019, the Corporation will be required to adopt IFRS 16 Leases. The new standard

contains a single lease accounting model for lessees, whereby all leases with a term longer than 12 months are recognized

on-balance sheet through a right-of-use asset and lease liability. The model features a front-loaded total lease expense

recognized through a combination of depreciation and interest. Lessor accounting remains similar to current requirements. The

Corporation's long term leases primarily relate to rental of real estate. The new standard will result in a material increase in

right of use assets and lease obligations but the impact to earnings has not yet been estimated.

Risk Management and Uncertainties

As with most businesses, Wajax is subject to a number of marketplace and industry related risks and uncertainties which could

have a material impact on operating results and Wajax's ability to pay cash dividends to shareholders. Wajax attempts to

minimize many of these risks through diversification of core businesses and through the geographic diversity of its

operations. In addition, Wajax has adopted an annual enterprise risk management assessment which is prepared by the

Corporation's senior management and overseen by the board of directors and committees of the board. The enterprise risk

management framework sets out principles and tools for identifying, evaluating, prioritizing and managing risk effectively and

consistently across Wajax. There are however, a number of risks that deserve particular comment which are discussed in

detail in the MD&A for the year ended December 31, 2016 which can be found on SEDAR at www.sedar.com. There have been no material changes to the business of Wajax that

require an update to the discussion of the applicable risks discussed in the MD&A for the year ended December 31, 2016.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Wajax's management, under the supervision of its Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), is

responsible for establishing and maintaining disclosure controls and procedures ("DC&P") and internal control over financial

reporting ("ICFR").

As at March 31, 2017, Wajax's management, under the supervision of its CEO and CFO, had designed

DC&P to provide reasonable assurance that information required to be disclosed by Wajax in annual filings, interim filings or

other reports filed or submitted under applicable securities legislation is recorded, processed, summarized and reported within

the time periods specified in such securities legislation. DC&P are designed to ensure that information required to be

disclosed by Wajax in annual filings, interim filings or other reports filed or submitted under applicable securities legislation

is accumulated and communicated to Wajax's management, including its CEO and CFO, as appropriate, to allow timely decisions

regarding required disclosure.

As at March 31, 2017, Wajax's management, under the supervision of its CEO and CFO, had designed

internal control over financial reporting ("ICFR") to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting

Standards ("IFRS"). In completing the design, management used the criteria set forth by the Committee of Sponsoring Organizations

of the Treadway Commission ("COSO") in its 2013 version of Internal Control – Integrated Framework. With regard to general

controls over information technology, management also used the set of practices of Control Objectives for Information and related

Technology ("COBIT") created by the IT Governance Institute.

There was no change in Wajax's ICFR that occurred during the three months ended March 31, 2017

that has materially affected, or is reasonably likely to materially affect, Wajax's ICFR.

Non-GAAP and Additional GAAP Measures

The MD&A contains certain non-GAAP and additional GAAP measures that do not have a standardized meaning prescribed by

GAAP. Therefore, these financial measures may not be comparable to similar measures presented by other issuers.

Investors are cautioned that these measures should not be construed as an alternative to net earnings or to cash flow from

operating, investing, and financing activities determined in accordance with GAAP as indicators of the Corporation's

performance. The Corporation's management believes that:

|

(i)

|

these measures are commonly reported and widely used by investors and

management;

|

|

(ii)

|

the non-GAAP measures are commonly used as an indicator of a company's cash

operating performance, profitability and ability to raise and service debt;

|

|

(iii)

|

the additional GAAP measures are commonly used to assess a company's

earnings performance excluding its capital, tax structures and restructuring costs and

|

|

(iv)

|

"Adjusted net earnings (loss)" and "Adjusted basic and diluted net earnings

(loss) per share" provide indications of the results by the Corporation's principal business activities prior to

recognizing restructuring costs that are outside the Corporation's normal course of business. "Adjusted EBITDA"

used in calculating the Leverage Ratio excludes restructuring costs which is consistent with the leverage ratio

calculations under the Corporation's bank credit and senior note agreements.

|

Non-GAAP financial measures are identified and defined below:

|

Funded net debt

|

Funded net debt includes bank indebtedness, long-term debt and obligations

under finance leases, net of cash. Funded net debt is a component relevant in calculating the Corporation's Funded

Net Debt to Total Capital, which is a non-GAAP measure commonly used as an indicator of a company's ability to raise and

service debt.

|

|

|

|

Debt

|

Debt is funded net debt plus letters of credit. Debt is a component

relevant in calculating the Corporation's Leverage Ratio, which is a non-GAAP measure commonly used as an indicator of a

company's ability to raise and service debt.

|

|

|

|

EBITDA

|

Net earnings (loss) before finance costs, income tax expense, depreciation

and amortization.

|

|

|

|

Adjusted net earnings (loss)

|

Net earnings (loss) before after tax restructuring costs.

|

|

|

|

Adjusted basic and diluted earnings (loss) per

share

|

Basic and diluted earnings per share before after tax restructuring

costs.

|

|

|

|

Adjusted EBITDA

|

EBITDA before restructuring costs.

|

|

|

|

Leverage ratio

|

The leverage ratio is defined as debt at the end of a particular quarter

divided by trailing 12-month Adjusted EBITDA. The Corporation's objective is to maintain this ratio between 1.5

times and 2.0 times.

|

|

|

|

Funded net debt to total capital

|

Defined as funded net debt divided by total capital. Total capital is

the funded net debt plus shareholder's equity.

|

|

|

|

Backlog

|

Backlog includes the total sales value of customer purchase commitments for

future delivery or commissioning of equipment, parts and related services.

|

|

|

|

Additional GAAP measures are identified and defined below:

|

|

|

Earnings (loss) before finance costs and income taxes

(EBIT)

|

Earnings (loss) before finance costs and income taxes, as presented on the

Consolidated Statements of Earnings.

|

|

|

|

EBIT Margin

|

Defined as EBIT divided by revenue, as presented on the Consolidated

Statement of Earnings.

|

|

|

|

Earnings (loss) before income taxes (EBT)

|

Earnings (loss) before income taxes, as presented on the Consolidated

Statements of Earnings.

|

|

|

|

Working capital

|

Defined as current assets less current liabilities, as presented on the

Consolidated Statements of Financial Position.

|

|

|

|

Other working capital amounts

|

Defined as working capital less trade and other receivables and inventories

plus accounts payable and accrued liabilities, as presented on the Consolidated Statements of Financial

Position.

|

Reconciliation of the Corporation's net earnings (loss) to adjusted net earnings (loss) and adjusted basic and diluted

earnings (loss) per share is as follows:

|

Three months ended

|

|

March 31

|

|

|

2017

|

|

2016

|

|

Net earnings (loss)

|

$

|

6.2

|

$

|

(9.7)

|

|

Restructuring costs, after-tax

|

|

-

|

|

9.1

|

|

Adjusted net earnings (loss)

|

$

|

6.2

|

$

|

(0.6)

|

|

Adjusted basic earnings (loss) per share (1)(2)

|

$

|

0.31

|

$

|

(0.03)

|

|

Adjusted diluted earnings (loss) per share (1)(2)

|

$

|

0.31

|

$

|

(0.03)

|

|

(1)

|

For the three months ended March 31, 2017 weighted average shares

outstanding for calculating basic and diluted earnings per share were 19,818,629 and 20,188,117, respectively.

|

|

(2)

|

For the three months ended March 31, 2016 the weighted average shares

outstanding for calculating basic and diluted loss per share were 19,990,764.

|

Reconciliation of the Corporation's net earnings to EBT, EBIT, EBITDA and Adjusted EBITDA is as follows:

|

For the twelve

months ended

March 31

|

For the twelve

months ended

December 31

|

|

2017

|

2016

|

|

Net earnings

|

$

|

27.0

|

$

|

11.0

|

|

Income tax expense

|

10.6

|

4.7

|

|

EBT

|

37.6

|

15.7

|

|

Finance costs

|

11.0

|

11.2

|

|

EBIT

|

48.6

|

26.9

|

|

Depreciation and amortization

|

24.0

|

24.5

|

|

EBITDA

|

|

72.6

|

51.5

|

|

Restructuring costs(1)

|

|

-

|

12.5

|

|

Adjusted EBITDA

|

$

|

72.6

|

$

|

64.0

|

|

(1) For the twelve months ended December 31, 2016 – Includes the $12.5

million Wajax restructuring provision recorded in the first quarter of 2016.

|

Calculation of the Corporation's funded net debt, debt and leverage ratio is as follows:

|

March 31

|

December 31

|

|

2017

|

2016

|

|

Bank indebtedness (cash)

|

$

|

3.7

|

$

|

(4.9)

|

|

Obligations under finance leases

|

8.2

|

8.9

|

|

Long-term debt

|

122.1

|

122.0

|

|

Funded net debt

|

$

|

134.0

|

$

|

126.0

|

|

Letters of credit

|

|

7.0

|

|

6.4

|

|

Debt

|

$

|

141.0

|

|

132.4

|

|

Leverage ratio(1)

|

1.94

|

2.07

|

|

(1)

|

Calculation uses trailing four-quarter Adjusted EBITDA.

|

|

This leverage ratio is calculated for purposes of monitoring the

Corporation's objective target leverage ratio of between 1.5 times and 2.0 times. The calculation contains some

differences from the leverage ratios calculated under the Corporation's bank credit facility and senior note agreements

("the agreements"). The resulting leverage ratios under the agreements are not significantly different. See

the Liquidity and Capital Resources section.

|

Cautionary Statement Regarding Forward-Looking Information

This MD&A contains certain forward-looking statements and forward-looking information, as defined in applicable securities

laws (collectively, "forward-looking statements"). These forward-looking statements relate to future events or the

Corporation's future performance. All statements other than statements of historical fact are forward-looking

statements. Often, but not always, forward looking statements can be identified by the use of words such as "plans",

"anticipates", "intends", "predicts", "expects", "is expected", "scheduled", "believes", "estimates", "projects" or "forecasts",

or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could",

"would", "should", "might" or "will" be taken, occur or be achieved. Forward looking statements involve known and unknown

risks, uncertainties and other factors beyond the Corporation's ability to predict or control which may cause actual results,

performance and achievements to differ materially from those anticipated or implied in such forward looking statements.

There can be no assurance that any forward looking statement will materialize. Accordingly, readers should not place undue

reliance on forward looking statements. The forward looking statements in this MD&A are made as of the date of this

MD&A, reflect management's current beliefs and are based on information currently available to management. Although

management believes that the expectations represented in such forward-looking statements are reasonable, there is no assurance

that such expectations will prove to be correct. Specifically, this MD&A includes forward looking statements regarding,

among other things, our 4 Points of Growth Strategy and the goals for such strategy, including our goal of becoming Canada's leading industrial products and services provider; our belief that achieving excellence in our

areas of core capability will position Wajax to create value for its customers, employees, vendors and shareholders; our

commitment to and confidence in the 4 Points of Growth Strategy; the strategic reorganization we undertook in 2016 and the

benefits we expect to achieve therefrom, including, without limitation, full annualized cost savings of $17 million starting in 2017; our outlook for major resource and industrial markets for the remainder of 2017;

our areas of focus for the remainder of 2017, including generating revenue sufficient to offset the four large shovel deliveries

made in 2016 which are not expected to repeat, effectively managing our margins and delivering the operational improvements and

full annualized savings expected from the strategic reorganization; and our outlook for 2017 adjusted net earnings should we be

successful in achieving the forgoing objectives; our target leverage ratio range of 1.5 – 2.0 times; our financing, working and

maintenance capital requirements, as well as our capital structure and leverage ratio; our foreign exchange risks and exposures,

including the impact of fluctuations in foreign currency values; the adequacy of our debt capacity; and our intention and ability

to access debt and equity markets or reduce dividends should additional capital be required. These statements are based on a

number of assumptions which may prove to be incorrect, including, but not limited to, assumptions regarding general business and

economic conditions; the supply and demand for, and the level and volatility of prices for, oil and other commodities; financial

market conditions, including interest rates; our ability to execute our 4 Points of Growth strategy, including our ability to

develop our core capabilities, execute on our organic growth priorities, complete and effectively integrate acquisitions and to

successfully implement new information technology platforms, systems and software; our ability to execute our strategic

reorganization and realize the benefits therefrom, including cost savings and productivity gains; the future financial

performance of the Corporation; our costs; market competition; our ability to attract and retain skilled staff; our ability to

procure quality products and inventory; and our ongoing relations with suppliers, employees and customers. The foregoing

list of assumptions is not exhaustive. Factors that may cause actual results to vary materially include, but are not

limited to, a deterioration in general business and economic conditions; volatility in the supply and demand for, and the level

of prices for, oil and other commodities; a continued or prolonged decrease in the price of oil; fluctuations in financial market

conditions, including interest rates; the level of demand for, and prices of, the products and services we offer; levels of

customer confidence and spending; market acceptance of the products we offer; termination of distribution or original equipment

manufacturer agreements; unanticipated operational difficulties (including failure of plant, equipment or processes to operate in

accordance with specifications or expectations, cost escalation, our inability to reduce costs in response to slow-downs in

market activity, unavailability of quality products or inventory, supply disruptions, job action and unanticipated events related

to health, safety and environmental matters); our ability to attract and retain skilled staff and our ability to maintain our

relationships with suppliers, employees and customers. The foregoing list of factors is not exhaustive. Further

information concerning the risks and uncertainties associated with these forward looking statements and the Corporation's

business may be found in this MD&A under the heading "Risk Management and Uncertainties" and in our Annual Information Form

for the year ended December 31, 2016, filed on SEDAR. The forward-looking statements

contained in this MD&A are expressly qualified in their entirety by this cautionary statement. The Corporation does not