Apple, Inc (NASDAQ: AAPL) is expected

to report fiscal fourth-quarter earnings after Thursday's close.

Benzinga took a look back at Apple’s last seven fourth-quarter earnings reports to look for any potential patterns in how the

stock reacts.

- Q4 2017: shares gained 2.5 percent the day following the report

- Q4 2016: down 2.2 percent

- Q4 2015: up 4.1 percent

- Q4 2014: up 2.7 percent

- Q4 2013: down 2.4 percent

- Q4 2012: down 0.9 percent

- Q4 2011: down 5.8 percent

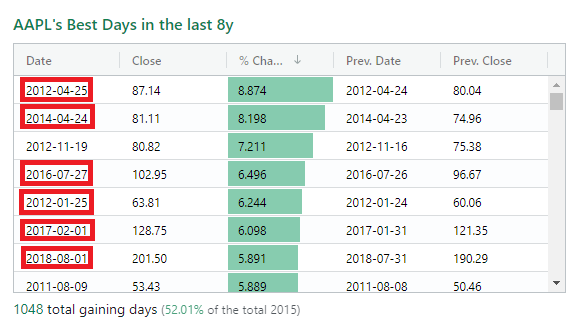

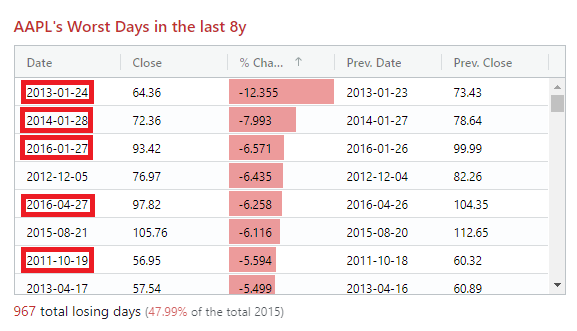

While most initial fourth-quarter earnings reactions have been relatively modest, many of Apple’s most volatile trading sessions

of the past eight years have happened within two days of an earnings release. The charts below show Apple’s largest single-day

gains and losses of the past eight years. The dates highlighted by the red boxes indicate trading sessions that occurred within two

days of a quarterly earnings report.

Here are some potential takeaways from the information outlined above:

- Apple tends to have volatile earnings reactions, but Q3 market reactions aren’t typically some of the biggest.

- Apple stock has typically moved up or down less than 3 percent on the day following Q3 earnings.

- Apple hasn’t had a major negative reaction (a more than 5.5 percent decline) to any earnings report since its 6.2 percent

drop following its Q2 report in April 2016.

According to Optionslam.com, Apple’s seven-day implied

movement based on the weekly options market is 6.2 percent.

Apple's stock traded around $220.50 at time of publication Thursday afternoon. The stock is up 40 percetn year-to-date.

For investors looking to receive news on Apple's fourth-quarter release, try out Benzinga's real-time news platform,

Benzinga Pro.

Related Links:

Wall

Street Reacts To Apple's New MacBooks, iPad Pro

The

Technical Setup Into Apple's Q4 Earnings Release

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.