Michael Kors Holdings Ltd (NYSE: KORS)

stock crashed more than 15 percent Wednesday morning after the company reported a decline in fiscal

second-quarter same-store sales and said full-year same-store sales growth will be negative as well.

Michael Kors has a long history of volatile earnings reactions, and Wednesday is certainly no exception.

The Earnings

Michael Kors reported adjusted second-quarter earnings per share of $1.27 topping consensus analyst estimates of $1.10. Revenue

for the quarter was $1.25 billion, up 9.3 percent from a year ago but slightly missing consensus expectations of $1.26 billion.

Michael Kors said same-store sales declined by 2.1 in the quarter, down from a 0.2 percent increase in the first quarter.

Looking ahead, the company raised its full-year EPS forecast from a previous range of between $4.90 and $5.00 to a new range of

between $4.95 and $5.05, but investors zeroed in on its guidance for same-store sales to decline in the “low single digits” for the

full fiscal year. The declines in same-store sales suggest Michael Kors will continue to struggle to grow its business in what is

an extremely difficult environment for retail stocks.

The Price Action

Traders has a strong knee-jerk reaction on Wednesday, sending the stock plummeting more than 15 percent.

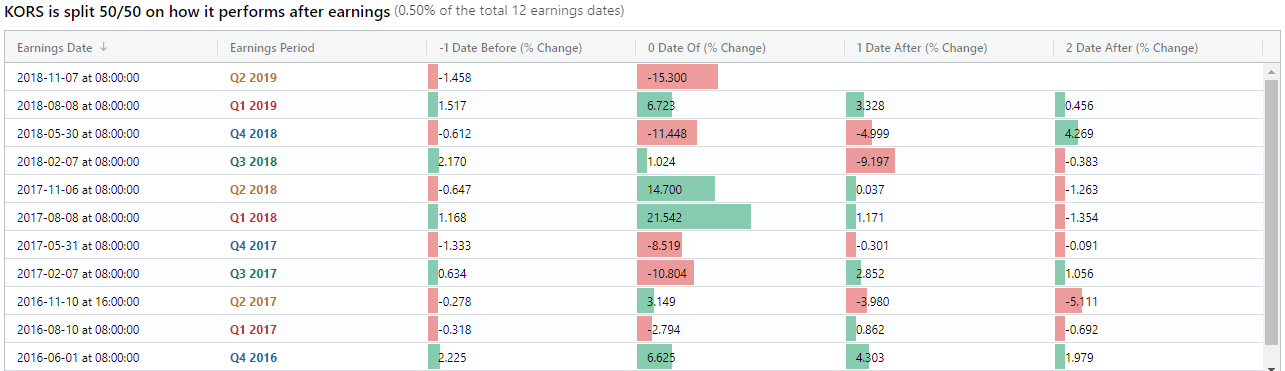

Michael Kors traders are no strangers to earnings volatility. The chart below highlights the recent earnings reactions for the

stock. Earnings day trading action over the past three years has been positive exactly half the time, with earnings day moves of at

least 6 percent happening on six of the company’s past eight earnings days.

At time of publication, the stock traded around $49.69 per share.

Related Links:

Need A

Reason To Buy Michael Kors? UBS Offers 8

Survey:

Michael Kors Still The Preferred Handbag Among Teens

Photo credit: SPERA.de Designerschuhe, Taschen und Accessoires from Deutschland, via

Wikimedia Commons

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.