Despite a huge stock market surge Wednesday after dovish comments from Fed Chair Jerome Powell, caution flags

appear to be back on the beach ahead of this weekend’s G20 meeting.

That’s probably the only way to explain why volatility barely inched back even after Powell indicated that rates

are close to neutral, remarks that sent the stock market back to positive territory for the year as the Dow Jones Industrial

Average ($DJI) climbed more than 600 points Wednesday. The VIX hardly cooled off at all immediately after Powell’s words, falling

less than 4 percent by late afternoon. It actually rose 4 percent to back above 19 by Thursday morning. Stocks appeared to have a

slightly negative tone early Thursday, but a little pullback might not be a big surprise.

Often you’d see volatility take a bigger hit when the S&P 500 Index (SPX) jumps 60 points for its best day

in eight months, as it did Wednesday. The thing that’s arguably keeping that from happening this time is tariff fears as trade

talks approach between President Trump and Chinese President Xi. In fact, it wouldn’t be all that surprising to see VIX slowly rise

as we head into the weekend and this big unknown. When there’s uncertainty in the market—and the meeting definitely puts that

factor right down the middle of the runway—VIX often stays elevated.

If the Fed news had come by itself, without the tariff worries, it’s arguable that VIX might have been

annihilated. As it is, the bond market—which at first barely reacted to Powell’s speech—did draw some buying by early Thursday,

with the 10-year yield dipping briefly below 3 percent for the first time since September as investors continued to react to the

Fed chairman’s words.

A few more Fed speakers are on the calendar today, along with Fed minutes. It might be a waiting game the next

day or two ahead of G20.

On the data watch, PCE prices came in at 0.2 percent for October, up from 0.1 percent in September but still not

a big signal of any gathering inflation. Core PCE, which strips out energy and food, rose just 0.1 percent, below Wall Street

analysts’ estimates for a 0.2 percent gain. In other data early Thursday, the government reported initial weekly jobless claims of

234,000, above the 220,000 analyst projection.

Meanwhile, crude slipped below $50 briefly early Thursday before powering back to $51 a barrel. The original

drop came as Saudi Arabia said it wouldn’t cut production on its own. An OPEC meeting Dec. 6 looms large, and crude could remain

volatile in the meantime. The $50 level is a psychologically important one and arguably remains the key point to watch.

Powell Remarks Seem to Inject New Optimism

The Powell remarks on rates approaching neutral were a bit of a surprise, and seemed to be music to the stock

market’s ears. Based on the academic-sounding title of the speech, it felt like he might not discuss the rate situation. Instead,

he didn’t seem shy about addressing the issue, adding his dovish views to a series of more dovish comments made by other Fed

officials lately.

Powell said interest rates are still low by historical standards, but remain “just below the broad range of

estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth.”

That was quite a contrast to remarks he made just two months ago when he said there was a long way to go until

rates reached neutral. Just as a reminder, the Fed funds target range of between 2 percent and 2.25 percent hasn’t changed in those

two months. While the market has corrected since then, falling 10 percent or more at its lows, the Fed isn’t typically influenced

by stock market gyrations. Instead, the Fed might believe the neutral rate has fallen due in part to overseas economic

sluggishness, tariff concerns, and lack of much U.S. inflation. The recent crude oil dive to 13-month lows might be another issue

the Fed is eying, because that arguably makes inflation even less of a factor.

All this doesn’t mean a hike isn’t on the way next month. The futures market still puts chances of that at

almost 83 percent. However, the 2019 rate picture seems to look a bit different now than it did just a few weeks back, as evidenced

by rate expectations today versus the readings from a month ago. According to the CME Group FedWatch tool, a month ago the market

was pricing in more than an 80 percent chance of at least one hike in 2019 over and above the one that’s widely expected to occur

next month. As of today, that’s slipped to 70 percent. Odds of three or more 25 basis-point hikes between now and the end of 2019

are about 32 percent. A month ago that reading was a shade under 50 percent. So, while that’s not a large-scale sign of a change in

Fed rate expectations, the market looks to be dialing it back a bit.

China Trade Fortunes Still Front and Center

The other thing that might be helping stocks spike this week could be optimism ahead of the G20 summit. Whether

that optimism is warranted, we’ll probably find out after Saturday night’s dinner meeting between the two presidents.

Though it’s never safe to predict what might happen, the market action this week seems to point toward hopes

that Trump and Xi might come out of that meeting with positive words but probably not a lot of details. It’s hard to believe all

the issues can be solved over a few courses of food, though the administration said talks started again recently.

When you look at the sectors gaining the most on Wednesday, it does appear to point toward trade hopes. Info

tech and industrials were two of the biggest gainers, with info tech helped by sharp gains in Apple Inc. (NASDAQ:

AAPL). That widely-held stock finished the session up

nearly 4 percent and positioned to break a weekly losing streak that began in late October, if it can hold its gains through

Friday. Other strong sectors included consumer discretionary and health care.

Almost every stock in the $DJI rose on Wednesday, the exceptions being some of the big dividend payers, as

investors appeared more willing to embrace a “risk-on” approach after Powell’s comments. Utilities, often seen as a “defensive”

sector, were the only sector loser for the day. Some of the biggest $DJI gainers, other than AAPL, were stocks that might stand to

benefit if a trade deal could get ironed out, including the usual crew of Boeing Co. (NYSE: BA) and Caterpillar Inc. (NYSE: CAT), along with Microsoft Corporation (NASDAQ: MSFT) and Nike Inc. (NYSE: NKE).

Dollar Descends As Rate Fears Ease

The U.S. dollar also took a tumble after Powell’s remarks, not too surprising considering the Fed now appears

ready to loosen the reins a bit on monetary policy after likely raising rates for the fourth time this year in December. The dollar

index fell about 0.6 percent by the end of the day Wednesday and is back under 97. However, don’t count the strong dollar out as a

possible bearish factor in the weeks ahead, especially if there isn’t much progress in the trade battle with China. Even with

Wednesday’s loss, the dollar index isn’t far below its yearly high.

With Powell’s comments so widely watched, Fed minutes due later Thursday might take a back seat. They’ll likely

reflect the Fed’s thinking from early this month, while Fed Vice Chair Richard Clarida and Powell have both spoken much more

recently and both expressed the same thoughts about rates now being near neutral. Whether they thought that back in the beginning

of November is an open question.

One thing to consider watching in the minutes, which will be out early this afternoon, is for the Fed’s outlook

on inflation. Remember, that Fed meeting came less than a week after the October payrolls report showed wages rising 3.1 percent

and job growth at 250,000. Both were big numbers and raised some concerns about price pressure at the time. However, inflation

worries have deflated quite a bit since then, based on data that came out the rest of the month.

In data released Wednesday, October new home sales looked pretty disappointing. Even though the number for

September got upwardly revised, sales in October fell 8.9 percent month over month and missed Wall Street analysts’ estimates.

Supplies appear on the high side, and so do prices. “The key takeaway from the report is that the pace of new home sales is weak

across all regions and reflects the affordability constraints fueled by rising mortgage rates,” Briefing.com observed. The October

sales pace was the slowest since March 2016. However, homebuilder stocks mostly finished higher Wednesday, as it appears hopes for

slowing interest rate hikes might be outweighing worries about current demand.

Speaking of beaten-down sectors, the semiconductor group also burst out to some gains Wednesday after getting

smacked earlier this month. Solid early readings on holiday sales might be helping this particular neighborhood of the stock

market, and that’s almost certainly the case in consumer discretionary. Much of the lift for consumer discretionary came from a 6

percent jump in shares of Amazon (AMZN).

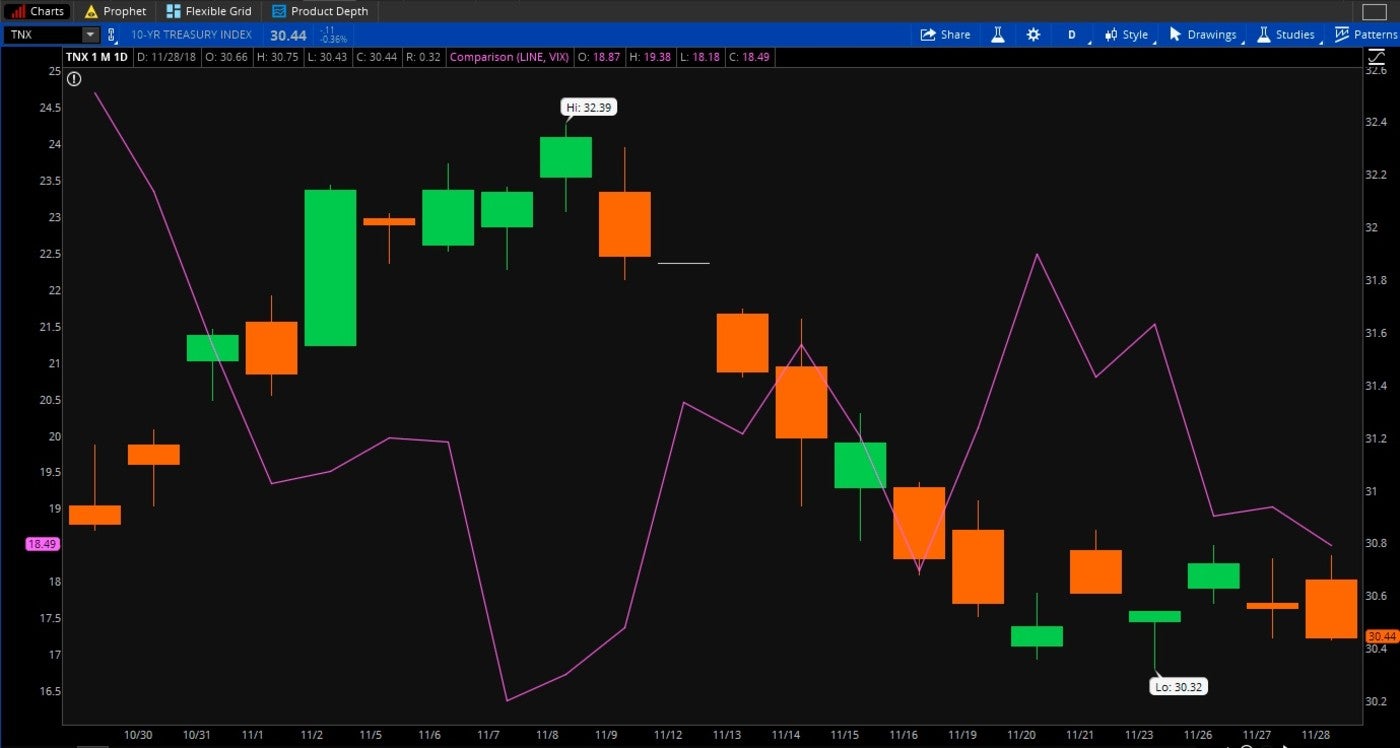

Figure 1: Surprise of the Day: Despite the stock market’s best day in eight months Wednesday, the 10-year

Treasury note yield (candlestick) and the VIX (purple line) stayed pretty steady. This might appear a bit surprising, because VIX

and Treasuries (which trade opposite of yields), often decline when the stock market rallies. However, it appears that nerves ahead

of the G20 meeting might be keeping some of the risk-off sentiment from taking a big hold. Data Source: Cboe Global

Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future

results.

CEO Perspective

Powell wasn’t the only one talking Wednesday. CNBC ran an interesting interview with Deere (DE) Chairman and CEO Samuel Allen in

which Allen touched on tariffs, the G20 meeting, the company’s business, interest rates, and the economy. Allen—also chairman of

the Council on Competitiveness—isn’t a fan of tariffs and hopes the U.S. and China can settle their differences, he told CNBC. He’s

also worried that if Chinese tariffs on U.S. soybean and other commodity imports continue for long, they could have a structural

impact similar to the U.S. grain embargo on the Soviet Union in the 1980s, which hurt U.S. farmers by permanently shifting some

demand for their products. He called himself “not very optimistic” about countries reaching any kind of major agreement on

commodity, or specifically agricultural commodity, trade at this weekend’s G20 conference.

Generally, Allen hasn’t seen quantifiable signs of economic slowing and he remains optimistic about DE’s construction equipment

sales going into 2019, but hopes the Fed pauses its interest rate hike cycle to avoid slowing the economy. He’s seen a “slowing of

order book activity,” which he said could indicate worry among customers about rates continuing to rise. We talk a lot about the

importance of listening to CEOs on earnings calls, but even between earnings seasons it’s worth getting their perspective on the

economy, especially when it’s a multinational like DE and trade is top of mind for many.

TIF and Tourists

The first thing some people might tend to think when Tiffany & Co. (NYSE: TIF) reports disappointing earnings, as it did Wednesday, is that maybe there’s

trouble at the “high end” of the consumer market. TIF’s same-store sales rose in the quarter, but didn’t meet Wall Street analysts’

expectations. However, it’s probably less a story about U.S. high-end customers and more a scenario in which falling tourism and a

rising dollar ganged up on the company. Management said it saw higher sales growth among “local customers” in all regions, but

lower spending by foreign tourists, “specifically Chinese,” in certain locations. Those locations, it said, included Hong Kong and

the U.S. While tourism is a big economic factor to watch in the U.S., it’s unclear how many people journey here from overseas to

buy expensive jewelry, so the impact to the U.S. economy beyond TIF might be slim unless overall tourism slows. On the other hand,

if TIF is seeing slower spending by Chinese tourists, that might add to some concerns about the high-end Chinese customer, even

though TIF said its sales growth in mainland China was strong. Don’t discount the impact of Chinese tourism on the U.S. economy,

either. The U.S. Commerce Department says 2.97 million Chinese tourists traveled to the U.S. in 2016, spending a total of $33

billion. That’s the most spent in the U.S. by tourists of any country.

Talking Technicals

Even with the gains so far this week—which have been substantial—the S&P 500 Index (SPX) remains below its 200-day moving

average of 2761. A close above that mark would likely signal a chance for more bullishness ahead, while a close back below

psychological support at 2700 could trigger further selling, according to technical analysts. One potentially positive technical

note is the failure of the SPX and Dow Jones Industrial Average ($DJI) to challenge their October lows on the latest turn downward

earlier this month. Those intraday lows of 24,122 for the $DJI and 2603 for the SPX might be worth socking away in the back of

investors’ minds in case of another spin downward. Below that, the SPX’s intraday low for the year of just below 2533 might be

another supportive level. There’s also concern among some technical analysts that unless the SPX can once again make a new high

above the 2941 peak seen in late September, the market might look like it’s formed a “double top” between that mark and the 2873

high from back in January. Failure to make new highs could bring selling pressure, some analysts say.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any

particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with

each strategy, including commission costs, before attempting to place any trade.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.