Chase Announces Major Branch Expansion in 2019

Bank plans to expand branches into nine top U.S. markets; will continue to grow network in Greater

Washington, Philadelphia and Boston

Plans to open up to 90 branches in new markets and hire up to 700 employees by end of year

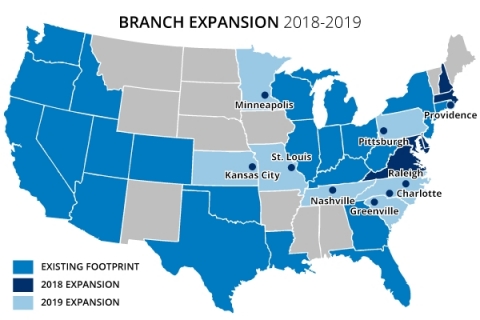

Chase today announced that it plans to expand its retail branches into nine top U.S. markets1 in 2019, while

continuing to open dozens of new branch locations in Greater Washington, D.C, Philadelphia and Boston.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190313005105/en/

(Graphic: Business Wire)

Chase expects to open up to 90 new branches in new markets and hire up to 700 employees by the end of the year, giving more

customers access to its retail and business banking services while offering local jobs to residents. The bank announced last year

that it planned to open 400 new branches and hire as many as 3,000 employees in new markets over the next five years. Approximately

30 percent of branches will be in low-to-moderate income communities.

Beginning this summer, the bank plans to open the first of its new retail branches in nine of the top U.S. markets

including:

- Charlotte, North Carolina

- Raleigh, North Carolina

- Greenville, South Carolina

- Kansas City, Kansas

- Minneapolis, Minnesota

- Nashville, Tennessee

- Pittsburgh, Pennsylvania

- Providence, Rhode Island

- St. Louis, Missouri

The bank also plans to add branches in new locations close to large universities, including Auburn University in Auburn, Alabama

and the University of Nebraska in Lincoln, Nebraska, with plans to expand into these states more broadly in 2020.

“This expansion marks a major milestone for our firm by allowing us to serve more customers, small businesses and communities

across the country,” said Thasunda Duckett, CEO of Chase Consumer Banking. “To us, this is so much more than building branches.

This is about new customer relationships, better access to credit, and local jobs.”

This expansion adds retail and business banking to markets where the firm already serves hundreds of thousands of consumers and

local businesses, including clients through its Investment Bank, Commercial Bank and Private Bank. Today, Chase serves 62 million

households and over 4 million small businesses across the country.

Chase will enter each city with a mix of full service branches that help customers and local small businesses with more complex

needs, like lending and advice, as well as smaller, digital-first locations that assist customers manage every day transactions.

New branches will include modern design elements and feature open, collaborative spaces with ample room for meetings and “Chase

Chats,” a new series of small group sessions focused on financial health.

Customers will also have access to cardless ATMs that can perform more than 70 percent of teller transactions, and complements

the Chase mobile app and Chase.com where they can open an account, pay bills, instantly transfer money, monitor and track their

credit and save money automatically.

The firm will actively hire staff to support its new branches across the country. Entry-level employees in new markets announced

today will be paid no less than $15 - $16.50/hour, and will receive the firm’s full benefits package, which is valued at an average

of $12,000 annually per employee in this pay range. It includes health care coverage and retirement savings, as well. To help ease

the burden of out-of-pocket medical expenses, the firm also recently reduced medical plan deductibles by $750 per year for

employees making less than $60,000.

As part of this expansion, the firm will also work with local community partners to help drive inclusive economic growth

including jobs and skills training, small business growth, neighborhood revitalization, and financial health.

Chase will begin opening new branches in the above locations starting this summer. To check for updates or to learn more about

Chase’s branches, products and services, please visit Chase.com.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial

services firm with assets of $2.6 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad

range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business

loans and payment processing. Customers can choose how and where they want to bank: Nearly 5,000 branches, 16,000 ATMs, mobile,

online and by phone. For more information, go to Chase.com.

1 Markets are defined as U.S. core-based statistical areas (CBSA).

Media:

Elizabeth Seymour

415-538-5064

Elizabeth.c.seymour@jpmorgan.com

Brian Hanover

312-732-1081

brian.s.hanover@chase.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20190313005105/en/