The 2021 PGA Masters golf tournament in Augusta, Georgia had all the usual thrills that give it a global audience and make it the most watched golfing event every year. On Sunday, Hideki Matsuyama became a Japanese legend, holding off Xander Schauffele and 24-year old Will Zalatoris to become the first Japanese golfer ever to win a major golf championship, earning the vaunted green jacket with four-round total of 10 under par. Matsuyama delivered a nice payout to anyone that took him from the outset, where he was a 40-1 longshot, as betters looked to the typical favorites like Jordan Spieth, Dustin Johnson, Bryson DeChambeau and Justin Thomas. Zalatoris came in at 125-1, according to DraftKings (NASDAQ: DKNG).

Safe to say that in-play betting at DraftKings was extremely active throughout the tournament considering the top four at the end of round two on Friday included Zalatoris, Brian Harman and Marc Leishman, all of which were 100+:1 odds entering the tournament, and leader Justin Rose, who came in at 90:1. With that type of dynamic, DraftKings wants to get in front of as many potential customers worldwide as possible for its sportsbook and fantasy contests, and for that, they look to Hashoff , a subsidiary of DGTL Holdings Inc. (TSX-V: DGTL) (OTCQB: DGTHF) .

Hashoff is an emerging leader in the Content-as-a-Service (CaaS) social media martech space, booming components of advertising and marketing that utilize cutting-edge technologies like Artificial Intelligence and Machine Learning (AI & ML) to build and manage campaigns involving social media and influencers to showcase brands. As ad spend on traditional media like television and newspapers is in a constant state of decline, social media and digital advertising, which are much less overt while being more effective, are surging.

To lend some color, understand that social media spending increased 20% in 2020 from 2019 to $43 billion and influencer marketing shot up 50% to $9.7 billion . The upside to the nascent adtech/martech market bears out in the fact that global ad spend for 2020 was $572 billion.

Hashoff provides a turnkey solution with access to more than 150 million relevant digital content creators globally, along with all the technology to help define what will be the most effective strategy, best target demographics and more, along with metrics measuring overall campaign performance.

To access the platform, Hashoff clients pay a monthly SaaS fee and then a separate cost specific to a designated campaign (the CaaS component). In the DraftKings case, for instance, the one-week campaign was valued at $75,000 plus the monthly SaaS fee.

The Masters campaign came shortly after DraftKings signed a two-year SaaS licensing agreement with Hashoff and activated a $200,000 campaign during the 2021 NCAA Men’s Basketball Tournament, better known as “March Madness.”

To be clear, DGTL is careful not to actually use the name “DraftKings” in its press releases, a verboten act in the business owing to competitive advantages, but the description of the company allows investors to connect the dots to know that Hashoff is attracting some Tier 1 clients. Another case in point was DGTL activating a campaign for Quaker Oats in March, where the brand name wasn’t used outwardly. However, even a novice gumshoe would uncover that there aren’t any other companies that fit the bill as being a 150-year-old Chicago-based food conglomerate specialized in breakfast cereals, owned by PepsiCo (NYSE: PEP) and recognized as having the first ever registered USPTO trademark in their product category.

These companies join a litany of other household brands that Hashoff has in its client portfolio, such as Anheuser Busch-InBev (NYSE: BUD), Pizza Hut (NYSE: YUM), Keurig-Dr. Pepper (NASDAQ: KDP), Dunkin’ Brands, TJ Maxx (NYSE: TJX), Veritone (NASDAQ: VERI), Syneos Health (NASDAQ: SYNH), Publicis Groupe, Patagonia, DoorDash and more.

Working with these types of global companies affords DGTL the unique opportunity to upsell into different segments of each’s business. This has already happened with ABInBev as evidenced through campaigns with their brands Bud Light (at the Super Bowl), Montejo and Michelob Ultra, as well as Stella Artois, which it imports and distributes into the U.S. from Interbrew International. Now, different verticals are opening up within DraftKings via the NCAA and PGA markets, a company that covers every major sport across its daily fantasy sports and online sportsbook that could easily represent millions of dollars in annual revenue for DGTL.

A tech accelerator, DGTL acquired Hashoff last summer and has grown sales exponentially in the first quarters under its umbrella. Revenue during the quarter ended August 31, 2020 (fiscal Q1 2021) rose 83% from the year earlier quarter to $1.16 million . In the second quarter, revenue rose to $1.25 million , up 70% from fiscal Q2 2020. Q3 results should be coming in the next few weeks,– and with these recent blockbuster signings, one would expect to see continued revenue growth.

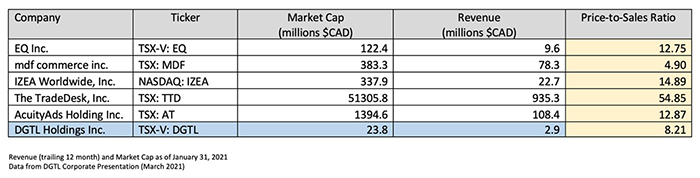

Traders often look to a price-to-sales ratio get a snapshot of value amongst peers. A calculation of market capitalization divided by 12 months of sales, the interpretation is simple: the lower the P/S ratio, the more attractive the investment opportunity.

DGTL reflected $2,416,000 in revenue for the six months ending November 30, 2020, prior to announcing now six major new global brand accounts. According to DGTL Director John Belfontaine, the Hashoff acquisition included revenue growth milestones in which Hashoff must achieve $10 million in revenue in 2021 in order to receive 100% of cash and share payments from its initial $5 million valuation. Closest comparable IZEA Worldwide trades at $5.11 a share currently ($302.15 million MC) with $18.33 million in revenue in 2020 (in USD), or approximately 16:1 P/S ratio. With DGTL gaining quickly on IZEA’s annual revenue, DGTL presents a significant value opportunity especially when considering the potential of additional future SaaS acquisitions.

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of four thousand dollars for DGTL Holdings advertising from the company. There may be 3rd parties who may have shares of DGTL Holdings and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.