Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) announces that it has completed an IP survey (induced polarization survey) of its Silver Hill project in Morocco (the “Project”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220323005615/en/

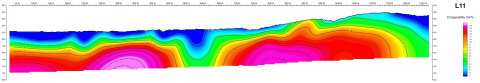

Fig. 1: Examples of IP pseudo-sections (L11 and L13) showing (1) clear increasing of chargeability in depth and (2) lateral continuity of the chargeable objects (here at least on 200m) (Graphic: Business Wire)

Initial drilling targeted areas that showed evidence of historical mining, testing the strength of the mineralization in those areas. The program successfully identified copper and silver grades, with notable values for cobalt. The survey covers the areas of known mineralization providing signatures to compare to other areas of the property. Highly mineralized areas, defined by drilling or trenching, all had notable chargeability anomalies, and areas without mineralization coincided with areas of weak chargeability. However, the areas of drilled mineralization only accounted for two of the numerous chargeability anomalies and did not test any of the strongest anomalies, but comparatively weak anomalies near the surface. The survey identified two trends that run the full length of the property, increasing the scope of our target to two parallel trends with deep roots, beyond the two discrete zones that are visible at surface.

Jed Richardson, President and CEO, commented, “The survey shows that we have a very favorable position with two strong trends that run the full width of our 4 km claim area. That is even more exciting than the simple connection between the drilled discovery area and the mineralization highlighted by our first trench and hole S9, we had hoped the survey would reveal. We now have a long list of promising targets to explore in the coming drill program and are looking forward to revealing the next generation potential of Trigon Metals.”

The survey covered the central part of the concession with an IP pole-dipole configuration and a limit of investigation to a depth of 150m. During a period in excess of three weeks, twenty linear kilometers were surveyed with a NW-SE line orientation (37 lines perpendicular to the assumed structural orientation that is interpreted to control the mineralization) with a 200m line spacing.

The examination of linear pseudo-sections of chargeability (Fig. 1) illustrates a large increase in the depth of the chargeability values (up to 25-30 mV/V) that indicate moderate to high IP anomalies interpreted at 120m depth. Additionally, the juxtaposition of proximal pseudo-sections shows a notable lateral continuity of these anomalies, especially two NE-SW major IP axes (Northern axis and Southern axis).

Thereby, the IP chargeability map at 120m depths (Fig. 2) highlights the identified two major IP axes here described:

- The Northern IP axis (A1): represents an interpretation of the continuity of two minor western (A1-a) E-W (600m long) and eastern (A1-b) NE-SW (800m long) IP axis with chargeability anomalies up to 18-20 mV/V (moderate IP anomalies);

- The Southern IP axis (A2): represents a major IP axis of some 2.4 km long (also open to the SW) with four (A2-a to A2-d) successive and globally aligned secondary axis that rich 25-30 mV/V of chargeability intensity (moderate to high IP anomalies)

The compilation of these very encouraging results with outputs of the successful 2020 drilling program (2,000m of core drilling executed between October and December, 2020) has confirmed the expected high potential of the Project.

The compilation supports three main interpretive aspects:

The results obtained in ddh’s S1, S5, S13, S22, S23, S24, S25 and S27 are probably related to the A1-a minor axis which trends east - west.

1. Copper sulphides (particularly Chalcopyrite) were recognized in these holes, an ensuing drill program is planned to investigate further.

|

Drill

|

Thickness (m)

|

Cu (%)

|

Ag (ppm)

|

|

S1

|

14

|

1.08

|

74

|

|

S5

|

8

|

1.2

|

13

|

|

S13

|

8

|

1.77

|

121

|

|

S22

|

3

|

0.52

|

18

|

|

S23

|

32

|

0.77

|

28

|

|

S24

|

30

|

0.73

|

21

|

|

S25

|

23

|

0.55

|

16

|

|

S27

|

28

|

0,5

|

14

|

2. The eastern NE-SW minor axis (A1-b) is interpreted as the extension of the western E-W minor axis (A1-a) and the interesting values of chargeability (up to 18 mV/V) are certainly related to the presence of sulphides; this assumption is strongly supported by the significant results obtained on drill S10 (7m @ 0.9% Cu or 20m @ 0.55% Cu) even if this drill is completely located outside of the anomaly (some 200m south) and with low chargeability, (only around 8-9 MV/V); this axis also has to be drilled, especially its north-eastern max (18 mV/V).

3. The southern IP axis is the main and high potential result from the IP survey. It consists of globally four aligned secondary axes of 0.4 to more than 1 km long, on the same NE-SW trend (at least 2.4 km long considering that the extreme south-western axis have been only partially covered) and with maximum of chargeability between 20 and 30 mV/V (moderate to high IP anomalies). These four secondary axes represent four main targets that have to be drilled without delay as they represent high potential targets according to the results from drills S11 (7m @ 1.04% Cu and 25ppm Ag or 19m @ 0.62% Cu and 10ppm Ag), S12 (5m @ 0.52% Cu and 7ppm Ag), S9 (6.5m @ 1.29% and 3m @ 1.98% Cu or 21m @ 0.96% Cu) and from the trench (13m @ 2.7% Cu and 34ppm Ag). These results are even more valuable when we know that drills S11 and S12 are clearly outside (to the north) of the limits of the anomalies (more than 300 m for the S11 and some 200 m for the S12) and that drill S9 and the nearest trench (20 m north of S9) coincides only with a very small rounded limit of the anomaly (around 100 m diameter) at 16 mV/V. Definitely, this southern IP major axis (A2) concentrates and materializes the main high potential object of the Project and represents the first priority for the next coming drilling program.

Considering these new positive results, the new exploration program is built in four steps:

- An orientation-drilling program on the four main IP anomalies (A2-a to A2-d) on the southern IP axis (at least 4-5 drills, up to 750 m in total) and, secondary, on the two minor IP axis (A1-a and A1-b) of the northern IP axis (minimum 2 drills, at least 300 m in total); this corresponds to main six drilling targets (T1 to T6, see Fig. 2 above).

- In case of positive results from the orientation-drilling program, a main and systematic drilling program will be conducted in order to verify-delimit the mineralized zone’s extensions in all spatial dimensions (quantities of drilling to be defined and planed).

- Extension of the IP survey to the southern part of the concession with a configuration that can explore at least at 200-250 m depths considering the topography in this area and the dipping (to the South) of the geological units that host the mineralization.

- On the possibly highlighted new IP anomalies in the southern part of the concession, another orientation drilling program will be executed to test these newly discovered anomalies.

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Project, the mineralization of the Project, the Company’s exploration plans, the prospectivity of the Project and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220323005615/en/