CALGARY, Alberta, Feb. 09, 2023 (GLOBE NEWSWIRE) -- Crew Energy Inc. (TSX: CR; OTCQB: CWEGF) ("Crew" or the "Company"), a growth-oriented natural gas weighted producer operating in the world-class Montney play in northeast British Columbia (“NE BC”), is pleased to provide highlights from our year-end independent corporate reserves evaluation prepared by Sproule Associates Ltd. (“Sproule”) with an effective date of December 31, 2022 (the “Sproule Report”), along with an operations update.

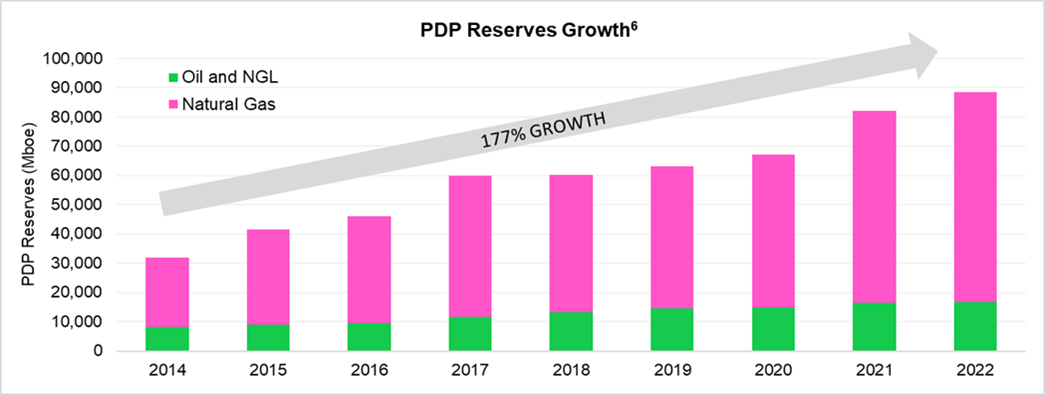

The Company’s two-year plan concluded at the end of 2022, and the successful execution of this plan is demonstrated by our year-end 2022 reserves. The updated reserves reflect strong additions to Proved Developed Producing (“PDP”) reserves along with meaningful increases in production levels, adjusted funds flow1 (“AFF”) and free AFF2 which were directed to debt repayment, resulting in significantly improved leverage metrics exiting 2022. Looking forward, Crew plans to build on this momentum by continuing to grow PDP reserves while harvesting the Company’s Total Proved (”1P”) reserves and Total Proved Plus Probable (“2P”) reserves, as we have consistently done since 2014. Expanding our 1P and 2P reserves beyond current levels will require additional infrastructure which is planned with the addition of a new gas plant at Groundbirch, the timing and sanctioning of which will be dependent on supportive natural gas prices and other factors as outlined in our corporate presentation. Crew’s primary goal over the past two years has been realized with debt being reduced materially, placing the Company in a strong financial position. Our primary focus will continue to be maintaining balance sheet strength while unlocking the inherent value of our vast resource.

Crew’s 2022 reserves evaluation reflects the addition of 18.7 million boe of PDP reserves to total 88.6 million boe, representing an 8% increase year-over-year and a 27% increase when including the replacement of 2022 production volumes of 12.1 million boe. Crew also materially increased the before tax net present value discounted at 10% (“NPV10”) of our year-end 2022 PDP reserves by 46% to $985 million. The Company’s Q4/22 average production increased to 32,893 boe per day3, above guidance of 30,000 to 32,000 boe per day and an increase of 13% over the 29,142 boe per day3 in Q4/21, while reducing net debt1 by 63% over year-end 2021 to $150 million at year-end 20224.

2022 RESERVES HIGHLIGHTS

Highlights of our PDP,1P and 2P reserves from the Sproule Report are provided below. All finding, development and acquisition (“FD&A”)5,6 costs and finding and development (“F&D”)5,6 costs below include changes in future development capital6 (“FDC”) unless otherwise noted.

- Significant PDP Additions: Crew added 18.7 million boe of PDP reserves in 2022 to total 88.6 million boe, marking a record high for the Company and a 32% increase since commencing the two-year plan in January 2021. The additions were achieved with PDP F&D costs5,6 of $9.28 per boe and PDP FD&A costs5,6 of $2.34 per boe in 2022, resulting in recycle ratios5,6 of 3.5 and 14.0 times, respectively.

- Materially Higher Before Tax NPV: Crew’s before tax NPV10 for year-end 2022 PDP reserves increased 46% to $985 million ($5.33 debt adjusted per share including $150 million of year-end net debt1,4, and before any value attributed to undeveloped reserves) compared to 2021 due to improved pricing and higher production. 1P and 2P before tax NPV10 increased 46% and 36% to $1.9 billion ($11.17 debt adjusted per share) and $3.0 billion ($18.19 debt adjusted per share) compared to year-end 2021, respectively, largely due to improved pricing, extensions on recent drilling, and enhanced capital efficiencies in the undeveloped reserve categories primarily as a result of increased well lengths.

- 1P and 2P Increased: Crew’s 1P and 2P reserves increased year-over-year to 210.9 mmboe and 374.0 mmboe, respectively, after taking into account the divestiture of Crew’s Attachie property in Q3/22. Throughout Crew’s two-year plan, the Company delineated new areas at Groundbirch South and Septimus North, and commenced new development in existing areas of Greater Septimus in the Upper Montney ‘C’ zone to position for additional development in the future. These new areas position Crew for longer term 1P and 2P reserve growth as additional facility capacity is established.

- Excellent Recycle Ratios5,6,7on1P and 2P FD&A Costs: 1P and 2P FD&A5,6 costs in 2022 were $8.45 per boe and $3.85 per boe, respectively, generating recycle ratios of 3.9 times for 1P FD&A5,6 and 8.5 times for 2P FD&A5,6. These results were boosted by the successful divestiture of Crew’s Attachie property which yielded gross proceeds of $130 million and, as of the Company’s year-end 2021 reserves report, included associated 1P and 2P reserves of 4.7 mmboe and 34.2 mmboe, respectively, as well as FDC of $25.7 million and $182.9 million, respectively.

| 2022 F&D and FD&A Costs5,6 |

|

F&D

per boe |

F&D

recycle5,7 |

FD&A

per boe |

FD&A

recycle5,7 |

| PDP |

$9.28 |

3.5x |

$2.34 |

14.0x |

| 1P |

$13.97 |

2.3x |

$8.45 |

3.9x |

| 2P |

$15.35 |

2.1x |

$3.85 |

8.5x |

- 1P and 2P F&D5,6Costs: Crew’s 2022 1P and 2P F&D costs5,6 were $13.97 per boe and $15.35 per boe, respectively. These results are largely attributable to our successful capital program execution in 2022, notwithstanding the substantial inflation in goods and services experienced during the year.

- Debt Adjusted Per Share Reserves Growth: Year-over-year PDP, 1P and 2P growth per share on a debt adjusted basis was 32%, 25% and 13%, respectively8.

* Information derived from the Company’s year-ended independent reserves evaluations.

2022 RESERVES DETAIL

The detailed reserves data set forth below is based upon the Sproule Report with an effective date of December 31, 2022. The following presentation summarizes the Company’s crude oil, natural gas liquids and conventional natural gas reserves and the net present values before income tax of future net revenue for the Company’s reserves using forecast prices and costs based on the Sproule Report. The Sproule Report has been prepared in accordance with definitions, standards, and procedures contained in the Canadian Oil and Gas Evaluation Handbook (“COGE Handbook”) and National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (“NI 51-101”). The reserves evaluation was based on Sproule forecast escalated pricing and foreign exchange rates at December 31, 2022 as outlined in the table herein entitled "Price Forecast".

All evaluations and summaries of future net revenue are stated prior to provision for interest, debt service charges and general administrative expenses, the input of hedging activities and after deduction of royalties, operating costs, estimated well abandonment and reclamation costs ("ARC") associated with the Company’s assets in the reserve report and estimated future capital expenditures associated with reserves. It should not be assumed that the estimates of net present value of future net revenues presented in the tables below represent the fair market value of the reserves. There is no assurance that the forecast prices and cost assumptions will be attained and variances could be material. The recovery and reserve estimates of our crude oil, natural gas liquids and conventional natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Actual crude oil, conventional natural gas and natural gas liquids reserves may be greater than or less than the estimates provided herein. Reserves included herein are stated on a company gross basis (working interest before deduction of royalties without including any royalty interests) unless noted otherwise. In addition to the detailed information disclosed in this news release, more detailed information as prescribed by NI 51-101 will be included in the Company's Annual Information Form (the “AIF”) for the year ended December 31, 2022, which will be filed on the Company's profile at www.sedar.com on or before March 31, 2023.

See "Information Regarding Disclosure on Oil and Gas Reserves and Operational Information" for additional cautionary language, explanations and discussion and "Forward Looking Information and Statements" for principal assumptions and risks that may apply.

Corporate Reserves9,10,11

|

Light & Medium

Crude Oil |

Natural Gas

Liquids |

Conventional

Natural Gas12 |

Barrels of

oil equivalent13 |

|

(mbbl) |

(mbbl) |

(mmcf) |

(mboe) |

| Proved |

|

|

|

|

| Developed Producing |

131 |

16,467 |

431,930 |

88,587 |

| Developed Non-producing |

34 |

119 |

3,497 |

736 |

| Undeveloped |

2,463 |

23,833 |

571,575 |

121,559 |

| Total Proved |

2,628 |

40,420 |

1,007,002 |

210,882 |

| Total Probable |

5,529 |

28,641 |

773,792 |

163,136 |

| Total Proved plus Probable |

8,158 |

69,061 |

1,780,795 |

374,018 |

Reserves Values10,11,14,15

The estimated before tax net present value (“NPV”) of future net revenues associated with Crew’s reserves effective December 31, 2022, and based on the Sproule Report and the published Sproule (December 31, 2022) future price forecast, are summarized in the following table:

| (M$) |

0% |

5% |

10% |

15% |

20% |

| Proved |

|

|

|

|

|

| Developed Producing |

1,649,778 |

1,227,777 |

985,006 |

832,477 |

728,483 |

| Developed Non-producing |

10,132 |

8,207 |

6,805 |

5,788 |

5,028 |

| Undeveloped |

2,367,956 |

1,380,264 |

909,673 |

647,147 |

483,259 |

| Total Proved |

4,027,866 |

2,616,248 |

1,901,485 |

1,485,412 |

1,216,770 |

| Total Probable |

4,092,132 |

1,940,081 |

1,132,952 |

751,723 |

542,880 |

| Total Proved plus Probable |

8,119,998 |

4,556,329 |

3,034,436 |

2,237,135 |

1,759,649 |

Price Forecast16,17

The Sproule December 31, 2022 price forecast is summarized as follows:

| Year |

Exchange

Rate |

WTI @

Cushing |

Canadian

Light Sweet |

Henry Hub |

Natural gas at

AECO/NIT spot |

Westcoast

Station 2 |

|

($US/$/Cdn) |

(US$/bbl) |

(C$/bbl) |

(US$/mmbtu) |

(C$/mmbtu) |

(C$/mmbtu) |

| 2023 |

0.750 |

86.00 |

110.67 |

5.00 |

4.33 |

4.18 |

| 2024 |

0.800 |

84.00 |

101.25 |

4.50 |

4.34 |

4.23 |

| 2025 |

0.800 |

80.00 |

96.18 |

4.25 |

4.00 |

3.89 |

| 2026 |

0.800 |

81.60 |

98.10 |

4.34 |

4.08 |

3.97 |

| 2027 |

0.800 |

83.23 |

100.06 |

4.42 |

4.16 |

4.05 |

| 2028 |

0.800 |

84.90 |

102.06 |

4.51 |

4.24 |

4.13 |

| 2029 |

0.800 |

86.59 |

104.10 |

4.60 |

4.33 |

4.22 |

| 2030 |

0.800 |

88.33 |

106.18 |

4.69 |

4.42 |

4.30 |

| 2031 |

0.800 |

90.09 |

108.31 |

4.79 |

4.50 |

4.39 |

| 2032 |

0.800 |

91.89 |

110.47 |

4.88 |

4.59 |

4.47 |

| 2033+(16) |

|

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

Reserves Reconciliation11,18

The following reconciliation of Crew’s gross reserves compares changes in the Company’s reserves as at December 31, 2022, based on the Sproule (December 31, 2022) future price forecast relative to the reserves as at December 31, 2021.

|

MBOE |

| FACTORS |

Total Proved |

Total Probable |

Total Proved + Probable |

| December 31, 2021 |

206,807 |

197,878 |

404,684 |

| Extensions and Improved Recovery19 |

21,211 |

(3,300) |

17,911 |

| Infill Drilling |

864 |

(219) |

646 |

| Technical Revisions |

(3,915) |

(591) |

(4,506) |

| Discoveries |

- |

- |

- |

| Acquisitions |

- |

- |

- |

| Dispositions |

(4,713) |

(29,536) |

(34,248) |

| Economic Factors |

2,773 |

(1,096) |

1,677 |

| Production |

(12,146) |

- |

(12,146) |

| December 31, 2022 |

210,882 |

163,136 |

374,018 |

Corporate level technical revisions on a boe basis were -2% at the Proved level and -1% at the Proved plus Probable level. Technical revisions were primarily due to operating cost increases, high-grading future development bookings in context of COGE Handbook recommended development timing windows, performance adjustments attributable to the Company’s 2022 capital program, well performance and type curve changes, and reserves reclassifications. Other technical revisions were attributable to the Company’s updated development planning resulting in adjustments to future development bookings, reflective of a continuing shift towards extended reach horizontal well designs.

Material changes in other categories were attributable to divestment of the Company’s Attachie and Portage assets in Q3/22, pricing, carbon tax, and royalty regime changes, and infill and extension additions associated with Crew’s 2022 development activity.

Capital Program Efficiency – Including FDC

|

2022

|

|

PDP |

1P |

2P |

| Exploration and Development Expenditures20,21($ thousands) |

$176,637 |

$176,637 |

$176,637 |

| Acquisitions/(Dispositions)20,21($ thousands) |

($129,802) |

($129,802) |

($129,802) |

| Change in Future Development Capital6,20($ thousands) |

|

|

|

| - Exploration and Development |

($3,112) |

$115,883 |

$64,744 |

| - Acquisitions/Dispositions |

($3,112) |

($25,701) |

($182,850) |

| Reserves Additions with Revisions and Economic Factors (mboe) |

|

|

|

| - Exploration and Development |

18,689 |

20,934 |

15,728 |

| - Acquisitions/Dispositions |

0 |

(4,713) |

(34,248) |

|

2022 |

|

PDP |

1P |

2P |

| Finding & Development Costs6,22,23($ per boe) |

|

|

|

| - with revisions and economic factors |

$9.28 |

$13.97 |

$15.35 |

| Finding, Development & Acquisition Costs6,22,23($ per boe) |

|

|

|

| - with revisions and economic factors |

$2.34 |

$8.45 |

$3.85 |

| Recycle Ratio23(F&D) |

3.5x

|

2.3x

|

2.1x

|

| Reserves Replacement5 |

154% |

134% |

(152%) |

OPERATIONS UPDATE

Production Exceeds Forecasts

Full year 2022 production exceeded forecasts to average 33,277 boe per day3, and Q4/22 production surpassed guidance of 30,000 to 32,000 boe per day to average 32,893 boe per day3. This strong performance was largely due to the continued strength of the 4-17 Groundbirch wells and the 4-14 ultra-condensate rich (“UCR”) wells at Septimus, combined with the encouraging performance of our new wells at the 11-27 pad noted below.

Strong Condensate-Rich Wells at Greater Septimus

Five (5.0 net) extended reach horizontal UCR wells were completed on the 11-27 pad in December 2022. Prior to shutting in for tubing installation, four of the wells averaged raw initial production rates of 1.7 mmcf per day of natural gas and 1,000 bbls per day of condensate after an average of 19 days flowing. The fifth well is currently flowing back on cleanup at 2.3 mmcf per day of natural gas and 1,005 bbls per day of condensate over the last three days.

Agreement Reached Between B.C. Government and Blueberry River First Nations

On January 18, 2023, the B.C. Government and Blueberry River First Nations (“BRFN”) announced the ‘BRFN Implementation Agreement’ in response to a B.C. Supreme Court decision issued on June 29, 2021. Following this, on January 20, 2023, the province announced a Consensus Agreement with four Treaty 8 First Nations. Collectively, these agreements outline a collaborative approach to land and resource planning while protecting treaty rights. Having this framework in place is expected to provide stability and predictability for industry operating within NE BC. While some uncertainty is anticipated to persist until details are confirmed, the partnership framework provides guidance related to land, water and resource stewardship.

As a result of this positive development, Crew is optimistic about the path forward and our ability to execute an active drilling and completions program with the ability to make optimal capital allocation decisions across our asset base. The Company has submitted additional permit applications for approval, which include 93 well locations, the planned Groundbirch Plant, gathering lines, facilities, and other ancillary operations.

ADVISORIES

Unaudited Financial Information

Certain financial and operating information included in this press release for the quarter and year ended December 31, 2022, including, without limitation, exploration and development expenditures, acquisitions / dispositions, finding and development costs, finding, development and acquisition costs, recycle ratio, operating netbacks and debt are based on estimated unaudited financial results for the quarter and year then ended, and are subject to the same limitations as discussed under Forward Looking Information set out below. These estimated amounts may change upon the completion of audited financial statements for the year ended December 31, 2022 and changes could be material.

Information Regarding Disclosure on Oil and Gas Reserves and Operational Information

All amounts in this news release are stated in Canadian dollars unless otherwise specified. Our oil and gas reserves statement for the year ended December 31, 2022, which will include complete disclosure of our oil and gas reserves and other oil and gas information in accordance with NI 51-101, will be contained within our Annual Information Form which will be available on our SEDAR profile at www.sedar.com on or before March 31, 2023. The recovery and reserve estimates contained herein are estimates only and there is no guarantee that the estimated reserves will be recovered. In relation to the disclosure of estimates for individual properties or subsets thereof, such estimates may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

This press release contains metrics commonly used in the oil and natural gas industry, such as "recycle ratio", "finding and development costs", "finding, development and acquisition costs”, “future development capital”, "maintenance capital”, “operating netback per boe”, “exploration and development expenditures” and “reserves replacement”. Each of these metrics are determined by Crew as specifically set forth in this news release. These terms do not have standardized meanings or standardized methods of calculation and therefore may not be comparable to similar measures presented by other companies, and therefore should not be used to make such comparisons. Such metrics have been included to provide readers with additional information to evaluate the Company’s performance however, such metrics are not reliable indicators of future performance and therefore should not be unduly relied upon for investment or other purposes. Recycle Ratio is calculated as operating netback per boe divided by F&D costs on a per boe basis. Exploration and development expenditures as used herein is equivalent to property, plant and equipment expenditures, a term with a standardized meaning prescribed under IFRS. Reserves Replacement is calculated as total reserve additions (including acquisitions net of dispositions) divided by annual production. Crew’s annual 2022 production averaged 33,277 boe per day. Management uses these metrics for its own performance measurements and to provide readers with measures to compare Crew’s performance over time.

Both F&D and FD&A costs take into account reserves revisions during the year on a per boe basis. The aggregate of the costs incurred in the financial year and changes during that year in estimated FDC may not reflect total F&D costs related to reserves additions for that year. Finding and development costs both including and excluding acquisitions and dispositions have been presented in this press release because acquisitions and dispositions can have a significant impact on our ongoing reserves replacement costs and excluding these amounts could result in an inaccurate portrayal of our cost structure.

NPV10 debt adjusted per share metrics disclosed herein are based on 156,684,620 common shares issued and outstanding as at December 31, 2022, on a non-diluted basis, and year-end net debt of $150 million.

Reserves Reconciliation by Product Types

| TOTAL PROVED |

Light/Med Crude

Oil (mbbls) |

NGL's

(mbbls) |

Conventional

Natural Gas

(mmcf) |

Oil Equivalent

(mboe) |

| December 31, 2021 |

3,457 |

38,891 |

986,753 |

206,807 |

| Extensions |

0 |

5,062 |

96,897 |

21,211 |

| Infill Drilling |

311 |

67 |

2,916 |

864 |

| Improved Recovery |

0 |

0 |

0 |

0 |

| Technical Revisions |

(1,127) |

(228) |

(15,361) |

(3,915) |

| Discoveries |

0 |

0 |

0 |

0 |

| Acquisitions |

0 |

0 |

0 |

0 |

| Dispositions |

0 |

(1,034) |

(22,071) |

(4,713) |

| Economic Factors |

23 |

345 |

14,432 |

2,773 |

| Production |

(36) |

(2,683) |

(56,564) |

(12,146) |

| December 31, 2022 |

2,628 |

40,420 |

1,007,002 |

210,882 |

| TOTAL PROBABLE |

Light/Med Crude

Oil (mbbls) |

NGL's

(mbbls) |

Conventional

Natural Gas

(mmcf) |

Oil Equivalent

(mboe) |

| December 31, 2021 |

2,422 |

41,152 |

925,817 |

197,878 |

| Extensions |

4,020 |

(4,390) |

(17,577) |

(3,300) |

| Infill Drilling |

(130) |

(11) |

(470) |

(219) |

| Improved Recovery |

0 |

0 |

0 |

0 |

| Technical Revisions |

(710) |

(2,154) |

13,638 |

(591) |

| Discoveries |

0 |

0 |

0 |

0 |

| Acquisitions |

0 |

0 |

0 |

0 |

| Dispositions |

0 |

(5,719) |

(142,899) |

(29,536) |

| Economic Factors |

(72) |

(238) |

(4,716) |

(1,096) |

| Production |

0 |

0 |

0 |

0 |

| December 31, 2022 |

5,530 |

28,641 |

773,792 |

163,136 |

| TOTAL PROVED PLUS PROBABLE |

Light/Med Crude

Oil (mbbls) |

NGL's

(mbbls) |

Conventional

Natural Gas

(mmcf) |

Oil Equivalent

(mboe) |

| December 31, 2021 |

5,879 |

80,044 |

1,912,570 |

404,684 |

| Extensions |

4,020 |

672 |

79,319 |

17,911 |

| Infill Drilling |

182 |

56 |

2,447 |

646 |

| Improved Recovery |

0 |

0 |

0 |

0 |

| Technical Revisions |

(1,838) |

(2,382) |

(1,723) |

(4,506) |

| Discoveries |

0 |

0 |

0 |

0 |

| Acquisitions |

0 |

0 |

0 |

0 |

| Dispositions |

0 |

(6,753) |

(164,970) |

(34,248) |

| Economic Factors |

(49) |

107 |

9,716 |

1,677 |

| Production |

(36) |

(2,683) |

(56,564) |

(12,146) |

| December 31, 2022 |

8,158 |

69,061 |

1,780,795 |

374,018 |

Forward-Looking Information and Statements

This news release contains certain forward–looking information and statements within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "may", "will", "project", "should", "believe", "plans", "intends" “forecast” and similar expressions are intended to identify forward-looking information or statements. In particular, but without limiting the foregoing, this news release contains forward-looking information and statements pertaining to the following: Estimates of Q4 operating netbacks per boe, the potential recognition of significant additional reserves under the heading 2022 Reserves Detail; the volumes and estimated value of Crew's oil and gas reserves, the future net value of Crew's reserves, the future development capital and costs, the future ARC, the life of Crew's reserves, the estimated volumes, and product mix of Crew's oil and gas production; production estimates; Crew's commodity risk management programs; future liquidity and financial capacity required to carry out our planned program; future results from operations and operating metrics; future development activities (including drilling and completion plans and associated timing and cost estimates) and related production estimates; the potential attributes of the recently announced agreements among the BC Government, BRFN and Treaty 8 First Nations, and the anticipated positive impact on the Company’s ability to execute an active drilling and completions program across its asset base; and methods of funding our capital program.

In addition, forward-looking statements or information are based on a number of material factors, expectations or assumptions of Crew which have been used to develop such statements and information but which may prove to be incorrect. Although Crew believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because Crew can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: that Crew will continue to conduct its operations in a manner consistent with past operations; results from drilling and development activities consistent with past operations; the quality of the reservoirs in which Crew operates and continued performance from existing wells; the continued and timely development of infrastructure in areas of new production; the accuracy of the estimates of Crew’s reserve volumes; certain commodity price and other cost assumptions; continued availability of debt and equity financing and cash flow to fund Crew’s current and future plans and expenditures; the impact of increasing competition; the general stability of the economic and political environment in which Crew operates; the general continuance of current industry conditions; the timely receipt of any required regulatory approvals and permits; the ability of Crew to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects in which Crew has an interest in to operate the field in a safe, efficient and effective manner; the ability of Crew to obtain financing on acceptable terms; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development and exploration; the timing and cost of pipeline, storage and facility construction and expansion and the ability of Crew to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Crew operates; and the ability of Crew to successfully market its oil and natural gas products.

In this press release and other disclosures reference is made to the Company's longer range Four-Year Plan. Such information reflects internal targets used by management for the purposes of making capital investment decisions and for internal long range planning and budget preparation. Readers are cautioned that events or circumstances could cause capital plans and associated results to differ materially from those predicted and Crew's guidance for 2023 and beyond may not be appropriate for other purposes. Accordingly, undue reliance should not be placed on same.

The forward-looking information and statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors that may cause actual results or events to defer materially from those anticipated in such forward-looking information or statements including, without limitation: the continuing and uncertain impact of COVID-19; changes in commodity prices; changes in the demand for or supply of Crew's products, the early stage of development of some of the evaluated areas and zones the potential for variation in the quality of the Montney formation; interruptions, unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates; climate change regulations, or other regulatory matters; changes in development plans of Crew or by third party operators of Crew's properties, increased debt levels or debt service requirements; inaccurate estimation of Crew's oil and gas reserve volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time-to-time in Crew's public disclosure documents (including, without limitation, those risks identified in this news release and Crew's Annual Information Form).

The forward-looking information and statements contained in this news release speak only as of the date of this news release, and Crew does not assume any obligation to publicly update or revise any of the included forward-looking statements or information, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Test Results and Initial Production Rates

A pressure transient analysis or well-test interpretation has not been carried out and thus certain of the test results provided herein should be considered to be preliminary until such analysis or interpretation has been completed. Test results and initial production (“IP”) rates disclosed herein, particularly those short in duration, may not necessarily be indicative of long-term performance or of ultimate recovery.

BOE Conversions

Barrel of oil equivalents or BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency of 6:1, utilizing the 6:1 conversion ratio may be misleading as an indication of value.

Non-IFRS and Other Financial Measures

Throughout this press release and other materials disclosed by the Company, Crew uses certain measures to analyze financial performance, financial position and cash flow. These non-IFRS and other specified financial measures do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other entities. The non-IFRS and other specified financial measures should not be considered alternatives to, or more meaningful than, financial measures that are determined in accordance with IFRS as indicators of Crew’s performance. Management believes that the presentation of these non-IFRS and other specified financial measures provides useful information to shareholders and investors in understanding and evaluating the Company’s ongoing operating performance, and the measures provide increased transparency and the ability to better analyze Crew’s business performance against prior periods on a comparable basis.

Capital Management Measures

| a) |

Funds from Operations and Adjusted Funds Flow (“AFF”) |

|

|

|

Funds from operations represents cash provided by operating activities before changes in operating non-cash working capital, accretion of deferred financing costs and transaction costs on property dispositions. Adjusted funds flow represents funds from operations before decommissioning obligations settled (recovered). The Company considers these metrics as key measures that demonstrate the ability of the Company’s continuing operations to generate the cash flow necessary to maintain production at current levels and fund future growth through capital investment and to service and repay debt. Management believes that such measures provide an insightful assessment of the Company's operations on a continuing basis by eliminating certain non-cash charges, actual settlements of decommissioning obligations and transaction costs on property dispositions, the timing of which is discretionary. Funds from operations and adjusted funds flow should not be considered as an alternative to or more meaningful than cash provided by operating activities as determined in accordance with IFRS as an indicator of the Company’s performance. Crew’s determination of funds from operations and adjusted funds flow may not be comparable to that reported by other companies. Crew also presents adjusted funds flow per share whereby per share amounts are calculated using weighted average shares outstanding consistent with the calculation of income per share. |

|

|

| b) |

Net Debt and Working Capital Surplus (Deficiency) |

|

|

|

Crew closely monitors its capital structure with a goal of maintaining a strong balance sheet to fund the future growth of the Company. The Company monitors net debt as part of its capital structure. The Company uses net debt (bank debt plus working capital deficiency or surplus, excluding the current portion of the fair value of financial instruments) as an alternative measure of outstanding debt. Management considers net debt and working capital deficiency (surplus) an important measure to assist in assessing the liquidity of the Company. |

Non-IFRS Financial Measures and Ratios

| a) |

Free Adjusted Funds Flow |

|

|

|

Free adjusted funds flow represents adjusted funds flow less capital expenditures, excluding acquisitions and dispositions. The Company considers this metric a key measure that demonstrates the ability of the Company’s continuing operations to fund future growth through capital investment and to service and repay debt. The most directly comparable IFRS measure to free adjusted funds flow is cash provided by operating activities. |

|

|

| b) |

Operating Netback per boe |

|

|

|

Operating netback per boe equals petroleum and natural gas sales including realized gains and losses on commodity related derivative financial instruments, marketing income, less royalties, net operating costs and transportation costs calculated on a boe basis. Management considers operating netback per boe an important measure to evaluate its operational performance as it demonstrates its field level profitability relative to current commodity prices. |

Supplemental Information Regarding Product Types

References to gas or natural gas and NGLs in this press release refer to conventional natural gas and natural gas liquids product types, respectively, as defined in National Instrument 51-101, Standards of Disclosure for Oil and Gas Activities ("NI 51-101"), except where specifically noted otherwise.

The following is intended to provide the product type composition for each of the production figures provided herein, where not already disclosed within tables above:

|

Crude Oil |

Condensate |

Natural Gas

Liquids1 |

Conventional

Natural Gas |

Total

(boe/d) |

| Q4 2021 Average |

1% |

9% |

8% |

82% |

29,142 |

| Q4 2022 Average |

0% |

12% |

8% |

80% |

32,893 |

| 2022 Average |

0% |

14% |

8% |

78% |

33,277 |

Notes:

1) Excludes condensate volumes which have been reported separately.

Crew is a growth-oriented natural gas and liquids producer, committed to pursuing sustainable per share growth through a balanced mix of financially and socially responsible exploration and development. The Company’s operations are exclusively located in northeast British Columbia and feature a vast Montney resource with a large contiguous land base in the Greater Septimus and Groundbirch areas in British Columbia, offering significant development potential over the long-term. Crew has access to diversified markets with operated infrastructure and access to multiple pipeline egress options. The Company’s common shares are listed for trading on the Toronto Stock Exchange (“TSX”) under the symbol “CR” and on the OTCQB in the US under ticker “CWEGF”.

FOR DETAILED INFORMATION, PLEASE CONTACT:

| Dale Shwed, President and CEO |

Phone: (403) 266-2088

|

| John Leach, Executive Vice President and CFO |

Email: investor@crewenergy.com |

_______________________________________

1 Capital management measure that does not have any standardized meaning as prescribed by International Financial Reporting Standards, and therefore, may not be comparable with the calculations of similar measures for other entities. See “Advisories - Non-IFRS and Other Financial Measures” contained within this press release.

2 Non-IFRS financial measure or ratio that does not have any standardized meaning as prescribed by International Financial Reporting Standards, and therefore, may not be comparable with calculations of similar measures or ratios for other entities. See “Advisories - Non-IFRS and Other Financial Measures” contained within this press release and in our most recently filed MD&A, available on SEDAR at www.sedar.com.

3 See table in the Advisories for production breakdown by product type as defined in NI 51-101.

4 All 2022 financial amounts are unaudited. See “Advisories – Unaudited Financial Information”.

5 "Finding, Development and Acquisitions costs" or "FD&A costs", "Finding and Development costs" or "F&D costs", “Reserves Replacement”, “Operating Netback” and “recycle ratio” do not have standardized meanings. See “Capital Program Efficiency” and “Advisories - Information Regarding Disclosure on Oil and Gas Reserves, and Operational Information".

6 The 2022 change in Future Development Capital (FDC) used in the calculation of Crew’s 1P and 2P F&D and FD&A costs does not include approximately $154 million (undiscounted) in the 1P case and $181 million (undiscounted) in the 2P case of maintenance capital that was reclassified as a capital expense in the December 31, 2021, Sproule Report and maintained the same classification in the December 31, 2022 Sproule Report.

7 Estimated operating netback per boe in Q4 2022, used in the above calculations, averaged $32.64 per boe (unaudited). See ‘Advisories - Unaudited Financial Information’ and ‘Advisories - Information Regarding Disclosure on Oil and Gas Reserves and Operational Information’.

8 Debt adjusted values are based on a 2022 year-end debt of $149.5 million using a year-end share price of $5.65 as at December 31, 2022. All 2022 financial amounts are unaudited. See “Advisories – Unaudited Financial Information”.

9 Reserves have been presented on a “gross” basis which is defined as Crew’s working interest (operating and non-operating) share before deduction of royalties and without including any royalty interest of the Company.

10 Based on Sproule’s December 31, 2022 escalated price forecast.

11 Columns may not add due to rounding

12 Reflects 100% Conventional Natural Gas by product type.

13 Oil equivalent amounts have been calculated using a conversion rate of six thousand cubic feet of natural gas to one barrel of oil.

14 The estimated future net revenues are stated prior to provision for interest, debt service charges, general administrative expenses, the impact of hedging activities, and after deduction of royalties, operating costs, ARC associated with the Company’s assets and estimated future capital expenditures.

15 The after-tax net present values of future net revenue attributed to Crew’s reserves will be included in the Company’s 2022 AIF to be filed on or before March 31, 2023.

16 Escalated at 2.0% per year starting in 2033 with the exception of foreign exchange which remains constant.

17 Product sale prices will reflect these reference prices with further adjustments for quality and transportation to point of sale.

18 See the tables under “Reserves Reconciliation by Product Types” contained in this news release for a reconciliation by product type in accordance with NI 51-101

19 Increases to Extensions and Improved Recovery are the result of step-out locations drilled or proposed to be drilled by Crew. Reserves additions for improved recovery and extensions are combined and reported as "Extensions and Improved Recovery".

20 The aggregate of the exploration and development costs incurred in the most recent financial year and the change during that year in estimated future development capital generally will not reflect total finding and development costs related to reserve additions for that year.

21 All 2022 financial amounts are unaudited. See “Advisories – Unaudited Financial Information”.

22 F&D and FD&A costs above are calculated, as noted, after changes in FDC required to bring proved undeveloped and developed reserves into production, by dividing the identified capital expenditures by the applicable reserves additions.

23 Recycle ratio is defined as operating netback per boe divided by F&D costs on a per boe basis. Operating netback per boe is a Non-IFRS Measure and is calculated as revenue (excluding realized hedging gains and losses) minus royalties, operating expenses, and transportation expenses. Crew’s estimated operating netback per boe in fourth quarter 2022, used in the above calculations, averaged $32.64 per boe (unaudited). This amount is an estimate and is subject to audit verification. See ‘Advisories - Unaudited Financial Information’ and ‘Advisories - Information Regarding Disclosure on Oil and Gas Reserves and Operational Information’.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/653210b1-c81b-4e3c-b03b-65ca608b4888