Gold and silver mineralization, up to 72.4 grams per tonne (“g/t”) Au and up to 1,473 g/t Ag over 0.6 drill meters, reported

VANCOUVER, British Columbia, March 01, 2023 (GLOBE NEWSWIRE) -- Patagonia Gold Corp. (“Patagonia” or the “Company”) (TSXV: PGDC) is pleased to announce new gold and silver analytical results in exploration drill samples from the Monte Leon (“MLN”) target near its Cap Oeste (“Capo”) mine in the Santa Cruz province of southern Argentina.

Highlights

- On November 16, 2022, the Company announced an exploration agreement with a private arm’s-length company for a 20,000 meter, two-phase, core drilling program at MLN (see news release on www.patagoniagold.com).

- MLN is located on a major, NNW-SSE structural trend that extends beyond MLN to the east-southeast and to the north-northwest to the Capo mineral system.

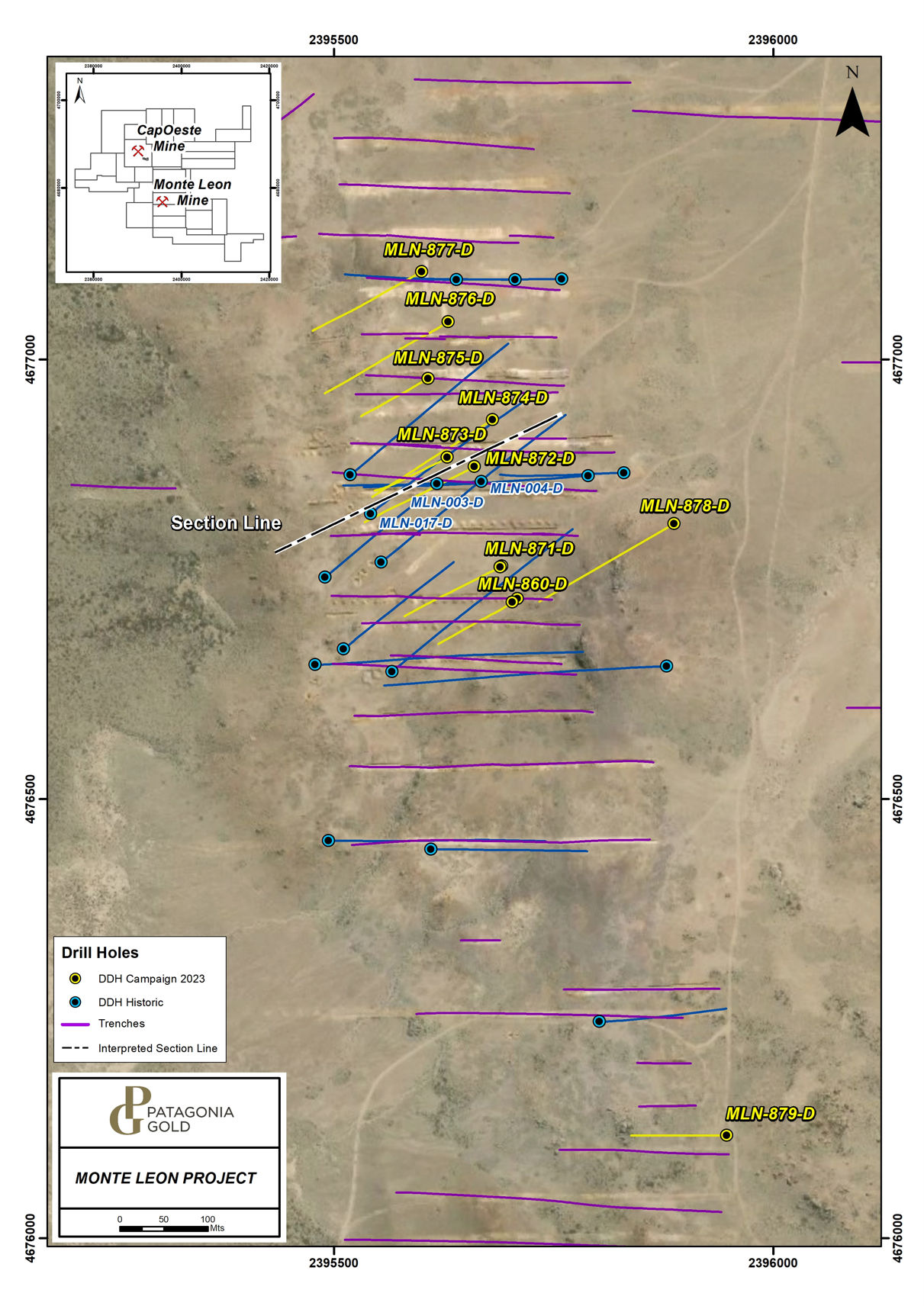

- To date, a total of 1,760 meters in five, HQ-sized core holes were completed in this phase of drilling (see Figure 1 below). Results from 973 meters in 5 core holes are reported in this news release (through MLN-874-D ).

- Anomalous gold and silver mineralization, greater than 0.5 grams per tonne (“g/t”) gold (“Au”), was intersected in five new core holes. Au values up to 72.4 g/t and silver (“Ag”) values up to 1,473 g/t were reported from hole MLN 873D (see Table 1).

Mr. Christopher van Tienhoven, CEO of Patagonia, commented “We have had MLN as one of our priority exploration targets for this year. Prior Company drilling defined near surface oxidized mineralization in late 2020 and 2021. We are pleased with the analytical results thus far and are designing additional drilling to help define the depth and lateral extension of the new gold and silver mineralization.”

Historical Work

Prior to this new program of core drilling at MLN, the Company identified gold mineralization in oxidized and brecciated structures at MLN, with 104 trenches and 21 core holes (see December 29, 2020 news release on www.patagoniagold.com). In addition, Patagonia Gold Plc (the AIM-listed predecessor to the Company), drilled 75 reverse circulation and 21 core holes in the general area surrounding the recent MLN drilling in 2011 and 2015. The location of the historic work in noted in Figure 1. In addition, 43.9 line-kilometers (‘’km”) of ground-based, induced polarization and resistivity (pole-dipole IP-Res) surveying was completed in 2021, and more than 800 line-km of ground magnetics.

Figure 1. Location of MLN and Capo in the El Tranquilo concession black

Note: new drilling labelled in yellow font with azimuth and inclination direction noted from each drill collar. See inset map for MLN and Capo location reference in the El Tranquilo concession block.

Current Activities

In 2021 and 2022, the Company identified near surface gold and silver mineralization with geologic mapping and sampling and rotary air blast (“RAB”) drilling. Coupled with the historical data, this new work led to the new drill program. Composited Au and Ag analyses from the new core samples are shown in Table 1.

Table 1. Analytical Results (composited) from MLN Core Drilling

| Drill Hole Data |

Mineralization |

Number

|

Azimuth

(degrees)

|

Inclination

(degrees)

|

Depth

(m)

|

From (m)

|

To (m)

|

Length

(m)

|

Au |

Ag |

| (g/t) |

(g/t) |

| MLN-860A-D |

240 |

-50 |

143 |

102.9 |

103.85 |

0.95 |

1.11 |

1.0 |

|

|

|

|

130.4 |

135.85 |

5.45 |

1.20 |

2.2 |

| MLN-871A-D |

240 |

-50 |

185 |

62 |

63.9 |

1.9 |

49.50 |

11.0 |

|

|

|

|

110.87 |

111.65 |

0.78 |

4.88 |

126.0 |

|

|

|

|

115.75 |

116.25 |

0.5 |

9.92 |

12.0 |

| MLN-872-D |

240 |

-50 |

218 |

85.22 |

93 |

7.78 |

0.98 |

5.8 |

| Incl. |

|

|

|

89 |

89.83 |

0.83 |

3.02 |

28.0 |

|

|

|

|

162.28 |

163.1 |

0.82 |

27.10 |

403.0 |

| MLN-873-D |

240 |

-50 |

137 |

59 |

72.97 |

13.97 |

1.74 |

12.2 |

| Incl. |

|

|

|

61.3 |

62 |

0.7 |

5.51 |

7.0 |

| Incl. |

|

|

|

70.55 |

71 |

0.45 |

10.40 |

126.0 |

|

|

|

|

77.73 |

80.3 |

2.57 |

15.95 |

326.6 |

| Incl. |

|

|

|

78.42 |

78.97 |

0.55 |

72.40 |

1473.0 |

|

|

|

|

92.7 |

93.2 |

0.5 |

7.92 |

15.0 |

|

|

|

|

120.6 |

127.1 |

6.5 |

3.36 |

130.0 |

| Incl. |

|

|

|

125.5 |

126.4 |

0.9 |

20.00 |

584.0 |

| MLN-874-D |

240 |

-50 |

240 |

112.4 |

113 |

0.6 |

1.43 |

6.0 |

|

|

|

|

158.15 |

158.75 |

0.6 |

3.28 |

167.0 |

Notes to Table 1.

- “Incl.” means including.

- Samples were collected from HQ-diameter core.

- Mineralized intervals are down-hole lengths. True widths are not yet known.

- 0.5 g/t Au minimum grade was used in compositing and no more than 2 consecutive grades less than 0.5 g/t Au were used in compositing.

- Grades were not capped.

- All analyses were performed by Alex Stewart International, a certified, independent analytical services provider, in their Mendoza, Argentina facilities using fire assaying for Au and four-acid digestion, ICP-MS for Ag.

- Assays for 5 drill holes are pending.

- For QA/QC purposes, a total of 39 blanks, 80 Certified Reference Material standards were inserted into the primary, drill sample stream by Company personnel at a ratio of one QA/QC sample to 9 primary samples. All QA/QC results were within acceptable limits.

- There has been insufficient exploration to define a mineral resource at this time and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Drilling thus far has confirmed the main 12.75 km long structural corridor on strike with the Capo mine. Within the corridor at MLN, two prominent, near vertical, NNW-SSE structural trends have been recognized that are believed to control the widest zones of gold and silver mineralization defined to-date. Other precious metal occurrences occur in narrower, sheeted structures sub-parallel to the two main trend (see Figure 2).

MLN mineralization is believed to be intermediate sulfidation, epithermal in character, hosted within a near-vertical oxidized and sulfidic breccia. The breccia is pipe-like and appears to be 1.5 km by 0.3 km (NNW-SSE) in dimension and near vertically oriented.

Figure 2. MLN Geologic and Mineralization Cross Section Looking Northwest

Qualified Person’s Statement

Donald J. Birak, an independent geologist and Registered Member of SME and Fellow of AusIMM and a qualified person as defined by NI 43-101, supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the scientific and technical disclosure herein. The Qualified Person visited the MLN property in November 2022 and viewed the historic drill sites, new RAB drilling then underway, and the surface geology and mineralization exposed in a shallow pit, as well as Company core sample preparation activities from other drilling. The Qualified Person has not validated the historic trenching and drilling nor any historic QA/QC.

About Patagonia Gold

Patagonia Gold Corp. is a South America focused, publicly traded mining company listed on the TSX Venture Exchange. The Company seeks to grow shareholder value through exploration and development of gold and silver projects in the Patagonia region of Argentina. The Company is primarily focused on the Calcatreu project in Rio Negro and the development of the Cap-Oeste underground project. Patagonia, indirectly through its subsidiaries or under option agreements, has mineral rights to over 430 properties in several provinces of Argentina and Chile and is one of the largest landholders in the province of Santa Cruz, Argentina.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements with respect to, among other things, plans related to additional drilling and the results of such drilling; the belief that the exploration results herein present viable exploration targets for the Company to evaluate with additional drilling; and the anticipated growth in shareholder value. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6a90560-5bca-45d6-8f51-ce54f43a1cc8

https://www.globenewswire.com/NewsRoom/AttachmentNg/a15f9d4d-9655-4f99-bfcf-5cf9c5ee8d3f

Christopher van Tienhoven, Chief Executive Officer Patagonia Gold Corp T: +54 11 5278 6950 E: cvantienhoven@patagoniagold.com