Aids Transparency in Technology Pricing as Solar Modules Become Increasingly Commoditized

SINGAPORE and NEW YORK and LONDON, July 17, 2024 /PRNewswire/ -- Platts, part of S&P Global Commodity Insights, the leading independent provider of information, data, analysis, benchmark prices and workflow solutions for the commodities, energy, battery metals and energy transition markets, has launched the world's first independent daily, spot market solar photovoltaic (PV) panel price assessments for US, Europe and Asia. In addition to six individual Platts Solar Module prices, Platts will also publish the Platts Global Solar Module Marker, which is a daily average of the six individual assessments, and which will provide a global perspective of solar panel prices.

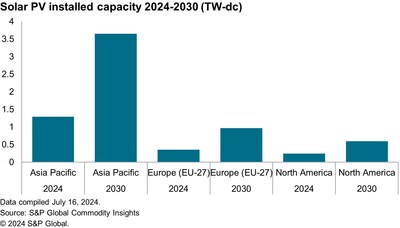

Edurne Zoco, Executive Director of Analysis, Clean Energy Technology, S&P Global Commodity Insights, said: "Solar PV will be the most installed energy source for the next decades, with S&P Global Commodity Insights forecasting more than 4 terawatts direct current (TWdc) of new installations before 2030, which equates to three times the total power generation capacity of the US today. Furthermore, solar will account for nearly 40% of new power generation capacity globally by 2050. Solar modules have become one of the most sought-after commodities in the increasingly competitive energy markets."

With the exponential growth in the manufacture, trade and installation of solar modules, industry and market interest in an independent, transparent source of physical market solar module pricing has expanded accordingly. After receiving feedback from the market, S&P Global Commodity Insights is now offering six new daily price assessment reflecting the value of bifacial solar modules procured for commercial and industrial (C&I) and utility scale renewable energy projects.

The new spot physical market price assessments of solar modules of differing megawattage (MW) and delivered duty paid (DDP) or free on board (FOB) include:

- Platts Solar Module FOB China 5-50 MW, reflecting 10-30 days forward free on board (FOB) Shanghai, China

- Platts Solar Module FOB China 50-100 MW, reflecting 10-30 days forward free on board (FOB) Shanghai, China

- Platts Solar Module DDPEurope 5-50 MW, reflecting 28-70 days forward delivery to Rotterdam, Europe

- Platts Solar Module DDPEurope 50-100 MW, reflecting 28-70 days forward delivery to Rotterdam, Europe

- Platts Solar Module DDP US 5-50 MW, reflecting 28-60 days forward for delivery to US East Coast

- Platts Solar Module DDP US 50-100 MW, reflecting 28-60 days forward for delivery to US East Coast

- Platts Global Solar Module Marker is a daily average of the six individual solar module panel assessments, which will provide a global perspective of solar panel prices

The Platts Solar Module price assessments reflect solar modules with 570 -720 watts (W) of output. Topcon specification and wafer sizes of 182-210 mm for volumes of 5 megawatt (MW) up to 50 MW, and 50 MW up to 100 MW. The value reflects solar modules, expressed as an outright price in US cents per watt.

Annalisa Jeffries, Global Head, Electricity Power Pricing, S&P Global Commodity Insights: "We take seriously our commitment to help the marketplace and industry find solutions to pricing challenges and we're pleased to heed the call and bring transparency to the solar module market, which is becoming more commoditized and is increasingly important to energy transition planning. We bring our 100-year-plus experience in price assessment methodology to a new use, in this electricity-producing technology, at a time when the marketplace is seeking a recognized benchmark provider."

The price assessments, announced by subscriber note, will follow the Platts Market-on-Close methodology based on the concept that price is a reflection of time. All market pricing indications, such as bids, offers and transactions, will be published in real-time throughout the full-day Platts price assessment process, which culminates in an end-of-day price assessment reflecting the value as determined by buyers and sellers in the open market at the 4:30 pmLondon market close. For more details visit this link.

Importation duties, oversupply, and supply chain costs have led to significant solar module pricing volatility, particularly since the start of 2023.

The new spot market Platts solar module panel DDP and FOB price assessments are available via S&P Global Commodity Insights products and services, including such as Platts Connect, Platts Market Center, and the Platts price database.

The new spot market Platts Solar Module prices augment S&P Global Commodity Insights' pre-existing Platts spot physical market electricity prices, which have been published for decades, as well as the more recent Platts Capture Prices – what the renewable energy generators receive for the electricity they produce across a daily period -- which were launched in 2018 in Europe and 2020 in the US.

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

Asia: Melissa Tan + 65-6597-6241, melissa.tan@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and work?ow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-worlds-first-independent-daily-solar-module-panel-price-assessments-for-asia-us-europe-and-a-global-marker-302199629.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-worlds-first-independent-daily-solar-module-panel-price-assessments-for-asia-us-europe-and-a-global-marker-302199629.html

SOURCE S&P Global Commodity Insights