(TheNewswire)

Vancouver, BC, September 19, 2024 – TheNewswire – Global Stocks News – Sponsored content disseminated on behalf of Eastside Distilling. On September 11, 2024, Eastside Distilling (Nasdaq: EAST) announced it has signed a merger agreement with Beeline Financial Holdings (BFH).

Beeline is a young technology & finance company that has quickly found traction in the competitive mortgage landscape operating an end-to-end, all-digital, AI-enhanced platform that targets millennials, Gen Z and gig workers.

Eastside Distilling produces award-winning craft spirits in Portland, Oregon and operates a digital can labeling business. On August 14, 2024 Eastside reported Q2 gross sales of $3.1 million and 6 million cans digitally printed.

The merger gives Eastside access to proprietary technology in human-level B2C AI tools, while Beeline gains an opportunity to create shareholder liquidity and grow asset value in a forecasted environment of lower mortgage rates.

“The Federal Reserve slashed interest rates by a half percentage point Wednesday and charted a course for two additional cuts this year followed by four more in 2025,” reported Yahoo Finance (YF) on September 18, 2024.

“The action marks the Fed’s first easing of monetary policy since 2020 and the termination of its most aggressive inflation-fighting campaign since the 1980s,” added YF.

The combined company will have the scale necessary to leverage the investment in a public company structure while providing growth capital to each business.

“The cost to generate a mortgage can be as high as $13,000 while taking 30 to 45 days to close and that’s not fair to the borrower,” stated Nick Liuzza Co-founder and CEO of Beeline.

“It Is often a deeply frustrating process for home buyers seeking a mortgage,” added Liuzza. “We have built a front-end platform with proprietary AI to decrease turn times and lower costs. We now want to focus our efforts on the back end of the process. Leveraging capital through the public markets will allow Beeline to continue to build stronger mortgage technology creating better outcomes for consumers.”

Click Image To View Full Size

In addition to the conventional, Federal Housing Administration (FHA) loans and Veteran Affairs (VA) loans offered by many lenders, Beeline also provides debt service coverage ratio (DSCR), bank statement, bridge and fix-n-flip loans that are popular with younger investors and self-employed borrowers.

Beeline’s mix of investment property vs single family home loans is about 300% higher than the national average.

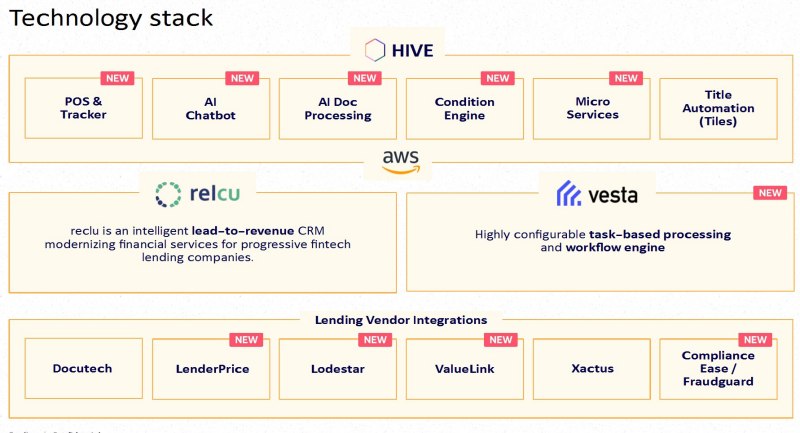

The custom machine learning models at Beeline allow its AI GPT-powered mortgage chatbot (named Bob) “to instantly respond to almost any Beeline-related question through a conversational interface — with Beeline's signature twist of irreverence and playfulness”.

"It's not difficult to write a prompt for a chatbot to ask a set of questions to complete a 1003,” states Jay Stockwell, a Beeline co-founder and founder of Magic Blocks, a new top of the funnel AI platform incubated at Beeline.

“Building a virtual AI department that navigates a gig worker’s financial context requires a more sophisticated ensemble approach.”

“Until now it hasn't been possible to automate without compromising the customer experience and painstakingly training up large teams on a company's products,” states Beeline, “LLMs (Large Language Models) can address this problem”.

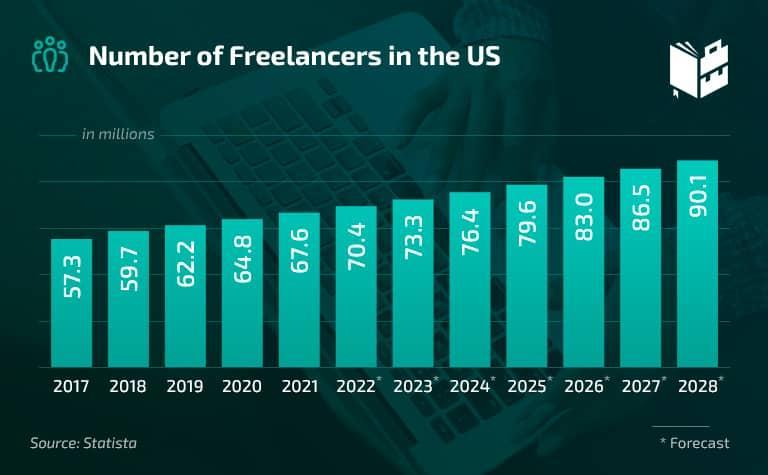

Without regular pay-stubs and long-term employment contracts, gig workers often find it difficult to qualify for a traditional mortgage.

The Bank of America (BOA) measures “gig-type income” through direct and debit card deposits. Freelancers are often paid in cash, by cheque or e-transfer. “Is the peak of the gig economy now behind us?” asks The Bank of America (BOA) in April 2023.

Current employment data suggests the answer to this question is “No”.

“The global Gig Economy is expected to reach USD 1,864.16 billion in 2031, exhibiting a CAGR of 16.18% during the forecast period,” reports Business Research Insights.

“Statistics show that 53% of Gen Z and 50% of Millennials are embracing the gig economy,” confirms Baseline Mag.

Source: https://whattobecome.com/blog/gig-economy-statistics

“A lot of gig workers have difficulty qualifying for traditional mortgages,” Liuzza told Guy Bennett, the CEO of Global Stocks News (GSN).

“These young entrepreneurs are judged on old models of assessing risk,” continued Liuzza. “There are a lot of bankable gig employees who are being shut out of home ownership.”

“Beeline offers a wider spectrum of products than most lenders allowing our borrowers a higher probability of success in landing a mortgage.”

Here’s Kalli - a freelance music therapist, teacher and singer describing how she completed a Beeline application online in a single evening - and was then offered a competitive mortgage rate, using a bank statement loan.

“My income can change a lot,” explained Kalli. “A lot can come in one month, and then nothing in the next month. I knew that I wanted a home and roots for my son while still being able to live my dream of being a music therapist.”

Kalli described applying for a mortgage through a traditional lender, being forced to submit “tedious documents” – and then being rejected.

“I found Beeline online,” Kalli recalls, “And I just went ahead. The process was easy. I was able to do it in one night. They acted quickly. And got me a lower rate. Based on bank statements more than tax returns.”

65% of Beeline’s applications come in after working hours or on the weekends. In the US, there are currently 73 million Millennials; the youngest being 27 years old. This group is expected to impact the real estate market like the Baby Boomers did in the 1980’s and 1990’s.

The 69 million Gen Zers already purchase properties faster, on a percentage basis, than Millennials did at the same stage.

Gig workers have been waiting for a lender to cater to their expectations of doing business online. It is a mobile workforce, conditioned to use mobile applications.

Click Image To View Full Size

"We're able to interact with thousands of customers simultaneously, 24/7 at an extremely low cost with human help never far away,” confirms Liuzza. “We are launching digital protocols into the production piece of our platform, which means Beeline will have a truly end-to-end digital mortgage platform.”

Beeline is targeting approximately 750 mortgages, 1500 title closings a month to hit the $100 million annual revenue run rate. Measured against a monthly industry of 666,667 mortgage closings, this represents a US market share of .001% for Beeline.

Both Eastside's Board and Beeline's Board of Directors have approved the merger, which is expected to close later in 2024.

Contact: Nick Luzza: nick@makeabeeline.com,

Disclaimer: Eastside paid GSN $1,500 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2024 TheNewswire - All rights reserved.