These last few weeks markets across the globe have been swaying up and down.

Looking at media headlines, are we about to see a full recovery of the global economy … or is more trouble ahead?

Data showed that consumer inflation unexpectedly accelerated in April, the first time in 10 months. Meanwhile, investors await and end to the debt-ceiling debate roiling Washington between President Joe Biden met with congressional leaders.

Given how interconnected the Canadian and American economies are, as the United States’ top trading partner under a bilateral relationship worth $3.2 billion of daily business, the potential ripple effects are immense.

The deal to raise the debt ceiling before June 1st is the earliest date the Treasury Department has said the U.S. could default on its debt obligations. Last week, Treasury Secretary Janet Yellen said that not signing a deal could spur an “economic catastrophe.”

What have some of the top talked about companies on the Bullboards accomplished in light of this news? Let’s find out.

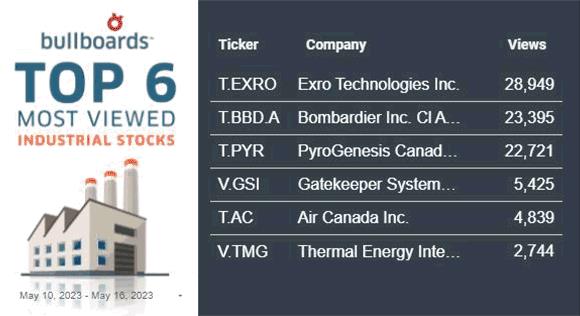

Thermal Energy International Inc. (TSXV:TMG), a provider of energy efficiency and emissions reduction solutions, will undertake a C$1.8 million GEM steam trap conversion order from a multinational consumer goods company.

The nine-month order covers a combination of partial and full-site GEM conversions for five sites across Europe, North America, and South America.

The client chose Thermal Energy’s GEM steam traps after evaluations for reliability, efficiency, productivity, and return on investment.

What the “Buzz”

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

“This customer is rolling out GEM steam traps to sites across three continents after conducting their own savings and ROI, which is a clear indication of how much our customers trust that ours are the most efficient and reliable steam traps on the market,” said William Crossland, Thermal Energy’s CEO.

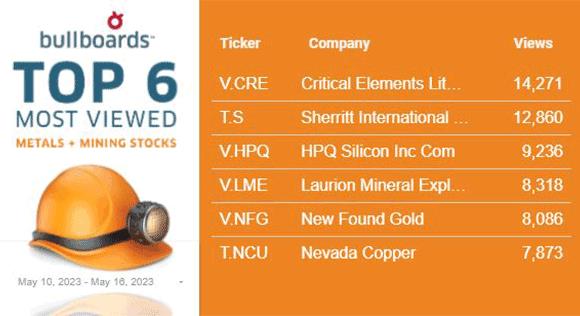

New Found Gold Corp. (TSXV:NFG) released the results from nine diamond drill holes that this week.

These holes were completed as part of a drill program designed to expand on known zones and test new target areas along the northern segment of the highly prospective Appleton Fault Zone (AFZ).

New Found’s district-scale Queensway Project comprises a 1,662km2 area, accessible via the Trans-Canada Highway, 15km west of Gander, Newfoundland and Labrador.

The company’s ongoing 500,000 metre drill program has led to the discovery of three new gold zones – “Monte Carlo”, “K2” and “Everest”, in turn, extending known mineralization along the AFZ to more than 4.1 km in strike length.

Keats West is a shallow zone of gold mineralization starting at surface, with all intercepts drilled to date occurring above 130 metre vertical depth. It is defined by continuous gold mineralization over an area spanning 305 metres long by 250 metres wide that averages 30 metres in thickness.

Photos of mineralization from NFGC-23-1171: Left: at 42.5 metres Right: at 43 metres. Source: New Found Gold Corp.

Photos of mineralization from NFGC-23-1171: Left: at 42.5 metres Right: at 43 metres. Source: New Found Gold Corp.

The company continues to unearth high-grade gold mineralization over considerable thicknesses as seen in NFGC-23-1171 grading 5.16 g/t Au over 28.65 metres and in NFGC-23-1189 grading 4.02 g/t Au over 14.65 metres. NFGC-23-1171 occurs 60m along strike of previously released interval of 10.1 g/t Au over 22.50 metres in NFGC-22-945 and NFGC-23-1189 occurs 25 metres along strike of previously released interval of 17.2 g/t Au over 22.90 metres and 12.0 g/t Au over 18.40 metres in NFGC-22-1040.

Additional intervals include 2.71 g/t Au over 10.15 metres and 1.71 g/t Au over 12.85 metres in NFGC-23-1158, 2.55 g/t Au over 17.05 metres in NFGC-23-1162, and 1.58 g/t Au over 13.10 metres in NFGC-23-1180 are characteristic of the broad domains of gold found at Keats West, with true widths of these intercepts estimated to be between 70 to 95 per cent.

The COVID-19 pandemic was a crisis that created opportunities for many new businesses, but now that the World Health Organization has declared the emergency is over, how many become redundant?

WELL Health Technologies Corp. (TSX:WELL) recently logged another record performance for total patient interactions.

The Vancouver-based digital health technology company reported 1.4 million in Q1-2023 reflecting a year-over-year increase of 27 per cent, primarily driven by organic growth.

WELL also saw a combined 975,500 patient visits in Canada and the United States for Q1 2023, a 25 per cent increase compared to Q1 2022.

WELL Health CEO and founder Hamed Shahbazi said Q1 was the 5th consecutive quarter of double-digit organic growth.

“We are now on a run-rate of 5.6 million synchronous and asynchronous patient interactions which reflects truly impressive scale and reach”.

Next week is a shorter trading week in Canada, yet the news and global market activity will continue. Any action or event can have a cascading effect on the rest of the markets, so it is important for investors to keep their eyes fixated on the trading pulse. The best way to stay up to date on the latest small cap movements is to keep checking the weekly Buzz on the Bullboards. For previous editions: click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.