The doldrums of summer hit North America's forest products industry with full force this week, writes Keta Kosman in Madison’s Lumber Reporter

https://madisonsreport.com.

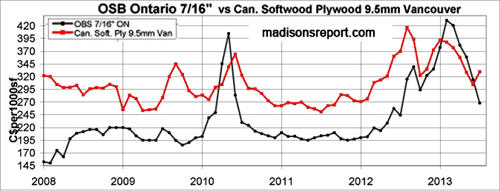

The usual seasonal slowdowns are in full effect, with the entire province of Quebec taking its annual construction and manufacturing holiday for the next two weeks. Even with that, sales of lumber and panel commodities were brisk enough to nudge prices further upward. In this third week of consistent prices increases, players are confident that the price bottom has been reached and surpassed.

The reluctance of May and June to purchase wood at volumes disappeared as sawmill order files grew even further out this week, into the middle of August on some items.

Benchmark WSPF KD 2x4 #2&Btr prices popped another $5, or 1.6 per cent, to US$325 mfbm on steady demand and limited inventories, while #3/Utilty grade jumped $20, or 8 per cent, to US$250 mfbm. Traders expressed glee at strong buying from the US and from several Asian countries this week.

So far this year, the benchmark dimension lumber price has fluctuated wildly; from a high of US$408 mfbm -- which was maintained from March 15 to April 19 -- to a low of US294 mfbm on June 28. Now that players can agree prices are firming, more regular ordering schedules will materialize.

Lumber producers in the west are concerned that rising temperatures and dry forests will soon bring the seasonal fire ban. This week that impediment was not yet in place, so operators focussed on harvesting as much timber as they could to fill sawmill yards for the next couple of month's foreseeable needs.

Major North American lumber producers announcing 2Q results so far were West Fraser, Canfor, and Weyerhaeuser.

West Fraser Timber Co. Ltd. (

TSX: T.WFT,

Stock Forum) reported earnings July 17 of $109 million, on sales of $900 million, in 2Q 2013, compared to earnings of $24 million, on sales of $774 million for the same period last year. Canfor Corp. (

TSX: T.CFP,

Stock Forum) Thursday reported net income of $110.3 million, on $843.2 million in sales, for 2Q 2013, compared to $2.6 million, on $685 in sales, for the 2Q last year. For its part, Weyerhaeuser Co. (

NYSE: WY,

Stock Forum) Friday reported net earnings of US$196 million, on sales of US$2.1 billion, for 2Q 2013, compared with earnings of US$$84 million, on net sales of US$1.8 billion, for 2Q 2012.

Given the improvement of dimension lumber, studs, and panel, prices during July, it is safe to assume that 3Q results will be equally glowing, if not better. The elusive bottom of solid wood commodity prices has been determined, bringing greater customer confidence in rebuilding much-depleted inventories.

Follow me on Twitter! https://twitter.com/KetaK

Keta Kosman

Publisher

Madison's Lumber Reporter

604 984-6838

www.madisonsreport.com