Plus: Uranium, Whiplash & Never-Look-Back

November 5, 2014

TCR family: By now we all have seen the vomiting camel -- right? Relating to gold charts.

Here is the link: what a hump.

Unless otherwise noted here, I continue to hold all metals equities that are in our TCR sphere. If I were to raise cash to sell anything at these Hades prices, the ones on the list are Bellhaven Copper & Gold (TSX: V.BHV, Stock Forum), African Gold Group (TSX: V.AGG, Stock Forum), one or two others so obscure, they probably never appeared here.

Whiplash: For our new thomcalandra.com TCR subscribers, this is the one mistake I refuse to suffer. It happens when you were on the mark, but so early on a theme, you finally (excuse me) spill out (vomit) the goods.

Gold and all metal equities are into their 43rd month of declines. My saving grace is: I do not use borrowed money, margin, to purchase investments. I own about 52 equities -- listed in the (Stockhouse.com) portfolio function and also referred to at our thomcalandra.com. The only thing rising today in my TCR world is Ivanhoe Mines (TSX: IVN, Stock Forum), after South Africa cleared the way for a platinum mine on the Platreef. IVN in Canada.

With inherited securities, make that 60 or 61 on the ownership count. About 48 of them are natural resources. Whiplash? Not here. Not now.

BioCryst Pharmaceuticals: Our influenza, leukemia, gout, angio-edema multi-drug developer will publish quarterly numbers Thursday morning. BCRX (NASDAQ: BCRX, Stock Forum) is probably the least 'promotional' experimental drug developer in North America. Little mention of its ebola and Marburg's anti-viral candidates, except to reference them as BCX4430, a broad spectrum antiviral for hemorrhagic fevers.

BioCryst will have its numbers out before the USA market opens. Then, an 8 a.m. investor conference call -- probably with slides. See the BioCryst web site on that. At the current $11, speculative investors -- and those looking for a drug developer that could become a multi-billion-dollar pharmaceuticals company -- will be purchasing the shares. I own 'em.

Sysorex Global: Same for our computer systems integrator. Numbers that we hope confirm rapid sales growth for SYRX (OTO: SYRX, Stock Forum) are out next week, on the Thursday. I see that Cleve Adams, CEO of Sysorex's AirPatrol Corporation, joined the advisory board of the National Initiative for Cybersecurity Education (NICE) Cybersecurity Map. Nice, as they say.

Cambodia Social Worker: Good perspective on a miner with a heart.

See Asia Miner article: https://angkorgold.ca/wp-content/uploads/2014/11/November_December-2014-Asia-Miner.pdf

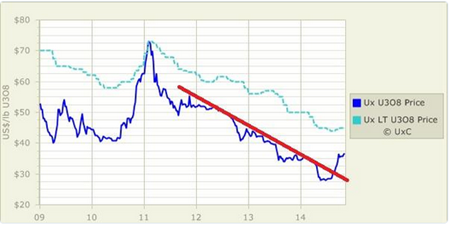

Uranium: John Gomez of our TCR family sends this 4-year uranium chart along. The price of U308 has been rising slowly since summer. The related equities are NOT following suit like a good bridge player. Still, the chart looks promising for those looking for uranium to shed its 4-year hump. We shall see. I own Azarga Uranium (TSX: AZZ, Stock Forum), recently renamed from Powertech and active in the western USA and in Asia.

More to come from The Calandra Report.

Note On Our Special Situations: I purchased BioCryst Pharma call options that expire in December. I purchased more Sysorex Global Holdings. I am holding my Sterling Biotech (GREY: SLTHY, Stock Forum). I seek to purchase more Natcore Technology (TSX: V.NXT, Stock Forum). Each of these will publish quarterly updates and other events, transactions, contracts or lab/clinical results in coming weeks.

THE CALANDRA REPORT: Subscribe

Now $129 yearly! My ass is on the line, too.

See: A thomcalandra.com home for our expanding TCR family.