In a recent Seeking Alpha article Beanie Baby and Other Bubbles (https://https://seekingalpha.com/article/3990709-beanie-baby-bubbles-fed-can) , we argued, based on several different metrics, that the stock market has lost touch with fundamental reality. Here, we provide more evidence that the equities casino is suffering mass psychosis; bad news is good news in this upside-down world.

GDP growth was forecasted to be 2.6% year-over-year in the second quarter, instead it came in at 1.2% and Q1 was revised down to 0.8%. That is a terrible economy in action, but of course the stock market made a new high.

Bad news is good news in the glass towers of Wall Street, since bad news will keep the FED from raising rates anytime soon and THAT is all that matters to the financial industry. Corporate earnings are down year-over-year for the last four quarters…but who cares?

Corporate (CAT) earnings are down year-over-year for the last four quarters…but who cares? Caterpillar reported a 16% year-over-year decline in second quarter sales and revenue along with a 22% decline in profit per share; CAT shares increased 5%.

Apple (AAPL) had a 14.5% year-over-year decline in revenue and a 23.2% year-over-year decline in earnings per share; AAPL shares increased 6.5%.

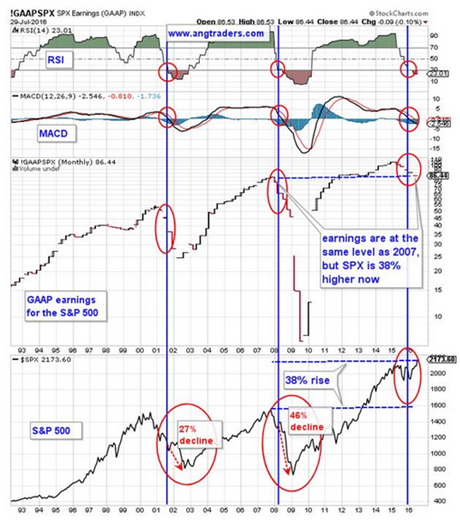

In 2007, just before the great-unwind, GAAP earnings for the S&P 500, where $84.92. Today, the earnings are $86.44 which is only 1.5% higher, while the S&P 500 is 38% higher (see chart below).

The stock market is completely disconnected from the real economy, but this has happened many times in the past, most recently 1997, and 2007, and the bubble took years to pop.

Pop it will, but the timing of the pop is impossible to pin-down. We are quite confident in the FED’s ability to provide the pin-prick that will cause a sudden and massive collapse of the bubble, but the odds of that happening before the election are not high; the CME FED Tool (https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html) gives only a 12% chance of a hike Nov. 2/16. Once disconnected from reality, the market can bubble for an indeterminate length of time.

We suggest that all positions, whether long or short, should be hedged; anything can happen inside a psychotic bubble.

ANG Traders

Join us at ww.angtraders.com and replicate our trades and profits.