Copters: The Most Important New Driver

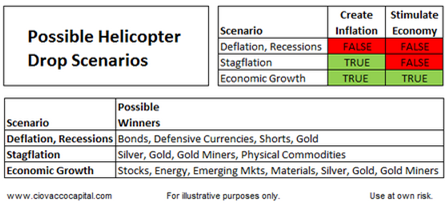

The why and how, with respect to helicopter money, are covered later in this post. If we skip ahead to the objectives of stimulating demand and creating positive inflation, we can think about the possible impact on a wide variety of asset classes.

What Are Helicopters Trying To Avoid?

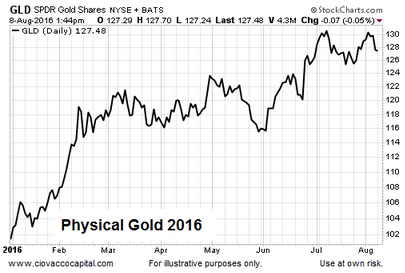

The poster child for what helicopters are trying to avoid is the period January 1, 2016 to February 11, 2016, which was marked by leadership from defensive/deflation-friendly assets, such as bonds (TLT), gold (GLD), and shorts (SH). Therefore, if helicopter drops are successful in flipping the inflation/deflation playing field, we would expect that leadership list to see some significant shifts.

If Helicopters Create Positive Inflation

Fear of currency debasement tends to create demand for alternative stores of value. During periods of rising prices, bonds tend to underperform more inflation-friendly assets, such as silver (SLV) and oil (USO). In 2016, the fear of future inflation has helped push precious metals and gold-mining stocks (GDX) into the ETF winners list. The movement in precious metals is related to increased chatter of impending helicopter drops from central banks.

If Helicopters Can Also Stimulate The Economy

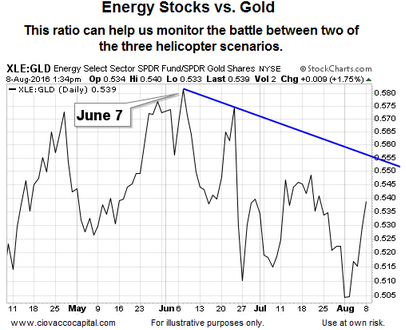

In recent months, the “fear of currency debasement” theme has been stronger than the “central banks will be successful in creating economic growth” theme, as shown via the energy vs. gold ratio below. The last time the ratio made a new high in favor of economically sensitive energy stocks was in early June.

Do The Charts Confirm Or Question The Move In Stocks?

This week’s video examines five key charts related to the sustainability of the S&P 500’s breakout from a multiple-year consolidation box.

After you click play, use the button in the lower-right corner of the video player to view in

full-screen mode. Hit Esc to exit full-screen mode.

Why Helicopters And Why Now?

Given (a) global economic growth remains concerning and stuck in a low range, and (b) debt levels remain in a very concerning and in an elevated range, central banks are not likely to remain idle. As outlined in detail on July 16, policymakers have shot most of their traditional bullets. From The Financial Times:

The standard expansionist tools to cope with a likely recession are blunt or unusable.

Helicopters Represent A Big Shift For Markets

The Financial Times outlined two of the most commonly cited schools of thought on getting helicopter money into the real economy:

Contemporary advocates of helicopter money like Willem Buiter and Adair Turner see it mainly in terms of monetary financing of additional government spending. The government should pay for, say, an investment program not by issuing debt to the public but by borrowing from the central bank. This will increase the government’s deficit, but not the national debt, since a loan by the central bank to the government is not intended to be repaid. Thus the government acquires an asset but no corresponding liability.

However, this is only one possible form of helicopter money. Another way of achieving the desired increase in spending was suggested by the Swiss businessman, Silvio Gesell, in 1906. His idea was to give cash directly to households. But to give people an incentive to spend the money and not hoard it, there had to be a cost to holding on to it. In his scheme, unspent currency notes would have to be stamped each month by the post office, with a charge to the holder for stamping them.

How can this be done today? You could create smart cards with £1,000 for each person on the electoral register. The cards could be programmed to reduce the value of the balance automatically each week.

Helicopters Will Attempt To Avoid Deflationary Spiral

If economic growth remains stagnant globally, stock and real estate prices could begin to fall. Central bankers toss and turn at night worrying about the possibility of elevated asset prices slipping into a hard to stop deflationary spiral, which may bring helicopters into the picture in the coming months. From a BloombergView piece written by Gary Shilling:

“Given the mad as hell attitude of many voters in Europe and the U.S., on the left and the right, don’t be surprised to see a new round of fiscal stimulus financed by helicopter money, whether Donald Trump or Hillary Clinton is the next president. Major central bank helicopter money is a fact of life in war time — and that includes the current global war on slower growth. Conventional monetary policy is impotent and voters in Europe and North America are screaming for government stimulus.”

The Market Will Determine Winners

Our objective here is not to pick future winners and losers, but rather to better understand the message being sent by asset class performance. The current message is somewhat mixed. The deflation/recession scenario has been losing some relative traction in recent weeks, aligning with last Friday’s better than expected employment report.

There is an ongoing and yet to be determined battle between the stagflation scenario and economic growth scenario. It is also noteworthy that longer-term concerns about the deflation/recession scenario are still in the picture, which can be seen in the ratio of bonds to energy stocks below.

If you are questioning the whole radical concept of helicopter money, keep in mind global central banks are already implementing numerous “are they really doing that” policies.

This entry was posted on Monday, August 8th, 2016 at 1:47 pm and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)