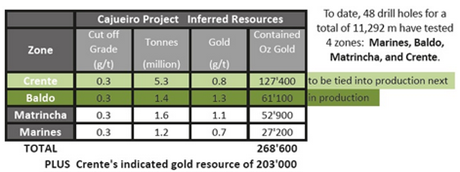

Today, Equitas Resources Corp. delivered the second set of assays from drilling its 100% owned Cajueiro Gold Project in the Brazilian states of Para and Mato Grosso. The encountered gold mineralization is significant when considering that most gold open-pits worldwide currently operate with average grades between 0.7 and 2 g/t.

Of the 37 holes, 33 intercepts with a gold mineralization ranging between 0.95 and 4.07 g/t were identified. This is a remarkable achievement considering that the drilling program was completed in an area of the Baldo Zone which gave Rockstone the impression of not being as prospective as other parts. Equitas conducted the exploration program there in order to be granted a full mining licence for Baldo.

Therefore, today’s results are valued as a pleasant surprise and are an indication that the best is still to come because the upcoming exploration program (such as drilling and trenching) in other parts of Baldo – and especially in the nearby Crente Zone – may deliver even better results.

The Baldo Zone is already in moderate sluice-box production, set to expand significantly with plans for a new CIL processing plant to be installed shortly. In comparision with other gold projects in South America, Equitas provides great chances for substantial appreciation going forward. Assays are pending from 2 more highly interesting holes drilled at Crente and should be released within the next 2 weeks.

Recently, Equitas reported results from metallurgical testings from Baldo. It was found that recovery rates with a gravity plant are quite bad (maximum of 22%), however at the same time it was found that recoveries from CIL are better than expected (96%).

Originally, Equitas planned to first install a gravity plant (costs: ~$300,000 USD; capacity: ~3,000 ounces of gold per year) and thereafter a CIL plant (costs: ~2 million USD; capacity: ~10,000 ounces of gold per year). Based on the latest metallurgical tests, Equitas decided to not install a gravity plant and to move straight to phase 2, setting up a CIL plant immediately. Rockstone is glad that Equitas made this decision, not only because a larger production capacity can be achieved much faster but obviously it’s the gravity plant which could bring about bad surprises once production starts.

Recently, Goldsource Mines Inc. enjoyed a market capitalization of $70 million CAD and commissioned a gravity plant at its Guyana gold project. A few days ago, very disappointing recovery rates, and hence production rates, were disclosed. Since then, its share price is free falling as shareholders’ disappointment is accordingly big. Interestingly, Equitas owns a similar gold project as Goldsource, however Equitas’ resource grades are significantly higher than Goldsource’s previously estimated production grades (0.76 g/t).

Hence, Equitas’ decision to not install a gravity plant (but to start directly with a highly efficient CIL plant) can be valued positively. Although the CIL plant is more expensive and requires more time to commission than a gravity plant, it appears to be a long-sighted and wise decision.

Until the CIL plant is operational in about 6 months, Equitas plans an aggressive and extensive exploration program to expand the current NI43-101-compliant resource estimate. A highly increased newsflow is likely.

As the above map shows, the recently completed exploration program focussed on a part of the Baldo Zone (highlighted in white), where no high-grade surface samples have been found.

However in other parts of Baldo, extremely high-grade surface samples were grabbed (see red dots with >25 g/t), up to 118 g/t gold. An upcoming exploration program in these nearby parts of Baldo may deliver even better results than today. To date, only 1 hole was drilled in those other, highly prospective parts of Baldo.

The completed exploration program was performed in this part of Baldo in order to be granted a full mining licence. Equitas could have made the decision to first explore the more prospective parts, thereafter moving to less prospective areas, which, however, would have brought the risk that initially very good results were delivered to potentially deteriorate thereafter.

Surprisingly, Equitas was able to deliver very good results in this, originally thought less prospective part of Baldo, and now has discovered and started to delineate an entirely new zone, by the name of Zona Dois (highlighted in dark red) with a remarkable strike length of 300 m.

Today’s drill assays, combined with trenching assays on July 6, are a pleasant surprise as being higher than 0.95 g/t gold. Goldsource is in production with even lower grades (~0.76 g/t, or even less) from a similar resource size, and currently has a market value of $50 million CAD.

More drilling and trenching is expected to start at Zona Dois soon, as well as at adjacent parts of Baldo.

The best at the end (of this report): After drilling was completed at Baldo, Equitas decided to drill 2 more holes, however this time in the nearby Crente Zone (~2 km south from Baldo). Both assays are pending and expected in about 2 weeks (mid-September). As below map shows, historic drilling beneath (and near) the historic Crente Pit delivered similar grades than Baldo. However the mineralized drill intercepts are much longer than at Baldo and partly reach more than 30 m. The CIL plants is planned to be installed between Baldo and Crente in order to process material from both zones. More drilling at Crente may bring more positive results and expand the global resource significantly.

The many drilling and trenching activities performed over the last months, and as well over the next months, have great potential to significantly increase the NI43-101-compliant resource size. The next 6 months, until production starts, is expected to deliver a large number of new assays. Most importantly, Equitas has a strong financial partner on its side (Cartesian Capital Group, an investment fund with >$2.5 billion under management), which has offered Equitas up to $5 million USD in a revolving gold prepayment loan to enable Equitas to construct production facilities and aggressively explore their Brazilian assets.

Core from latest drilling:

Company Details

Equitas Resources Corp.

1450 - 789 W Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 681 1568

Email: skingsley@equitasresources.com

www.equitasresources.com

Shares Issued & Outstanding: 222,247,424

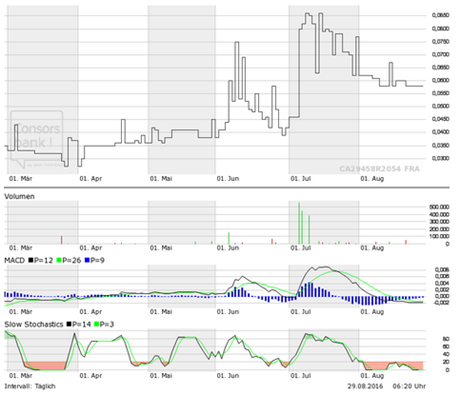

Canadian Symbol (TSX.V): EQT

Current Price: $0.08 CAD (August 26, 2016)

Market Capitalization: $18 million CAD

German Symbol / WKN (Frankfurt): T6UN / A12CWK

Current Price: €0.05 EUR (August 26, 2016)

Market Capitalization: €13million EUR

Coverage

Research #13 “Trenching Discovers High-Grade Gold at Surface“ ( Jul 6, 2016)

Research #12 “Equitas secures innovative funding for an unique opportunity“ (June 7, 2016)

Research #11 “Equitas starts drilling to prove up more gold for production“ (May 26, 2016)

Research #10 “Ready to make money as an incrementally growing gold miner“ (April 27, 2016)

Research #9 “Equitas Acquires Turnkey Gold Mine For Near-Term Cash Flow Growth While Getting Ready For Garland Nickel Exploration“ (January 15, 2016)

Research #8 “The Pathway To Discovery“ (December 16, 2015)

Research #7 “Voisey‘s Bay 2.0“ (October 21, 2015)

Research #6 “Equitas Starts Drilling and Triggers Buying Rush“ (September 24, 2015)

Research #5 “Kingsley Arrives at Equitas‘ Garland Base Camp“ (September 10, 2015)

Research #4 “Early Warning Report on Equitas Resources“ (September 2, 2015)

Research #3 “Beyond Our Wildest Dreams (Revisited)“ (June 26, 2015)

Research #2 “King & Makela Identify 9 Knock-Your-Socks-Off-Targets near Voisey`s Bay Nickel Mine“ (May 13, 2015)

Research #1 “Vale Vale! Ex-Vale‘s Principal Geologist and Chief Geophysicist on the Case to Answer the Multi-Billion-Dollar-Question“ (April 20, 2015)

Disclaimer: Please read the full disclaimer within the full research report (here) as fundamental risks and conflicts of interest exist.