Smoking hot piece of zinc

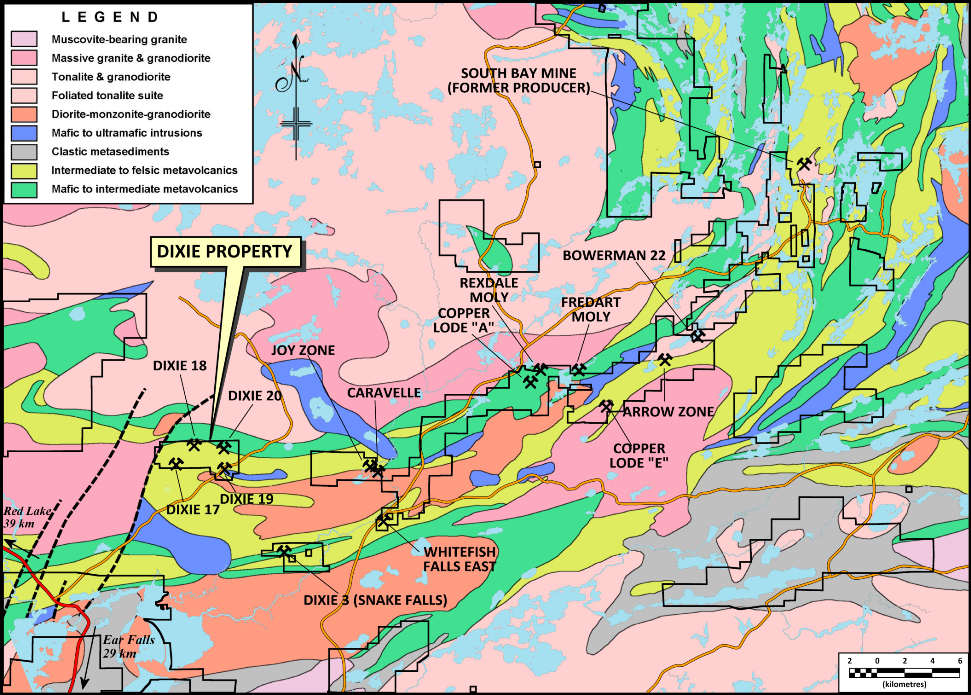

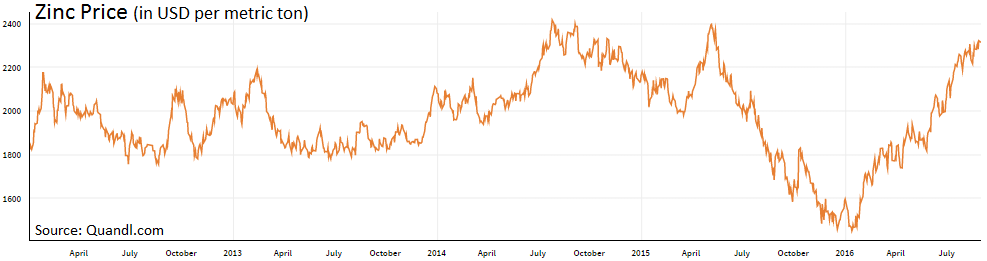

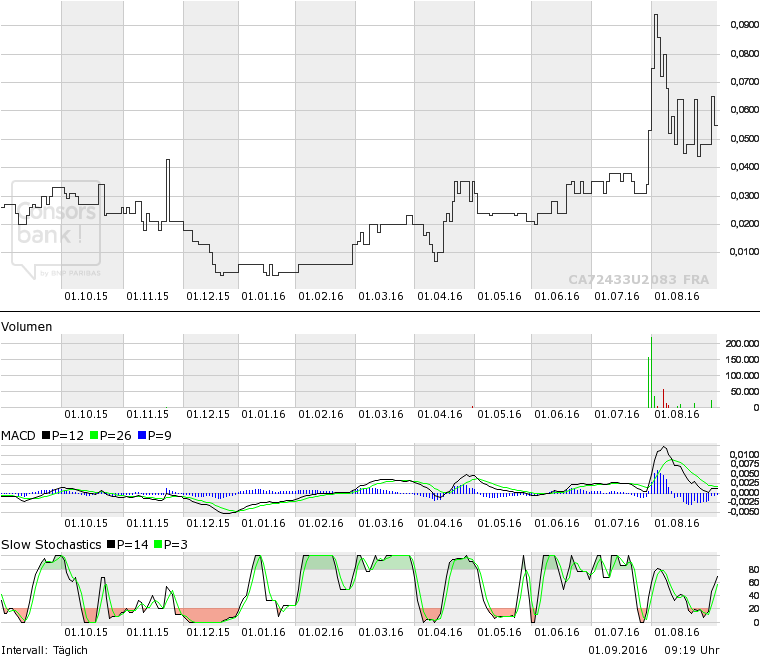

Today, Pistol Bay Mining Inc. announced an option agreement to acquire 100% of additional zinc-copper claims, the Dixie 3 Property in the prolific Red Lake Mining District of Ontario. This marks a perfect fit for the company’s existing Dixie 17, 18 and 19 Properties located 8 km away. As Pistol Bay has recently closed a financing, the start of an exploration program is expected shortly, which comes at a perfect time as the zinc price is poised to continue its exceptional surge that started in January 2016 (+62% YTD).

Although 2016 is the fifth consecutive year of the zinc market being a deficit, the price has started to react this year due to sharply dwindling inventories, a shortage of zinc concentrate following closures of depleted mines and cutbacks from Glencore. In last years, 6 major mines reduced its zinc output by 1 million tons (7% of global supply) while demand from China rose by 5%. Accordingly, investment funds have jumped on the bandwagon. Goldman Sachs recently noted that zinc has “by far the most bullish supply-side dynamic of all base metals”, raising its forecasts for the next year on tightening supply and robust demand in China. Zinc is the most exposed base metal to China infrastructure. China’s infrastructure spending rose 19% in the first 4 months of 2016, the biggest amount since its response to the global financial crisis. Now China, the world’s top consumer and producer of zinc, added fuel to the fire by shutting down the power of 26 zinc and lead mines in the Hunan Province due to safety and environmental concerns.

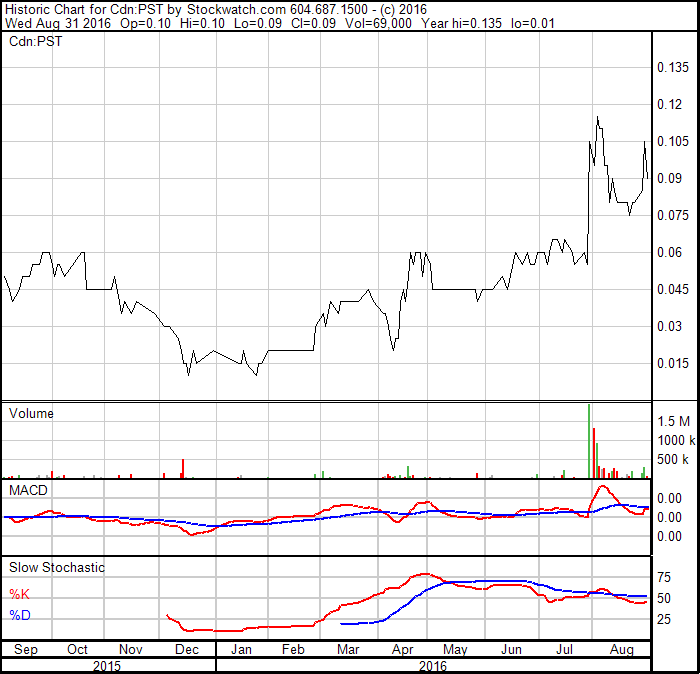

Considering that Pistol Bay currently has a market capitalization of $2 million CAD, the upcoming exploration program offers great potential for significant upside, especially if geophysics and drilling can confirm historic grades and discover new zinc-rich zones.

Smoking hot piece of zinc

Today, Pistol Bay Mining Inc. announced an option agreement to acquire 100% of additional zinc-copper claims, the Dixie 3 Property in the prolific Red Lake Mining District of Ontario. This marks a perfect fit for the company’s existing Dixie 17, 18 and 19 Properties located 8 km away. As Pistol Bay has recently closed a financing, the start of an exploration program is expected shortly, which comes at a perfect time as the zinc price is poised to continue its exceptional surge that started in January 2016 (+62% YTD).

Although 2016 is the fifth consecutive year of the zinc market being a deficit, the price has started to react this year due to sharply dwindling inventories, a shortage of zinc concentrate following closures of depleted mines and cutbacks from Glencore. In last years, 6 major mines reduced its zinc output by 1 million tons (7% of global supply) while demand from China rose by 5%. Accordingly, investment funds have jumped on the bandwagon. Goldman Sachs recently noted that zinc has “by far the most bullish supply-side dynamic of all base metals”, raising its forecasts for the next year on tightening supply and robust demand in China. Zinc is the most exposed base metal to China infrastructure. China’s infrastructure spending rose 19% in the first 4 months of 2016, the biggest amount since its response to the global financial crisis. Now China, the world’s top consumer and producer of zinc, added fuel to the fire by shutting down the power of 26 zinc and lead mines in the Hunan Province due to safety and environmental concerns.

Considering that Pistol Bay currently has a market capitalization of $2 million CAD, the upcoming exploration program offers great potential for significant upside, especially if geophysics and drilling can confirm historic grades and discover new zinc-rich zones.

A total of 80 core holes have been drilled at Dixie 3 (formerly known as Snake Falls), at last by Tribute Minerals (now Aurcrest Resources) between 2002-2012.

Historic exploration estimated 91,000 short tons grading 10% zinc and 1% copper at the

Dixie 3 VMS Zone. In 1992, Noranda drilled a single hole at the near-by

Breccia Zone returning 3.63% zinc over 2 m (but apparently never drilled again). On top of that, the property includes a number of mineralized zones or targets with single drill intercepts never followed up:

•

South Zone: 1.96% zinc over 6.5 m (38 m of anomalous zinc)

•

Ten Mile Zone: 1.25% zinc over 4 m

•

Vent Zone: 1.1% zinc over 31 m

•

Dixie South-East Zone: 0.5% zinc over 28 m, including 1.9% zinc over 5 m

•

Dixie South-Central Zone: 0.95% zinc over 18 m

•

Dixie South-West Zone: 0.57% zinc over 24 m

In 2008, Tribute Minerals carried out modern geophysics (Titan-24 DCIP & MT) covering about 17% of the Dixie 3 Property, demonstrating 2 target areas at depths between 300-600 m, whereafter 6 core holes were recommended (but apparently never drilled).

Pistol Bay plans to compile the historical diamond drilling and geophysical survey data for the Dixie 3 Property and, if possible, to reacquire and re-evaluate the results of the 2008 Titan-24 survey. Possible further work includes additional deep-penetration surveys over the rest of the property and drill testing of new target areas, as well as lateral and depth extensions of known mineralized zones.

Thanks to the recently closed financing, Pistol Bay may also start exploration at its

Dixie 17, 18, 19 Properties, which are located within 8 km from today’s acquired Dixie 3 and perfectly fit in the company’s exploration model of zinc-copper-rich VMS deposits within the prolific Confederation Lake Greenstone Belt, which is known to host numerous VMS occurrences and deposits. The largest VMS deposit to date, the

South Bay Mine, produced in 1971-1981 approximately 354 million pounds of zinc, 58 million pounds of copper and 3.7 million ounces of silver from 1.6 million short tons (grades of 11% zinc, 1.8% copper and 73 g/t silver).

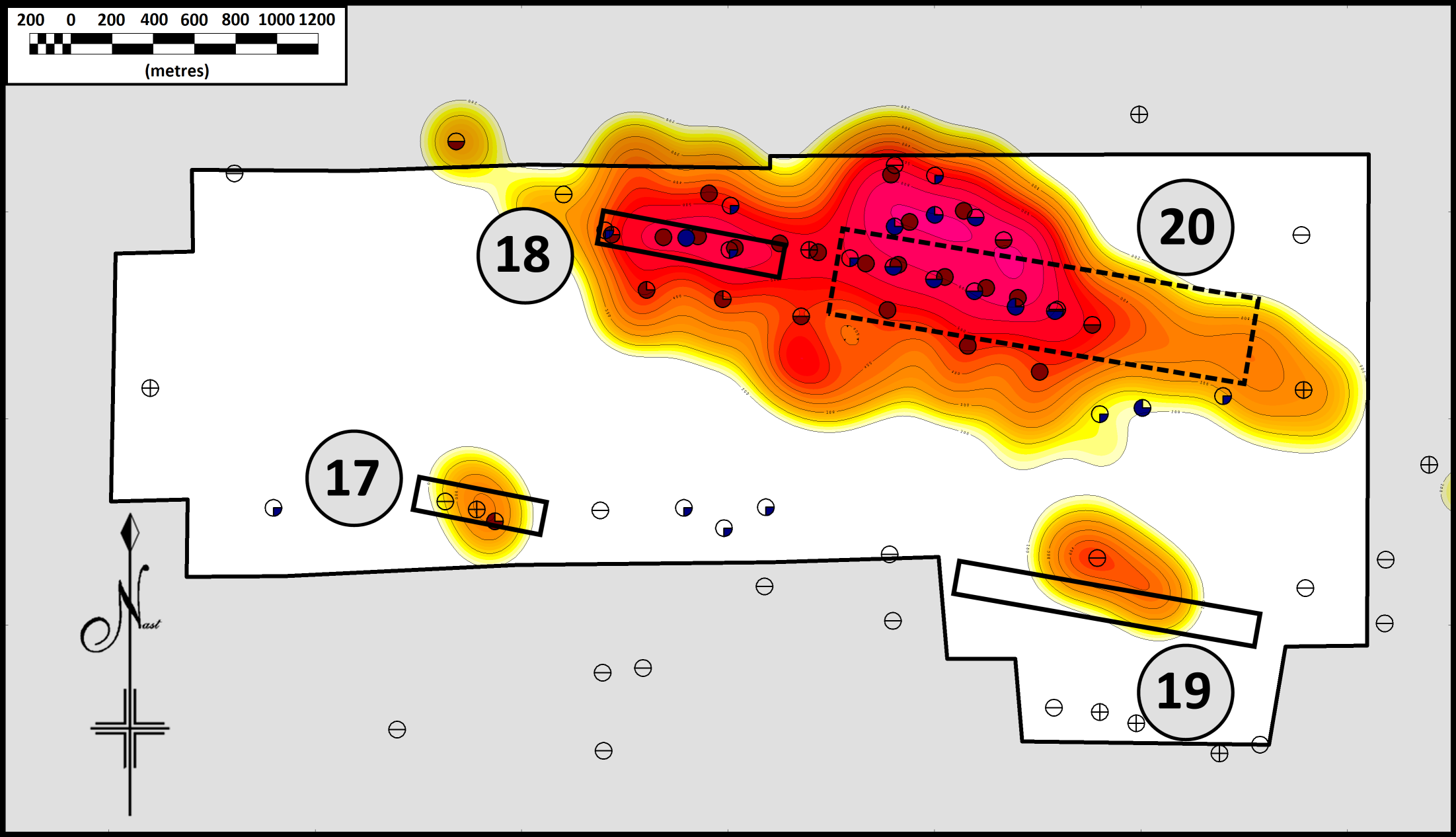

The geophysical anomalies identified on the Dixie properties should be followed up with a new drilling campaign:

The geophysical anomalies identified on the Dixie properties should be followed up with a new drilling campaign:

Previous operators demonstrated significant zinc-copper mineralization with drilling on some of the claims (caution: historic results which need to get confirmed with new drilling):

Previous operators demonstrated significant zinc-copper mineralization with drilling on some of the claims (caution: historic results which need to get confirmed with new drilling):

•

Dixie 17: 7.34% zinc and 1.4% copper over 9.5 m.

•

Dixie 19: 6.33% zinc and 1.5% copper over 3.55 m, as well as 9.71% zinc over 1.25 m. These intersections were

at vertical depths of 262 and 350 m respectively. No deeper drilling was done on this target, despite the interpretation that the top of the conductor was

at 375 m below surface. Hence the potential exists for the discovery of a high-grade zone with the upcoming drill program.

•

Dixie 20: A bit north of Dixie a

second, much larger, and much deeper conductive body was identified. The conductive body, a resistivity low interpreted from inversion modelling of magneto-telluric data, has an irregular shape, but extends over a length of 1,800 m.

Noranda drilled 7 holes on the property and calculated a (historic) resource estimate of approximately

135,000 t at an average grade of 14% zinc. A historic hole (

0.98% zinc and 1.13% copper) may have only scratched the upper part of this zone. Down-hole electromagnetic surveying indicates that this hole had penetrated a large (up to 800 × 800 m) conductive body close to its edge. Follow-up drilling may discover a significant new zone.

The western two-thirds of the property, including the Dixie 17 and 18 zones, has not been covered by deep-penetrating geophysical surveys. The principal zinc mineral, sphalerite, is not electrically conductive, and the absence of strong electromagnetic conductors should not be taken to mean that zinc is absent. The 3 known VMS zones (Dixie 17-19) have not been fully closed off by drilling and are partly open at depth, especially the Dixie 19 zone with the geophysically interpreted deep zone below the historical drill holes.

Rockstone is looking forward to the upcoming exploration programs as the potential for new discoveries appears high besides looking into highly interesting targets never followed up.

“We’re zinc bulls,” Morgan Stanley said. “But its 2016 price performance has surprised even us. Any upside from here depends on China’s steel production rate and Glencore’s willingness to re-fire some of its mine supply.” Zinc has led gains in metals this year after the shutdown of depleted mines coupled with Glencore’s cutbacks. Chief Executive Officer Ivan Glasenberg has repeatedly argued the case for miners not producing materials into oversupplied markets, saying in May that volume growth can’t be an end in itself. Morgan Stanley said zinc is its top commodity pick, while Goldman Sachs Group has dubbed it the “bullish exception” among metals. (Source: Bloomberg)

Speculation has now turned to whether producers would bring mines back into production. In the half year report Glencore kept full year guidance on zinc production steady at lower levels. A table tucked away in the report gave an indication why. Despite zinc’s huge run-up this year the average price in the first half is still 16% below the same period last year. Glencore may be looking for further evidence zinc has entered a new boom phase before switching on its considerable capacity. (Source)

“We’re zinc bulls,” Morgan Stanley said. “But its 2016 price performance has surprised even us. Any upside from here depends on China’s steel production rate and Glencore’s willingness to re-fire some of its mine supply.” Zinc has led gains in metals this year after the shutdown of depleted mines coupled with Glencore’s cutbacks. Chief Executive Officer Ivan Glasenberg has repeatedly argued the case for miners not producing materials into oversupplied markets, saying in May that volume growth can’t be an end in itself. Morgan Stanley said zinc is its top commodity pick, while Goldman Sachs Group has dubbed it the “bullish exception” among metals. (Source: Bloomberg)

Speculation has now turned to whether producers would bring mines back into production. In the half year report Glencore kept full year guidance on zinc production steady at lower levels. A table tucked away in the report gave an indication why. Despite zinc’s huge run-up this year the average price in the first half is still 16% below the same period last year. Glencore may be looking for further evidence zinc has entered a new boom phase before switching on its considerable capacity. (Source)

Source

Source

Source

Source

Company Details

Pistol Bay Mining Inc.

Suite 205 - 1717 Haro Street

Vancouver, B.C. V6E 4T1 Canada

Phone: +1 604 369 8973

Email: info@pistolbaymininginc.com

www.pistolbaymininginc.com

Shares Issued & Outstanding: ~23,500,000

Canadian Symbol (

TSX.V): PST

Current Price: $0.09 CAD (August 31, 2016)

Market Capitalization: $2 million CAD

German Symbol / WKN(

Frankfurt): 0QS2 / A12DZH

Current Price: €0.055 EUR (August 31, 2016)

Market Capitalization: €1 million EUR

Previous Coverage

Research #1 "Early Bird Special Report: Pistol Bay with Zinc like a Phoenix from the Ashes?"(29 Jul 2016)

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.

FULL DISCLOSURE: Rockstone Research is a Stockhouse Publishing client.