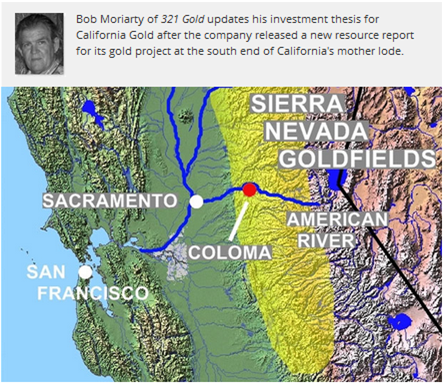

I've been writing about California Gold Mining Inc. (CGM:TSX.V) for a couple of years now, here and here. You should read the pieces as I did a good job discussing the history of the project and gold mining in California. The company has a major gold project just at the south end of the mother lode in California. On the 1st of November the company released their initial 43-101 resource on the project. It was a barnburner and the market didn't get it.

As I have discussed in prior pieces, the Fremont Project had a historic resource of just over two million ounces yet the company had a market cap of about $13 million at the time. After spending millions of dollars and coming out with a 43-101 resource, the company is still only selling for just over $15 million. That's about $7.50 an ounce for high-grade gold in the ground. That's absurd.

In the historic resource there were three resource figures given. The Pine Tree-Josephine open pit resource was estimated at 826,965 ounces. The Queen Speciment-Succedo open pit resource was estimated at 126,080 for a total of 952,973 ounces in an open pit. In addition, the underground portion at Pine Tree-Josephine was estimated at 1,107,000 ounces.

In the resource just published, the Pine Tree-Josephine open pit total resource was 879,000 gold ounces of which 515,000 ounces was in a high-quality indicated resource with 364,000 ounces in the inferred category. The most important issue with the 43-101 resource is that it not only validated the historic resource of 826,965 ounces, it actually increased it by almost 10%.

I'm not a big fan of 43-101. There have been a few examples in the past fifteen years where charlatans in Canada have gotten away with murder coming up with BS numbers in 43-101. The most outrageous example I can think of was when Frank Callaghan was fined the incredible sum of $30,000 for costing his shareholders over a hundred million dollars. Thirty-thousand dollars wasn't even chump change, it was far too small to be chump change. That's like taking a left hook from a newborn. Frank didn't even feel it.

But the TSX has put the fear of God into all the actually honest companies out there regarding 43-101. When California Gold went to the company doing the 43-101, they presented all the historic data and their current drill data and were hoping for a similar validation of the 1.1 million ounces of gold in the underground segment. The company doing the resource estimate came back saying they need even more data even though the numbers for Pine Tree-Josephine came in higher than the historic report.

So I'll climb out on a limb. California Gold has a 43-101 and historic resource in excess of two million ounces of gold in a gold district with hundreds of known veins. Any major or mid-tier not looking at them is going to miss the boat. They will get taken out and it will be for a lot more that $7.50 an ounce of gold. Their land position at Fremont is worth more than the entire market cap of the company. There is as little risk to buying CGM at these prices of any gold company I know.

I liked the story enough to go out in the open market and buy a lot more shares and I participated in their latest PP at a price higher than the current market price. Investors may not get it but I do.

California Gold is an advertiser and I am biased. Their website is informative and gives a lot of valuable information but as always, you are responsible for your own due diligence.

California Gold Mining

CGM-V $.48 (Nov 07, 2016)

CFGMF-OTCBB 32 million shares

California Gold Mining website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: California Gold Mining. The following companies are advertisers on 321 Gold: California Gold Mining. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.