Report #1

Drill core from the gold-rich Talbot Copper-Zinc Deposit, where the ongoing phase-2 drill program has recently been increased due to results exceeding expectations.

Drill core from the gold-rich Talbot Copper-Zinc Deposit, where the ongoing phase-2 drill program has recently been increased due to results exceeding expectations.

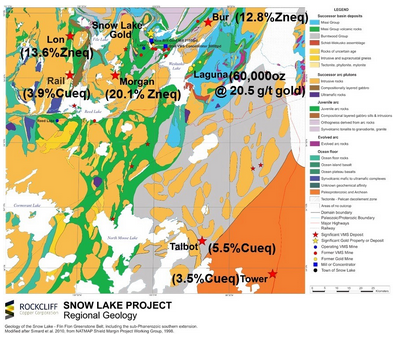

With a current market capitalization of $14 million CAD, a well-funded treasury of $3 million CAD and no debt, Rockstone initiates coverage of Rockcliff Copper Corporation. The Toronto-based company is focused on the discovery, advancement and consolidation of the highest grade unmined deposits within the prolific Flin Flon-Snow Lake Greenstone Belt in mining-friendly Manitoba. This is Canada’s most productive greenstone belt, hosting over 30 mines and 90 deposits over the last century.

Today, Rockcliff announced the acquisition of the near surface, unmined MacBride Deposit with historic high zinc grades (8.8%).

Last week, Rockcliff acquired the Morgan Property with historic high zinc (15%) and gold (3.42 g/t) grades. Last Tuesday, Rockcliff reported impressive assay results from its phase-2 drill program (6,000 m) at the gold-rich Talbot Copper Deposit. All 3 holes disclosed to date intersected high-grade copper mineralization including significant zinc, gold and silver credits.

As the Financial Times reported a few days ago, the mood begins to turn on copper as long and widely held assumptions about the underlying market dynamics are questioned and picked apart by investors. Even Goldman Sachs (the most consistently negative voice on copper over the past couple of years) has turned more positive: “The pick-up in Chinese demand has left the market tighter than we previously expected.” Last month, the copper price started a major comeback, appreciating by a whopping 25%. If indeed copper’s time has come, it’s about time to look at prospective copper juniors.

The global trend of rapidly declining copper inventory and mining grades has resulted in a looming copper shortage starting in 2018.

A staggering 51% of current copper producers are not profitable at $2/lb. Although prices surged from $2.10 to $2.60/lb last month, most copper miners are still suffering. On the other hand: No matter how market prices are trending, the best is to simply have high grades (“grade is king”).

However, there are only very few juniors active in the high-grade copper space. Rockcliff is one of these rare exceptions, with world-class grades exceeding 5% copper equivalents (“Cueq”; including a lot of zinc, gold and silver) in several deposits in mining-friendly Manitoba.

Rockcliff’s combined “all-in” project resources (historic plus NI43-101-compliant; excluding today’s acquired MacBride Deposit):*

>9 million t averaging 4.8% Cueq, or

>9 million t averaging 12.5% Zneq, or:

415,929,857 lbs of copper

910,140,483 lbs of zinc

248,662 oz of gold and

5,425,516 oz of silver

Rockcliff has been consolidating properties in the actively producing Flin Flon-Snow Lake Mining District and now owns or is earning an interest in the highest grade unmined copper, zinc and gold deposits/former mines in the entire camp. And Rockcliff is currently exploring and advancing several of these typically low-CAPEX and high-margin/ low-cost projects towards production.

A steady newsflow of new drill and exploration results from multiple projects can be expected in a regular fashion, and as such Rockstone will be covering the respective progress in due course. This initial report briefly presents the most promising projects, which are expected to be actively advanced in 2017 by Rockcliff and which have already seen >$20 million in past exploration expenditures with >50,000 m drilled in >160 holes. Interestingly, the potential for new discoveries still is exceptionally high. On top of all that, Rockcliff expects an estimated $1 million annual free cash flow (risk-free royalty stream) starting in 2018/2019 from the Tower Cu-Zn-Au-Ag Project (sold to Akuna Minerals in 2015).

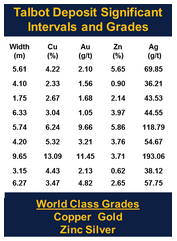

Talbot (Cu, Zn, Au, Ag)

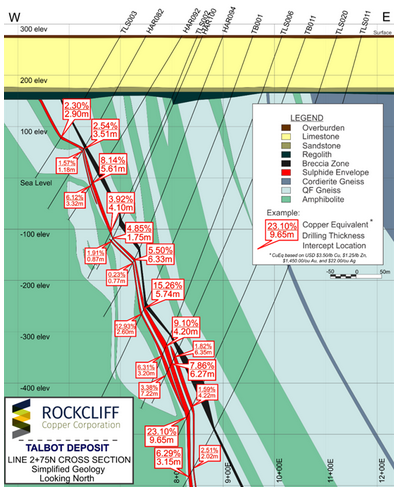

A few days ago on November 29, Rockcliff reported results from its phase-2 drill program (6,000 m) at the high-grade, gold-rich Talbot Deposit: Hole TB-013 returned 7 m averaging 4.1% Cueq (1.3% copper, 3.3% zinc, 1.28 g/t gold and 29 g/t silver) including a higher grade zone yielding almost 2 m of 7.8% Cueq (2.8% copper, 4.6% zinc, 3 g/t gold and 56 g/t silver). Hole TB-014 : 2.6 m averaging 2.4% Cueq.

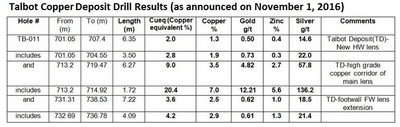

On November 1, Rockcliff announced the assays of the first hole from phase-2 at Talbot: 6.3 m averaging 9% Cueq including 1.7 m of 20.4% Cueq in the Main Lens, 7.2 m grading 3.6% Cueq in the Footwall Lens and 3.5 m grading 2.8% Cueq in the Hanging Wall.

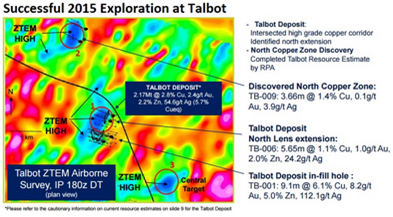

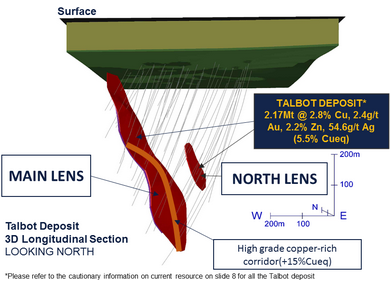

In January, an inferred resource estimate compliant with NI43-101 was calculated for Talbot (part of the Snow Lake Project), totaling 2.2 million t averaging 2.8% copper, 2.2% zinc, 2.4 g/t gold and 55 g/t silver (contained metal: 134 million lbs of copper, 107 million lbs of zinc, 165,000 oz of gold and 3.8 million oz of silver. As the recently announced drill results exceeded grades of this inferred resource, Rockcliff is well on track to significantly expand the resources with the ongoing and upcoming drill programs.

Rockcliff’s President & CEO, Ken Lapierre, commented on November 29:

“The high grade, gold-rich, Talbot copper deposit continues to exhibit impressive grades and we will continue to focus efforts on expansion of the present resource. Additionally, our current 6,000 metre phase 2 drill program is testing high priority geophysical anomalies that have similar size and conductance values comparable to that associated with the Talbot deposit.”

The Talbot Deposit is the highest grade unmined copper deposit in the Flin Flon-Snow Lake Mining Camp with excellent potential for additional tonnage. The deposit hosts pervasive copper-zinc-gold-silver grades across 800 m of strike to a vertical depth of 900 m.

The Main Lens is open in all directions and hosts a central high-grade metal corridor:

• 3-5 m thick across 75-250 m of strike

• 500 m of dip grading 8.3% copper, 7.5 g/t gold, 3.4% zinc and 114 g/t silver (15.7% Cuäq)

The North Lens is also open in all directions.Surface and drill hole geophysics identified untested anomalies along strike of the deposit.

The ongoing Q4-2016 exploration program (~15 holes totaling 6,000 m) is aimed to determine the copper significance of ZTEM and drill hole anomalies below the copper discovery at the North Copper Zone. At the Talbot Deposit, the goal is to define grades and thickness of the main lens high-grade copper corridor and determine the significance of a bore hole anomaly associated with the North Lens extension. The goal at the Central Target in the south is to determine copper significance of an untested ZTEM anomaly (similar to the ones at the Talbot Deposit and the North Target).

Rockcliff can earn a 51% interest in the Talbot Property from Hudson Bay Exploration & Development Company Ltd., a wholly-owned subsidiary of Hudbay Minerals Inc.

MacBride (Zn, Cu, Au, Ag)

Today, Rockcliff announced the acquisition of the MacBride Property (1,662 hectares; located 45 km north of Leaf Rapids in Manitoba), which contains the historical high-grade MacBride Zinc Deposit with 1.8 million t averaging 8.8% zinc, 0.3% copper, 0.1 g/t gold and 4.5 g/t silver in historic resources (1977; non-compliant with NI43-101).

This deposit is located within a 6 km long structural magnetic high corridor, which hosts several additional undrilled electromagnetic anomalies similar to the EM signature of the MacBride Deposit. The chances for new discoveries, as well as upgrading the historic resource estimate into NI43-101-compliant standards with a drill program, are considered excellent.

Ken Lapierre, commented in today’s press-release:

“With the present worldwide zinc shortage and the recent corresponding sharp rise in zinc prices, high grade near surface zinc assets like the MacBride zinc deposit are very rare particularly in a stable, safe, mining friendly jurisdiction. The high grade MacBride zinc deposit is underexplored and the mineralization remains open in all directions and has the potential to substantially grow in size with more drilling. Additionally, the likelihood of discovering additional high grade zinc-rich mineralization on the property elsewhere along the same magnetic corridor that hosts the MacBride zinc deposit is considered excellent.”

Morgan (Zn, Au)

On November 22, Rockcliff announced the acquisition of the Morgan Property comprising of the Morgan Lake, Woosey Lake and Cook Lake Properties in the Snow Lake Mining Camp.

The Morgan Property hosts stratigraphic horizons similar to the prolific Chisel Lake Basin which contain a number of former zinc mines and is located within 3 km from the now operating Lalor Mine owned by Hudbay Minerals. The Morgan Property includes a high-grade historic zinc-rich VMS deposit and a high-grade, gold-rich quartz vein system. The Morgan Property forms part of Rockcliff’s Snow Lake Project which hosts several high-grade VMS deposits and a former historical gold mine. The project is strategically located near Hudbay’s mining operations. The Morgan Property hosts the historical gold-rich Morgan Zinc Deposit, documented as having between a total of 272,000 t grading 15% zinc and 3.42 g/t gold and 200,000 t grading 8% zinc.

Ken Lapierre commented:

“The Morgan property hosts high grade zinc and gold zones within trucking distance to operating milling operations centered in the Snow Lake mining camp. The Morgan property acquisition is in line with our strategy of acquiring the highest grade un-mined copper, zinc and gold properties available in the camp that have excellent growth potential. The Morgan property hosts favourable VMS and gold-bearing stratigraphy striking for many kilometres. We look forward to advancing our understanding of the Morgan property’s potential through compilation of existing historical data followed by exploration programs in 2017.”

Laguna (Au)

The Laguna Property (920 hectares) is strategically located 20 km from a fully functional, non-operating, 2,150 t/day gold mill facility in Snow Lake. The property hosts the Laguna Gold Mine, the highest grade former gold mine in the Flin Flon-Snow Lake Mining Camp. Historical, intermittent gold mining from the Laguna vein between 1916-1939 of approximately 101,012 t averaged 20.5 g/t gold and produced over 60,000 ounces of gold. The Laguna Gold Mine infrastructure consists of a 3 compartment vertical shaft to 381 m and 8 levels totalling over 3 km of underground drift and stope development.

The Laguna vein remains open along strike and at depth. Exploration has identified quartz veins #001 to #007 located proximal to the Laguna vein, all of which show significant potential for advancement.

On October 26, Rockcliff announced the discovery of high-grade gold mineralization (including visible gold) from known historic surface quartz veins at its Laguna Gold Property. Additionally, the company has discovered a gold bearing quartz vein stockwork system with a minimum surface strike length of 300 m and a true thickness of up to 5 m. Termed the “007 quartz vein”, it is open to expansion in all directions with grab samples assaying from trace to 43 g/t gold, 1.2 to 119 g/t silver, and trace to 6.2% zinc. Additional historic veins (newly termed #001 vein to #006 vein) were located with grab samples assaying from trace up to 699 g/t gold. The veins ranged between 0.2 and 5 m in width and were traced up to 1 km along strike and visible gold was observed in outcrop. A total of 50 grab samples were taken by Rockcliff.

The company’s follow-up plans will include data compilation, surface geophysics (an induced polarization survey) followed by a first phase drill program.

With multiple high-grade, gold-rich, quartz veins throughout the Laguna Property and no diamond drilling completed since the 1940s, the 2016-2017 exploration program is the first systematic and scientific work on the property in >70 years.

Snow Lake Gold (Cu, Zn, Au, Ag)

On October 5, Rockcliff announced the acquisition of the Snow Lake Gold Property, strategically located in the Snow Lake Mining Camp and adjacent to a former 1 million ounce gold producer (New Britannia Mine).

The newly acquired property now forms part of Rockcliff’s existing Snow Lake Project which hosts the highest grade former gold mine (Laguna) and the highest grade unmined copper-rich and zinc-rich VMS deposits (Talbot and Rail) in the Snow Lake Mining Camp.

Ken Lapierre commented:

“This strategic property hosts multiple, gold-rich shear zones interpreted to be associated with fault splays off the main McLeod Road Thrust Fault, a major regional structural break that strikes across the property for 9 km and is associated with gold mines and deposits in the Snow Lake camp. The land package has exceptional high grade gold potential with geology sitting beside a gold mill facility in the middle of the Snow Lake camp. Our plan is to advance this asset by first compiling of all existing data followed by the completion of modern airborne and surface geophysical surveys and ultimately testing of the areas of gold potential by drilling in 2017.”

Lapierre also once said:

“The Snow Lake project is de-risked, is high grade, has excellent infrastructure, is located in a politically stable country within a world class mining camp and has growth potential for copper, gold, zinc and silver.”

Exploration on the project has followed an “exploration template for success” and has included:

• >20,000 line km of helicopter generated magnetic and EM (“electromagnetic”) coverage;

• >2,500 line km of helicopter generated “deep penetrating” VTEM coverage;

• Multiple surface EM geophysical surveys covering known targets and discovering new targets for follow-up;

• >50,000m of NQ sized drilling;

• Numerous NI43-101 technical and resource reports;

• >$20 million of exploration to 2016;

Presently the Snow Lake Property hosts 47 deposits of high-grade copper, gold, zinc and silver as tabulated above.

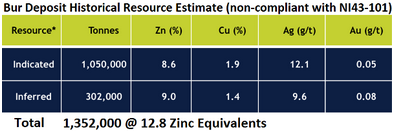

Bur (Zn, Cu, Au, Ag)

The Bur Deposit is the highest grade unmined zinc-rich deposit in the Flin Flon-Snow Lake Mining Camp.

Adding high-grade zinc resources near Rockcliff’s existing high-grade copper resources brings excellent diversity in metals that are experiencing a world-wide shortage. Also, it is one of the most cost effective ways to achieve significant growth within a world-class mining camp known for its exceptional metal grades, outstanding infrastructure and low-cost electrical power. This high-grade zinc deposit enhances the company’s ability to make significant strides towards their ultimate goal of becoming the next mine finder in one of the best mining and exploration jurisdictions in the world.

Why Manitoba and the Flin Flon-Snow Lake Belt?

Manitoba ranks fourth in the world (Fraser Study, 2015) for exploration and mining. Mining is the second-largest industry in Manitoba. In 2014, it directly employed approximately 6,000 people, contributing 6.5% to provincial GDP and 9% of total exports. Although many remote regions of the province still remain unexplored, the Flin Flon-Snow Lake greenstone belt located in central Manitoba has been mined for over 100 years and promising ongoing operations in the Snow Lake camp will extend mining operations for decades.

Over a century old, the Flin Flon-Snow Lake mining camps has had continous mining since the 1930s, hosts over 30 VMS mines and 90 VMS deposits, and several gold mines, representing the most prolific greenstone belt in Canada.

Mining in Manitoba comes with its own business strengths and rewards. The low cost of electrical power, access to high quality skilled labour and excellent infrastructure helps corporations keep the capital and operating expenditures for mine development low and profit margins high. Manitoba ranked fourth in Canada according to the Pricewaterhouse-Coopers 2013 Canadian mining tax report. The financial incentive program offered by the province includes a generous 30% Mineral Exploration Tax Credit, and the government spent more than $200 million on the ongoing rehabilitation of orphaned and abandoned mine sites across the province.

Rockcliff’s Snow Lake Project contains the highest grade unmined copper and zinc deposits and the highest grade former gold producer in the entire Flin Flon-Snow Lake Greenstone Belt. Rockcliff will continue to explore, discover and expand its present resources to become the next mine finder in this world-class mining camp.

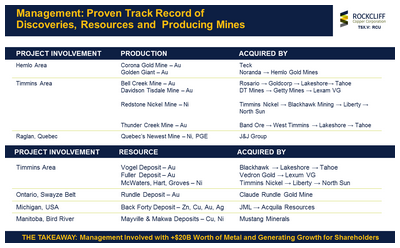

Management & Directors

Kenneth Lapierre (President, CEO, Director)

Kenneth J. Lapierre, P.Geo., is a Professional Geologist and a member of the Association of Professional Geoscientists of Ontario, who graduated from the University of Western Ontario in 1983. He was the founder, director and President & CEO of Rockcliff Resources Inc. since its inception in 2005 until its merger with Solvista Gold Corporation in 2015. Prior to that Mr. Lapierre held management positions as President & CEO of JML Resources (2001-2006) and Vice President of Exploration with Mustang Minerals Corp. (1996-2006), Findore Minerals Inc. (1987-1995) and Tyranex Gold Inc. (1986-1989). Mr. Lapierre has over 30 years’ experience in exploration, discovery, production and mining in base and precious metals across North and South America.

Gerald McCarvill (Chairman, Director)

Mr. McCarvill has extensive experience in the origination and execution of global mining and energy private equity and finance transactions. McCarvill’s career includes more than 30 years in the financial sector holding senior positions with major investment firms including the executive committee of CIBC Wood Gundy. Most recently, McCarvill was CEO of McCarvill Corporation, a diversified financial services company, which financed mining and energy companies. He helped establish Repadre Capital Corporation, a mining royalty company, now IAMGOLD (TSX: IMG), Desert Sun Mining, acquired by Yamana Gold (NYSE: AUY), and Consolidated Thompson Iron Mines.

Daniel Crandall (CFO)

Mr. Crandall is a Senior Manager at Marrelli Support Services Inc., providing CFO, accounting, regulatory compliance and management advisory services to numerous issuers on the TSX, TSX-venture and other Canadian and US exchanges. Previously he was a Manager at Collins Barrow Toronto LLP, a public accounting firm where he worked for over five years. Mr. Crandall holds a CPA and CA certification.

Bruce Durham (Director)

Mr. Durham is a Professional Geologist, who graduated from the University of Western Ontario in 1976. He is currently President, CEO and a director of Nevada Zinc Corp. (since 2010). Mr. Durham also sits on the board of directors of Nebu Resources Inc., NMC Resource Corp., Schyan Exploration Inc., Canoe Mining Ventures Corp. and Rainbow Resources Inc. Between 1998 and 2007, he held various management positions with Canadian Royalties Inc., including President, Vice President Exploration and Vice President Business Development. Mr. Durham has worked in mineral exploration for over 30 years in various positions with junior and senior mining companies exploring primarily for precious and base metal deposits in Ontario and Quebec, but also with companies exploring across Canada, in the United States and in Africa.

Donald Christie (Director)

Don has nearly 30 years of experience in Canada’s institutional debt and equity markets. He served as Senior Vice President and Director of Newcourt Credit Group Inc., where he was involved in the origination of structured debt and equity financings ranging in size from $20 million to $425 million and in the syndication of approximately $1.5 billion of private debt to both Canadian and U.S. life insurance companies and pension funds. Don served as CFO of Continental Gold Limited, a Colombian-based gold exploration company, from February, 2008 to September, 2010; during that period, he also served as Chairman of the audit committee of a TSX listed gold exploration company (San Anton Resource Corporation) with operations in Mexico. Don is currently the President and CEO and Director of Norvista Capital Corporation, was former CFO of Calvista Gold Corporation, Chairman of the audit committee of Northern Graphite Corporation, and Director and CFO of Nevada Zinc. He has a Bachelor of Commerce Honours degree from Queen’s University and received his Chartered Accountant designation in 1980 while working for PricewaterhouseCoopers.

G. Edmund King (Director)

Mr. King has been Chairman and CEO of MTHIRTY Communications, an internet media company, since May 2004. He has been Corporate Director of Caldwell Partners International Inc. since 2003 and currently serves as Chairman. He served as Chairman and Chief Executive Officer of Wood Gundy Ltd. and CIBC Wood Gundy Ltd. from 1988 to 1995. He has also served as the Chairman for the Investment Dealers Association of Canada, Western International Communications,and Rockwater Capital Corporation.

William R. Johnstone (Director, Corporate Secretary)

William R. Johnstone has been a partner at Gardiner Roberts LLP since 2005 practicing in the areas of securities and corporate law. He is the Practice Leader of the firm’s Securities Law Group. Prior to that, he was the proprietor of Johnstone & Company, a boutique corporate and securities law firm, for 12 years. He has been practicing law for 30 years. He is also a director and/or officer of 5 TSXV listed companies and 3 CSE listed companies.

About Rockcliff

“We are one company, one camp and three high grade metals.”

The company is committed to resource growth and discovery from 3 high-grade metals; copper, zinc and gold. The Snow Lake Project totals in excess of 45,000 collective hectares and hosts the highest grade of unmined copper-rich and zinc-rich deposits and the highest grade former gold producer in the greenstone belt.

“The Snow Lake project is de-risked, high grade, and has tremendous upside potential and excellent infrastructure in a politically stable country. We have consolidated the very best unmined deposits in one mining camp with outstanding growth potential in copper, gold, zinc and silver.” (Ken Lapierre)

By Trish Saywell on October 27, 2016 (PDF)

While it may not be apparent from its share price, which has ranged between 1.5¢ and 16¢ over the last year, Rockcliff Copper (TSXV: RCU) has quietly expanded its grip on Manitoba’s Flin Flon-Snow Lake greenstone belt, with recent option deals on two of the mining camp’s highest-grade metal deposits.

In September, the junior explorer signed an agreement with a prospector to earn 100% of the Laguna gold property, which hosts a former high-grade gold mine, 20 km southeast of Snow Lake and Hudbay Minerals’ (TSX: HBM; NYSE: HBM) 2,150-tonne-per-day gold mill facility.

The deposit was mined intermittently between 1916 and 1939 — producing more than 60,000 oz. gold from 101,000 tonnes averaging 20.57 grams gold per tonne — and there has been virtually no exploration done there in the last 70 years.

Rockcliff struck a second deal, also in September, to earn up to 100% of Hudbay’s Bur property, which hosts a high-grade, zinc-rich volcanogenic massive sulphide (VMS) deposit.

That deposit, 28 km from Snow Lake and 22 km northeast of Hudbay’s Snow Lake copper-zinc concentrator, has a historic resource of 1.1 million tonnes grading 8.6% zinc, 1.9% copper, 12.1 grams silver per tonne and 0.05 gram gold in the indicated category, and another 302,000 tonnes grading 9% zinc, 1.4% copper, 9.6 grams silver and 0.08 gram gold of inferred.

“We have been fortunate in the past couple of years that we do have money in our treasury, and we’ve consolidated some of the best assets in this camp,” Rockcliff’s president and CEO Ken Lapierre says in an interview. “It’s such a prolific belt, and it’s a great place to hang your hat as a geologist and find mines.”

In addition to its latest acquisitions, which include a deal on Oct. 5 to earn 100% of the Snow Lake gold property, which sits next to Hudbay’s New Britannia gold mine (and is believed to be part of the same structural gold trend), Rockcliff is earning a 51% stake in Hudbay’s Talbot copper project.

The gold-rich VMS deposit is open in all directions and has an inferred resource of 2.2 million tonnes grading 2.8% copper, 2.4 grams gold, 2.2% zinc and 54.6 grams silver, for a 5.7% copper-equivalent grade.

The junior released results on Nov. 1 from the first drill hole in its phase two drill program, and increased its planned drill meterage at Talbot to 6,000 metres from 5,000 metres. The hole returned several mineralized intercepts, including a 6.4-metre intercept grading 1.3% copper, 0.50 gram gold per tonne, 0.4% zinc and 14.6 grams silver per tonne, and another 6.3-metre intercept grading 3.5% copper, 4.82 grams gold, 2.7% zinc and 57.8 grams silver.

Assistant project geologist Ashley Durham beside a century-old trench on the 007 vein at Rockcliff Copper’s Laguna gold property, 20 km southeast of Snow Lake, Manitoba. Rockcliff has collected high-grade gold, silver and zinc samples from the trench. Credit: Rockcliff Copper.

“It’s a pretty special deposit,” Lapierre says of Talbot. “It has very, very high-grade associated gold, but the copper is truly outstanding. We think it’s going to grow substantially, and we’re out there drilling right now.”

Talbot, Rockcliff’s flagship asset, is 40 km northwest of the Tower deposit, which Rockcliff sold a year and a half ago to private company Akuna Minerals. Akuna is working on a feasibility study and Rockcliff holds a 1.5% net smelter return royalty (NSR) on the project.

“If Akuna is successful and puts the deposit in production, our royalty stream will be slightly over $1 million per annum over a six-year mine life,” he says. “It is a lot of risk-free cash flow on an annual basis for Rockcliff.

“A production scenario at Tower will mean we have achieved our goal of becoming a mine finder,” he adds. “This bodes well for our existing deposits that have the same pedigree, but with higher metal grades.”

Tower contains 88.97 million lb. copper in the indicated category (1.1 million tonnes grading 3.7% copper, 1.1% zinc, 17.28 grams silver and 0.55 gram gold), and 55.2 million lb. copper in the inferred category (1.3 million tonnes averaging 2% copper, 1% zinc, 9.78 grams silver and 0.27 gram gold).

“We feel that the Tower deposit has an excellent chance of becoming a significant deposit and a significant mine,” Lapierre says.

“One of the things that we pride ourselves on is that we know how to explore in this camp,” he adds. “We’ve been there since 2006, and we’ve spent a little over $20 million.”

Rockcliff also owns 100% of the Rail deposit, 40 km west of Snow Lake, which it earned from Hudbay.

The deposit is open in all directions and contains indicated resources of 822,000 tonnes grading 3% copper, 0.7 gram gold, 0.9% zinc and 9.3 grams silver, for a 3.9% copper-equivalent grade.

Hudbay decided not to buy back in, but has a 2% NSR on the project.

Fifteen kilometres north of the Rail deposit is Rockcliff’s wholly owned Lon deposit, which the company staked itself. Lon has a historic resource of 250,000 tonnes averaging 3.2% copper, 0.6 gram gold, 5.2% zinc and 18.8 grams silver, for a 5.6% copper-equivalent grade.

Geologist Greg Robinson inspects core from the first drill hole at Rockcliff Copper and Hudbay Minerals’ Talbot copper project in Manitoba. Credit: Rockcliff Copper.

“We were searching for an opportunity and we looked at that particular area, and noticed the Lon deposit was open for staking,” Lapierre says. “We staked the entire greenstone belt associated with it.

“I just wanted to find and consolidate the highest-grade assets in the camp — whether they be copper, zinc or gold — and it has taken 12 years to do it.”

Lapierre also notes that the infrastructure in the area can’t be beat.“You know it’s great infrastructure when you pour yourself a cup of hot coffee in the morning and by the time you get to the property, the coffee is still hot. We can do that at every one of our properties.”

He also points out that the area is mining friendly.

“The townsfolk of Snow Lake all call you by your first name and want to see you succeed. That’s a good feeling, knowing you’re not alone in this crazy business!”

With $3 million in the treasury and no debt, Lapierre says the company doesn’t have to go back to the market any time soon, and adds that management runs “a very frugal ship.”

The company started drilling at Talbot a month ago, and plans to drill 10 to 15 holes totalling 5,000 metres that focus on three areas on high-priority targets. The drill will then move to the Rail deposit, which LaPierre notes has “an outstanding geophysical target” below the deposit that he wants to test. After that, the drill will move to Laguna to test some of the gold veins.

On Oct. 26, Rockcliff reported that at its new Laguna property, it identified visible gold and high-grade gold mineralization from historic surface quartz veins, and also found a gold-bearing quartz vein stockwork system, with a minimum 300-metre surface strike length and an up to 5-metre true thickness.

Called the “007 quartz vein,” it is open to expansion in all directions, with grab samples assaying from trace to 43.3 grams gold, 1.2 grams to 118.6 grams silver and trace to 6.2% zinc.

“We just had boots on the ground, and it really is an incredible gold property. The grades are substantial,” he says of Laguna. “This is a property that has tremendous potential. It has multiple quartz veins on surface that you can bang off visible gold. We’ve got values of up to 20 oz. in grab samples. It’s all very encouraging, and one of the interesting and striking things is that it is a property that is completely underexplored. The last drilling was completed in the 1940s, and it boggles my mind that there is a three-compartment vertical shaft down to 381 metres, with 3 km of underground development on one vein that averages almost 20 grams gold.

“It’s a wonderful place to do business,” Lapierre says of the Snow Lake camp. “It is well-endowed with copper, gold, zinc and silver, and right now we have the highest-grade, un-mined copper deposit … and we’ve just acquired the highest-grade gold producer, Laguna, so we really like our chances there. Grade is king, as we all know.”

Source: https://www.northernminer.com/news/rockcliff-expands-reach-manitoba/1003779366/

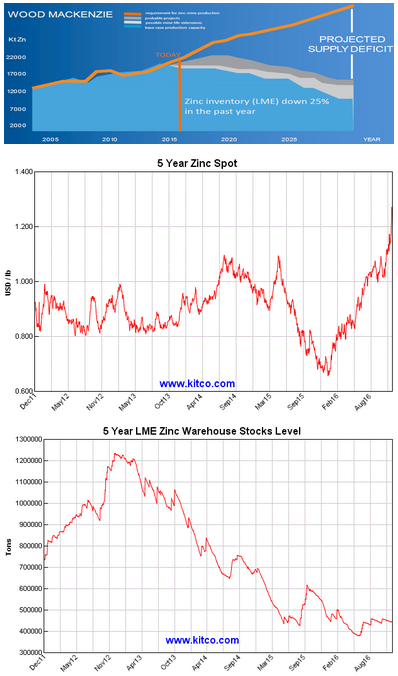

The Zinc Market

“Zinc remains the metal with the strongest near-term fundamentals, and prices are expected to rise from an average of $0.85/lb in 2016 to $1.25 in 2017 and $1.55 in 2018. An acute deficit in zinc concentrate supply has emerged on the back of depletion prompted closures (>600 ktpa) as well as economic idling of 500 ktpa worth of zinc mine capacity globally. This concentrate deficit has begun working its way into the refined metal market, where stocks have already begun to draw. Inventory draw-downs are expected to become pronounced by mid-2017, prompting price increases.” (Scotia Bank Commodity Price Index; October 25, 2016)

A Zinc Market Outlook by Frik Els, MINING.com:

Zinc is the best performing base metal so far this year and measured from its six-year low struck mid-January today’s $2,280 a tonne zinc prize is up 55%.

Zinc’s prospects brightened considerably after the shutdown of two major mines last year – Australia’s Century and the Lisheen mine in Ireland.

The two mines had a combined output of more than 630,000 t. The shuttering of top zinc producer Glencore’s depleted Brunswick and Perseverance mines in Canada in 2012 brings total tonnes going offline since 2013 to more than one million tonnes.

While the pace of gains in 2016 is unsustainable, zinc prices are expected to rise steadily over the long term.

Glencore has been out in front when it comes to curtailing production to shore up prices and the Swiss giants’ announcement of cutbacks inspired another leg up in the price. Glencore’s first half production numbers showed a 31% output decline to 506,000 tonnes after the company idled mines in Peru and downscaled its Australia operations.

Nyrstar’s zinc mine output fell 39%over the same period and the Swiss company has cut capex by nearly two-thirds as it seeks to exit mining.

China is now forecast to have a mined zinc deficit of 390,000 t in 2016, widening from a deficit of 9,000 tonnes a year ago.

China, top consumer and producer of the metal mainly used to galvanize steel, recently added fuel to the fire after Beijing ordered the shutdown of all lead and zinc mines in parts of Hunan province, the centre of Chinese production.

A new report by BMI Research says that while the pace of gains in 2016 is unsustainable, zinc prices are expected to rise steadily over the long term, averaging $2,000 a tonne in 2016 and $2,350 a tonne by 2020. BMI’s forecast represents an annual average gain of 3.9% to 2020, following an average annual contraction of 2% over the previous five-year period.

The better price environment is due to structurally weaker supply that will keep the global market in a deficit. Shortage is most acute at mine level with ore and concentrate production forecast to drop by 6.8% year on year in 2016, according to the report.

Total global refined output will shrink by just under 1% this year and return to tepid growth of less than 2% through 2020, outpaced by demand growth.

Sustained deficits will translate into a very tight-above ground stocks-to-use ratio according to BMI, with inventories representing less than 5% of consumption by the end of the decade compare to more than 11% this year.

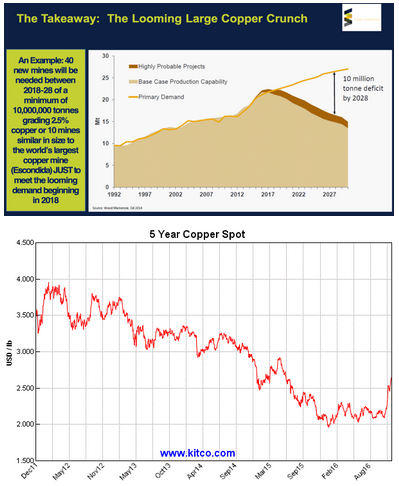

The Copper Market

“There is a need of 40 new mines between 2018 and 2028 of a minimum of 10,000,000 tonnes grading 2.5% copper or 10 mines similar in size to the world’s largest copper mine to meet the looming demand beginning in 2018. A copper price increase is predicted as the supply would not be able to meet the demand. Copper prices have remained relatively flat, range -bound between roughly $2.10-2.20/lb, and the mid-September mini-rally back toward $2.20/lb appears to have come on the back of profit-taking on speculative short positions. A recent surge in new Peruvian mine supply — up 50% so far this year on the back of increased domestic mine activity, particularly at the recently opened Las Bambas project — has mostly found its way into China, which holds the bulk of the world’s spare copper refining capacity. Normally, rapidly rising Chinese imports of copper concentrate (up 33% y/y through August, with Peruvian tonnage nearly doubling) would be a bullish signal for the copper market if it wasn’t for the fact that Chinese exports of refined copper are also rising at a break-neck pace (up almost threefold in the May-August period relative to last year), though China remains a net-importer of refined copper.” (Scotia Bank Commodity Price Index; September 30, 2016)

On November 23, the Financial Times published the article entitled “Copper: the commodities slouch that has found top gear - Mood begins to turn on the metal as long-held assumptions are questioned”; excerpts:

“Copper has suddenly burst into life, surging 14 per cent this month to above $5,500 a tonne as investors start to pick apart widely-held assumptions about the underlying dynamic for a metal used in everything from wiring to power grids.The concern over a wall of supply from projects commissioned in the aftermath of the financial crisis is fading just as more optimistic views on demand in China and the US emerge. Even Goldman Sachs — the most consistently negative voice on copper over the past couple of years — has turned more positive, conceding the 23m-tonne-a-year market will be broadly balanced this year. Others are more bullish, forecasting deficits of up to 400,000 tonnes in 2017 if Chinese demand holds up and authorities in Beijing continue to pump credit into the economy ahead of the 19th National Congress of the Communist Party in the autumn. If prices can stay above $5,500 or march higher that will be a huge boost to miners such as Anglo American, Glencore and Freeport-McMoRan, helping them to generate extra cash to pay down debts and eventually restart dividend payments. “The pick-up in Chinese demand has left the market tighter than we previously expected,” Goldman said.

While many have attempted to pin copper’s recent bounce on the still hazy infrastructureplans of US president-elect Donald Trump, sentiment had already started to shift before the shock US election result. One reason is China, where demand has been running at a much faster pace than expected this year thanks to Beijing, which has been trying, with some success, to stimulate the economy with credit. Another is over supply. During the first half of the year there were very few problems at major deposits. That changed abruptly during the third quarter, when several of the world’s biggest copper miners including BHP Billiton and Freeport-McMoRan reported weak results and cut production guidance for 2017. Copper is a difficult commodity to produce, and for that reason, analysts normally price in a 4 to 5 per cent loss of mining output each year due to disruptions...”

An Introduction to Copper

Below are some key points on the copper market, partly derived from The World Copper Factbook 2016 (International Copper Study Group).

1. Copper Basics

Copper is one of the most recycled of all metals. It is our ability to recycle metals over and over again that makes them a material of choice. Recycled copper (also known as secondary copper) cannot be distinguished from primary copper (copper originating from ores), once reprocessed. Recycling copper extends the efficiency of use of the metal, results in energy savings and contributes to ensuring that we have a sustainable source of metal for future generations.

What is Copper?

Copper is a malleable and ductile metallic element that is an excellent conductor of heat and electricity as well as being corrosion resistant and antimicrobial. Copper occurs naturally in the Earth’s crust in a variety of forms. It can be found in sulfide deposits (as chalcopyrite, bornite, chalcocite, covellite), in carbonate deposits (as azurite and malachite), in silicate deposits (as chrysycolla and dioptase) and as pure “native” copper.

Copper also occurs naturally in humans, animals and plants. Organic life forms have evolved in an environment containing copper. As a nutrient and essential element, copper is vital to maintaining health. Life sustaining functions depend on copper.

Copper and copper-based alloys are used in a variety of applications that are necessary for a reasonable standard of living. Its continued production and use is essential for society’s development.

How society exploits and uses its resources, while ensuring that tomorrow’s needs are not compromised, is an important factor in ensuring society’s sustainable development.

The demand for copper will continue to be met by the discovery of new deposits, technological improvements, efficient design, and by taking advantage of the renewable nature of copper through reuse and recycling.

As well, competition between materials, and supply and demand principles, contribute to ensuring that materials are used efficiently and effectively.

Copper Properties and Benefits

Copper makes vital contributions to sustaining and improving society.

Copper’s chemical, physical and aesthetic properties make it a material of choice in a wide range of domestic, industrial and high technology applications.

Alloyed with other metals, such as zinc (to form brass), aluminum or tin (to form bronzes), or nickel, for example, it can acquire new characteristics for use in highly specialized applications. In fact, society’s infrastructure is based, in part, on copper.

But copper’s benefits extend beyond mechanical characteristics:

• Copper is essential to the health of plants, animal and humans. Deficiencies, as well as excesses, can be detrimental to health.

• Antimicrobial Properties. Due to copper’s antimicrobial properties, copper and copper alloys can be used to eliminate pathogens and reduce the spread of diseases.

• Recycling. Copper is one of the most recycled of all metals. Virtually all products made from copper can be recycled and and recycled copper loses none of its chemical or physical properties.

• Energy Efficiency. Copper can improve the efficiency of energy production and distribution systems.

Copper in History

Archaeological evidence demonstrates that copper was one of the first metals used by humans and was used at least 10,000 years ago for items such as coins and ornaments in western Asia. During the prehistoric Chalcolithic Period (derived from chalkos, the Greek word for copper), man discovered how to extract and use copper to produce ornaments and implements. As early as the 4th to 3rd millennium BC, workers extracted copper from Spain’s Huelva region.

The discovery that copper, when alloyed with tin, produces bronze, led to the Bronze Age, c. 2,500 BC. Israel’s Timna Valley provided copper to the Pharaohs (an Egyptian papyrus records the use of copper to treat infections and to sterilize water). Cyprus supplied much of the Phoenician, Greek and Roman needs for copper. “Copper” is derived from the latin Cyprium, literally Cyprian metal.

The Greeks of Aristotle’s era were familiar with brass as a valued copper alloy. In South America, the pre-Columbian Maya, Aztec and Inca civilizations exploited copper, in addition to gold and silver. During the Middle Ages, copper and bronze works flourished in China, India and Japan.

The discoveries and inventions relating to electricity and magnetism of the late 18th and early 19th centuries by scientists such as Ampere, Faraday and Ohm, and the products manufactured from copper, helped launch the Industrial Revolution and propel copper into a new era.

Copper Today

Today, copper continues to serve society’s needs. Although copper has been in use for at least 10,000 years, innovative applications for copper are still being developed as evidenced by the development of the copper chip by the semi-conductors industry.

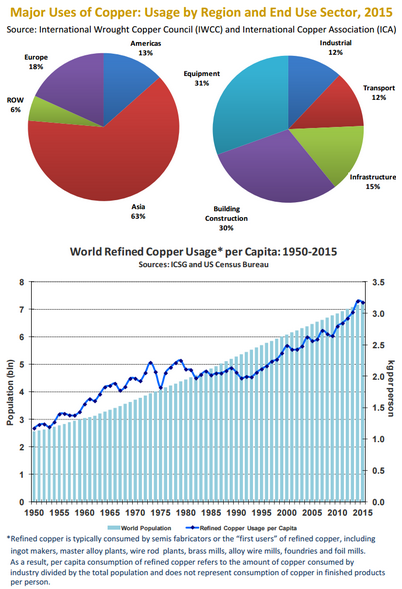

The global demand for copper continues to grow: world refined usage has more than tripled in the last 50 years thanks to expanding sectors such as electrical and electronic products, building construction, industrial machinery and equipment, transportation equipment, and consumer and general products. Some of the highlights of 2015 copper production and usage are listed below.

2. Copper Resources and Long-Term Availability of Copper

Copper Reserves and Resources

Typically, the future availability of minerals is based on the concept of reserves and resources. Reserves are deposits that have been discovered, evaluated and assessed to be economically profitable to mine. Resources are far bigger and include reserves, discovered deposits that are potentially profitable, and undiscovered deposits that are predicted based on preliminary geological surveys. (see definitions below)

According to the United States Geological Survey (USGS), copper reserves currently amount to around 720 million tonnes (Mt) and identified and undiscovered copper resources are estimated to be around 2,100 Mt and 3,500 Mt, respectively. The latter does not take into account the vast amounts of copper found in deep sea nodules and land-based and submarine massive sulphides. Current and future exploration opportunities will lead to increases in both reserves and known resources.

Definitions

Resource: A concentration of naturally occurring solid, liquid, or gaseous material in or on the Earth’s crust in such form and amount that economic extraction of a commodity from the concentration is currently or potentially feasible.

Identified Resources: Resources whose location, grade, quality, and quantity are known or estimated from specific geologic evidence. Identified resources include economic, marginally economic, and sub-economic components.

Undiscovered Resources: Resources, the existence of which are only postulated, comprising deposits that are separate from identified resources. Undiscovered resources may be postulated in deposits of such grade and physical location as to render them economic, marginally economic, or sub-economic.

Reserves: That part of the reserve base (part of an identified resource that meets specified minimum physical and chemical criteria related to current mining and production practices, including those for grade, quality, thickness, and depth) which could be economically extracted or produced at the time of determination. The term reserves need not signify that extraction facilities are in place and operative

2015 World Copper Reserves & Mine Production(undiscovered resources not including deep sea nodules and land-based and submarine massive sulfides - contained copper)

Total Resources (identified and undiscovered):

5,600 million tonnes (Mt)

• Identified Resources 2,100 Mt

• Reserves 720 Mt

• Mine Capacity 22 Mt

• Mine Production 19 Mt

Global Distribution of Identified and Undiscovered Copper Resources in Porphyry and Sediment-hosted Stratabound Copper Deposits

In 2013 the U.S. Geological Survey (USGS) completed a geology-based, cooperative international in two deposit types that account for about 80% of the world’s copper supply. Porphyry copper deposits account for about 60% of the world’s copper. In porphyry copper deposits, copper ore minerals are disseminated in igneous intrusions. Sediment-hosted stratabound copper deposits, in which copper is concentrated in layers in sedimentary rocks, account for about 20% of the world’s identified copper. The mean undiscovered totals for porphyry and sediment-hosted deposits are 3,100 and 400 Mt respectively, resulting in a global total of 3,500 Mt of copper. With identified copper resources currently estimated at 2,100 Mt, total copper resources (undiscovered + identified) are estimated at 5,600 Mt.

Despite increased demand for copper produced from ore in recent years, increases in reserves have grown, and there is more identified copper available to the world than at any other time in history.

Are We Going to Run Out of Copper?

It is highly improbable. Since 1950, based on the then current rate of demand, there has always been, on average, 40 years of reserves, and significantly greater amounts of known resources (USGS data). In addition, recycling, innovation and mining exploration continue to contribute to the long-term availability of copper.

In the period 2005-2015, 182 million tonnes of copper have been mined. In that same period however, reserves have grown by 250 million tonnes. This reflects additional exploration, technological advances and the evolving economics of mining.

Technology has a key role to play in addressing many of the challenges faced by new copper production. Known and as yet unknown innovations will ensure new mine production continues to provide vital copper supplies.

In addition copper recycling plays an important role in copper availability since today’s primary copper is tomorrow’s recycled material.

Unlike other commodities such as energy or food, copper is not “consumed”. Copper is one of the few raw materials which can be recycled repeatedly without any loss of performance, and key stakeholders such as policy-makers, scrap collectors, copper producers and recyclers must all focus on ensuring that yesterday’s metal is recycled and re-used.

While this will ensure a progressive move towards a more sustainable economy, the loop cannot be completely closed for two reasons. Firstly, demand will continue to increase due to population growth, product innovation and economic development. Secondly in most applications, copper stays in use for decades.

Consequently, meeting future metals demand will continue to require a combination of primary raw materials, coming from mines, as well as recycled materials, while innovative policies and technology should continue to contribute to improvements in recycling performance and resource efficiency.

Based on the latest knowledge on geological availability and continuous industry innovation there are good reasons to believe that copper will continue to be a vital and positive contributor to society well into the future.

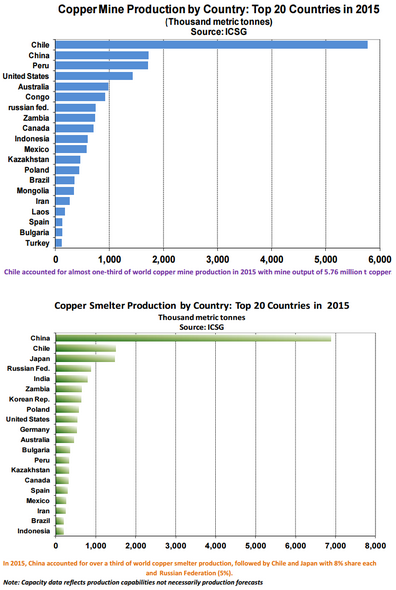

3. Copper Production

How is Copper Produced?

Geologists look for signs and/or anomalies that would indicate the presence of a mineral deposit. Under the right geological, economic, environmental and legal conditions, mining can proceed.

Primary copper production starts with the extraction of copper-bearing ores. There are three basic ways of copper mining: surface, underground mining and leaching. Open-pit mining is the predominant mining method in the world. After the ore has been mined, it is crushed and ground followed by a concentration by flotation. The obtained copper concentrates typically contain around 30% of copper, but grades can range from 20 to 40 per cent. In the following smelting process, sometimes preceded by a roasting step, copper is transformed into a “matte” containing 50-70% copper. The molten matte is processed in a converter resulting in a so-called blister copper of 98.5-99.5% copper content.

In the next step, the blister copper is fire refined in the traditional process route, or, increasingly, re-melted and cast into anodes for electro-refining.

The output of electro-refining is refined copper cathodes, assaying over 99.99% of copper.

Alternatively, in the hydrometallurgical route, copper is extracted from mainly low grade oxide ores and also some sulphide ores, through leaching (solvent extraction) and electrowinning (SX-EW process). The output is the same as through the electro-refining route - refined copper cathodes. ICSG estimates that in 2015, refined copper production from SX-EW represented 17% of total copper refined production.

Refined copper production derived from mine production (either from metallurgical treatment of concentrates or SX-EW) is referred to as “primary copper production”, as obtainable from a primary raw material source. However, there is another important source of raw material which is scrap. Copper scrap derives from either metals discarded in semis fabrication or finished product manufacturing processes (“new scrap”) or obsolete end-of-life products (“old scrap”). Refined copper production attributable to recycled scrap feed is classified as “secondary copper production”. Secondary producers use processes similar to those employed for primary production. ICSG estimates that in 2015, at the refinery level, secondary copper refined production reached 17% of total copper refined production.

Since 1900, when world production was less than 500 thousand tonnes copper, world copper mine production has grown by 3.2% per annum to 19.1 million tonnes in 2015. SX-EW production, virtually non-existent before the 1960s, exceeded 3.9 million tonnes in 2015.

Constraints on Copper supply

With copper concentrate in strong demand, there has been growing interest in understanding the obstacles that can prevent copper mine supply from coming on stream.

• Declining ore grades: a serious issue in developed copper areas such as the USA and Chile

• Project finance: prolonged economic and price volatility may have significant impact on cost of capital

• Tax & investment regimes: recent research indicates these are less important than geological endowments

• Other cost issues: lower capital expenditure may have adverse long term effect on copper supply; operating cost escalation

• Water supply: a critical issue in dry mining districts

• Energy: coal is the fuel chosen to power main copper mines and processes... climate change may increase costs

• Other environmental issues: governments are becoming more aware of the impact of mining to the surrounding environment in recent years. In countries like Peru and the Philippines, the relationship with indigenous community is also a key factor.

• Resource nationalism: It has become a priority for certain governments to develop their mineral resources that have not been exploited until now. While willing to develop their natural resources, countries might be seeking to extract strong revenue flows from them. It will be important to balance royalty/taxation levels with the need to encourage capital investment to develop their rising industries.

• Sulphuric acid supply and price: 16% cost factor for SX-EW projects

• Skilled labor: open labor markets would help address this constraint

• Labor strikes: tend to increase when refined prices are high and GDP is growing faster, but tend to be longer and less frequent otherwise

• High domestic costs if there is “Dutch disease” (resulting in higher exchange rates due in part to strong exports)

• Rate between imported inputs and domestic input costs affected by the currency strength of the producer

•

Political risks: Security and transport accessibility is crucial to mine operation

4. Copper Trade

Copper products across the value chain are traded internationally.

Often, countries where upstream copper production capacity exceeds downstream production capacity will import the raw materials needed to meet their production needs, and vice versa.

Major product categories of copper traded internationally include:

• Copper concentrates

• Copper blister and anode

• Copper cathode and ingots

• Copper scrap and

• Copper semis

Copper powders and compounds are also traded globally, but typically in much smaller quantities. In additional, copper is contained in end-use products that are traded globally including automobiles, appliances, electronic equipment and other products. Changes in trade regulations, such as import duties or export quotas, can have significant impacts on the international trade of copper.

The global Copper market and the “commodity“ Copper

Copper, as any other good or merchandise, is traded between producers and consumers. Producers sell their present or future production to clients, who transform the metal into shapes or alloys, so that downstream fabricators can transform these into different end-use products. One of the most important factors in trading a commodity such as copper is the settlement price for the present day (spot price) or for future days.

Exchanges

The role of a commodity exchange is to facilitate and make transparent the process of settling prices. Three commodity exchanges provide the facilities to trade copper: The London Metal Exchange (LME), the Commodity Exchange Division of the New York Mercantile Exchange (COMEX/NYMEX) and the Shanghai Futures Exchange (SHFE). In these exchanges, prices are settled by bid and offer, reflecting the market’s perception of supply and demand of a commodity on a particular day.

On the LME, copper is traded in 25 tonne lots and quoted in US dollars per tonne; on COMEX, copper is traded in lots of 25,000 pounds and quoted in US cents per pound; and on the SHFE, copper is traded in lots of 5 tonnes and quoted in Renminbi per tonne. More recently, mini contracts of smaller lots sizes have been introduced at the exchanges.

Exchanges also provide for the trading of futures and options contracts. These allow producers and consumers to fix a price in the future, thus providing a hedge against price variations. In this process the participation of speculators, who are ready to buy the risk of price variation in exchange for monetary reward, gives liquidity to the market.

A futures or options contract defines the quality of the product, the size of the lot, delivery dates, delivery warehouses and other aspects related to the trading process. Contracts are unique for each exchange. The existence of futures contracts also allows producers and their clients to agree on different price settling schemes to accommodate different interests.

Exchanges also provide for warehousing facilities that enable market participants to make or take physical delivery of copper in accordance with each exchange’s criteria.

5. Copper Usage

How Is Copper Used?

Copper is shipped to fabricators mainly as cathode, wire rod, billet, cake (slab) or ingot. Through extrusion, drawing, rolling, forging, melting, electrolysis or atomization, fabricators form wire, rod, tube, sheet, plate, strip, castings, powder and other shapes. The fabricators of these shapes are called the first users of copper. The total use of copper includes copper scrap that is directly melted by the first users of copper to produce copper semis.

Copper and copper alloy semis can be further transformed by downstream industries for use in end use products such as automobiles, appliances, electronics, and a whole range of other copper-dependent products in order to meet society’s needs. This section provides a range of information about refined copper usage, total use, major uses of copper and end-use.

Major Uses of Copper

Electrical

Copper is the best non-precious metal conductor of electricity as it encounters much less resistance compared with other commonly used metals. It sets the standard to which other conductors are compared.

Copper is also used in power cables, either insulated or uninsulated, for high, medium and low voltage applications.

In addition, copper’s exceptional strength, ductility and resistance to creeping and corrosion makes it the preferred and safest conductor for commercial and residential building wiring.

Copper is an essential component of energy efficient generators, motors, transformers and renewable energy production systems. Renewable energy sources such as solar, wind, geothermal, fuel cells and other technologies are all heavily reliant on copper due to its excellent conductivity.

Electronics and Communications

Copper plays a key role in worldwide information and communications technologies. HDSL (High Digital Subscriber Line) and ADSL (Asymmetrical Digital Subscriber Line) technology allows for high-speed data transmission, including internet service, through the existing copper infrastructure of ordinary telephone wire.

Copper and copper alloy products are used in domestic subscriber lines, wide and local area networks, mobile phones and personal computers. Semiconductor manufacturers have launched a revolutionary “copper chip.”

By using copper for circuitry in silicon chips, microprocessors are able to operate at higher speeds, using less energy. Copper heat sinks help remove heat from transistors and keep computer processors operating at peak efficiency. Copper is also used extensively in other electronic equipment in the form of wires, transformers, connectors and switches.

Construction

Copper and brass are materials of choice for plumbing, tabs, valves and fittings. Thanks in part to its aesthetic appeal, copper and its alloys, such as architectural bronze, is used in a variety of settings to build facades, canopies, doors and window frames.

Unlike plastic tubing, copper does not burn, melt or release noxious or toxic fumes in the event of a fire. Copper tubes also help protect water systems from potentially lethal bacteria such as legionella. Copper fire sprinkler systems are a valuable safety feature in buildings. The use of copper for doorknobs and plates exploits copper’s biostatics properties to help prevent the transfer of disease and microbes.

Copper roofing, in addition to being attractive, is well known for its resistance to extreme weather conditions. Major public buildings, commercial buildings and homes use copper for their rainwater goods and roofing needs. The telltale green patina finish, that gives copper the classic look of warmth and richness, is the result of natural weathering.

Transportation

All major forms of transportation depend on copper to perform critical functions.

Copper-nickel alloys are used on the hulls of boats and ships to reduce marine biofouling, thereby reducing drag and improving fuel consumption. Automobiles and trucks rely on copper motors, wiring, radiators, connectors, brakes and bearings. Today, the average mid-size automobile contains about 22.5 kg (50 lbs) of copper, while luxury cars on average contain around 1,500 copper wires totaling about 1.6 km (1 mile) in length.

Electric and hybrid vehicles can contain even higher levels of copper. Copper’s superior thermal conductivity, strength, corrosion resistance and recyclability make it ideal for automotive and truck radiators. New manufacturing technologies, processes and innovative designs are resulting in lighter, smaller and more efficient radiators.

Copper is also used extensively in new generation airplanes and trains. New high-speed trains can use anywhere from 2 to 4 tonnes of copper, significantly higher than the 1 to 2 tonnes used in traditional electric trains.

Industrial Machinery and Equipment

Wherever industrial machinery and equipment is found, it is a safe bet that copper and its alloys are present.

Due to their durability, machinability and ability to be cast with high precision and tolerances, copper alloys are ideal for making products such as gears, bearings and turbine blades.

Copper’s superior heat transfer capabilities and ability to withstand extreme environments makes it an ideal choice for heat exchange equipment, pressure vessels and vats.

The corrosion resistant properties of copper and copper alloys (such as brass, bronze, and copper-nickel) make them especially suitable for use in marine and other demanding environments.

Vessels, tanks, and piping exposed to seawater, propellers, oil platforms and coastal power stations, all depend on copper’s corrosion resistance for protection

Consumer and General Products

From the beginning of civilization copper has been used by various societies to make coins for currency. Today, countries are replacing lower denomination bills with copper-based coins, as these coins last 10, 20 and even 50 times longer.

In the United States, one cent coins and five cent coins contain 2.5% and 75% copper, respectively, while other U.S. coins contain a pure copper core and 75% copper face.

In the recently expanded European Union, the Euro coins, first introduced in 2002, also contain copper.

Copper and copper-based products are used in offices, households and workplaces. Computers, electrical appliances, cookware, brassware, and locks and keys are just some of the products exploiting copper’s advantages. In addition, in areas known to be copper deficient, copper is used by farmers to supplement livestock and crop feed.

6. Copper Recycling

Copper is among the few materials that do not degrade or lose their chemical or physical properties in the recycling process. Considering this, the existing copper reservoir in use can well be considered a legitimate part of world copper reserves.

In the recent decades, an increasing emphasis has been placed on the sustainability of material uses in which the concept of reuse and recycling of metals plays an important role in the material choice and acceptance of products.

If appropriately managed, recycling has the potential to extend the use of resources, and to minimize energy use, some emissions, and waste disposal.

Closing metal loops through increased reuse and recycling enhances the overall resource productivity and therefore represents one of the key elements of society’s transition towards more sustainable production and consumption patterns. It is widely recognized that recycling is not in opposition to primary metal production, but is a necessary and beneficial complement.

In 2014, ICSG estimates that around 30% of copper usage came from recycled copper. Some countries’ copper requirements greatly depend on recycled copper to meet internal demands. However, recycled copper alone cannot meet society’s needs, so we also rely on copper produced from the processing of mineral ores.

Company Details

Rockcliff Copper Corp.

#1660 – 141 Adelaide Street West

Toronto, ON, Canada M5H 3L5

Phone: +1 416 644 1752

Email: klapierre@rockcliffcoppercorp.com

www.rockcliffcoppercorp.com

Shares Issued & Outstanding: 133,034,321

Canadian Symbol (TSX.V): RCU

Current Price: $0.105 CAD (11/30/2016)

Market Capitalization: $14 million CAD

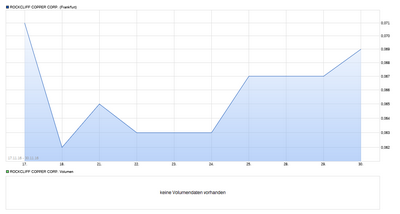

German Symbol / WKN (Frankfurt): RO0 / A142TR

Current Price: €0.067 EUR (11/30/2016)

Market Capitalization: €9 million EUR

Stay Tuned!

For smartphones and tablets, an APP from Rockstone Research is available in the AppStore and in the GooglePlayStore.

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.