Earlier I shared with you that when it comes to President-elect Donald Trump, the media takes him literally

but not seriously. His supporters, on the other hand, take him seriously but not always literally.

We saw an example of this polarity Tuesday morning when Trump took a shot at Boeing, tweeting to his nearly 17 million Twitter followers that the jet-manufacturer “is building a brand new 747 Air Force One for future presidents, but costs are out of control, more than $4 billion. Cancel order!”

When journalists sought clarification, Trump said he wants Boeing to make money, “but not that much money.”

As the

Wall Street Journal pointed out, the current Air Force One has been in use for 30 years—since Ronald Reagan’s administration—and includes many cutting-edge modifications for communications and defense. It’s designed to

withstand a nuclear blast. For the value we get out of the president’s main ride, in other words, the exorbinant sticker price might not be so exorbinant as it initially appears.

But then, the $4 billion Trump refers to couldn’t be confirmed. Boeing responded by saying it’s currently under contract to build the jet for only $170 million, and production hasn’t even begun yet.

Again, in questioning the details of Trump’s tweet, the media might be missing the forest for the trees. It’s possible the president-elect means simply that we need to keep government cost overruns in check—not literally cancel the Air Force One order—something we can all agree with.

Investors Take Trump Seriously—and Somewhat Literally

Investors have so far managed to find the right balance between taking Trump seriously

and literally, to a certain extent. Since Election Day, small-cap stocks have rallied more than 12 percent, suggesting the market sees Trump’s “America First” policies benefiting them the most. Because they have less exposure to foreign markets than blue-chip companies, small caps are in an attractive position to take advantage of lower corporate taxes, streamlined regulations and a stronger U.S. dollar.

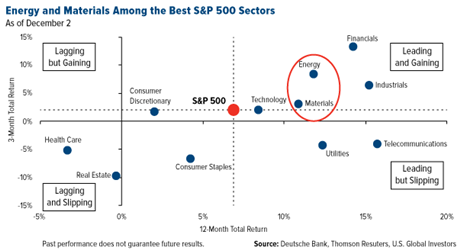

The market’s also betting big on Trump’s proposal to spend $1 trillion on infrastructure over the next 10 years. For the one-year and three-month periods, the energy and materials sectors were among the best performers in the S&P 500 Index. Both landed in the “leading and gaining” quadrant in the chart below.

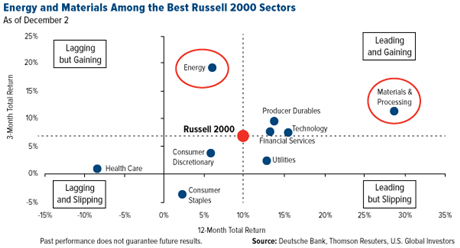

We see similar results in the small-cap Russell 2000 Index. Materials and processing was the best performer for the one-year period while energy led over the past three months.

Granted, a lot of the growth in energy can be

attributed to OPEC’s recent announcement that it would trim production for the first time since 2008. Such an agreement was

rumored back in October. Oil rallied sharply following the announcement but has retreated slightly on news that the cartel raised production to more than 34 million barrels a day in November. Speculation is also high on whether non-OPEC countries such as Russia will join the coordinated effort to help prices recover.

But like small-cap stocks, energy and materials appear to be getting a boost on hopes that Trump will make good on his commitment to opening the fiscal valves. If he succeeds at getting what he wants from Congress, we could very well see another major infrastructure boom and commodities bull market similar to the one

led by China a decade ago.

No Better Time Than Now

It’s worth noting that Trump will likely face some tough opposition from Congress. Even though most of the $1 trillion will allegedly come from private investment, the same fiscal conservatives who said no to President Obama’s 2009 stimulus package, worth over $800 billion, might also balk at Trump’s request.

But if the government is serious about rolling out such a monumental spending package, there’s really no better time than now, with borrowing costs still at near-historic lows.

As Steve Bannon, Trump’s controversial advisor,

told the Hollywood Reporter: “With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything. Shipyards, ironworks—get them all jacked up. We’re just going to throw it up against the wall and see if it sticks.”

I don’t know if I’d be so flippant about $1 trillion, but most everyone agrees that more needs to be done about our nation’s infrastructure. According to the American Society of Civil Engineers (ASCE), each American household

could lose as much as $3,400 per year if roads, bridges and tunnels never see an upgrade. The longer we put off repairing our infrastructure, the more expensive it might get.

In a report this week, Deutsche Bank agreed that the U.S. should dream big or go home:

To drive strong infrastructure spending growth, the country will need to get much more aggressive in building new (or replacing) major transport bridges and tunnels, and to reach for Earth-altering infrastructure that addresses national risks like floods, droughts… If the U.S. is to meaningfully stimulate its economy via infrastructure, it must think bigger and act quicker.

Besides roads and bridges, Deutsche writes, the U.S. should pursue “ten-figure projects” such as levee systems, storm protection systems, water tunnels and river dredging, not to mention “new science and technology super structures like new rocket building and launch facilities, biotech labs,” and “next-generation communication and air traffic control.”

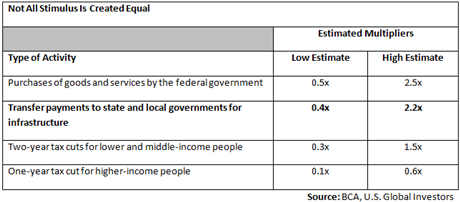

Such projects would benefit many more people than those using them. According to BCA Research, public spending on infrastructure has one of the highest multiplier effects, making it more effective at stimulating the economy than tax cuts.

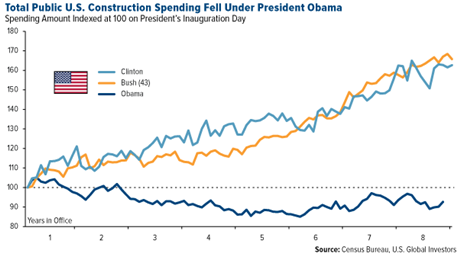

Finally, the U.S. is due for another major infrastructure build. Under Obama, total public construction spending dropped relative to spending during his two predecessors’ administrations.

Global Economy at Point of Inflection: OECD

Global Economy at Point of Inflection: OECD

Increasing infrastructure investment would be good not just for the U.S. but also the world economy, which has struggled to gain traction for the past couple of years. In its just-released

Global Economic Outlook, the Organization for Economic Cooperation and Development (OECD) strongly endorsed the idea of “using the fiscal levers to escape the low-growth trap”—similar to what Trump has proposed.

With the U.S. and China both planning sweeping stimulus efforts in the next one to two years, the Paris-based group sees global GDP growing 3.6 percent in 2018, the fastest pace since 2011. The OECD also revised its earlier 2017 growth estimate to 3.3 percent, up from 3.2 percent.

Speaking in Paris last month, OECD Secretary-General

Ángel Gurría commented that “there is reason to hope that the global economy may be at a point of inflection.”

I agree. Although I have my differences with Trump, I’m optimistic he can negotiate an infrastructure deal that will jumpstart growth, both here and abroad.

Explore investment opportunities in commodities and natural resources!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2016: The Boeing Co.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC").

This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.