Somebody owes Dolly Varden Silver Corp’s former CEO and President, Rosie Moore, a nice bottle of scotch, that is for sure. Mrs. Moore managed to work some substantial magic over the past two years on behalf of silver explorer/developer, Dolly Varden. After an eventful 2016, the reorganized, reinvigorated Dolly is playing towards a nice comeback in 2017. Shareholders witnessed a battle mid 2016 between major shareholder Hecla Mining Company (NYSE: HL) and Dolly Varden (TSX.V: DV OTC: DOLLF). Two commissions, the Ontario and British Columbia Security Commissions, coordinated to decide the fate of Dolly Varden’s $6 mill financing and a hostile Hecla takeover bid for Dolly Varden. The bid came July 8, 2016, for $0.69 a share for all the outstanding shares of DV not already owned by Hecla. Dolly Varden was trading at $0.62 at that time. Hecla ended up withdrawing their bid, and remain shareholders of approximately 15.7% of the outstanding shares. I wonder how those board meetings are going. More on this broo-haha later though. Let us move on to the good stuff.

Silver Lining in BC’s Golden Triangle

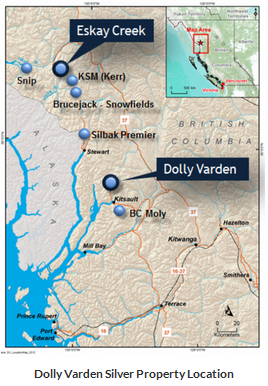

Dolly Varden is developing an advanced stage silver property in northwestern British Columbia’s Golden Triangle. The best place to find a mine is near a mine, and this 94km2 high grade property is on the same structural and stratigraphic belt that produced both Eskay Creek and Brucejack, two well-known, sizeable deposits in BC. Over 220 million ounces of silver and over 7 million ounces of gold have been produced by the Hazelton Group Arc Assemblage, including Eskay Creek. Eskay Creek is 100 km north of Dolly Varden’s substantial land package.

Dolly Varden, whose name comes from the Charles Dickens novel Barnaby Rudge, owns 100% of the historic silver property, first discovered in 1910. The property encompasses four historic mines that produced approximately 20 million ounces of silver in the good ole days. Assays taken from ore have been as high as 2200 ounces of silver per ton. Now that is grade. The property is said to have well-understood targets, encouraging for when drill news starts a churning again.

The Company envisions defining additional silver resources, confirming historical resources that were known to operators in the late 50’s, and drilling further down to test the high grade silver mineralization potential. Mineralized zones are 5-20m wide (true width), so there is plenty to chew on and discover along the way.

The team is also being built out now- more details on who is who at this link: Dolly Varden Management. Newly appointed CEO and President, Gary Cope, had this to say December 6th, 2016: “We have put together an exceptional geological team with a diverse set of skills and knowledge to support our exploration effort at Dolly Varden. After validating the high-grade silver-rich nature of the Dolly Varden property in the 2015 maiden NI 43-101 mineral resource estimate, we expect that current estimated high-grade silver mineralization is further expandable, and we believe there are similar deposits on the under-explored remainder of the large project where the same lithologies, structure, alteration and indicator elements have been defined in previous field programs. The results achieved in 2016 on Ace-Galena are an example of the growing opportunity at Dolly Varden.”

The Dolly Varden Silver Property

The property can be accessed best through Terrace BC via an all-weather road to the historic mining town and port of Kitsault, and then by a 15 minute helicopter ride. The property has good potential to prove up something economic down the road, at least one must assume so if a major like Hecla is taking a run at it. Here is the latest resource estimate from the 2015 tech report:

August 27, 2015 Technical Report for the Dolly Varden Silver Property: Giroux Consultants Ltd., encompassing the Dolly Varden, Wolf, Torbrit and North Star deposits

August 27, 2015 Technical Report for the Dolly Varden Silver Property: Giroux Consultants Ltd., encompassing the Dolly Varden, Wolf, Torbrit and North Star deposits

- 150 grams of silver per tonne (g/t Ag) cutoff grade

- Mineral resources that are not mineral reserves have not demonstrated economic viability. Please refer to the company’s updated Technical report filed on www.sedar.com for further details.

- Zinc and lead contents, known to exist in the deposits, were not included in the mineral resource estimate due to sparsity of lead and zinc assay data (not assayed in pre-2011 drill holes).

- Specific gravity (SG) data was also very conservatively modeled due to sparsity of data. Known presence of barite and sulfides will likely result in higher SG of rock, resulting in greater tonnage.

- Significant volumes of historic (non-compliant) resource estimate were not included in the current estimate due to lack of data. Further drilling will allow adding this material to future resource estimates.

- Deposits are open along strike and down dip in some areas

Previous Production

In the early 1920’s the Dolly Varden Mine produced 1.5 million ounces at an average grade of 35.7 ounces Ag per ton. Between 1949-1959, the Torbrit mine produced 18.5 million ounces of silver at an average recovered grade of 13.58 ounces Ag per ton. Two other defined targets that are partially developed include the North Star and Wolf deposits.

Property Geology

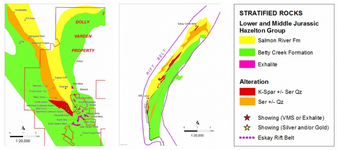

The Dolly Varden Silver Property consists of volcano-sedimentary rocks belonging mostly to the lower and middle Jurassic Hazelton Group. The main silver and base metal deposits of the Kitsault River valley were interpreted as vein mineralization in the early days. Devlin, in 1986, reinterpreted the main deposits to be volcanic exhalative in origin. The silver deposits of the upper Kitsault valley are mapped with important geological similarities to the Eskay Creek deposit, providing a hopeful comparison for exploration on the Property.

The most obvious mineralized zone on the Property is an aerially extensive sheet of chemical sediment mineralization (the “DVT Exhalite”) that extends from the west of the Dolly Varden mine, through the North Star underground workings and ending in the Torbrit mine on the east. The DVT Exhalite body forms an almost continuous sheet, ranging in true thickness from 3 to 38m.

For a look at their maps and sections go to this link: MAPS and SECTIONS

To view their technical reports, follow this link: TECHNICAL REPORTS

Eskay Creek Look-alike

The Eskay Creek region is a silver and gold rich area in the Unuk and Iskut River region on the north coast of British Columbia. The region experienced a mining boom in 1987 due to Canadian Mining Hall of Fame promoter, Murray Pezim. Through good old fashion diamond drilling and underground development, sprinkled with a dash of eccentric promotion, Pezim’s team discovered this polymetallic, high grade sulphide deposit.

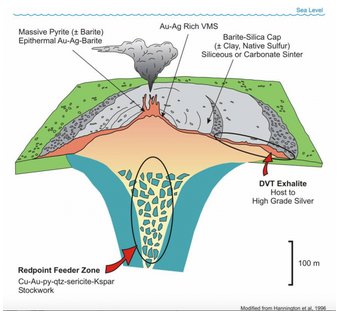

The exploration goal at Dolly Varden is to target an Eskay-esque discovery. A classic, high-sulphidation VMS deposit, where precious and base metal-rich hydrothermal fluids (yeah baby) form near the hot-spring vents. Bedrock in these areas are underlain by precious metal rich veins, stockwork veins, and strong alteration. The good stuff.

The below image shows the geological and spatial characteristics of the precious metal rich VMS deposits, including Dolly Varden. The DVT Exhalite hosting the silver deposits at Dolly Varden (North Star and Torbrit), correlate with the Barite-Silica Cap. The Redpoint Feeder Zone correlates with the footwall stockwork alteration feeder zone.

Back to the Broo-Haha

Nothing worse than a confusing breakup… But Hecla didn’t really break it off with Dolly, he just put the hostile brakes on, upset over the $6 million financing Dolly Varden’s Management and Board felt compelled to complete, driving up the Hecla bid price much like a dilutive poison pill would. From Dolly Varden’s perspective, it was about becoming debt free, cashed up and project focused again. From Hecla’s point of view, damn you Dolly, we’re your major shareholder and we just opened the exit door for you.

From Osler.com: “In a significant decision, the British Columbia and Ontario securities commissions have upheld a contested private placement by the target of an unsolicited take-over bid where they concluded that there was a legitimate need for the financing and the private placement was not implemented as a defensive tactic in response to the bid…

The decision is notable in particular for its explicit acknowledgement of the importance of the fiduciary responsibilities and business judgment of boards of directors in this context and arguably exhibits a degree of deference to that judgment which has not often been seen on the part of Canadian securities regulators.”

Speculators flew into Dolly Varden’s stock in July, and the price rocketed up to the $1.10 level. Since then, the wind has taken this one back down to the attractive, in our opinion, $0.60-$0.65 level. (Please do you your own due diligence, this is not investment advice nor solicitation to buy stock. Talk to an investment advisor if you are considering buying any microcap stock).

New Lease and All The Pieces

Dolly Varden has hit the reset button. The Company is well positioned to take advantage of exploration successes that should fall in line about the same time as when the silver price sees a spike or two again. I can only imagine how some retail shareholders feel after holding strong over the last few years. Glancing at Dolly Varden’s last year of news, there is not one project or exploration related press release in the bunch.

30,000 people in British Columbia are employed in the mining industry. The value of major commodities mined in BC totalled around $5.9 billion dollars in 2015. Dolly Varden has a lot of the pieces that a retail investor looks for in a buy-low market, including a geographical focus on a good mining-friendly jurisdiction.

Enough cannot be said for a pubco with an intact capital structure, a high grade project with a lovable metal and a motivated, newly-assembled team. The company is not dealing with debt, joint venture ownership issues, political or community problems. Hecla’s bid showed the markets just how interesting and prospective this historical silver property is in the eyes of a major. With a $21 million market cap, Dolly Varden should see a positive year ahead. And silver and other precious metals should start to shine up even more with Trump’s inauguration, Europe’s continued implosion and sh*t generally hitting the fan.

We view this distracting couple of years for Dolly Varden’s stakeholders as well behind them now, and thankfully, we are onto the good stuff. Adding value. Drilling. Talking rocks and core and resource and infrastructure and PDAC. Clearly, the Dolly Varden team feels there is more value to be unearthed in BC’s silver rich mountain scape.

~DISCLAIMER~

This is not in any way investment advice or any sort of stock recommendation. Please do your own due diligence and talk to a qualified investment advisor.

The contents of this article are for informational purposes only. Nothing in this article, in any way whatsoever, should be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. Note the inherent risks when investing in microcap stocks.

Dolly Varden is a client to an arm’s length party to one of the owners of StockSyndicate.com. The author of the report does own shares in Dolly Varden, with no plans to sell over the next 60 days.