With President Trump having now begun his role in office, much uncertainty still  remains surrounding his global economic policies. The largest challenge for the Canadian economy is a potential change to U.S. trade policy. This would include higher border tariffs and a U.S. renegotiation (or complete exit) of NAFTA. Fortunately, recent news coming out of meetings seems to point that Canada may be less in the crosshairs than many thought.

remains surrounding his global economic policies. The largest challenge for the Canadian economy is a potential change to U.S. trade policy. This would include higher border tariffs and a U.S. renegotiation (or complete exit) of NAFTA. Fortunately, recent news coming out of meetings seems to point that Canada may be less in the crosshairs than many thought.

Based on 2015 statistics from the International Monetary Fund’s World Economic Outlook Database, exports accounted for about 25.0% of total Canadian economic output. From a continental perspective, 78.0% of Canadian exports were delivered to its NAFTA partners: United States and Mexico. Therefore, in the short-term, increased import taxes from the new Trump government would present one of the greatest risks to Canada’s economy.

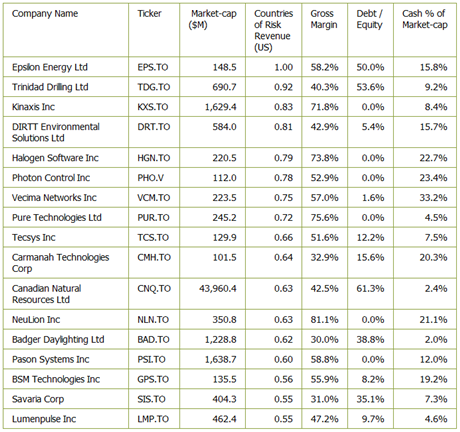

With this in mind, we will use this iteration of the 5i Filter to highlight companies that have revenue exposure to the U.S., where a reading of “1.0” indicates a higher level of risk (this is a model result and does not imply 100.0% of revenues come from the U.S.). We will focus on sectors that have benefitted from the ‘Trump Bump', or have an ability/cushion to navigate policies of “America First”. The industries included were Tech, Financials, Industrials and Energy, as these appear to be the areas that will be most impacted or have the best ability to adapt, for better or worse.

To the filter, we have added the requirement of high gross margins (greater than 35.0%) and well-managed balance sheets (debt/equity less than 65.0%). Doing so gives us further confidence that if the Trump Administration implements unfavourable trade policies for Canadian companies, these companies have room to operate and can withstand a reduction to margins without the underlying business being threatened. A food business with a 3.0% margin has a tougher time adjusting to an operating environment change than a software company with a 50.0% margin. We also highlight ‘cash and equivalents’ as a percentage of market-cap, with a higher reading adding further confidence in the company’s ability to weather political risk and invest in a way to adjust to changing realites.

According to Dawn Desjardins, Deputy Chief Economist with RBC Economic Research, a growing proportion of our exports are intermediate inputs into the production of U.S. goods. The levying of a tariff that results in sharply higher costs of Canadian exports would translate into a significant boost to prices for finished goods and potentially result in the dissolution of these trading relationships.

However, there are always two sides to every debate. To the extent that the Trump administration is able to implement deregulation policies and fiscal stimulus/ increased infrastructure spending, stronger U.S. demand should have a positive spillover effects, given the close link and geography of our two economies.

As always, please remember that this should simply be viewed as an idea generator and not a commentary on the merit of any of the above stocks for investment. You can view our previous filter here.