- The share price of Tasca Resources Ltd. is poised for significant upside revaluation as the enormous inherent value of its Bleiberg property in Austria is understood by the market.

- Historic production was ~500,000 t/annum, and it was the 6th largest Germanium producer in the world.

- Highly prospective for new discovery.

Tasca Resources Ltd. (TSX-V: TAC) (Frankfurt: 3TA) Bleiberg Zn-Pb-Ge property is a major historic past producer, 116 mining claims covering 35 km, located 140 km SE of Salzburg in southern Austria. First discovered in the 12th century, the Bleiberg property has been mined along 8 km of strike to a depth of 900 m by way of 1,120 km of underground tunnels and 6 main shafts. The mine abruptly closed in 1993 due to the bankruptcy of the parent company conglomerate VOEST, however this mine is high-grade and was highly productive; historically producing ~500,000 tons per year, and it was the 6th largest Germanium producer in the world --

average grades were 6% Zinc, 1% Lead, 200 parts per million (ppm) Germanium, 10% fluorite, and economic amounts (~2,000 ppm) of cadmium.

Tasca is the subject of a Mining Journal review, full copy of which may be viewed at

https://miningmarketwatch.net/tac.htm online.

The risk-reward characteristics are highly advantageous for investors establishing a long position in TAC.V as the current market cap (~$1.42M Canadian, trading at 10 cents/share) relative to the enormous inherent value of Tasca Resources' Bleiberg Zn-Pb-Ge property is disproportionate, the share price is poised for significant upwards revaluation. The Company is executing on a plan to quickly add value by advancing the property to a point where a higher degree of the potential is recognized. Currently there appears exploration potential for

30 - 50 million tonnes of material left behind in the hanging wall on strike with previous working, additionally the western section is also highly prospective for new discovery.

Fig. 1 (below) Sample of Bleiberg area workings

there are

>1,100 km of tunnels from historic exploration & production

The fact this mine was a meaningful and successful past producer gives the Company an advantage and mitigates risk for early investors that understand the magnitude of what the Tasca possesses. Copious amounts of geological research from a wide range of institutes and universities support a geological target in the order of 30 to 50 million tonnes with historic grades of 6% Zn, 1% Pb, and 200 ppm Ge. This belief has also been speculated by the chief mining geologist at the time the mine was closed, he published a documents that also detailed annual exploration consisting of 35,000 m of drilling and the creation of ~3 km of drifting/annum as well -- this geologist is still available for consultation as required.

On a project of such magnitude, the fastest path to profits for a junior exploration company is to make the value apparent to larger/well capitalized mining companies. Tasca will demonstrate the aforementioned potential in-part, starting with the compellation of data -- there is lots of material locked up in archives, past reports, and past exploration data that needs to be plotted up. Additionally, we note the Austrian government, on its own, is looking to do a 3D diagram of the entire deposit from data they have.

The objective of Tasca's 2017 exploration program will be to confirm the volume of unmined mineralized material remaining and to define targets for initial exploration, leading to underground drilling. A nominal, possibly ~5,000 m, underground drilling program will affirm the potential in part, and generated a significantly higher ranking of value for the Bleiberg Zn-Pb-Ge asset.

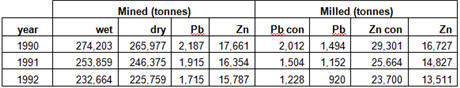

Table 1. Annual Production from Bleiberg Mine 1990-1993

(the last 4 years of production prior to closing)

"

More than 3 million tonnes of Pb and Zn metal were recovered from the Bleiberg deposits from initial mining in 1333 until closure in 1993. The mine geologist during the final years of production estimated roughly 2 million tonnes of metal remains"

Information source: Cerny and Schroll, 1995 (non NI 43-101).

Historic mining occurred in mineralization formed in stratiform zones ranging from 1 m thick by 100 m in diameter to 5 m thick and several hundred m in diameter. Indications are that there is substantial hanging wall mineralization not yet exploited in parts of the mine, as the footwalls were primarily targeted. in the later years of production the past operators shifted from chasing smaller sulphide pods and began chasing larger zones that were slightly less in grade but were move voluminous.

Several highly prospective exploration targets: Targets consist of two new zones, one in the hanging wall of the known structure, the other across the fault in the western section of the property.

There are three large apparently mineralized lenses that are expected to be part of initial exploration focus for Tasca going forward, and help provide a good shot at that 30M to 50M t of Zinc-Lead ore. There is a tunnel that is ~15 km long and that hooks up with another tunnel that is 8 km, it is above the water table so it is an adit that drains -- Tasca's exploration team will be able to go in and use that right off the bat. The property size is large and exploration potential is highly prospective for discovery. The same type of rock continues on other areas of the property.

The deposit is

Mississippi Valley type with stratabound lead and zinc mineralization in Triassic lagoon facies limestones and intercalated carbonates.

Exceptional risk-reward characteristics:

Exceptional risk-reward characteristics: Strengthening prices for

zinc,

lead and increasing demand for

germanium (used in fibre-optic systems, infrared optics, solar cell applications, light-emitting diodes, and some types of semiconductors) makes the Bleiberg Zn-Pb-Ge Property a good project for quick asset appreciation, especially considering the mine has already proven itself with stellar grades and historic past production.

Additional related insight on Tasca Resources Ltd. may be viewed at

https://miningmarketwatch.net/tac.htm online.

--- --- --- --- --- --- --- --- ---

James O’Rourke

James is a freelance information services professional for various media relation firms and consultant to several publicly traded entities. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors and is the managing director of Mining MarketWatch Journal. His articles have been published on over 400 websites, including: Yahoo Finance, Market Intelligence Center, MarketWatch, WallStreetJournal, USAToday, FinancialPost, BayStreet, Financial Content, Ibtimes, Oil&GasJournal, Moneytalks, SeekingAlpha.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Technical mining terms used by the writer may be used/expressed in simplified layman terms and should not be relied upon as appropriate for making investment decisions unless the reader contacts the company directly for independent verification. The author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. James does not currently own shares of Tasca Resources Ltd. – TAC.V however intends to accumulate.