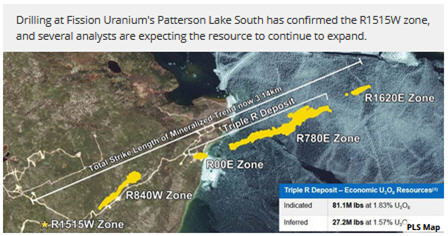

Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE) announced that follow-up drilling on the R1515W zone of the Patterson Lake South (PLS) project in Canada's Athabasca Basin region has confirmed the high-grade discovery that the company first announced on March 20. Fission has completed drilling two of the four follow-up holes, and they provide the strongest mineralization yet encountered at the high-grade, near-surface and land-based zone.

Ross McElroy, president, COO and chief geologist for Fission commented, "PLS17-553 is the second strongly mineralized hole in the newly discovered zone and confirms the potential for significant widths and high-grade radioactivity. The R1515W is the western-most zone of high-grade mineralization on our Patterson Lake Corridor trend and expands the strike-length of our high-grade mineralized foot-print to 3.14km—the largest in the region. . .it is open in multiple directions and we look forward to the next two holes of our follow-up drilling."

David Talbot, an analyst with Eight Capital, noted on April 4 that the R1515W zone may see further expansion, writing that it is the "third land based zone, and occurs near surface (185m depth), potentially high grade, and open in several directions including along strike. R1515W zone is not included in current resources or PEA. Provides further upside for future economic studies." He has a Buy rating and a target price of CA$2.25.

Analyst Rob Chang with Cantor Fitzgerald wrote on April 4, "While still early stage, the R1515W zone may provide yet another additional source of uranium pounds for Patterson Lake South. We reiterate our BUY recommendation."

Heiko Ihle, an analyst with Rodman & Renshaw, noted that the discovery has increased the strike length of PLS from 2.63 kilometers to 3.14 kilometers and commented that "the quick positive results of follow up drilling at R1515W bodes well for further exploration success at the zone and [we] think results from the next two drill holes may be positive."

Ihle also stated that he believes Fission should remain "somewhat insulated from the current uranium environment. While uranium prices continue to languish below $24.00 per pound, we remain confident that Fission's world class development stage project should continue to provide investors shelter from current prices. To this end, given that PLS is a non-producing asset, Fission is not forced to sell the project's resources into a depressed market. . .we currently envision PLS entering production in 2023. In our opinion, the timing of PLS coming online should coincide with when we expect utilities to re-enter the market as by 2025 over 80% of utility requirements are expected to be unmet."

Ihle concluded by noting Rodman & Renshaw continues "to view Fission as a potential takeover target." The firm has a Buy rating and a $1.70 target price on Fission Uranium.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Fission Uranium Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article

Disclosures from Eight Capital, Fission Uranium Inc. Comment, April 4, 2017

Eight Capital has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria, the quality of research and the value of the services they provide to clients of Eight Capital. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts and associates do not receive compensation based upon revenues from specific investment banking transactions.

Research Analyst Certification: Each Research Analyst and/or Associate who is involved in the preparation of this research report hereby certifies that:

•the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report;

•his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report;

•they have not affected a trade in a security of any class of the issuer whether directly or indirectly through derivatives within the 30-day period prior to the publication of this research report;

•they have not distributed or discussed this Research Report to/with the issuer, investment banking at Eight Capital or any other third party except for the sole purpose of verifying factual information;

•they are unaware of any other potential conflicts of interest.

The Research Analyst involved in the preparation of this research report does not have any authority whatsoever (actual, implied or apparent) to act on behalf of any issuer mentioned in this research report.

Eight Capital generally restricts any research analyst/associate and any member of his or her household from executing trades in the securities of a company that such research analyst covers, with limited exception.

Cantor Fitzgerald, April 4, 2017 Comment, Fission Uranium Inc.; Disclosures as of Feb. 6, 2017 Report. Facts may have changed.

Potential conflicts of interest

The author of this report is compensated based in part on the overall revenues of CFCC, a portion of which are generated by investment banking activities. Cantor may have had, or seek to have, an investment banking relationship with companies mentioned in this report. CFCC and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. Although CFCC makes every effort possible to avoid conflicts of interest, readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

CFCC has provided not investment banking services nor received investment banking related compensation from Fission Uranium within the past 12 months.

The analysts responsible for this research report have, either directly or indirectly, a long or short position in the shares or options of Fission Uranium.

The analyst responsible for this report has visited the material operations of Fission Uranium. No payment or reimbursement was received for the related travel costs.

Analyst certification: The research analyst whose name appears on this report hereby certifies that the opinions and recommendations expressed herein accurately reflect his personal views about the securities, issuers or industries discussed herein.

Rodman & Renshaw, Fission Uranium Corp. Company Update, April 5, 2017

I, Heiko F. Ihle, CFA and Jake Sekelsky , certify that 1) all of the views expressed in this report accurately reflect my personal views about any and all subject securities or issuers discussed; and 2) no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views expressed in this research report; and 3) neither myself nor any members of my household is an officer, director or advisory board member of these companies.

None of the research analysts or the research analyst’s household has a financial interest in the securities of (including, without limitation, any option, right, warrant, future, long or short position).

As of March 31, 2017 neither the Firm nor its affiliates beneficially own 1% or more of any class of common equity securities of Fission Uranium Corp.

Neither the research analyst nor the Firm has any material conflict of interest in of which the research analyst knows or has reason to know at the time of publication of this research report.

The research analyst principally responsible for preparation of the report does not receive compensation that is based upon any

specific investment banking services or transaction but is compensated based on factors including total revenue and profitability of the Firm, a substantial portion of which is derived from investment banking services.

The Firm or its affiliates did not receive compensation from Fission Uranium Corp. for investment banking services within twelve months before, but will seek compensation from the companies mentioned in this report for investment banking services within three months following publication of the research report.

The Firm does not make a market in Fission Uranium Corp. as of the date of this research report.