In a June 22 press release, DURECT Corp. (DRRX:NASDAQ) announced that it has completed enrollment for its Phase 3 PERSIST trial for Posimir, "an investigational locally acting, non-opioid analgesic intended to provide up to three days of continuous pain relief after surgery."

Moreover, as Ed Arce, an analyst with H. C. Wainwright, noted in a June 23 research report, the trial enrolled more rapidly than anticipated, and also included more patients. "The expected enrollment number for PERSIST was 264 patients, [but] actual enrollment was notably higher, at 296 patients, as a result of rapid enrollment toward the end of the trial," Arce wrote. "Early completion of enrollment for PERSIST, at 12% higher enrollment than targeted, has positive implications for Posimir."

Delving deeper, Arce laid out "three important positive implications" of the trial enrollment news. "First, a higher enrollment number may indicate increased physician and patient interest in Posimir. Second, having significantly more patients strengthens the statistical robustness of PERSIST results. Third, at minimum, a higher enrollment will provide a higher patient count for the NDA (new drug application) safety database," Arce explained. "Lastly, we also note that the final screen failure rate in PERSIST is lower than planned. In our view, and aside from Posimir itself, the clear interest in PERSIST speaks to the clinical need for new non-opioid options for post-operative pain management."

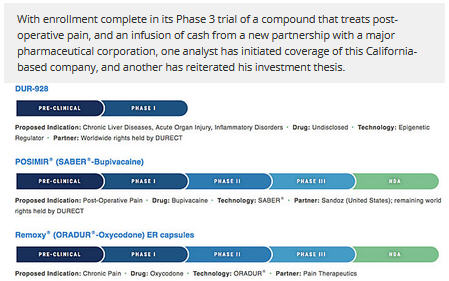

In a June 29 report initiating coverage on DURECT, Patrick Dolezal, an analyst with LifeSci Capital, cited the promise of DURECT's DUR-928 in chronic liver diseases, acute organ injury and inflammatory disorders, as well as its progress with Posimir for treatment of post-operative pain and its development and commercialization agreement with Sandoz (a division of Novartis AG [NVS:NYSE]), announced in May.

Under the terms of the agreement, which cleared formal review and became effective earlier in June, Sandoz "has made an upfront payment to DURECT of $20 million, with the potential for up to an additional $43 million in development and regulatory milestones, up to an additional $230 million in sales-based milestones, as well as a tiered double-digit royalty on product sales in the United States," according to the company.

"DURECT remains responsible for the completion of the ongoing PERSIST Phase 3 clinical trial for POSIMIR as well as FDA interactions through approval," the June 19 press release states.

LifeSci Capital looks favorably on the agreement between Sandoz and DURECT. "We view Sandoz as a partner well suited for Posimir, as the company has a dedicated hospital sales and marketing organization with relationships and experience that could help drive adoption," Dolezal stated.

Dolezal also commented on the market potential for Posimir. "There is a large market opportunity for post-surgical pain treatments, exemplified by the 28 million surgical procedures that used a local anesthetic in the US in 2015 and 32 million that are expected to occur in 2020," he wrote. "Post-operative pain occurs after more than 80% of surgical operations and is only controlled in about half of patients. Commonly used local anesthetics to manage post-operative pain are generic bupivacaine, ropivacaine, and Pacira Pharmaceuticals' (PCRX:NASDAQ) Exparel (liposomal bupivacaine). 28,539,647 vials of these agents sold in the US between June 30, 2015 and June 30, 2016. Based on Exparel's WAC of $285, which is the main branded competitor of Posimir, a 15% penetration in this market could be more than a $1.0 billion opportunity."

Arce also commented on the market potential for Posimir. "We believe Sandoz's expectations for peak U.S. annual Posimir sales are greater than $300M, equal to 2017 consensus for Exparel marketed by Pacira, and representing only ~3% of the total addressable market of 30M annual surgical procedures," the analyst stated.

"We continue to expect a positive readout of PERSIST," Arce continued. "Top line data is expected in 4Q17 (we believe October is likely). Our confidence that this trial reads out positively is based on the following: 1) Given that in a previous smaller study of 50 patients that followed the same surgical model, Posimir achieved ~25% reduction in pain intensity over the first 3 days after surgery (p=0.024), versus bupivacaine as active control, we believe that PERSIST will show comparable results; 2) With the early completion of enrollment and higher than expected enrollment number, we believe a positive readout of PERSIST has been incrementally more de-risked compared to other Phase 3 pain studies."

Dolezal addressed another aspect of Posimir that he views favorably. "Posimir can be delivered via instillation, which allows for drug administration directly into the surgical incision," he explained. "Compared to other local anesthetics, which typically require multiple injections along a surgical site, instillation offers fast and broad drug administration, reducing the variability of analgesia between surgery types and treatment centers, and can be used in a wider range of procedures. Anesthesiologists we spoke with felt than a local anesthetic delivered as an instillation could be a favorable option for ER wounds, where injectable local anesthetics are not currently used."

Other products in the DURECT pipeline include Remoxy ER, an extended-release formulation of the opioid pain reliever oxycodone with an abuse-deterrent technology, and compounds that address attention deficit hyperactivity disorder, schizophrenia, bipolar I disorder and post-herpetic neuralgia.