One of the largest surface outlines in the world; 3.22km2 of surface graphite mineralization, 89% large - super jumbo flakes, no impurities.

SRG Graphite Inc. (TSX-V: SRG) is a Canadian-based mining company focused on advancing its 100%-owned Lola Graphite Deposit in Guinea toward a Pre Feasibility Study by the end of this 2017, and Feasibility/production decision in mid-2018. If everything goes to plan the marketplace should be able to recognize a substantially higher value for the asset, one of the best graphite assets in the world due to its size (8.7 km long with average depth of 370m at surface), the quality of the mineral (89% of graphite flakes are super-jumbo, jumbo, and large, with weathering of the top ~20 m allowing for freeing of flakes, grades up to 20% carbon with no impurities), the stability and friendliness of the jurisdiction, geographically it is on the west side of Africa with direct access to North America and Europe, and with a very strong management team (including the founder of SEMAFO) at the helm able to fast-track the project thru to production decision. A decision that will see SRG selling some of the highest quality graphite available, with an optimal distribution of flakes, in an expanding market.

Fig. 1 (above)

Fig. 1 (above) SRG Graphite Inc. invited to open TSX-V Market for the first trading day in October-2017. Since listing in 2017, SRG has created an increase >$40M in shareholder value.

SRG.V currently has a market cap of ~C$52 million (~58 million shares outstanding trading at ~90 cents, with no warrant pressure over its head (~$65M fully diluted)), miniscule compared to other companies with meaningful graphite deposits in the world (see comparison further below) which SRG has advantages over in terms of quality. The share price is apt to appreciate as the Company accomplishes near-term milestones. SRG Graphite Inc., was recently formed (in January 2017) as a standalone Company to receive its flagship asset (the Lola Graphite Property) from Sama Resources (which is busy advancing its own flagship asset in another African country). Sama Resources retains ~43% of the outstanding shares of SRG after the spin-out and recent capitalization, Coris Capital out of Africa owns ~13%, and insiders own ~4% = ~60% in total in very strong hands. It has been a low profile transaction up to now, however that won't last -- going into October-2017 SRG has ~C$3.2 million in the bank, sufficient to complete all objectives through to Feasibility/production decision mid-2018, no further dilution is required.

Figure 2. (below) Comparison of SRG Graphite Inc. to other deposits

SRG is at a key stage of value creation and on sale

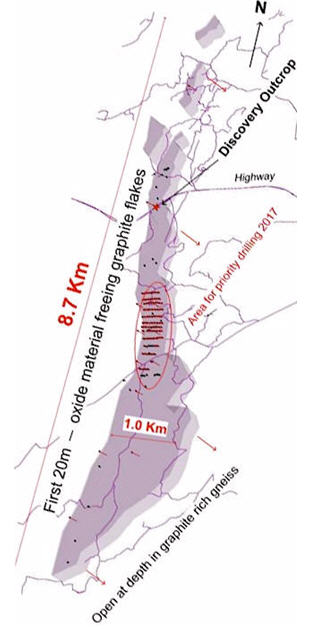

SRG is at a key stage of value creation and on sale; SRG compared to other projects is still very cheap at its current market cap; the comparable deposits portrayed in the image above adjacent the Lola Graphite deposit are in Africa (and of lesser quality graphite), Mason is in Quebec. Each has their own specs and have varying levels of development/improvements, so always never a straight comparison, however it is clear SRG is poised for upside revaluation -- the area (the red ellipse area seen in the image) SRG is targeting for the resource that it will publish later this year with its scoping study is expected to cover ~16% of the surface area of the deposit and involves only the top oxide portion (weathered zone). Compared SRG to Syrah Resources, which has a >US$1 Billion market cap., Syrah only has the one deposit in Mozambique, both comparables are on the same scale in the image above -- you can see the two proposed pits for Syrah are 3.2 km apart and about the same size as the red ellipse area of SRG, clearly SRG is set for significant upside revaluation if all goes to plan.

Figure 3. (above) Outcrop

Figure 3. (above) Outcrop - the vegetation has been peeled back to expose the graphite mineralization properly and sampled in the middle.

No geological risk, no metallurgical risk, no mining risk, no environmental risk: Interesting for shareholders is that 1) there is no geological risk; the discovery is made. 2) There is no metallurgical risk; the met tests are done and highly favorable. 3) Investors can also can also tick off the mining risk, as it is at surface (not an underground mine). 4) There is no environmental risk; there are no people to move from the deposit and the local village is supportive, and whatever waste SRG is going to put back into the ground after processing is harmless as there is no deleterious chemical elements used in floatation. 5) Execution risk is addressed as SRG has highly experienced mining professionals (e.g. Marc-Antoine Audet, BSc, MSc and Ph.D (Geology), P.Geo, and Benoit La Salle, FCPA, FCA, MBA) that have done this for the past 30 years with no flaws or failures to speak of. Essentially success for SRG from here boils down to execution on the pre-feasibility and feasibility.

Synopsis of a world-class graphite deposit:

The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest surface outlines in the world.

Figure 4. (below) 3D image of the deposit - The 3D image of the deposit show in grey the outline of the paragonite that is enriched with graphite, it is the outline SRG has mapped at surface of what can be seen visibly.

The Lola Graphite deposit is 8.7 km long with an avg. width of 370 meters. This Mining Journal projects* (*non 43-101) there is

upwards of 150 years of production in the top 20 meters of weathered material alone (calculated using 3.2 sq. km, density of 1.6, 60% of the surface area going through a plant at ~400,000 t/year, yielding 24,000t of concentrate per year), and then there is the rock under that 20 m which is rich too.

Obviously it makes no sense to drill the entire deposit now. The first-pass resource, for the scoping study that SRG is looking to deliver by the end of 2017, will come from its focused drilling of the indicated red ellipse area covering 16% of the deposit, and this Mining Journal believes* this first-pass will give SRG 15 - 20 years (at a removal rate of ~25,000t of concentrate/yr.) of first production.

Weathering advantage of top ~20 m: The first 20 meters or so of the deposit are well weathered (lateralized), freeing graphite flakes from the silicate gangue and allowing for an easy grinding with optimal recovery of all large and jumbo flakes. The weathering action from the sun and rain has occurred over millions of years, rotting the rock and causing the mobile elements to escape the rock, leaving behind immobile elements in the soil without organic material. Weathering makes the material amenable to easy low-cost removal as it is very easy to dig (e.g. with a backhoe), explosives are not needed. The weathered profile of the deposit is anywhere from 20 m to 30 m and in some places down to 50 m. The weathered material makes for easier processing too, it requires only gentle crushing to recover all the flakes. The majority of other deposits, around the world, and especially those in North America, are in hard rock structures, making them much harder to mine and much more difficult from a metallurgical standpoint. The Lola Graphite Deposit, within the top 20 m - 30 m, is like a sandbox with the graphite flakes freed from weathering, making them easy to recover.

The graphite mineralization extends deep under the top oxide layer within the nonweathered sheared gneiss.

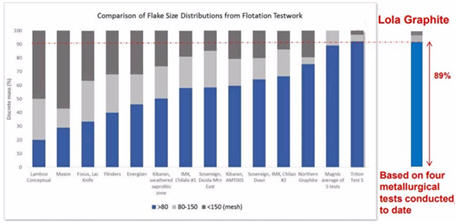

Flake size advantage; 89% of graphite flakes are super-jumbo, jumbo, and large (>0.18 mm):

The flake distribution found in graphite at the Lola Graphite Deposit is a unique occurrence, very few deposits in the world can compare. Being dominant large - super-jumbo flakes will allow SRG to market its deposit to all sectors of the economy and cater to the whole range of industries. Most graphite deposits in the world do not have as good a flake distribution as SRG and are pigeon-holed into intensive processing options characterized by low yields, high costs, and low margin, such selling graphite for Li-ion batteries. A large portion of the graphite market involves other aspects of the economy that demand larger flakes, such as steel/foundry/refractory, lubricants, composite parts (used in aerospace) and other specialty uses. A lot of buyers are looking for large flakes and are prepared to pay a premium because they realize these large flakes have a significant advantage.

Comparison of Flake Size Distribution

Table 1. (above) Comparison of flake size distribution

Table 1. (above) Comparison of flake size distribution from various selected published sources. This table image of comparisons (above) was actually published by Triton located in Mozambique, they claim flake distribution similar to SRG; ~89% large - super-jumbo flake size -- as you can see there are not many in that pedigree. Not shown in the above table is the purity, SRG is absent impurities, some deposits have issues in removing impurities.

Favorable metallurgy - free from impurities: Preliminary metallurgical tests on the top 20 m of oxide material returned excellent results. The graphite concentrate appears to be exempt of contaminants (Cu, Mo, V, etc) that are often seen in problematic concentrations in graphite concentrates from numerous other graphite deposits around the world and particularly in southern Africa. Mineralogical studies show that all the sulphide minerals have been naturally leached from the oxide facies, resulting in a chemically purer concentrate. For the same reason, the tailings are also expected to be non-acid generating.

The absence of impurities at the Lola Graphite Deposit can be traced to the origin on the carbon. Unlike most other deposits which were created from organics matter (with impurities) deposited, the Lola Deposit is at least 3.6B+ years old and has no organic composition to it as a carbon that has come from the earths mantel (deep inside the earth).

The following URLs have been identified For further DD on SRG Graphite:

- SRG Graphite Inc. Company website:

https://srggraphite.com

- SEDAR filings:

Click here

- Mining Journal article on SRG:

https://miningmarketwatch.net/srg.htm

James O’Rourke

James is a freelance information services professional for various media relation firms and financial publications. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors and is the managing director of Mining MarketWatch Journal.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Technical mining terms used by the writer may be used/expressed in simplified layman terms and should not be relied upon as appropriate for making investment decisions unless the reader contacts the company directly for independent verification. The author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. James does not currently own shares of SRG Graphite Inc.. – SRG.V however intends to accumulate.