Jaxon is set to advance significant discoveries in BC’s Skeena Arch and Golden Triangle

BC's Golden Triangle and Skeena Arch became world-renown for mining long before Queen Victoria approved the confederation of Canada. In 1861 a prospector by the name of Alexander “Buck” Choquette made a gold discovery which sparked the Stikine Gold Rush. During their long history, these phenomenally prolific districts produced millions of ounces of gold as well as other base and precious metals. Each hosting legendary mines such as Premier, Snip, Eskay Creek, Red Chris, Dome, Endako and Bell. In fact, Skeena Arch boasts some of the most richly endowed terrain in British Columbia with hundreds of known polymetallic veins and porphyry deposits.

However, even with a century of proven exploration and production, the remote beauty of both Golden Triangle and Skeena Arch have kept them relatively untapped. Now that infrastructure has radically improved, and precious metals have begun the upward curve of a new supercycle, these regions are experiencing yet another boom of excited activity.

One of the many explorers working to dig up a fortune in both these mineral-rich districts is Canadian-based Jaxon Mining (TSXV: JAX). Over the past year, Jaxon strategically acquired two massive, highly-prospective holdings: More Creek, encompassing 24,550 hectares approximately 50 kilometres north of Eskay Creek in the Golden Triangle, and the company's flagship project, Hazelton, forty kilometres north of Smithers in the Skeena Arch.

Hazelton Project spans an incredible 39,426 hectares and holds some intriguing possibilities for Jaxon and its investors.

Company Director and President, Jason Cubitt, joined the Jaxon story November 2016, "At that time Jaxon was a clean sheet and had just begun to bring on an interesting prospect called Price Creek that later was named Hazelton. We made Hazelton our focus and built the company's mandate around it."

And for good reason. Price Creek had some impressive historical showings: specifically, one known as the Knoll which was in the late 90s labeled by geologists as an Eskay Creek lookalike. A glowing comparison if you consider Eskay Creek was once the world's highest-grade gold mine (48 g/t) and fifth-largest silver mine by volume.

Not far from Knoll was another historic showing known as the Max which Cubitt went on to describe, "At that location, there was some fantastic high-grade silver and zinc at surface in these massive sulfide beds. We saw surface samples of up to 3.4 kilograms per ton silver and 20-30% zinc. Putting these two showings together, we began to wonder if the whole district might be mineralized."

Through a series of strategic acquisitions Jaxon expanded its holdings and by May 2017 was in control of a massive district-sized land package in Skeena Arch.

After closing a private placement with some considerable insider involvement, Jaxon announced that it would begin field work at Hazelton to prove up the 3.0 million dollars worth of historical data it picked up building Hazelton. This new program would include mechanical trenching, induced polarization surveys and exploration drilling.

Cubitt added, "Beyond confirming the good work done by previous private operators, we also wanted to see if we could tie some of these results together and really establish some scope and scale for the project, and most importantly, some continuity between outcroppings."

Therefore, early in the program, Jaxon brought on a structural geologist to give the company an understanding of what was going on at surface. The company also carried out a fair amount of channel sampling to gain an understanding of width and extent.

All this work combined with data from a previous VTEM survey and a new IP survey near the end of the season allowed Jaxon to put together a fine-grained 3D interpretation of what lay beneath the surface.

Cubitt explained those results, "From this model, we seemed to see some good anomalies, conductivity and chargeability that looked to be associated with what we were seeing at surface. It all seemed to tie together very well."

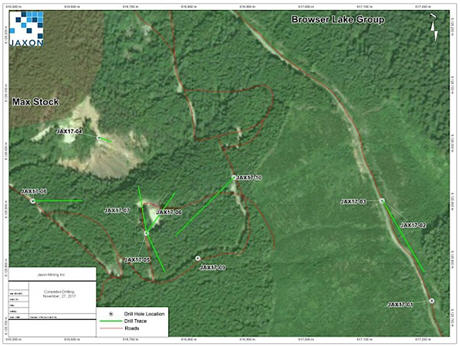

Jaxon is ending their 2017 work season with a 2,000-metre diamond drill program. (see drill plan map below)

In recent news, the company drilled a total of 2,281 metres in 12 diamond drill holes. The inaugural drill program was a success and core logging is almost complete. Core samples are heading to MS Analytical Laboratories in Langley, BC, but with the high volume of late season work at the lab, results may be delayed.

In recent news, the company drilled a total of 2,281 metres in 12 diamond drill holes. The inaugural drill program was a success and core logging is almost complete. Core samples are heading to MS Analytical Laboratories in Langley, BC, but with the high volume of late season work at the lab, results may be delayed.

However preliminary observation of the cores shows volcanic-hosted sulfides, zinc sulfides and intersections of various widths of semi-massive to massive stratiform bedding parallel sulfides.

Cubitt hopes to have final results in January and plans to use 2018 to follow up on this year's work. Currently the company's program covers a 2,500-square kilometre patch of Hazelton, but with nearly 40,000 hectares left to discover, Jaxon has more than enough to keep itself busy for years to come.

Does Jaxon have the financial staying power to follow through on its mandate? Well, the company has about 65.0 million shares outstanding and just last week closed $1.5 million dollars of flow-through financing with about $1.0 million in in the till. The books seem solid.

Who are some of the key players and what do they bring to the table that will enable Jaxon to drive forward? Cubitt has 25 years working with resource companies as founder, finance agent and institutional investor. Then you have Carl Swenson, VP of Exploration. Swenson is a 20-year veteran whose extensive career including acting as Chief Geologist, Exploration for Normandy Mining from '98 to '02 when the company went from less than $100 million to a $4.6 billion market cap.

Executive team aside, Jaxon's Chairman and Lead Director, John King Burns, is a mining icon. The former Global Head and Managing Director of the Derivative Trading and Structured Finance Group at Barclays Metals London, a division of Barclay's Bank, is also former Chairman and founder of Northern Orion, which was snapped up by Yamana Gold for $1.0 billion.

Another key character in the Jaxon family is Director Tony Guo, a 30-year industry veteran. Dr. Guo is a member of the Technical Committee of Zijin Midas Exploration Fund, a significant investor in Jaxon and subsidiary of Hong Kong-listed Zijin Mining Group, the world's largest gold producer by revenue.

Zijin Midas Exploration Fund is heavily invested in Skeena Arch and its backing of Jaxon is a serious feather in the junior's cap.

Cubitt summed up why investors should put Jaxon on their radar, "Quality of the assets and first-rate management. We're something of a first mover in this area of the Skeena Arch and it's evident there's a mineralized system we're working on. This kind of scale with a company this size and of this value, I think is remarkable. Also, More Creek hasn't even been priced into company, so I think you could consider that a carry and quite frankly, More Creek could be a company maker within itself."

Jaxon, with its high-grade assets, storied team and deep financial backing, is an untold story in the making and as the company completes its work at Hazelton over the winter, investors may find themselves with a tremendous capital growth opportunity.