GFG Resources Inc. (GFG:TSX.V; GFGSF:OTCQB) and Rapier Gold Inc. (RPR:TSX.V) recently announced they have completed a transaction where GFG acquired all of the shares of Rapier, both issued and outstanding.

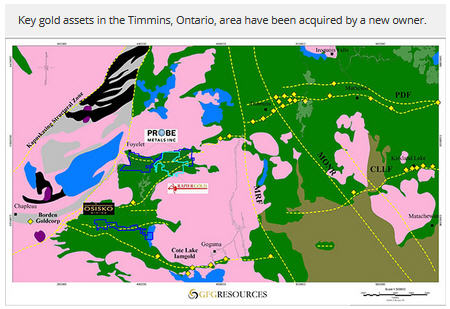

According to GFG, "the Arrangement was an integral part of the Company's recent land consolidation west of the prolific gold mining district of Timmins, Ontario."

GFG now oversees 700 square kilometers of gold assets in Ontario and Wyoming. The issued and outstanding common shares of Rapier were exchanged on the basis of 0.15 of a GFG common share for each Rapier common share.

"We are very pleased to complete the Rapier acquisition and welcome all Rapier shareholders and stakeholders. Our recent land consolidation in Ontario leverages our skill set and complements our strategy to control district scale gold projects that are highly prospective and located in tier one mining jurisdictions. We are excited about the discovery potential within this gold belt and will immediately begin to aggressively advance and explore our new 565 km2 land package," said Brian Skanderbeg, president and CEO of GFG.

Bob Moriarty of 321 Goldcommented on the deal the end of January when it was just taking shape, "In December of 2017 GFG announced a takeover deal with Rapier Gold and acquisitions of projects from Probe Metals and Osisko Mining in the Timmins District in Ontario. Not only will there be measurable progress twelve months a year, GFG can keep their technical people hard at work year round. I love the deal."

Craig Stanley, with Eight Capital, noted, "In addition to the acquisitions, GFG also announced a non-brokered private placement to raise gross proceeds of up to $7 M consisting of $2 M in flow-through common shares at $0.55/share and $5 M at $0.50/unit (one common share and one-half of a warrant with each whole warrant exercisable at $0.75 for 24 months). Pro forma, GFG will have approximately 87.1 M shares of which 58% will be held by current GFG shareholders, 17% held by Rapier shareholders, 7% held by Probe Metals, 1% held by Osisko Mining and 16% held by the purchasers of the Financing. Details about work programs on the newly acquired properties will be forthcoming, though GFG management expects to commence drilling as early as Q2/18.”