"Goliath will start drilling in high-grade mineralization -- the only question is how deep and what grade. The share share price of GOT.V appears to be a coiled spring."

Highly prospective for major Gold, Silver, and Copper discoveries of significance as indicators are strong.

Highly skilled technical team and management , in mining-friendly jurisdiction.

Goliath Resources Limited

(TSX-V: GOT) (Frankfurt: B4IE)

Share data, Capitalization, & Corporate info

Shares Outstanding: ~84.6 million

Fully Diluted: ~155M (average warrant strike price ~$0.18)

Recently Traded: ~CDN$0.18/share (TSX-V: GOT)

52 Week High/Low: $0.40/ 0.08

Current Market Capitalization: ~$15.22 million Canadian

Corporate Website: www.GoliathResourcesLtd.com

------ ------ ------ ------ ------ ------ ------ ------ ------

A very real possibility exists for investors to experience a major appreciation in share price when a discovery is announced. Analogies for what GOT.V investors have potential to see are what happened to the share prices of GT Gold Corp. (TSX-V: GTT) and Garibaldi Resources Corp. (TSX-V: GGI) when they hit their discovery drill holes in 2017:

Figure 1a & 1b (below) --

Charts of GTT ($0.20 to $2.76) and GGI ($0.12 to $5.27) showing what a discovery of significance can do.

If you made money on those discoveries in 2017 you will want to reload with GOT.V.

Valuation Commentary:

Goliath Resources Limited (TSX-V: GOT) (Frankfurt: B4IE) offers one of the best opportunities for extraordinary gains in the resource sector at the moment as it prepares to drill two of its four properties proximal to the Golden Triangle in British Columbia. The virgin targets which were previously under glaciers that only recently retreated are exposing exceptional Gold, Silver, and Copper mineralization at surface. GOT.V share price is apt to rise into drilling as the target indicators are of such quality it appears Goliath has potential to realize significant resources;

1) the 'Prosperity Bullseye Zone' on Goliaths' Lucky Strike Property is a drill ready target with strong and textbook porphyry potential, the zone registers high Au-Cu-Mo in-soil anomalies, believed to be the source of 6 oz nuggets historically found downstream in creeks encircling, and

2) the Copperhead Property will see exposed volcanic breccia targets drilled starting in 8% Copper and 45 g/t Silver mineralization at surface --

the only question is how deep and what grade.

Figure 1 & 2 (above) -- 1) Lucky Strike Prosperity Bullseye Zone Target

Figure 1 & 2 (above) -- 1) Lucky Strike Prosperity Bullseye Zone Target [

click to see video of Bullseye target] &

2) image of 11 metre Cu-Ag sample from Copperhead target at surface.

Both of Goliath's properties are highly prospective for major discovery from upcoming drilling this Summer-2018. The Copperhead Property has widespread highly mineralized volcanic breccia at surface, and Goliath's Lucky Strike Property's Prosperity Bullseye Zone, besides quality placer, also has a huge soil sampling grid that ticks all the boxes for porphyry, SkyTEM affirms this belief with the potential to be massive. In fact, the Prosperity Bullseye Zone has high-grade multi-ounce silver, and almost one ounce gold in bedrock at surface, with zinc, copper, and lead, which appears to be the by-product of a porphyry engine down below -- this porphyry appears to have caused pollymetallic quartz veining at surface which has been documented.

GOT.V currently has a market cap of ~$15.22 million (~84.6 million shares outstanding recently trading at $0.18/share), ~155M fully diluted (with most warrants at ~$0.18 strike price, exercising of warrants will bring in ~$11.5 million to the treasury to fund most of 2019). Entering the Summer-2018 Goliath Resources is cashed-up (having raised ~$3M in an oversubscribed financing in Q2-2018) to complete all its 2018 drilling and exploration plans. The current share float is closer to only ~33 million, there is believed to be a very large contingent of strong hands going into drilling later in 2018 -- the share price is apt to rise substantially pending fireworks.

The backstory on Goliath Resources Limited

The Founder, President & CEO of Goliath Resources is Roger Rosmus, MBA. He optioned the Company's 4 projects from the J2 Syndicate. The J2 Syndicate had explored from Terrace BC all the way North to the Yukon boarder, specifically looking for original elephant-size potential discoveries resulting from glacial and snowpack recession. Having funded the founder of the J2 Syndicate for many years (Mr. Rosmus is an individual well known in the mining industry for financing/nurturing mining ventures to successful fruition/hand-offs for decades, making money for investors), he had first dibs on the most prospective of J2's properties in 2016. Goliath Resources Limited was incorporated in February of 2017, and $2.2 million was privately raised (they had orders for $3.2 million); most of the people that were putting money into the deal were mining engineers, geologists, and people from the industry that could recognize that Goliath had something really special. All four properties have widespread high-grade mineralization of gold, copper, and/or silver at surface, in bedrock, splattered everywhere -- the bulk of the $2.2M went into the ground in 2017, exploring the ground on its four properties that had previously been hidden under glaciers for the last 15,000+ years and were being seen for the first time.

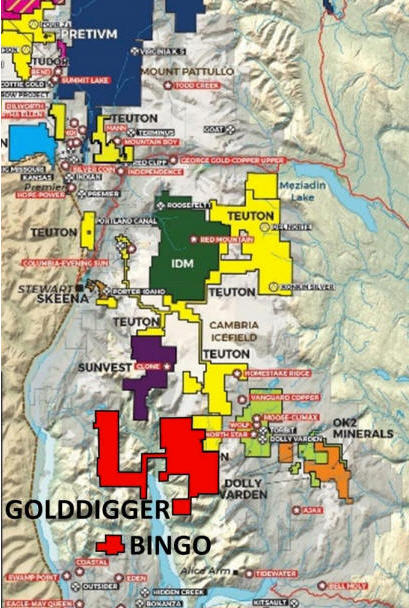

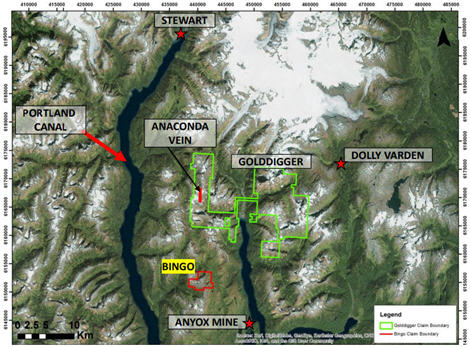

Figure 3 (above) -- Location Map of Goliath Resources Limited's 4 projects in prolific mining-friendly region

Figure 3 (above) -- Location Map of Goliath Resources Limited's 4 projects in prolific mining-friendly region -- Glaciers have melted (due to climate change) and the permanent snow pack is melting, revealing exceptionally highly-mineralized ground. GOT.V has an option to acquire 100% on 4 properties covering 44,003 hectares. In fact, Seabridge, which is in the Golden Triangle, credits climate change for uncovering Canada's biggest gold deposit.

Two of Goliaths' four properties, Golddigger and Bingo, are located in the southern tip of the prolific Golden Triangle near Stewart. The other two, which are the ones being drilled this 2018, Lucky Strike and Copperhead, are just to the south. Goliath is to the south, outside the triangle down near Terrace, where no one has spent a lot of time -- most of mining industry's focus has been in the triangle where the excitement and money flowed from the old Murray Pezim/Eskay Creek gold rush days. Goliath is not a rehash of old projects, it has all brand new discoveries. The majority of Goliath's claims had never had a BC Minfile registered. The Lucky Strike and Copperhead properties are located within the Skeena Arch, a world class geological setting, with a belt-scale structural corridor associated with significant porphyry and related mineralization.

All four properties have the potential to be a 'company-maker', one project on its own is enough to be company-makers. If Goliath Resources hits on all the projects it will likely dividend them out to the shareholders, create a new company, and finance each independently.

Goliath Resources' M.O.

The Company's business model is looking for new elephant-size projects that will tick all the boxes for senior mining companies to do a strategic investment, JV, and/or a potential take-out. Goliath is essentially a 'project generator', it has no intention of taking anything into production. Goliath will take its projects as far up the value curve, as far as it can, and at some point hand it off to the mining engineers and its job is done. 'Probability of success' is what Goliath is looking for.

Quality people are behind the management, governance, and technical team

We urge readers to view the CV's of key people at the bottom of this article, it is an impressive assemblage of talent. E.g.; Goliath's Senior Exploration and Corporate Development Consultant, Bill Chornobay, has seen a lot of press. He was lead on the team that discovered the Golden Mile in Ontario, which eventually got taken out by Argonaught for $327 million. He originally discovered the Coffee Creek asset up in the Yukon, the Supremo Zone, which was ultimately bought out by Goldcorp for $520 million. A couple years ago he did a $53 million JV with Newmont Mining on his brand new discovery that he generated in the Yukon. He has a proven track record with well over $1 billion in value by following this model that zeros-in on the big and obvious, that tick the boxes for majors, and intends on replicating success for Goliath Resources.

The Following is an overview of each of Goliath Resources Limited's projects:

#1) Lucky Strike Property, ~30 km North of Terrace, BC - 24,440 ha, 3% NSR on all with 1% buyback provision.

Stellar initial grab samples in 2016 came back 24.7 grams per tonne Gold, 172 grams per tonne Silver, 2.04% Copper and 6.3% Zinc, prompting staking. The Prosperity Bullseye Zone on Goliath Resources' Lucky Strike Property will be drilled this summer-2018.

Figure 4 (above) -- Lucky Strike Project claim map

Figure 4 (above) -- Lucky Strike Project claim map -- The reddish circle shows the location of the primary focus for GOT.V's 2018 drilling plans at Lucky Strike, the Prosperity Bullseye Zone. Goliath is in the right hunting ground for quality porphyry, and also more recently they've recognized VMS. Note the tributaries of Lorne Creek to the East (outside of the property claims) in the image above, ~50 years ago Newmont Mining was looking for porphyry there -- obviously they knew about these highly rich placer creeks with huge nuggets of gold -- but 50 years ago the Prosperity Bullseye was glacial, covered with ice and snow and inaccessible due to glacial ice and permanent snowpack. If the old timers could have gotten into Prosperity Bullseye Goliath Resources technical team would have found adits and the place would have been mined.

Infrastructure: Goliath's Lucky Strike Project has logging road access, is only 3 km to a major highway, power, and is only ~30 km (by Highway) north of major infrastructure in Terrace, BC.

Figure 5 (above) -- Image of Prosperity Bullseye Zone at Lucky Strike Project

Figure 5 (above) -- Image of Prosperity Bullseye Zone at Lucky Strike Project -- The reason the zone it is called 'Bullseye" is because of the gold laden creeks encircling a ~3.4 km x 2.4 km bullseye. The water stream comes right up to bench seen in the image above. There is gold in the placers that flow North, South, East, and West. You don't need to be a geologist to figure out where the gold is coming from here, and 6 oz gold nuggets don't swim upstream.

The Prosperity Bullseye Zone has all the making of a new massive porphyry discovery and is drill ready

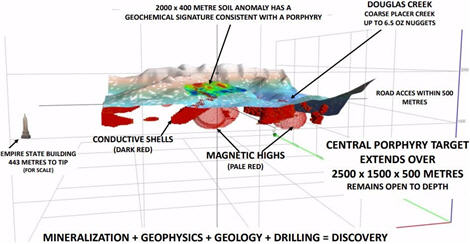

Figure 6 (above) -- 3D Model of Goliath's Lucky Strike Property Prosperity Bullseye Zone.

Figure 6 (above) -- 3D Model of Goliath's Lucky Strike Property Prosperity Bullseye Zone. With SkyTEM the modeling is a textbook porphyry, ~2.5 km x 1.5 km and at least 500m deep, with magnetic highs, and conductive shells. The big blob in the centre of this image is where Goliath will be drilling, in the middle, above where it did the positive soil geochem.

Click to view 3D Model Video of the Prosperity Bullseye Zone:

The Prosperity Bullseye Zone at Lucky Strike is 2.4km x 3.4km at the head waters of two prolific placer creeks and indicates strong Porphyry Potential; open in all directions.

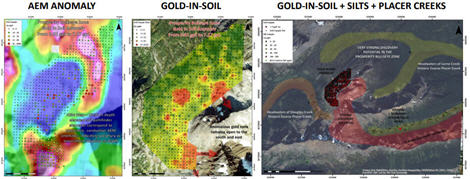

• SkyTEM electromagnetic aerial survey found concentric, highly conductive zones flanking magnetic highs, a classic porphyry signature extending over 2500 x 1500 x 500 metres and remains open to depth.

• Coincident with the SkyTEM geophysical anomaly soil geochemistry defined a 2000 x 400 metre zone of anomalous gold-copper-molybdenum. The zone remains open.

• The soil anomaly has a geochemical signature consistent with some porphyry systems.

Grab sample taken from an intrusive rock assayed 0.29% Mo, similar to other porphyry systems in this region.

• IP, trenching and mapping will be completed prior to drilling.

Soil sampling at Goliath's Lucky Strike Property Prosperity Bullseye Zone

Figure 7 (above) - Soil sampling grid;

Figure 7 (above) - Soil sampling grid; A 2 km x 400 m grid yielded up to 7.27 gpt Gold, 557 ppm Copper, 65 ppm Molybdenum, 50 ppm Tungsten, 4 ppm Antimony and 10 ppm Bismuth.

Figure 8 (above) - Anomalous block model, Prosperity Bullseye Zone.

Figure 8 (above) - Anomalous block model, Prosperity Bullseye Zone.

Figure 9 (above) - Prosperity Bullseye Zone Summary of porphyry indicators.

Figure 9 (above) - Prosperity Bullseye Zone Summary of porphyry indicators.

Figure 10 (above) - Close up view of alteration sample 25535

Figure 10 (above) - Close up view of alteration sample 25535 -- (µm = one millionth of a meter) Seen is porphyritic/equigranular intrusive rock with phyllic alteration and disseminated pyrite and chalcopyrite. Red dotted outline of fine-grained sericitized feldspar phenocrysts can be recognized in aplitic groundmass.

Sample results from soil samples as well as grabs from exposed bedrock occurring in polymetallic quartz veins at Prosperity Zone include:

Detailed Soil Sampling Grid 25 x 25 Metre Over an Area of 2000 x 400 Metres:

– up to 7.27 gpt Gold, 557 ppm Copper, 65 ppm Molybdenum, 50 ppm Tungsten, 4 ppm Antimony and 10 ppm Bismuth.

Channel Cut Over 0.21 Metres:

– 1.66 gpt Gold, 105 gpt Silver, 0.08% Copper, 0.39% Zinc and 5.45% Lead.

Chip over 1.2 Metres:

– 22.3 gpt Gold and 31.5 gpt Silver.

Grabs from exposed bedrock at surface:

– 0.29% Molybdenum similar to other porphyry systems in this region.

– 23.9 grams per tonne Gold and 32.2 grams per tonne Silver.

– 24.7 grams per tonne Gold, 172 grams per tonne Silver, 2.04% Copper and 6.3% Zinc.

– 1.53 grams per tonne Gold and 149 grams per tonne Silver.

– 0.3 grams per tonne Gold, 188 grams per tonne Silver, 0.41% Copper and 8.34% Lead.

– 1.6 grams per tonne Gold and 100 grams per tonne Silver.

– 122 grams per tonne Silver and 4% Lead.

2018 Plans at Goliath's Lucky Strike Property Prosperity Bullseye Zone: Goliath knows where it will drill. Drilling will start with a modest program of ~500 m to validate the porphyry.

Note: Goliath also is advancing the Kingpin Zone on the Lucky Strike Property, however that will not be a drill target for 2018. Details of the kingpin Zone may be located further below in this article under 'Other Projects/Properties' section.

------ ------ ------ ------ ------ ------ ------ ------ ------

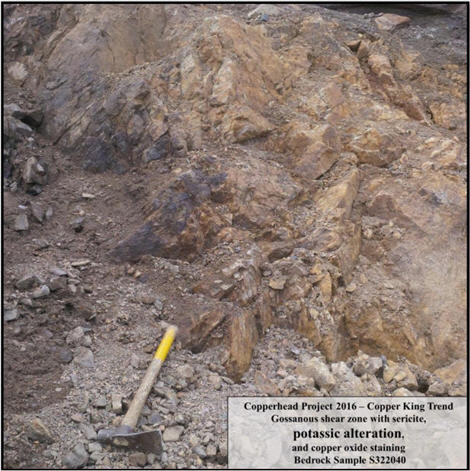

#2) Copperhead Property, ~40 km SW of Smithers, BC - 4,354 ha, 3% NSR on all with 1% buyback provision.

• Goliath will drill the Copperhead Property this summer-2018.

Figure 11 (above) Copperhead Property claims map.

Figure 11 (above) Copperhead Property claims map.

Copper King Trend is 2000 x 350 metres and has strong porphyry potential. The zone remains open in all directions.

SkyTEM aerial magnetics and electromagnetic data discovered an intense magnetic high and adjacent resistive zone, consistent with a hydrothermal alteration system.

Ground geophysics, trenching, and channel sampling will be completed prior to drilling.

Infrastructure: Goliath's Copperhead Project has logging road access, is ~3 km to a major road, power, and ~40 kilometres southwest of major infrastructure in Smithers, BC.

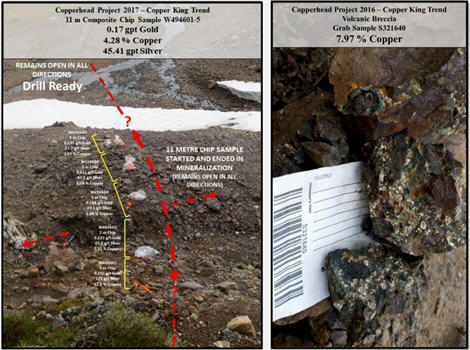

Figure 12 (above) Copperhead Property claims map, with image of 11 metre chip sample from target area.

Figure 12 (above) Copperhead Property claims map, with image of 11 metre chip sample from target area. Goliath has exceptional grades at surface and several drill ready targets.

The Copper King Trend is 2000 x 350 metres and has strong potential to be a large fault breccia system. The zone remains open in all directions.

Ground geophysics, trenching, and channel sampling will be completed prior to drilling.

Massive and semi-massive sulphide breccias are documented in an area of sparse outcrop over 450 metres with potassic alteration. Breccia grab samples of copper mineralization up to 7.97 %.

• Drill ready target at location of 11 metre chip sample from a volcanic breccia containing massive and semi-massive sulphides that returned 0.17 g/t Au, 4.28 % Cu, and 45.41 g/t Ag. The chip sample started and ended in mineralization that remains open.

• Drill ready target at location of 8 metre chip sample from breccia that returned 0.08 g/t Au, 1.57 % Cu, and 12.45 g/t Ag. The chip sample started and ended in mineralization that remains open.

Figure 13 & 14 (above) high quality widespread mineralization at surface.

Figure 13 & 14 (above) high quality widespread mineralization at surface.

Figure 15 (above) high quality widespread mineralization at surface.

2018 Plans at Goliath's Copperhead Property:

Figure 15 (above) high quality widespread mineralization at surface.

2018 Plans at Goliath's Copperhead Property: Goliath will certainly drill where it has ~8% copper at surface, and the area with ~4% and 45 g/t Silver mineralization as well, among others.

Recent news releases regarding Company accomplishments and operational developments:

• June 1, 2018

"Goliath Closes Oversubscribed Additional Financing of $1,645,855 For a Combined Raise Totaling $3,069,436".

• May 15, 2018

"Goliath Commences 2018 Exploration Program".

• Feb 26, 2018

"DSM Syndicate Discovers Large En Echelon Vein System That Assayed 1.57 Grams Per Tonne Gold From Bedrock Grab and 0.53 Grams Per Tonne Gold Over 2 Meters From a Chip Sample".

------ ------ ------ ------ ------ ------

Other Projects/Properties:

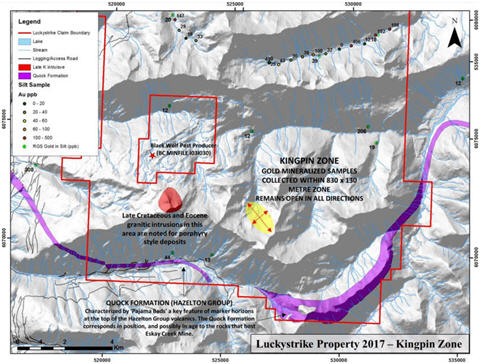

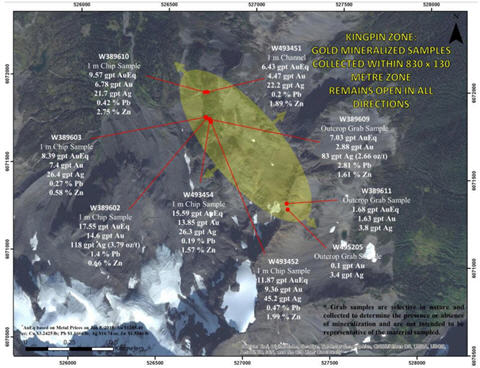

Lucky Strike Property - Kingpin Zone

• Strong Potential for Eskay Creek Style Mineralization

Figure 16 (above) - Map showing Kingpin Zone.

Figure 16 (above) - Map showing Kingpin Zone.

• Extensive bedrock polymetallic and gold mineralized samples over an

830 by 130 metre zone that remains open in all directions.

• The single

channel cut taken returned

6.43 g/t AuEq over 1metre.

• Incl. 4.47 g/t Au, 22.2 g/t Ag, 1.89 % Zn, and 0.2 % Pb

•1 metre chip sample returned 17.55 g/t AuEq.

• Incl. 14.6 g/t Au, 118 g/t Ag, 0.66 % Zn, and 1.4 % Pb

• Channel sampling, mapping, prospecting, and silting is

recommended to delineate drill targets.

•

Hazelton and Quock Fm. rocks were mapped along the southern

part of the property confirming the area has good potential for

Eskay Creek style mineralization.

Figure 17 & 18 (above) - Kingpin Zone mineralization.

Figure 17 & 18 (above) - Kingpin Zone mineralization.

Figure 19 (above) - Goliath's Kingpin Zone location map of highly mineralized samples.

Figure 19 (above) - Goliath's Kingpin Zone location map of highly mineralized samples.

------ ------ ------ ------ ------ ------ ------ ------ ------

Property #3) Bingo Property, Southern tip of Golden Triangle, BC

- 989 ha, 3% NSR on all with 1% buyback provision.

Figure 20 (above) Neighborhood map.

Figure 20 (above) Neighborhood map.

Figure 20 (above) Claims map

Figure 20 (above) Claims map -- Goliath's Bingo Property is located near tidewater southeast of Stewart, BC. located in the Golden Triangle.

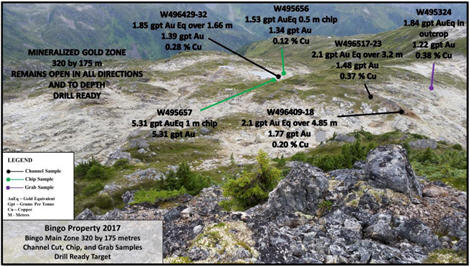

The Bingo Main Zone is a large stratabound horizon that contains gold mineralized grab, chip, and channel samples over an area of 320 metres 175 and remains open.

• The zone is very magnetic and the mineralized horizon will be traced to depth using ground magnetics in preparation for drilling in 2019.

• 83% of all the samples taken contained gold mineralization.

• Channel cut over 4.85 metres assayed 1.77 gpt Au, and 0.20 % Cu.

• Channel cut over 3.20 metres assayed 1.48 gpt Au and 0.37 % Cu.

• 19 chips samples assayed up to 9.79 gpt Au.

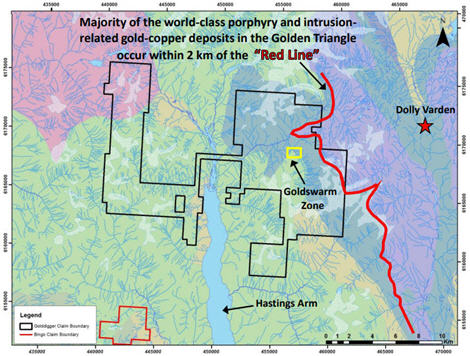

The property is located proximal to the unconformity between the Hazelton and Stuhini Group rocks, also known as the “Red Line”, the key location where the vast majority of major deposits have been found within the Golden Triangle.

Video of Bingo Main 2017 Channel cutting - Goliath Resources Ltd.:

Figure 21 (above) Bingo Property samples

Figure 21 (above) Bingo Property samples

Figure 22 (above) Bingo Property Main Zone

Property #4) Golddigger Property, Southern tip of Golden Triangle, BC

Figure 22 (above) Bingo Property Main Zone

Property #4) Golddigger Property, Southern tip of Golden Triangle, BC

- 15,559 ha, 3% NSR on all with 1% buyback provision.

Figure 23 (above) Claims map

Figure 23 (above) Claims map -- Goliath's Golddigger Property is located near tidewater southeast of Stewart, BC. located in the Golden Triangle.

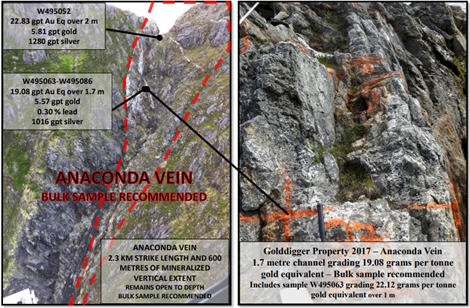

Anaconda Discovery: Bulk Sample Recommended

Anaconda Vein system has gold mineralization over a strike length of 2.3km, and has 600m of exposed vertical extent.

• Anaconda Vein channel cut assayed 22.83 gpt Au eq over 2 metres incl. 5.81 gpt Au and 1,280 gpt Ag.

• Anaconda Vein channel cut assayed 19.08 gpt Au eq over 1.7 metres incl. 5.57 gpt Au, 1,016 gpt Ag and 0.3 % Pb.

• Bulk sample recommended for the Anaconda Vein system to determine the economics.

The property is within two kilometres of the unconformity between Lower Hazelton and Stuhini rocks, also known as the “Red Line” the key location where the vast majority of major deposits have been found within the Golden Triangle.

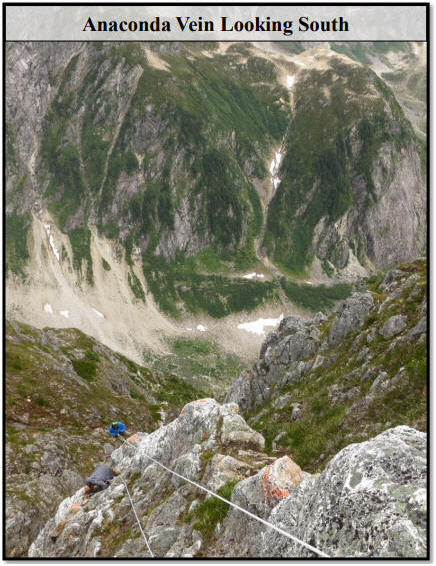

Figure 24 (above) Anaconda vein looking south, Golddigger Property.

Figure 24 (above) Anaconda vein looking south, Golddigger Property.

Figure 25 (above) Anaconda, Golddigger Property.

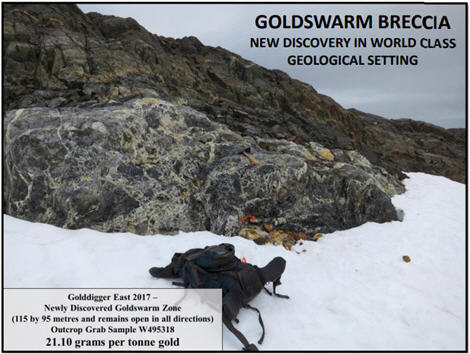

Golddigger Property, Goldswarm Discovery: World Class Potential

Figure 25 (above) Anaconda, Golddigger Property.

Golddigger Property, Goldswarm Discovery: World Class Potential

Figure 26 (above) Location of Goldswarm Zone on Goliath Resources' Golddigger Property.

Figure 26 (above) Location of Goldswarm Zone on Goliath Resources' Golddigger Property.

The Goldswarm Zone is within two kilometres of the unconformity between Lower Hazelton and Stuhini rocks, also known as the “Red Line” the key location where the vast majority of major deposits have been found within the Golden Triangle.

Geological mapping, prospecting and channel sampling is recommended to outline the full geometry of the Gold Swarm zone in preparation for drilling.

The new Goldswarm zone has tremendous potential to evolve into a new world class discovery.

Figure 27 (above) Goldswarm Zone on Goliath Resources' Golddigger Property.

Figure 27 (above) Goldswarm Zone on Goliath Resources' Golddigger Property.

Figure 28 (above) Breccia outcrop on Goliath Resources' Goldswarm Zone on Golddigger Property.

Figure 28 (above) Breccia outcrop on Goliath Resources' Goldswarm Zone on Golddigger Property.

------ ------ ------ ------ ------ ------ ------ ------ ------

#5) Goliath Resources' 10% interest in the DSM syndicate -- Project Generator Model

Goliath Resources put money into the deal and gets 10% of any economics generated from deals the syndicate does. DSM syndicate is fully funded for its second-pass 2018 exploration efforts.

About the DSM Syndicate

The DSM syndicate is a project generator focused on original discovery resulting from glacial and snowpack recession. DSM management, exploration, and technical teams have over 200 years of combined experience with a proven track record of success. Members of the DSM Exploration team have been recognized by their peers in the industry for several significant mineral discoveries over the last 30 years. The DSM Syndicate generated approximately 150 targets in North Western BC within a geological terrane that is host to many world class deposits. The targets were ground truthed during the summer and fall of 2017. Six properties were staked with the intent of optioning out to qualified parties.

Noteworthy projects that should return handsomely when vended out:

Money Property

(2018 Follow-up Exploration Fully Funded by DSM)

•Brand new 175 by 50 metre Goldzilla Zone bedrock discovery.

•No previous work in area

•One day total field time spent on the property.

•Five bedrock grab samples from polymetallic veins assayed above 10 g/t Au and up to 81.5 g/t Au (2.62 oz/t).

•Mineralized granodiorite intrusion with a grab sample containing 6.98 g/t Au.

Goldcrest Property

(2018 Follow-up Exploration Fully Funded by DSM)

•Brand new bedrock discovery of 750 by 100 metre Cadillac Trend.

•Remains open in all directions and no previous work in the area.

•A hydrothermal breccia and stockwork zone was traced over a 50 metre area within the Cadillac Trend (link to video).

•Grab samples containing anomalous gold and silver mineralization were collected from this breccia and the zone remains open in all directions.

•Bedrock grab samples assayed up to 3.16 g/t Au.

Skyhigh Property

(2018 Follow-up Exploration Fully Funded by DSM)

•Polymetallic and gold mineralized bedrock define the 700-metre-long Cloud 9 Zone that remains open in all directions.

•Grab sample from polymetallic vein material assayed 273.95 g/t AuEq.

•Chip samples from quartz veins returned 42.98 and 20.73 g/t AuEq.

•The Skyhigh Property covers 8 historic epithermal and Cu-Mo porphyry mineral occurrences dating back to the 1990’s. Rapid ongoing glacial and snowpack abatement provides for excellent additional potential.

Goldstar Property

(2018 Follow-up Exploration Fully Funded by DSM)

•Brand new bedrock discovery of 90 metre long Yellow Brick Road Zone.

•Remains open in all directions and no previous work in the area.

•Total field time of one day on the Goldstar property – excellent untapped potential.

•Six bedrock grab samples from polymetallic veins contained above 10 g/t AuEq and up to 76.25 g/t AuEq (2.22 oz/t).

# #

Goliath Resources Limited's Technical Leadership, Management, and Governance

The current management team and board of directors has a well rounded combination of people that each contribute expertise in disciplines necessary for a successful mining entity:

Richard Groome, BA, – Chairman and Director

Mr. Groome is a Corporate Finance entrepreneur and has started two successful securities firms in Canada from scratch in the 80’s and 90’s. He has actively managed or participated in over 400 financings representing ~$4 billion of small cap deals and is very well versed in start-up and early stage ventures. Mr. Groome’s passion for innovation carried him to be known as one of the preeminent financiers in Canada of small and medium sized emerging growth companies over the last 30 plus years. Prior to forming Notre Dame Capital, he was a co-founder of Marleau Lemire Inc.; which became quickly ranked as the number 1 firm in Canada in small, mid cap financings during the late 1980’s as well as Groome Capital Inc. This is where he created Canada’s leading underwriter of IPO’s, Private Placements and Secondary offerings on the Internet in the 1998 to 2000 period. The firm was subsequently sold to Desjardins Group in 2001, Canada’s seventh largest financial institution. Mr. Groome was a director of the CDNX Exchange, the predecessor of the TSX Venture exchange for several years, and currently sits on the boards of directors of private and public companies. He has a BA in Economics from McGill University.

Roger Rosmus, MBA, – President & Chief Executive Officer, Director

Mr. Rosmus is a co-founder and President of an independent investment bank Aberdeen Gould Capital Markets Ltd., a Toronto based Exempt Market Dealer. He has over 25 years of investment banking experience in the public and private sectors, acting as lead on many mergers, acquisitions and corporate financings. He is also the President and co-founder of Aberdeen Gould Advisory Services Ltd. that provides corporate advice encompassing strategic and operational strategies to private and public companies in the resource and industrial sectors. Previously he was the founder of Aberdeen Gould Inc., where he successfully completed over 30 M&A transactions, as well as owned and operated several businesses in a wide variety of industries. Mr. Rosmus holds an MBA from The University of Western Ontario – Richard Ivey School of Business.

Graham C. Warren, CPA, CMA, – Chief Financial Officer & Corporate Secretary, Director

Mr. Warren is a Senior Financial Executive with over 30 years of experience in the mining, oil and gas, environmental, biotech, service and tech sectors both domestically and internationally. He has been involved in numerous financings and M&A transactions for both private and public companies and has guided several companies through the going public process. Mr. Warren has served as CFO and/or Director of numerous public companies and is currently the CFO of Pangolin Diamonds Corp. and a reporting issuer Arehada Mining Limited. He is a past director of Changfeng Energy Inc., Cordoba Minerals Corp., Exile Resources Inc., Active Control Technology and Hanfeng Evergreen Inc. Mr. Warren has had extensive involvement in all facets of organizations including finance, human resources, sales, marketing and operations and has guided boards in their corporate governance obligations.

Louis Peloquin, BBA, LL.B, LL.M., – Director

Mr. Peloquin is a business consultant combining several specialties, including transactional law, and has extensive international experience in management, mergers and acquisitions, corporate development, government relations and corporate finance. He has developed a solid expertise in natural resources with over ten years’ experience as senior executive at major mining companies in Canada and the United States. Mr. Peloquin was a member of the management committees and senior executive of Golden Star Resources Ltd., an international mining company based in Denver, and of Quebec Cartier Mining Company (now Arcelor Mittal Mines Canada).

Michael A. Dehn, B.Sc, – Consulting Geologist and Director

Mr. Dehn has over 25 years of experience in the mining industry. Between 1994 and 2005, he worked as an exploration geologist and later as a Senior Geologist with Goldcorp Inc. Michael has been a director of publicly traded and private junior mining companies, with listings on the North American and European stock exchanges. His expertise lies in grassroots to advanced minerals exploration, marketing and financing junior companies.

Sam Ho, HBA, – COO

Mr. Ho is a co-founder of Aberdeen Gould Capital Markets Ltd., where he is involved in the firm’s Investment Banking activities. He is also the Vice President and co-founder of Aberdeen Gould Advisory Services Ltd. that provides corporate advice encompassing strategic and operational strategies to private and public companies in the resource and industrial sectors. He has over 15 years of corporate finance experience, and during his career, has worked at leading Canadian independent investment dealers. Mr. Ho holds an Honors Business Administration degree (with distinction) from The University of Western Ontario – Richard Ivey School of Business.

Stefan Kruse, Ph.D., P. Geo – Structural Geologist, – Chief Consulting Geologist

Dr. Kruse is a structural geologist specializing in structural controls on mineralization, from prospect to belt scale. His PhD dissertation focused on polyphase deformation and tectonic evolution in the Canadian Cordillera. Based on this work he was awarded the Governor General’s Academic Gold Medal award and GAC Structure and Tectonics division Best PhD award. Additionally, Dr. Kruse is a former lecturer and current Honorary Research Associate at the University of New Brunswick. Dr. Kruse is a registered professional geologist with the Association of Professional Engineers and Geoscientists of New Brunswick (APEGNB) and the Professional Engineers and Geoscientists of Newfoundland and Labrador (PEGNL).

Mr. Bill Chornobay, – Senior Exploration and Corporate Development Consultant

Mr. Chornobay a business man with over 30 years experience in negotiations, identifying and acquiring undervalued assets, corporate finance, corporate development, team building, and managing exploration programs in the Americas. He has held Board and Senior Management positions, and has been instrumental in raising over $150 million dollars in the resource sector. Mr. Chornobay is a leader , team and company builder who has provided the overall corporate vision and building blocks that are required to grow successful companies. He has extensive experience in project generation, acquisition, and management of several successful exploration programs resulting in discovery.

Mr. Chornobay is a firm believer in the untapped resource potential of Canada and his practical approach , team spirit , vision and project management have a long proven track record of success. A Project Generators 30 Year History 1987 to 2017 [click to view PDF].

Leon Daniels, Ph.D, BSc., BSc. Honours Geology, – Consulting Geologist

Dr. Leon Daniels has extensive exploration and production experience that spans over 35 years. He is the published author of numerous research papers relating to diamonds and associated minerals, and the exploration and development of kimberlites in various areas. Dr. Daniels worked for Falconbridge Exploration, Botswana, evaluating the 180 ha crater facies M1 kimberlite. He also discovered the DK4 kimberlite (the only kimberlite in the Orapa kimberlite field not discovered by De Beers, and more recently co- founded African Diamonds Plc (AIM: AFD), which was subsequently acquired by Lucara Diamond Corp. (TSX: LUC), a Lundin Group of companies in 2010, for $100,000,000. Dr. Leon Daniels is a member of the Australian Institute of Geoscientists.

Note: This article is not intended to be a complete overview of Goliath Resources Limited or a complete listing of Goliath Resources' projects. Mining MarketWatch urges the reader to contact the subject company and has identified the following sources for information:

For more information contact Goliath Resources Limited's head office at: Ph (416) 488.2887 ext.222

Company's web site:

www.goliathresourcesltd.com SEDAR Filings:

URL

*Content found herein is not investment advice see Terms of Use, Disclosure & Disclaimer. This is a journalistic article and the author is not a registered securities advisor, and opinions expressed should not be considered as investment advice to buy or sell securities, but rather journalistic opinion only. Technical mining terms used by the writer may be used/expressed in simplified layman terms and should not be relied upon as appropriate for making investment decisions unless the reader contacts the company directly for independent verification. *Estimates of potential made by the mining analyst and journal(s) are non 43-101 and not from the Company.