A ROTH Capital Partners report discussed the new drill results.

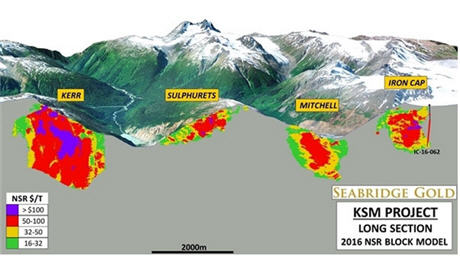

In an Oct. 31, 2018 research note, ROTH Capital Partners analyst Joe Reagor reported that the first two holes of Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) resource expansion drilling at Iron Cap "showed significant intervals of mineralization at higher grades than the average of the existing resource." He added, "We view this as a significant positive development." Iron Cap is part of the company's KSM project in British Columbia, Canada.

One recent Iron Cap highlight is hole IC-18-75, which intersected 582.7 meters averaging 0.59 grams per ton gold and 0.41% copper. Also "encouraging," the intercept encompassed two areas of higher grade mineralization, too, Reagor pointed out.

The analyst discussed the possible implications of these Iron Cap results. First, the findings suggest potential for further growth of the deposit there. "We believe continued positive drill results at Iron Cap could lead to a significant increase in Seabridge's resources at KSM."

Second, the results' "potential on mine sequencing" could improve the economics of a future mining project, Reagor suggested. Specifically, because the newly found mineralization is near KSM's Mitchell-Treaty Tunnel, Iron Cap could be included in a mine model with it. Were that to happen, mining at Kerr would likely be delayed, but that deposit has demonstrated lower average grades than those shown in these recent Iron Cap assays.

Reagor concluded by saying that while ROTH finds the latest news compelling, the investment banking firm will await further Iron Cap results that also suggest potential resource expansion before updating its price target on Seabridge. Therefore, ROTH's price target on the Buy-rated company remains at CA$17 per share. This compares to Seabridge's current stock price of about CA$12.93 per share.