Late one Saturday night, the movie A Fistful of Dollars came on TV.

At age 12, I was immediately drawn to Clint Eastwood’s character, “The Man with No Name.”

Still to this day, he is one of my favorite characters ever.

As you can appreciate, growing up in East Vancouver (back then – a lower income, immigrant blue collar neighborhood) with a name like Marin, you attract unwanted attention by the herd. Much like the character in the famous Johnny Cash song, Boy Named Sue.

The coolest person I had ever seen had no name. So, I thought to myself: Why couldn’t his name be Marin?

It was the first time in my life that I realized that you can make yourself into whoever you want to be. It might be a long, tough road. But, it’s possible.

Clint Eastwood’s character, The Man with No Name, rarely talks.

So when he does, you lean in close to listen. One specific line of his stuck with me… and has all these years:

“When a man’s got money in his pocket, he begins to appreciate peace.”

You and I are alligators. My long time readers know what I am talking about.

We are value speculators and investors.

We look for significantly discounted companies in the world’s most speculative, cyclical sector: the junior resource sector.

I’ve discussed position sizing and the importance of keeping cash on the sidelines at length.

I believe that the worst of the resource bear market is yet to come.

In this market environment, I appreciate the peace that comes from knowing I have money waiting for the right deal. When it’s time, I’ll pounce on great opportunities in the resource sector.

Let Me Explain Why This Is So Very Important Right Now…

Over the past two decades, I have watched as management teams have frantically pitched their company’s potential to large fund managers.

They hoped those fund managers would fund their dreams.

Unfortunately, most of these fund managers owned very little – if any – stock in their own funds.

Picture that. They had no skin in the game.

So, guess what happened?

The funds underperformed. And more than three-quarters of them have lost over 65%. Or shut down entirely.

That’s why there’s a massive opportunity for us right now as investors looking to buy venture stocks, especially in junior resources.

Big funds that were lead orders to many junior explorers are under a lot of pressure for their apparent lackluster performance and high fund redemptions.

- That means the traditional big buyers of stocks (Institutional Funds) are now the biggest sellers in a market with very little buying volume.

This is exactly when an alligator buys – when Institutional Funds are forced to sell.

We Are The Buyers With No Name

It’s me. It’s you.

It’s how an alligator wins.

It’s no secret I’ve never gotten along well with the big money managers. They are everything I can’t stand.

More importantly, the fund managers have no skin in the game.

They take fees from managing other people’s money, regardless of performance. And frankly, they are not one of us.

They will never be The Man with No Name.

They are part of the establishment. Suits who look down at the retail crowd.

They remind me of another quote from A Fistful of Dollars when The Man with No Name says:

“Sometimes the dead can be more useful than the living.”

The big institutions are essentially dead in the mid-tier and junior resource sector.

The few that are left are still experiencing fund redemptions. Fund redemptions are when shareholders of the fund want their money back.

So the fund managers are forced to sell shares of companies they own to give the fund shareholders their money back.

It’s time for them to be useful to us.

We have a Fistful of Dollars. We are going to be alligators, waiting for our prey to come to us.

So where am I looking to park a lot of my cash in the near future until the debt bombs start exploding?

Look no further…

What Is A Convertible Debenture?

Recently, I talked about how Warren Buffett just dropkicked the resource sector.

His company – Berkshire Hathaway – inked a debt deal with Occidental Petroleum (OXY) that will do the following:

- Pay an 8% coupon (interest), and

- Get Berkshire a half-warrant, that was at just a 9% premium to the share price at the time

Maybe you don’t think convertible bonds are your thing. But they should be.

They are much better than buying shares in certain situations.

So please read this as an educational primer.

If you are investing or speculating in equity, you need to understand the other side of corporate ownership: Debt.

Convertible debentures provide:

- A yield that gets paid to every debenture holder

- The “right” to convert your debentures into shares if the share price moves up so you can “catch” as much of the upside.

There’s nothing better than a real world example to make dollars and sense…

Let’s use the Pretium Resources (PVG) USD-denominated convertible debenture to explain our thesis.

A Real World Convertible Debt Example – Pretium Resources

On February 9, 2017, Pretium raised $100 million.

Pretium did this by selling a 2.25%, 5-year convertible debenture with a strike price to convert the debenture into stock at USD$16 per share (anytime, at the lender’s choice).

At the time, the stock was trading at $12.07 per share.

In addition to collecting 2.25% interest on the amount invested…

The convertible feature allowed the holder (the person lending the company money) the right (the choice) to convert the debt to stock at USD$16 per share at any time during the 5-year period of the debenture.

If the stock went to USD$20 per share…

A debenture holder could convert the debt into shares priced at $16 and book an extra $4 gain per share.

For example, let’s say you had $16,000 in debentures…

- If the stock went to $20 and you converted, you would get 1,000 shares and book a $4,000 profit in addition to the 2.25% yield you collected previously. So a holder in this example would make interest, and a profit on the stock sale after converting. Warren Buffett is the king of convertible debentures. It’s smart investing, and why I want everyone to pay attention to this strategy. However…

- If the share price goes down instead. You still get paid interest, but your option to convert is worthless.

The Pretium debentures are also listed and trade like a stock.

Here is the link to see where the bond is trading. Click here to look up the bond on FINRA, or you can look it up on your own platform under the symbol “PVG4587486”.

Note: THIS IS NOT A RECOMMENDATION – IT’S A REAL WORLD EXAMPLE.

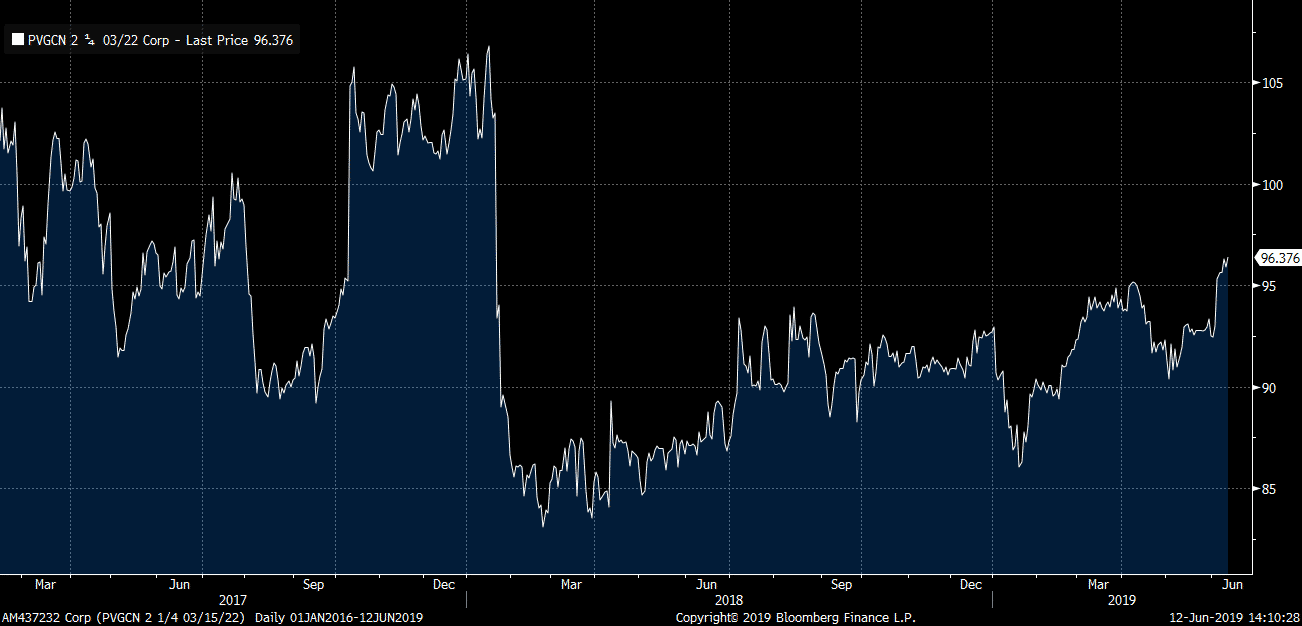

Now, let’s look at the real-world performance of Pretium’s debenture since its offering closed in 2017.

Like most mining bonds and debentures, the trading price of the debenture is considerably under the purchase price ($100).

Thus, certain investors have taken a big loss on those debentures, as they now trade at $95.15 and today have a yield to maturity of 4.13% (2.36% annually).

Essentially, they have passed on receiving their 2.25% to recoup some of their capital with a loss.

If someone wanted out of the debenture, they would be selling today at $95.

That’s a big loss in the bond market on a company that is still operating.

I thought buying a convertible debenture on a start-up mine paying 2.25% was stupid to begin with.

However, that leads us to where we are in the market today.

An Opportunity

I don’t believe Pretium will go bankrupt.

The debenture is for $100 million, which is very manageable for the company.

If you hold the debenture until expiry, which is March 15, 2022, you will be able to collect interest annually. And still have the convertible option at USD$16 per share.

The stock currently trades at USD$9.43 per share, so the stock will have to go up 70% before the convertible is in the money.

The gold price would probably have to be above $1,450 per ounce for that to occur. I just don’t see the spot price of gold above $1,450 this year, but if it does… subscribers and I are well prepared.

Regardless, think of this convertible feature as a free “kicker.”

The low for the Pretium debenture trading price is $83.07. It currently trades at $95.15.

The debenture listed trading price will fluctuate in price just like the Pretium share price. So, if gold prices remain weak or go a lot lower, the price of the bond is going lower.

If the spot gold price moves higher, the price of the bond will also move up.

The advantage of the convertible debenture is that because I don’t see Pretium going bankrupt, the likelihood of losing your capital investment is very low.

Again, I do think the market for gold gets worse later this year before it gets better…

If I’m right, the Pretium convertible debenture will trade lower and most likely trade below its previous low of $85.

Let’s say now that the debenture goes to $75.

A buyer of that debenture would now lock in 5% per year and over 10% yield to maturity. In the chart below you’ll see the trading activity in the bond since it was issued in 2017.

My Take on Pretium’s CEO – Bob Quartermain – Retiring

I think tax planning played a big part in his decision to retire.

That was a critical reason for me when I recently retired from the board of Copper Mountain after 12 years.

The rules have and continue to change for executives and directors. Specifically, the way options and soft shares are taxed. Thus, rather than getting taxed as a capital gain… after a certain amount, the rest of the gain (the bulk) is taxed at the maximum income rate.

Bob is smart and loyal.

And frankly, without him, Pretium would not have achieved the milestones it did.

He is human, and nobody is perfect. Except anonymous Twitter trolls, of course.

Retirement is a trend I also expect to see more of in the resource sector, as the older titans start their estate planning.

Good on you Bob, and I look forward to seeing what you do next. If not, enjoy your retirement.

- We have had many family offices and fund managers asking my opinion on how to play the convertible debenture market in mining.

I recently published on a better convertible debenture that will pay us 10% annually.

And I really think there’s a solid chance at making between 65-150% gains on the convertible option.

But that’s just one of many new options I am exploring in my newsletter, where I am personally investing my own money at the same time and price as my subscribers.

And to those who wonder where I’m at in this bear market, I’ll leave you with the best line from ‘A Fistful of Dollars’:

“When a man’s got money in his pocket, he begins to appreciate peace.”

Regards,

Marin

P.S. Many subscribers took advantage of Buying Like Buffett. And you could’ve too, if you were a member of my premium research service, Katusa’s Resource Opportunities. To learn more about subscribing and even get a sample issue to see how we break down a sector and opportunity, please send an email to MJ at subscribers@katusaresearch.com with the subject line “I’m Interested – Complimentary Issue”