We've been writing about the broader US stock market for many months – highlighting the Pennant/Flag formations that have continued to set up since early 2018. Sometimes, the keys to really understanding what is transpiring behind the scenes in the US markets is to pay attention to various market segments and to consider applying some “outside the box” thinking. Before you continue, be sure to

opt-in to our free market trend signals newsletter.

Our research team would like to fall back into price analysis using the Russell 2000 and the Transportation Index as “additional measures” that mirror the US major stock market in terms of price, volatility and future price targets. The interesting facet of this type of analysis is that we can study any symbols we want and apply the different techniques, patterns and insight we learn to the total scope of the broader US stock market. Thus, we can attempt to identify how and when certain price actions may become more intense or volatile while comparing how our predictive modeling systems and other tools share unique outcomes.

The Russell 2000 and the Transportation Index should be on every skilled traders radar – along with the three major US stock market symbols (ES: S&P500, YM: Dow Jones, and NQ: NASDAQ).

Additionally, all traders should follow the US Dollar, Gold, Silver, Oil, VIX and a handful of other key market sectors. The old saying is “it is not a stock market – it is a market of stocks” is very true.

After the two day selloff, many traders still have questions about what lies ahead for the US markets. We're reading some reports of a “collapse taking place in the US stock market” and others, like our research team, believe this move in the markets is related more closely to a “move away from risk and a capital shift into safety”. So which is it? A collapse in the making or a sideways shift of capital into various safe-havens? Let's look at the charts.

Weekly Russell 2000 (IWM) Chart

This Weekly Russell 2000 (IWM) chart highlights the rotation that has been in place throughout much of 2019. The MAGENTA support level near 144.25 has proven to be intermediate support through multiple downside price cycles. Ultimate Support resides at 125.00. The current downside price move is still above the intermediate support level, although that could be breached over the next few trading days if price weakness resumes. Therefore, until the 144.25 level is breached, we would presume that price may attempt to find support or form an intermediate basing pattern near recent lows. Our ADL predictive modeling system suggests the YM (Dow Jones) may have already bottomed. Thus, any continued weakness in the US stock market may result in a “wash-out” price low point near Ultimate Support.

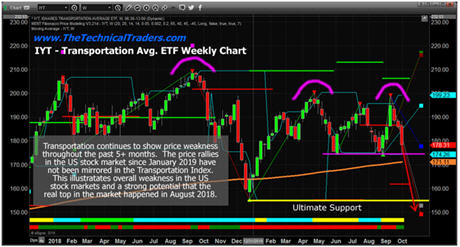

Transportation Average (IYT) Weekly Chart

Transportation Average (IYT) Weekly Chart

This Transportation Average (IYT) Weekly chart shares a similar price setup as the Russell chart. Again, we can see the recent downturn in price has only really moved back towards intermediate support near 174.25 and has yet to really attempt to breach into “new low price” territory. Because of this, we can assume the downside moves in the ES, NQ, and YM which did result in “new low” price formations can't be completely confirmed until the IWM and IYT also break into “new low” price formations. Ultimately, the MAGENTA support levels are key to understanding if this is a “collapse” or a “shift in capital” as we suggest.

Custom Weekly Market Volatility Index

Custom Weekly Market Volatility Index

One of our favorite tools for understanding market price volatility and potential is our Custom Volatility Index. This Weekly Custom Volatility Index chart highlights the current downside price rotation in historically rational terms. Much like the two charts above, this chart shows the current price levels are still well above the previous two base/bottoming price levels – thus, we have little confirmation of a breakdown or collapse in prices (yet). If the price of our Custom Volatility Index were to move lower and close below 8.00 on an END OF WEEK basis, then we would see a new “closing price” low that would immediately send up warning flags of a possible price collapse in the US stock markets.

Ultimately, without this type of price move happening, we are well within the standard deviation ranges of normal price rotation and strongly believe this rotation to be a shift in capital away from risk and towards value, safety, and Blue Chips. Think of it like this, traders and investors are shifting their investments away from what has been “high flying” and moving their capital into more traditional blue chip/dividend-paying assets.

Concluding Thoughts:

Concluding Thoughts:

Of course, time will tell if our analysis and predictions are correct or not. We urge you to also read our recent ADL predictions research post suggesting the ES and NQ will see broader price rotation and volatility than the YM in this

recent post here.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Be sure to ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Round or Gold Bar and

SPECIAL OFFER – CLICK HERE

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these supercycles are going to last years. This quick and simple to understand guide on trading with technical analysis will allow you to follow the markets closely and trade with it. Never be caught on the wrong side of the market again and suffer big losses. PDF guide:

Technical Trading Mastery

Chris Vermeulen

www.TheTechnicalTraders.com