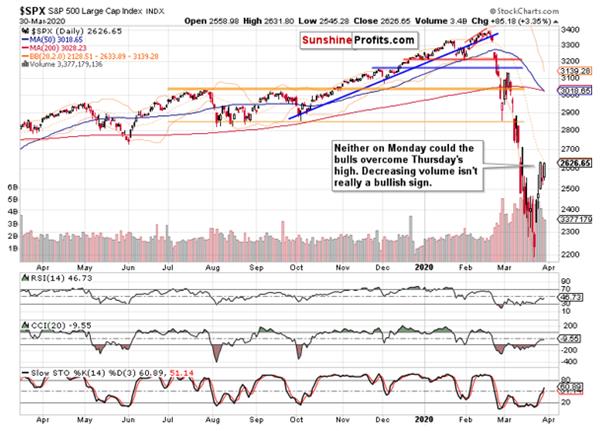

Yesterday’s S&P 500 upswing just couldn’t rise over Thursday’s highs. Earlier today, we’ve been in for some volatile, yet short-term sharp moves in the overnight sessions. Similarly to pre-earthquake tremors, does it point to a larger move about to happen?

Let’s check the situation on the daily chart (chart courtesy of

https://stockcharts.com).

Yesterday, we pointed to the Friday’s candle being an inside one, and the same point can be also made about Monday’s session. These were

our observations regarding its meaning:

(…) it is indeed rich in indications. Its shape is bearish thanks to the large upper knot and prices closing near the daily lows. As the daily volume was lower than that on preceding up days, thus marking the bears’ unwillingness to participate heavily in a reversal so far, we might still get another attempt to move higher.

But that’s unlikely to overcome Thursday’s highs in any lasting way, in our opinion. The pace of RSI and CCI rise is already weakening after they both reached their mid-range readings. While Stochastics is still on a daily buy signal, that can change pretty fast – even with a couple of days’ sideways action only.

But still, we expect the return of the bears in the coming sessions as the most likely scenario.

Again, the

volume was lower yesterday, and the daily

indicators are increasingly and tellingly curling lower. Food for thought.

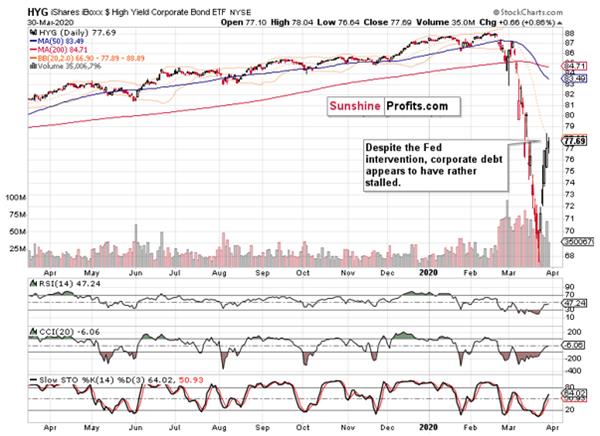

Let’s also revisit the high-yield corporate debt chart (HYG ETF).

The bulls don’t appear to be making much progress despite the

Fed’s policy moves. The market appears to be in the opening moments of doubting whether these solutions will indeed stick.

Before summarizing, let’s quote from

our quick intraday Alert sent earlier today to our subscribers. This is what we have written about the pre-market action:

(…) the futures moving much in our favor (below 2615 as we speak).

This is happening against the backdrop of surging USDX, plunging oil and commodity currencies (plunging AUDUSD and surging USDCAD). The S&P 500 futures gave up much of their overnight gains to trade close to unchanged when compared to yesterday’s closing prices. It’s highly likely we’re in for a risk-off day later today.

Our observations are valid also at this moment - with the notable exception of oil, which has turned somewhat higher in the past two hours (from around $21.40 to almost $21.80, yet trades at around $21.50 right now). Otherwise, the currencies’ moves are continuing, and not even the usual safe haven (JPY) has attracted a bid vis-à-vis the greenback. The risk-off mood rules on, and mightily so.

Summing up, despite the weekly chart’s price action, the bears still have the upper hand. While the temporary upswing has run into stiff headwinds on Friday, it can still retrace a part of today’s premarket decline but don’t bet your farm on that. On the other hand, it appears to be rolling over to the downside as we speak. The time for the rally is increasingly running out, as both the daily indicators and high-yield corporate debt charts show. Considering the risk-reward perspective, our currently open short position remains justified.

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts.

Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.