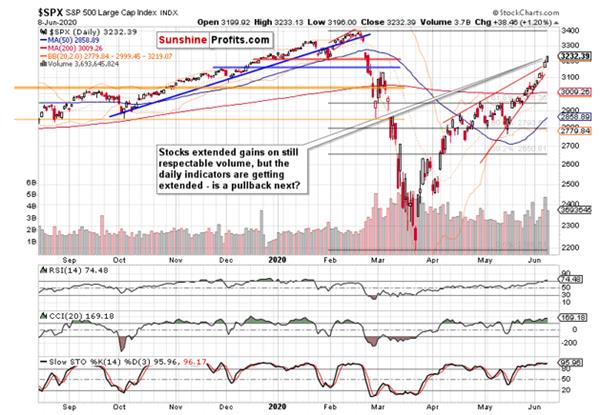

Going from strength to strength, but isn't a soft patch in stocks drawing near – or better yet, aren't we entering it with today's premarket action? The bulls have shaken off anything coming their way recently, and I continue to think it'll turn out as a blip on the screen.

S&P 500 in the Short-Run

Let’s start with the daily chart perspective (charts courtesy of

http://stockcharts.com ):

Another day with higher stock prices still. While the lower

volume than during Friday's spectacular upswing is no fly in the ointment, the extended daily indicators are one – but merely of short-term nature.

Why do I think that? Sure, the bears can force a test of the upper border of the rising red wedge – but will they be able to bring prices much back below that lastingly? Is such a reversal of fortunes on the cards right now?

Unless the Fed missteps tomorrow, that's not likely. And I don't really expect them to rock the boat in any meaningful way. The calls for more fiscal stimulus have been made, and the efforts towards accomplishing it are being made. The S&P 500 price action is telling us that the markets expect both parties to iron out the differences, with the end result being a stimulus bill to cheer.

That's how I interpret the price action thus far – regardless of the premarket decline driven by weak Geman export data. Do credit markets agree that the

trend of generally higher S&P 500 prices is intact?

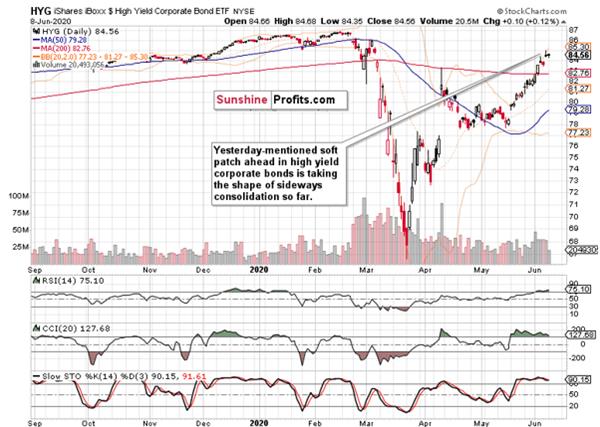

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) seem to be decelerating, but the breather so far took shape of a sideways move with lower bond values soundly rejected. Yesterday's hesitation also happened on lower volume, which is consistent with what we see in a pause within a trend. In other words, the trend is up and we haven't seen a true

reversal yesterday.

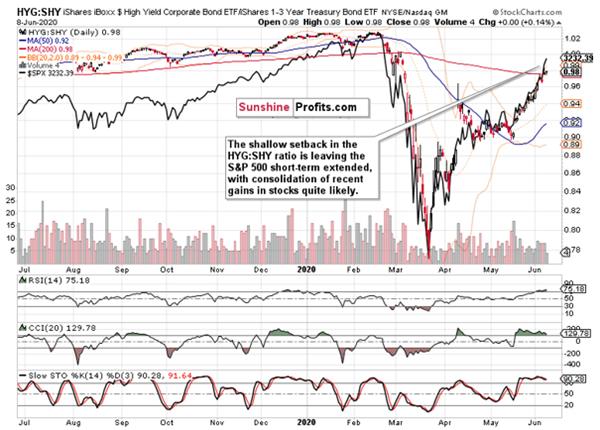

Would the leading credit market ratios confirm this view?

Yesterday's HYG consolidation is mirrored in its ratio to shorter-dated Treasuries. It's just stocks that diverged with their upswing, sizable part of which came in the final 30 minutes before the closing bell.

While such price action is bullish (stocks want to go up, after all), it leaves them in an extended position relatively speaking. But given the HYG:SHY setback suffered so far, is that a cause for more than a very short-term concern?

Investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) are unyielding in their rise. Both leading credit market metrics point to a rather limited downside in stocks that I shouldn't really view as anything but a perfectly natural microrotation.

Both the 3-7 year Treasuries (IEI ETF) and 20+ year Treasuries (TLT ETF) recovered a bit of lost ground yesterday. Neither that, nor the USD Index pause is a game changer though. Look at gold, it's been unwilling to sell off much so far. Will it do so in the runup to the USDX upleg? What upleg when Treasuries' closing prices are largely giving the appearance of being ready for more downside before resuming their long-term uptrend? Will the Fed deliver a deflationary squeeze tomorrow that would take traders out of their risk-on and inflationary-hedges? I don't think so.

That's why the current environment of inflation picking up and money printing as far as eye can see, is fundamentally conducive to higher stock prices. Money is being created faster than it's being destroyed. Technically, I've laid out the position of the credit markets – will

volatility analysis enrich our view?

The VIX has moved a little higher against the backdrop of rising stocks. Given the case for limited downside potential in stocks, the favorite volatility measure supports that assessment. It's because during bull market runs, the VIX doesn't make sharp spikes that would make one look for much more still – instead, it's bobbing around with a measured jump here and there amid generally falling or sideways values.

Now, VIX falling to around 6 as happened not all that long ago, that would be extreme complacency and mature stock bull market. We're nowhere near that currently.

Does the sectoral analysis support my thesis of the stock bull market having much further to run?

Key S&P 500 Sectors in Focus

Move on, the uptrend in technology (XLK ETF) is intact whatever intraday selling it meets. With the 2020 highs within spitting distance, the only question is how much of a resistance will they provide – both in time to overcome them, and in depth of price corrections to work out the extended daily indicators' readings before the bulls say enough is enough.

Healthcare (XLV ETF) is also getting ready to take on its February highs, and again it seems that overcoming them is merely a question of time.

Financials (XLF ETF) held onto their Monday's gains pretty well. Don't be deceived by the black candles – the sector still managed to keep most of its yesterday's bullish gap intact. The daily volume shows that the sellers haven't really stepped in with force, meaning the unfolding upswing has a solid chance of extending gains after the unfolding and in all probability shallow S&P 500 correction is over.

The stealth bull market trio has done well yesterday. Energy (XLE ETF), materials (XLB ETF) and industrials (XLI ETF) have extended opening gains, which is bullish for the stock market advance. Unless we see them making a top, this bull market has much further to run. And the bull is still very young, and the best is still ahead.

Summary

Summing up, stocks continue trading above the bearish wedge, and any downswing appears to be of temporary and rather shallow nature. The weekly and daily charts highlight the bullish outlook, and credit markets including Treasuries support the rotation into stocks with more buying power to come in from the sidelines. The sectoral performance remains conducive, and the strong showing of the early bull market trio (energy, materials and industrials) underscores that. So does the vigorous Russell 2000 (IWM ETF) performance or VIX being no cause for concern. As the dollar remains under pressure and unlikely to stage more than a reflexive short-term bounce, stocks won't probably face a new deflationary headwind any time soon. Tomorrow's Fed won't likely change that, and I expect Friday's inflation numbers to be a cherry on the cake. Coming full circle, the debt markets' performance is the key, and the rest broadly concurs with my bullish outlook.

I encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts.

Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.