The following is a Stockhouse Q&A interview with Kootenay Silver Inc. (TSX: V.KTN, Stock Forum) President and CEO James McDonald.

Why should people think of investing in Kootenay Silver today?

There has never been a better time to invest in Kootenay Silver. The stock is trading at levels not seen since 2004, and the company has outlined a measured and indicated resource of 92 million silver equivalent ounces at its flagship Promontorio silver project in Mexico.

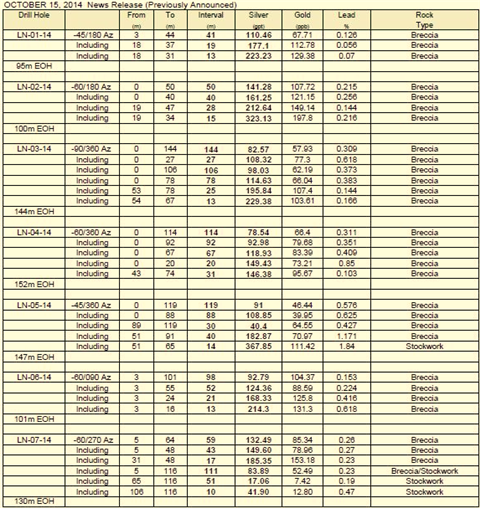

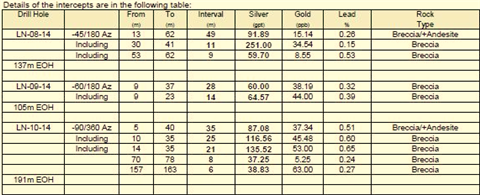

In the past two months, the company has announced a brand new silver discovery (La Negra) about 6.5 kilometres from Promontorio. Drill results, so far, have been fabulous and suggest the potential for low cost production in the future.

A brand new discovery in a bad market allows investors to see the results, study and comprehend them, and get into the stock at a really good price. It is therefore an ideal time to be entering the market.

What sets you apart from the competition?

There are a lot of junior companies with properties in Mexico, but very few with generative exploration teams on the ground that are finding things. We have come up with two new silver discoveries on the same property in the last six years.

That is a rare thing. Dr. Tom Richards, our vice-president of exploration has a Ph.D in geology and worked with the Geological Survey of Canada for quite a few years. Richards is a highly sought after geologist, supported by a team of geologists and prospectors.

(See additional results below).

What is your view on the outlook for silver?

It will be lead higher by the gold price. There will be some volatility. I don’t know if we have washed out at a bottom or not, but in the short to medium term we are definitely headed higher.

What are your overall strategic goals?

I can see us having big success on this new discovery (La Negra), because of all the geological characteristics that we are starting to see in the drill core. We are going to take La Negra as fast as we can down the road to feasibility, and potentially mine construction. If you can add value along the way, the likelihood is that you are going to attract a bid from an existing mining company.

Who are the major shareholders in Kootenay Silver?

Agnico Eagle Mines Ltd. (TSX: T.AEM, Stock Forum): 9%, Sprott Ltd. (TSX: T.SII, Stock Forum): 4%, Institutions: 64%, management and related 16%.

What prompted Agnico-Eagle to take a position in the company?

They liked our Mexico focus. Agnico invested in a private placement in 2012. They did that specifically for Promontorio. It’s a big system with 506,000 ounces of gold (measured and indicated resource) in it and 40 million ounces of silver, plus lead and zinc. But they saw that our other projects have the potential to generate new finds.

Who are the key players on the company’s management team? What do they bring to the table in terms of their ability to help the company achieve its strategic goals?

Chairman Ken Berry is a former professional hockey player, who also played Olympic Hockey for Canada. After retiring from hockey, he has been successful in financing startup companies in the tech sector, including fibre optics, as well as mining.

President and CEO James McDonald is a geologist (University of Alberta) who has been in the resource sector since 1988. Notable companies that he was involved with include National Gold (which merged with Alamos Minerals) to form Alamos Gold Inc. (TSX: T.AGI, Stock Forum). He started Kootenay in 2003 as a private company.

What milestones can investors expect to see in the near future?

Kootenay recently hit multiple high grade intercepts in a batch of 16 holes that were part of a 25-hole inaugural drill program at La Negra. Results from the final two holes were released on December 3, 2014. The next step is to build a geological model, and use available results to design another drill program that is expected to begin early in the New Year. The objective is to move quickly to a maiden NI 43-101 resource calculation.

Can you give us an update on what you plan to do with Promontorio?

It’s a great asset. The potential exists to develop a high grade core that was identified in the last round of drilling. If we can develop some continuity and size in the high grade core, then that changes the economic potential of Promontorio.

However, we are not planning to spend a lot of money on it right now. When the time is right, we will go back in and drill the high grade core. The next step would be a resource update, followed by a scoping study.

How much money does the company have?

The company will have $1.8 million after the current La Negra drill program is paid for.

Do you plan to raise any more money in the near future?

We will see what the market tells us in terms of financing. We can take advantage of financing windows if the appetite is there.

Full DISCLOSURE: Kootenay Silver is a client of Stockhouse Publishing.