Stockhouse Ticker Trax is published to subscribers every Monday (annual cost only $99). We focus on best-in-class high growth small companies trading on the TSX and TSX.V between 5 cents and $3 with a market cap below $300 million.

Equity Analyst Danny Deadlock has 30 years of experience speculating on Canadian penny stocks and targets capital gain opportunities and diversification in metals and minerals exploration, energy, and technology.

For the experienced investor, Ticker Trax provides an extra set of eyes and ears (idea generation) and for those learning to invest in micro cap stocks, we provide stock picks and market education.

Subscribers receive; (1) new research (stock picks) weeks in advance of being featured on this weekend column (2) exclusive access to our list of junior gold exploration companies (critical for peer valuation), (3) exclusive access to our list of Cash Rich micro cap companies (our Virtual Vulture Fund) which contains 80 companies with almost $3 Billion.

Both tables are updated monthly.

If you are a paid Ticker Trax subscriber or were fortunate to catch my report here last weekend, then this update will be relevant – otherwise you may want to skip it entirely.

November 26thPMI Gold Corp. (TSX: T.PMV, Stock Forum) (35 cents) was featured to paid Ticker Trax subscribers at 25 cents. Last weekend it was also featured in this weekend column for free readers at 28 cents. Typically there would be a much longer gap between paid and free readers but I felt PMV was an attractive speculation to wrap up 2013 with.

https://stockhouse.com/opinion/ticker-trax/insights/2013/12/13/pmi-gold-s-t-pmv-s-$94-million-cash-and-$5-gold-valuation

My report timing was very fortunate as Tuesday December 17th it was announced that Asanko Gold (TSX: T.AKG, Stock Forum) ($1.72) would attempt a takeover / merger with PMI Gold (this was our second Ticker Trax takeover in the region since summer - the first being Volta Resources)

This news pushed PMI Gold to 40 cents before gold collapsed on Thursday thanks to the U.S. Federal Reserve. While PMV is still holding a nice gain near 35 cents, it is a far cry from the short term 70% gain we saw before gold fell through $1200 Thursday.

The Most Logical Choice Given the Sector Environment

A year ago PMI and Asanko tried a merger but it was shot down by PMI shareholders - hopefully that doesn’t happen this time around. BOTH companies are now trading at equally depressed valuations and the upside growth potential of the combined companies is tremendous.

To view a bigger version of the chart, please click on the link:

https://stockhouse.com/media/tickertrax/PMV11.jpg

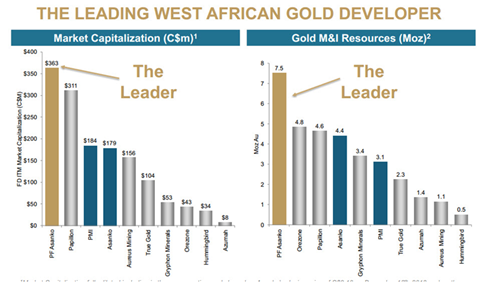

As a combined entity this would be a regional powerhouse with an estimated $280 million in the bank and funding to put the first mine into production. With both properties in full production they would have the capacity to produce up to 400,000 ounces of gold per year and have reserves approaching 10 million ounces (plus a large land position for exploration).

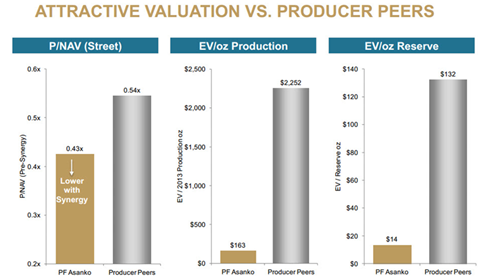

The combined companies would benefit substantially from lower capital costs and lower operating costs that would improve both earnings and cash-flow.

To view a bigger version of the chart, please click on the link:

https://stockhouse.com/media/tickertrax/PMV12.jpg

If another major regional player is interested in PMI they will step up to the table before this goes to a vote. But if they don’t, then this merger is the only logical decision in this low price & volatile gold environment.

PMI Gold may never develop this project on its own when gold is below $1300 and the share price has been reflecting that since the summer.

I personally will vote in favor of this merger because the two companies combined have the potential to create a tremendous producing gold company while rebuilding shareholder value from an incredibly depressed valuation (at least by historical standards).

If the merger goes through I will gladly tuck my share position away longer term. If it falls through I will immediately sell my PMV because I bought this (and featured the company to Ticker Trax readers) as a merger or takeover target – not as a stand-alone project (it doesn’t work in this gold environment).

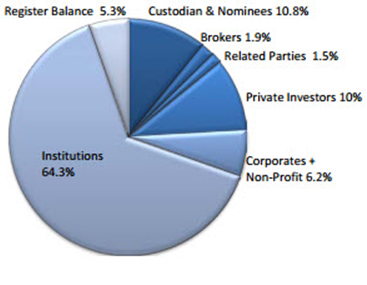

Now it is up to the Institutional Investors to Make the Logical Choice

An Excellent Overview of the Combined Entity

https://www.pmigoldcorp.com/i/pdf/Investor-Presentation_AKGFINAL-v4.pdf

____________________________________________________________________

Disclosure: Danny Deadlock owns 75,000 shares of PMV

______________________________________________________________________