Axis Auto Finance Inc

Axis Auto Finance Inc. (

TSX: V.AXIS,

Forum) is scaling up its lending operations while simultaneously

reducing its borrowing costs by 46%. On

March 26, 2019; the Company announced the closing of a new, senior secured revolving debt facility.

The financing is through a syndicate, led by a Canadian Schedule 1 Bank and a large insurance company. The terms are as follows:

- 46% reduction in borrowing costs on senior debt (to Prime Rate + 2.25%)

- More than doubling the size of the current facility (from $40 million to $100 million)

- Advance rate increases from 67% to 75% (of principal balance of eligible receivables)

- Net result: projected up to $0.05 annual gain on EPS assuming fully drawn balance of facility

Axis Auto is already Canada’s fastest growing publicly-traded alternative auto finance company. With this new credit facility, the Company is positioned to maintain if not increase that growth rate. CEO Todd Hudson framed this news for investors:

“This is a tremendous milestone for Axis and another key accomplishment in the roll-out of our strategic plan. The interest cost savings will immediately bolster our bottom line and the size of the new facility gives us ample runway to continue growing the portfolio.”

Increasing the scale of any business translates into increasing revenues. Decrease costs (simultaneously) and this immediately equates to rising margins. Further enhancing the Axis business model is the boost in its “advance rate”. This higher loan-to-value ratio allows the Company to leverage its capital more efficiently, further boosting Axis Auto’s lending capacity.

Of this $100 million, $80 comes from the bank and insurance company. The remaining $20 million is being financed by other interested institutions. Also of note, refinancing the existing credit facility will not trigger any prepayment or early-termination fees.

This new credit facility is based upon a 4-year term and (as noted) bears interest of Prime + 2.25%. This replaces the terms on its existing credit facility of Prime + 7.5%. This translates into interest rate savings of more than $5 million per year on a fully drawn facility.

(click to enlarge)

(click to enlarge)

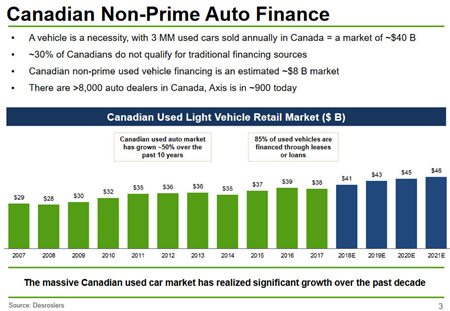

Axis Auto’s “alternative used vehicle financing” has a potential market of 30% of the Canadian population, according to data from Equifax. With 100% of these loans reporting to the credit bureau, this provides the opportunity for Axis clients to significantly improve their credit scores as a financial stepping stone.

The Company’s robust growth profile is a product of state of the art risk analytics, which the Company has developed in-house. With the vastly superior terms of this new credit facility, Axis is poised to significantly improve its bottom line

For investors, the “bottom line” is a much more attractive investment opportunity.

www.axisautofinance.ca

FULL DISCLOSURE: This is a paid client of Stockhouse Publishing.